Media Chinese - Efficient resource management

AmInvest

Publish date: Wed, 19 May 2021, 08:57 AM

Investment Highlights

- We maintain our HOLD recommendation on Media Chinese International Ltd (MCIL) with unchanged forecasts and fair value of RM0.19/share, pegged to a PB of 0.5x. We make no changes to share price to reflect a 3- star ESG rating as appraised by us (Exhibit 3). MCIL is a constituent of the FTSE4Good Bursa Malaysia Index.

KEY ESG METRICS

o Energy efficiency: The group’s energy efficient measures include reviewing the products’ print layout, adjusting printing slots and potential rationalization of printing plants. Through these measures, MCIL reduced its electricity consumption in Malaysia and Hong Kong by 8.2% YoY in FY20. For water usage, the group installs facilities to harvest and store rainwater for cleaning purposes. Water usage stood at 67,260 m3, which is fairly unchanged from the previous year. Carbon dioxide emissions from purchased electricity in Malaysia and Hong Kong decreased by 7.1% YoY. Newsprint yield stands at 229 pages per kg of newsprint in FY20.

o Recycling and waste management: MCIL managed to reduce newsprint wastage by 29.7% in FY20 and scheduled waste generated are collected and disposed of in compliance with relevant regulations.

o Content management: The group has editorial policies to ensure responsible journalism and strives to keep its online content trustworthy, up-to-date and accessible at all times.

o Digital transformation: Its flagship publication launched its “Digital First” campaign alongside the implementation of a new editorial system, a brand new online portal and mobile application. MCIL continues to work on improving its digital platforms and enhancing its digital publications performance.

o Customer reach and experience: The group is the leading Chinese media group in Malaysia with four major daily newspapers and a suite of magazine titles.

o Corporate social responsibility: MCIL’s community contributions include: (i) knowledge building, where it organizes events to hone writing skills, inculcate reading habits and build future talents in journalism; (ii) promoting education by providing sponsorships and donations through its Sin Chew Daily Education Fund, Sin Chew Daily Taiwan Education Aid and other charity funds; (iii) provide humanitarian assistance and medical assistance via Yayasan Sin Chew and Yayasan Nanyang Press.

In FY20, Yayasan Sin Chew donated RM4.5mil to NGOs, orphanages, old folk’s homes and hospices which faced financial constraints. MCIL also has an ongoing project known as “WeCare Project” which sponsors students from underprivileged homes by providing a monthly stipend. The group raised a total of RM6.7mil for the medical needs of the less fortunate and RM7.4mil as at 30 April 2020 to purchase the relevant PPE and medical supplies and equipment for hospitals in Malaysia following the outbreak of Covid-19. Yayasan Nanyang Press also launched a fundraising initiative to purchase Covid-19 test kits for hospital all over Malaysia and managed to raise RM1.4mil for the project by April 2020.

o Human capital development: MCIL’s employees’ average training hours stood at 8.2 in FY20, fairly unchanged from the previous year. The three main categories of training are technical skills, health and safety, and management which represented 76%, 18% and 6% of total training hours in FY20 respectively.

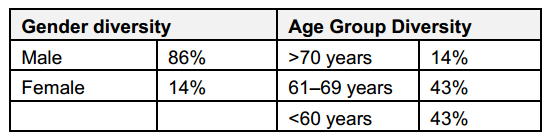

o Board composition: As at 31 March 2020, MCIL’s board comprised seven members which include three executive directors, one non-executive director and three independent non-executive directors. The composition of the board is summarized as follows:

o Accessibility and transparency: The group’s management has been less accessible to analysts and investors for the past year, with analyst briefings recently only held on an annual basis and a lack of updates.

- We remain cautious on the performance of the group’s media segment although its travel business could improve in 2HCY21 due to the gradual recovery in the travel sector as more countries embark on Covid-19 vaccination programmes. MCIL will continue with its cost optimisation initiatives and focus on monetisation of its digital assets.

Source: AmInvest Research - 19 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Nov 25, 2024

Created by AmInvest | Nov 21, 2024