Stock Idea - KSL Holdings

AmInvest

Publish date: Mon, 04 Sep 2023, 09:12 AM

Company Background. KSL Holdings (KSL) is one of the major property players in Johor, Malaysia and has been established for more than 30 years. The group has diversified its operation including ventures into the Klang Valley and has a strong presence within the Iskandar region. Its core business comprises of 2 segments: property development and property investment.

Prospects. (i) As at 31 Dec 2022, KSL owns 2,500 acres of strategic land banks across Johor and Klang. The group aims to acquire more land in key locations to sustain its property developments and project pipeline, (ii) KSL is ramping up promotional efforts, events, and roadshows to attract more visitors to its property investment segment, which included KSL City Mall & Hotel, KSL Hot Spring Resort and KSL Esplanade Hotel & Mall, Klang, and (iii) Moving forward, KSL plans to focus on building more affordable houses. We expect an improving economy and rising home buyers’ purchasing power to support demand for the affordable housing segment.

Financial Performance. In 1HFY23, KSL posted a higher revenue of RM605mil (+2.3x YoY) with a PAT of RM200.5mil (+3x YoY). This was mainly contributed by the group’s property development flagship projects in Johor Bahru, Kluang and Klang as well as improvements from property investments.

Valuation. KSL is currently trading at an attractive 3.6x trailing P/E, versus to Bursa Property Index’s 5-year forward average of 12x. As a comparison, Sunsuria and M K Land Holdings, both also involved in property development & investment, trades at a much higher 29x trailing P/E and 22x trailing P/E respectively.

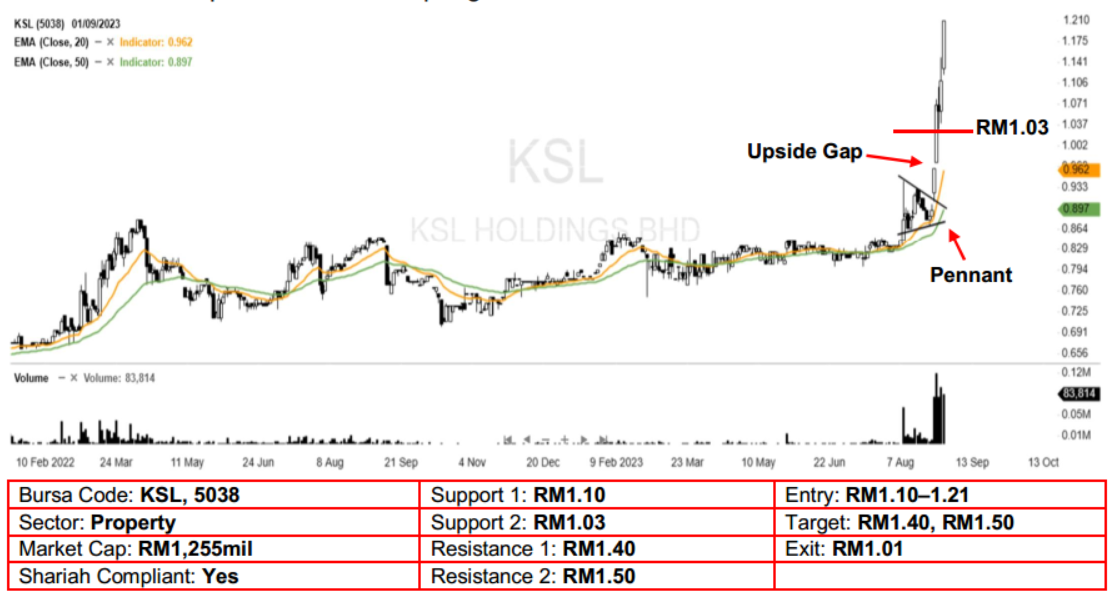

Technical Analysis. We expect further upside for KSL after it pushed above the RM1.00 psychological mark and hit a new multiyear high a few sessions ago. In view of the uncovered upside gap formed on 28 Aug with its rising EMAs, the bullish momentum is likely to pick up further. A bullish bias may emerge above the RM1.10 level, with stop-loss set at RM1.01, below the 29 Aug low. Towards the upside, near-term resistance level is seen at RM1.40, followed by RM1.50.

Source: AmInvest Research - 4 Sept 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024