ATFX Trader Magazine

USDJPY & USDCNH - The BoJ’s Monetary Policy Is Unchanged, the Yen Will Continue Rising As the Dollar Index Falls

newsroom

Publish date: Tue, 17 Jan 2023, 11:29 AM

The Bank of Japan’s (BoJ) monetary policy has been highly stable, adhering to the yield curve control (YCC) policy. The BoJ consistently maintains short-term interest rates at -0.1%, and ten-year bond yields around 0%. As a direct result of the low interest rates, the yen depreciated sharply by nearly 20% in 2022, making it the most depreciated currency among G7 currencies.

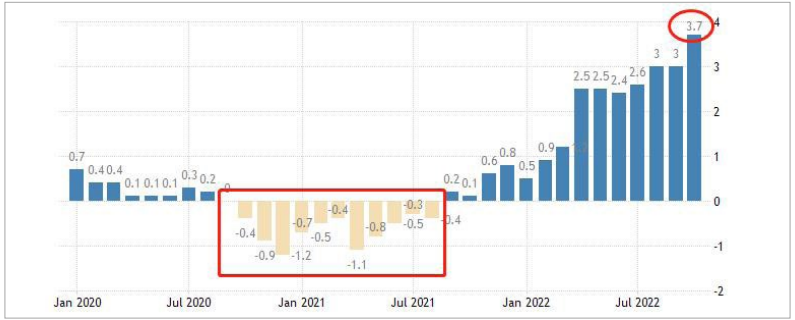

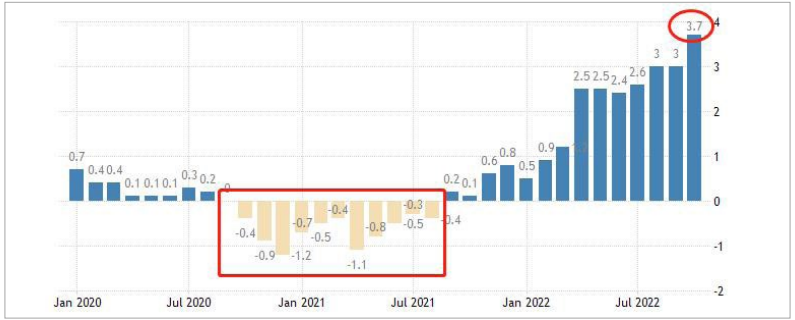

The Japanese economy is typically known for its low inflation levels. While the CPI growth rate of developed Western countries soared to over 7%, Japan’s CPI growth rate was only 3.7%. The internationally accepted level of moderate inflation is 2%. Japan’s CPI growth rate is higher than this standard, but it has not reached a level sufficient to change the BoJ’s monetary policy. The BoJ has been worried that the current high inflation rate cannot be sustained. As the bank’s Governor, Haruhiko Kuroda, said, “The BoJ has not yet reached a sustainable and stable inflation level. Until this target level is reached, we will press ahead with the easing policy.”

In 2020 and 2021, Japan’s CPI growth rate repeatedly fell to a negative range, reaching a low of -1.2%. In 2022, affected by the rising international energy prices, inflation improved, but no negative growth rate showed up. However, high inflation in the US, the European Union, and the UK has reached an inflection point. Japan’s inflation rate is expected to echo that and decline accordingly. Provided that in 2023, international oil prices fall more than expected, Japan’s inflation rate may fall into negative territory again.

The main reason for Japan’s persistently low inflation rate lies in its massive elderly population and the lacklustre domestic demand for goods and services. According to data from Japan’s Ministry of Internal Affairs and Communications, in 2022, the elderly population aged 75 and above rose to 19.37 million, accounting for more than 15% of the total population, while the elderly population aged 65 and above accounted for nearly 30% of the total population. According to internationally recognized standards, a country is defined as an ageing country when the proportion of the elderly aged 65 and above reaches 7%. Japan is at more than four times that standard. The yearly number of births in Japan is fewer than one million, the fertility rate is low, and there is a severe shortage of young people to fuel high consumer demand. Unfortunately, the population structure cannot be changed in a short time. Once international energy prices return to normal, it will be difficult for Japan’s inflation rate to remain above 3%.

Haruhiko Kuroda, the current governor of the BoJ, is due to step down in April 2023. Takehiko Nakao has been floated as the possible successor and publicly stated that he would re-evaluate the country’s monetary policy. Market participants, in this case, cannot help but wonder if the new governor will change the existing YYC policy in favour of a more aggressive monetary policy. We hold that Japan’s monetary policy is unlikely to undergo significant changes because of a new BoJ governor and that the macroeconomic strategies based on “Abenomics” will remain in force. No matter who is elected as the new governor, the reality of low inflation in Japan will not change, and the best way to deal with low inflation is the BoJ’s current YCC policy.

Since the BoJ’s monetary policy will likely stay the same in Q1 2023, the USDJPY’s trend mainly depends on the Fed’s actions and the US dollar index’s (DXY) performance. In Q1 2023, the Fed will announce two interest rate decisions, which are expected to be 50 bps and 25 bps, respectively. As the Fed shifts from aggressive to moderate interest rate hikes, the DXY will likely continue its downtrend from Q4 2022. Technically, in Q1 2023, the DXY could fall below 100, a critical integer resistance level; correspondingly, the USDJPY may slide below 130. Given that the USDJPY has plummeted in Q4 2022, it is expected that the USDJPY will rally to a certain level from January to early February 2023, and the major downward wave will start in late February.

Long and Short-Term LPR Rates Will Keep Declining as the USDCNH Retreats From Record Highs

Western central banks when adjusting monetary policies, mainly refer to the inflation rate and unemployment rate data, which is not the case for the People’s Bank of China (PBOC). The PBOC’s monetary policy adjustments are not based on individual economic data but are derived from a comprehensive analysis of the overall macroeconomic dynamics.

