ATFX Trader Magazine

The Euro: Aggressive Rate Hikes May Trigger an EU Recession

newsroom

Publish date: Tue, 17 Jan 2023, 11:28 AM

Spiralling inflation has sparked a cost-of-living crisis across Europe. Governments are trying to shield households and businesses from the seemingly never-ending surge in energy prices. The energy crisis has made the eurozone economy’s outlook gloomy, as industrial production fell 2% in October 2022.

With the supply chain risks and energy prices remaining high during Q1 2023, this promises to be a challenging year. Despite the aggressive rate hikes by most central banks, the eurozone consumer price index for November 2022 came in at 10% (Figure 1), down from 10.6% in the previous month. Double-digit inflation remains a significant burden for consumers forcing the ECB to maintain a tight monetary policy stance.

However, European central banks remain optimistic about the growth forecasts for the region’s economy while expecting inflation to ease to 3.4% in 2024 and 2.3% in 2025. At the same time, the growth forecast for the euro area sits at 0.5% in 2023 and 1.9% in 2024, which could support the euro, limiting its further decline.

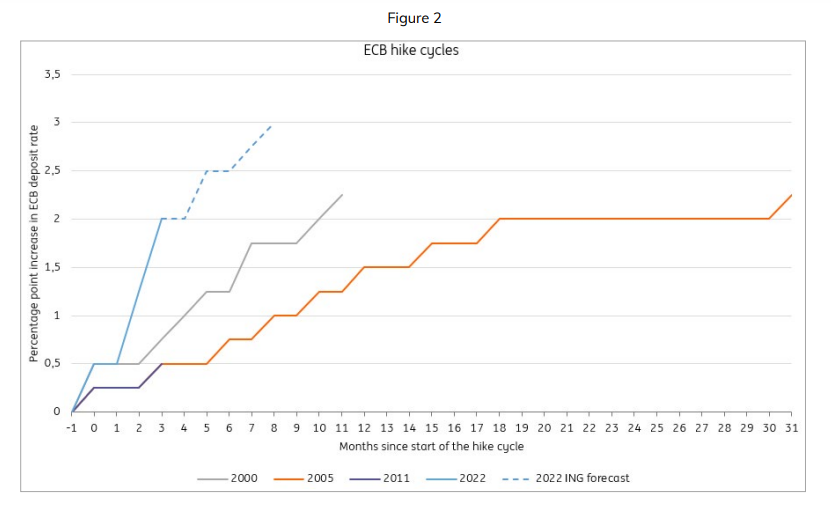

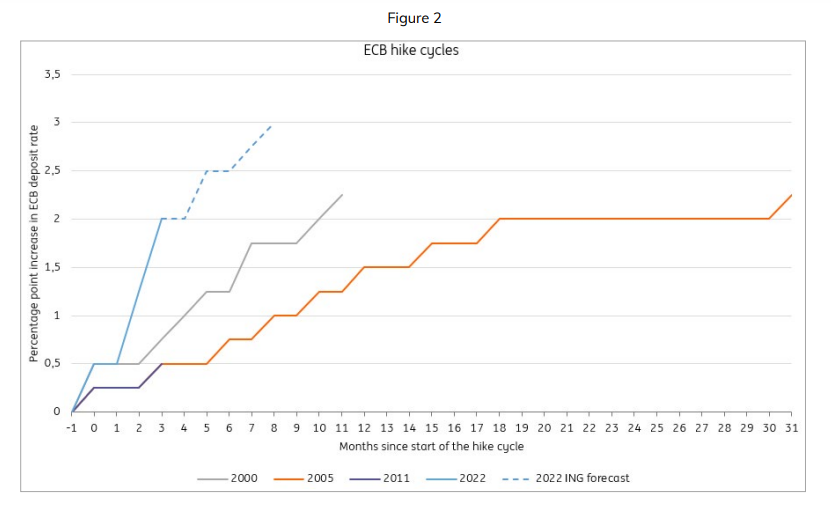

Furthermore, the ECB decided to raise interest rates by 50bps at its December interest rate meeting, slowing down from 75bps rate hikes at the previous two meetings. However, the ECB is expected to continue raising interest rates at its upcoming meetings to curb inflation, which remains at extremely high levels. By contrast, starting in March 2023, the ECB’s asset purchase program (APP) portfolio will decline at a measured and predictable pace.

The tightening of monetary policy is continuing even as the ECB predicts that economic activity will likely contract in 2023. However, the Eurozone’s recession will not last long, with the unemployment rate and labour market remaining healthy. Therefore, the Euro will likely be supported for most of the first quarter of 2023.

