ATFX Trader Magazine

European Stock Indices - How Will Euro Stocks Perform vs Monetary Tightening and a Recession?

newsroom

Publish date: Tue, 17 Jan 2023, 11:28 AM

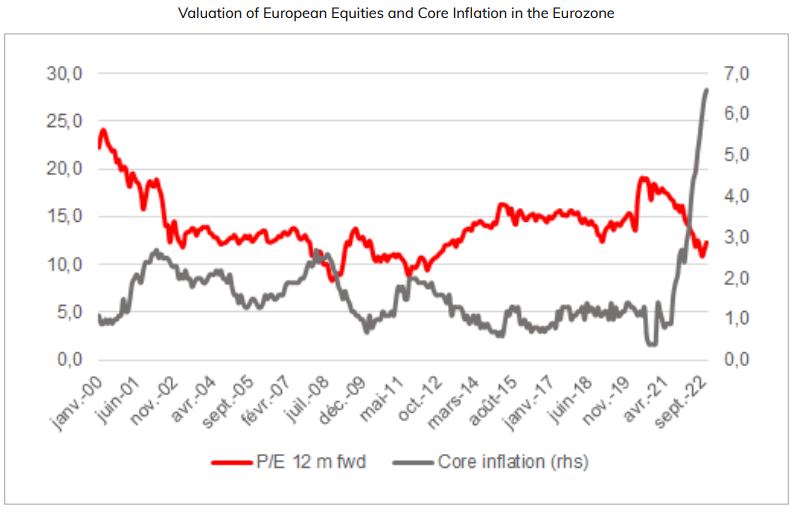

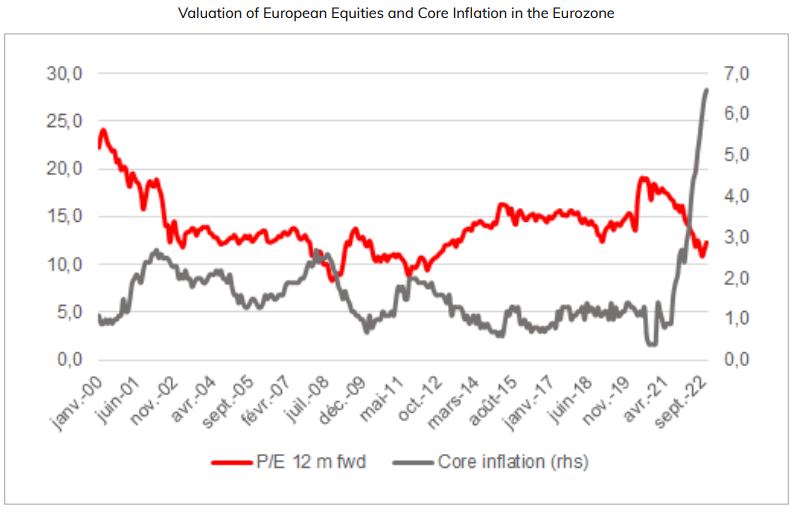

The year 2022 witnessed a 10% decline in the performance of European stocks, in addition to an unprecedented surge in inflation. This prompted major central banks, including the European Central Bank (ECB), to tighten their monetary policies and raise interest rates to record highs. Not forgetting the energy crisis ignited at the beginning of the Russia-Ukraine war in February.

Key factors that may affect the volatility of European stocks in Q1 2023 include inflation trends, the pace of monetary tightening, the depth of the economic recession and government bond yields. The new year could take the title of worst performer marking the most challenging period for European stocks since 2018.

Monetary Tightening

We had already seen a significant recovery in stock prices since late September 2022, when inflation figures began to slow, raising hopes that inflation would fall and the pace of interest rate hikes would slow significantly in early 2023.

So long as the ECB is not satisfied with the level of real inflation rates, the bank’s hawkish stance will continue to support higher interest rates for longer, creating more volatility in European equity markets.

Investors are predicting ECB rate hikes of more than 150 basis points by the end of June 2023.

Economic Recession

The risks of an economic recession are now evident as a natural outcome of the monetary tightening policies and the weakening of global growth momentum in the first half of 2023. This, in turn, pushes investors into risk aversion mode, offset by the partial decline in real bond yields, thus weakening the performance of European stock markets.

Russia’s invasion of Ukraine has pushed investors out of European stocks as energy and commodity prices have reached record highs, forcing heavily indebted governments to take on more debt to protect consumers and businesses from the consequences of hyperinflation.

In the first half of 2023, we may see slowing economic growth, a 12% drop in earnings estimates, and continued geopolitical and trade tensions, negatively affecting the performance of European stocks.