Given its large size and seismic influence, China’s real estate market is critical for its macroeconomic development. As Vice Premier Liu He said, “Real estate is the pillar industry of the national economy. In view of the current downside risks, we have promulgated some policies and are considering new measures to shore up the industry’s balance sheets and guide market expectations and confidence recovery.”

On November 22, 2022, Li Keqiang, Premier of the State Council, said in his speech, “(We will) step up supports for private enterprises’ debt issuance, and employ monetary policy tools such as required reserve ratio reductions in a timely and appropriate manner, so as to maintain reasonably sufficient liquidity.” Three days later, the PBOC announced a 0.25 percentage point cut in financial institutions’ required deposit reserve ratio. It is clear from this move that the pace at which the PBOC will implement loose monetary policies in 2023 depends mainly on how strongly private enterprises’ demand for capital is, especially the demand from real estate developers. Premier Li Keqiang’s speech serves as a beacon for the PBOC’s monetary policy in 2023 — continuing the loose monetary policy of cutting interest rates and reserve ratios to boost the steady and healthy development of the real estate industry from the funding side.

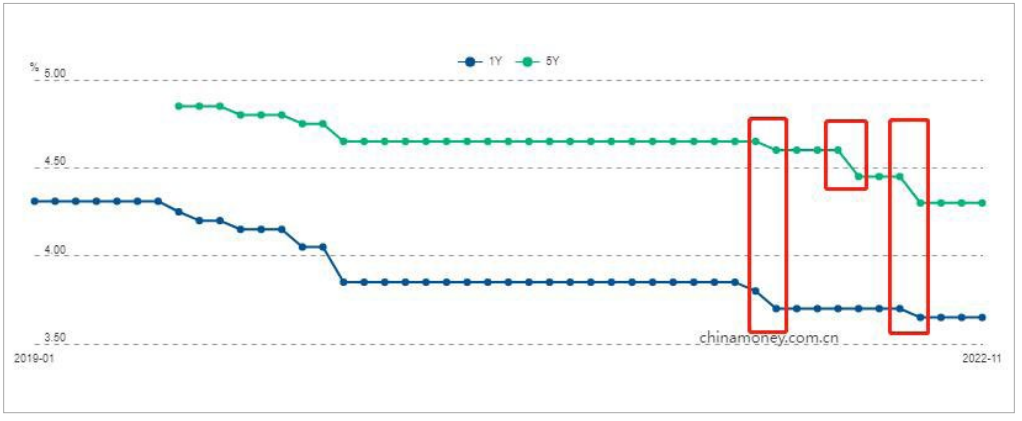

In 2022, the PBOC lowered the five-year LPR interest rate three times by 5 bps, 15 bps, and 15 bps, respectively. It lowered the two-year LPR interest rate twice, by 10 bps and 5 bps, respectively. In 2023, long-term and shortterm LPR interest rates are expected to be lowered at least twice, and the cumulative decline is likely to be 15 bps or more.

In December, the Fed’s interest rate decision lowered the single rate hike from 75 bps to 50 bps. Although the intensity has weakened, the pattern of interest rate hikes has not changed. Logically speaking, under the divergence of monetary policies between China and the US, the USDCNH possesses long-term upward momentum. However, the PBOC could adopt a loose monetary policy if the macroeconomic situation remains stable, as various economic indicators are controlled within a reasonable range. The LPR interest rate adjustment intervals are expected to be quite long.

Although the CNH will continue to face depreciation pressure at the monetary policy level imposed by the PBOC, the impact is supposed to be limited. Although China’s monetary policy will affect the offshore renminbi, the trend of USDCNH is not dominated by the monetary policy of the PBOC but by the Fed and the DXY. For example, the surge in USDCNH from February to October 2022 and the plunge from November to December were all caused by intensive swings in the DXY. Therefore, the trend of USDCNH in Q1 2023 will be determined by the DXY’s movements during the same period.

This turning point of the high inflation rate has caused disagreement within the Fed regarding whether to continue the aggressive interest rate hiking policy. The December interest rate decision to cut the size of a single rate hike was just the beginning. The interest rate decisions in January and March 2023 will continue to limit the size of each single rate hike, and it is forecasted that the Fed’s interest rate hike will officially end in Q2 2023. The DXY will likely break the 100 mark in Q1 2023, and the USDCNH will experience a resonant decline; hence, the medium-term target can be set at 6.7.

Investors should remember that since the “811 exchange rate reform” in 2015, the USDCNH has been fluctuating within a broad range from 6.2 to 7.2. Even in Q2 and Q3 2022, when the Fed aggressively raised interest rates, the USDCNH did not break through that range effectively. As the Fed’s interest rate hike weakens, there are salient signs that the USDCNH is falling back from its recent highs. Although some corrective rebound may appear during the process, the pair will continue to fall until it reaches the final target of approximately 6.2.

By Dean Chen, ATFX Guest Analyst

More articles on ATFX Trader Magazine

Crude Oil - Will Crude Oil Rally Despite Market Worries About an Economic Recession?

Created by newsroom | Jan 17, 2023

Gold & Silver - A Recession May Boost Prices Amid Rate Hike Pressure

Created by newsroom | Jan 17, 2023

USDCAD - The BoC Could Provoke Economic, Oil Price and CAD Price Shocks

Created by newsroom | Jan 17, 2023

European Stock Indices - How Will Euro Stocks Perform vs Monetary Tightening and a Recession?

Created by newsroom | Jan 17, 2023

Discussions

Be the first to like this. Showing 0 of 0 comments

.png)