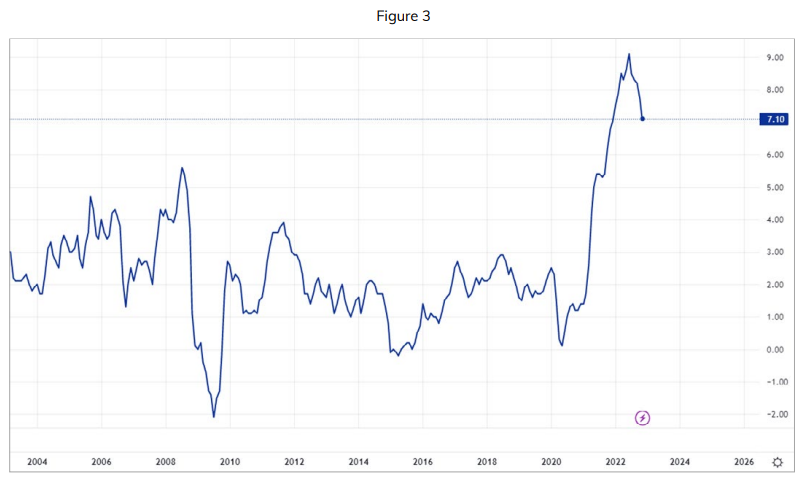

Across the Atlantic, the US inflation data published in December 2022 saw inflation fall from a peak of 9.1% to 7.1% (Figure 3). This positive development seems to have slowed down the previous aggressive interest rate hikes by the US Federal Reserve.

During its last meeting in December 2022, the Fed announced the decision to raise interest rates by 50bps to 4.5%, slowing its rate hikes, which caused the dollar to lose support.

However, analysts expect the Fed funds rate to peak at 5.1% in 2023 before dropping to 4.1% in 2024. This means that the Fed could maintain a high interest rate regime for most of 2023.

The Fed’s stance on monetary policy is different from the ECB’s. While the EU’s CPI has just begun to show signs of falling for the first time, the US CPI started declining following the July 2022 announcement. The macro advantage may favour the euro if we don’t consider the potential risks from geopolitical tensions and energy prices. However, it is necessary to keep a close eye on relevant economic and political news in the future.

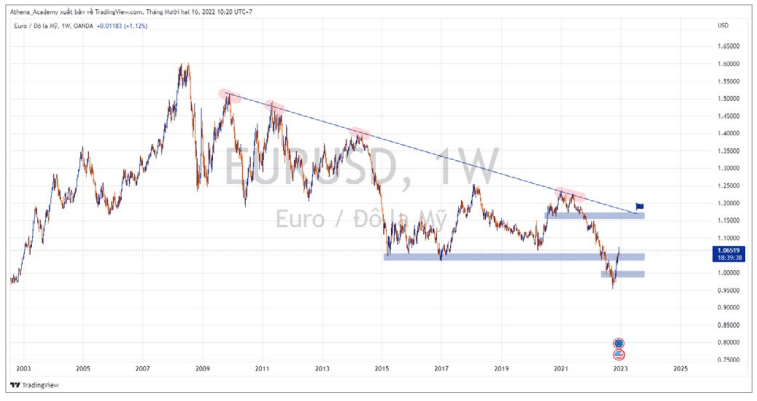

Technical Analysis

On the Daily time frame, the EURUSD currency pair broke out of a descending channel that had lasted from February 2022 and formed a bullish structure with higher highs and higher lows. Looking at the weekly timeframe, the uptrend seems to have just started, and the Euro needs more support to trade in the higher price zones.

Critical Support Levels are 1.03400 – 1.05600 & Zone 1.00000 – 1.02000. If the above support levels hold, the EURUSD will likely move towards 1.15400 – 1.17400.

By Linh Tran, ATFX Market Analyst (Vietnam)

More articles on ATFX Trader Magazine

Crude Oil - Will Crude Oil Rally Despite Market Worries About an Economic Recession?

Created by newsroom | Jan 17, 2023

Gold & Silver - A Recession May Boost Prices Amid Rate Hike Pressure

Created by newsroom | Jan 17, 2023

USDCAD - The BoC Could Provoke Economic, Oil Price and CAD Price Shocks

Created by newsroom | Jan 17, 2023

European Stock Indices - How Will Euro Stocks Perform vs Monetary Tightening and a Recession?

Created by newsroom | Jan 17, 2023

Discussions

Be the first to like this. Showing 0 of 0 comments

.png)