European Stock Indices in 2023

The “Stoxx Europe 600” remained on track to achieve its biggest annual decline since 2018 by falling about 12% since the beginning of 2022. However, we may see some stability around the 450-point level before the trend continues, with the index falling by more than 15% at the end of Q2 2023 before rebounding from 365 points to 430 points by the end of the year as European economies start recovering.

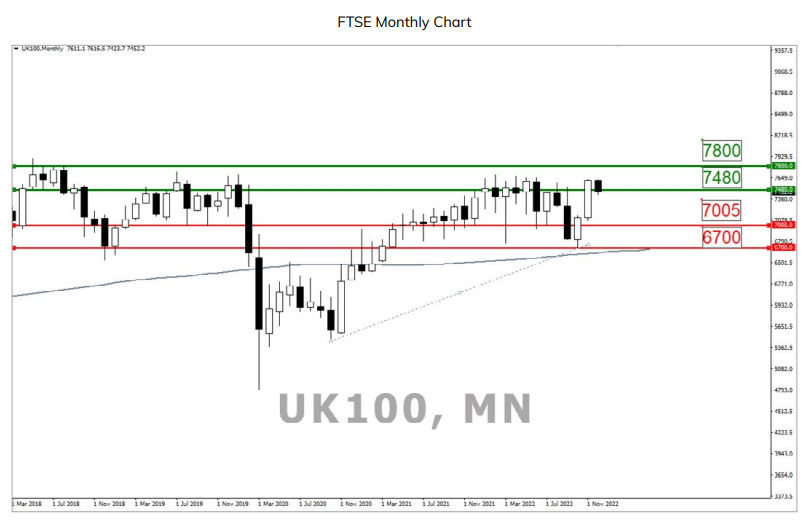

The UK “FTSE 100” may see a decline at the beginning of 2023 and likely settle at 6,700 points by the middle of the year. However, it could rise to 7,373 points by the end of 2023 as the UK economy recovers.

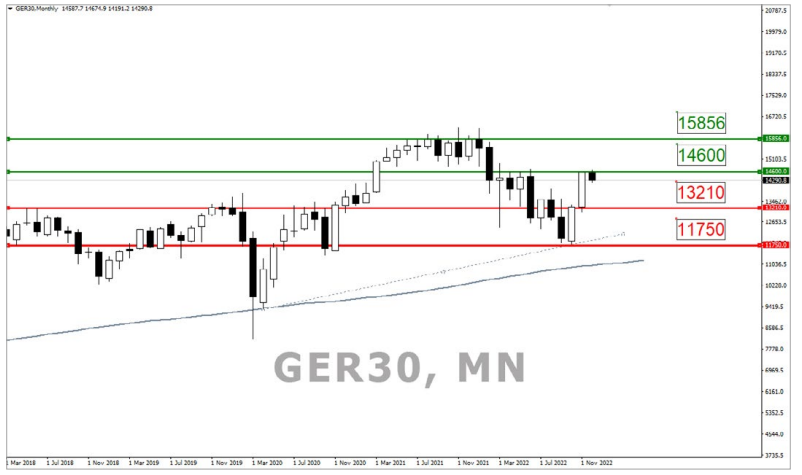

The German “DAX 30” is expected to end the first half of 2023 at 13,210 points and rise by a mere 2.2% in 2023.

DAX Monthly Chart

Short pressure continues on the German DAX amid high inflation and slowing economic activity

Technically on the monthly chart, the DAX is trending lower and could touch the primary bullish trend line at the 11,750 points support level, just above the 200-day moving average, provided the first support level at 13,210 points breaks.

The alternative scenario is if the index manages to hold above the 13,210-point level, it may rally back to the first resistance level at 14,600 points, then the next resistance level at 15,856 points.

Technically, on the monthly chart, the FTSE 100 fell strongly from the 7,649 resistance level due to continued interest rate hikes that put pressure on public company profits and profit margins.

The index will target the primary bullish trend line at the 6,700 support level above the 200-day moving average if it can break the first support level at 7,005 points.

An alternative scenario is if the index manages to hold above the 7,005 level, it may return to positive momentum and retest the first resistance level at 7,480 points, then the next resistance level at 7,800 points.

By Dr. Mohamed Nabawy, ATFX MENA Market Analyst

More articles on ATFX Trader Magazine

Crude Oil - Will Crude Oil Rally Despite Market Worries About an Economic Recession?

Created by newsroom | Jan 17, 2023

Gold & Silver - A Recession May Boost Prices Amid Rate Hike Pressure

Created by newsroom | Jan 17, 2023

USDCAD - The BoC Could Provoke Economic, Oil Price and CAD Price Shocks

Created by newsroom | Jan 17, 2023

Discussions

Be the first to like this. Showing 0 of 0 comments

.png)