Stock Idea - Kelington Group

AmInvest

Publish date: Tue, 28 Nov 2023, 09:42 AM

Company Background. Kelington Group (KGB) is one of the leading providers of ultra-high purity gas and chemical delivery solutions for high technology industry. The group is also a one-stop facility solution provider of turnkey engineering services from initial system design up to maintenance and servicing after completion. It operates under 4 core business divisions: (i) ultra-high purity (UHP), (ii) process engineering, (iii) general contracting, and (iv) industrial gases. KGB’s top 3 key operating markets collectively contributed 95% of 9MFY23 total sales: Malaysia (43%), Singapore (35%) and China (17%).

Prospects. (i) Healthy orderbook replenishment rate across UHP, process engineering and general contracting divisions. As at 30 Sep 2023, total outstanding orderbook stood at RM1.5bil (1x annualised FY23F revenue), (ii) Plan to increase production capacity at its 2nd liquid carbon dioxide plant in Kerteh to cater for rising demand in tandem with the economic recovery and growing export demand from Oceania countries, and (iii) In 1QFY24, the commencement of its 2nd on-site gas supply scheme will provide various industrial gases to a semiconductor giant in Kedah, positively underpinning earnings visibility for the next 10 years.

Financial Performance. In 9MFY23, KGB reported a higher revenue of RM1.13bil (+33.3% YoY) with a PAT of RM68.9mil (+77.7% YoY). This was mainly driven by contributions from UHP and process engineering divisions as well as elevated demand for liquid carbon dioxide and other industrial gases from local/export markets.

Valuation. KGB is trading at an attractive FY23F P/E of 14.4x, which is lower than its 5-year forward average of 17x and Bursa Industrial Production Index’s 23.8x currently. As a comparison, U.S.-based Linde and Europe-based Air Liquide, both also involved in specialty gases, industrial gas and processing solutions, trades at a much higher FY23F P/E of 29.4x and 27x respectively.

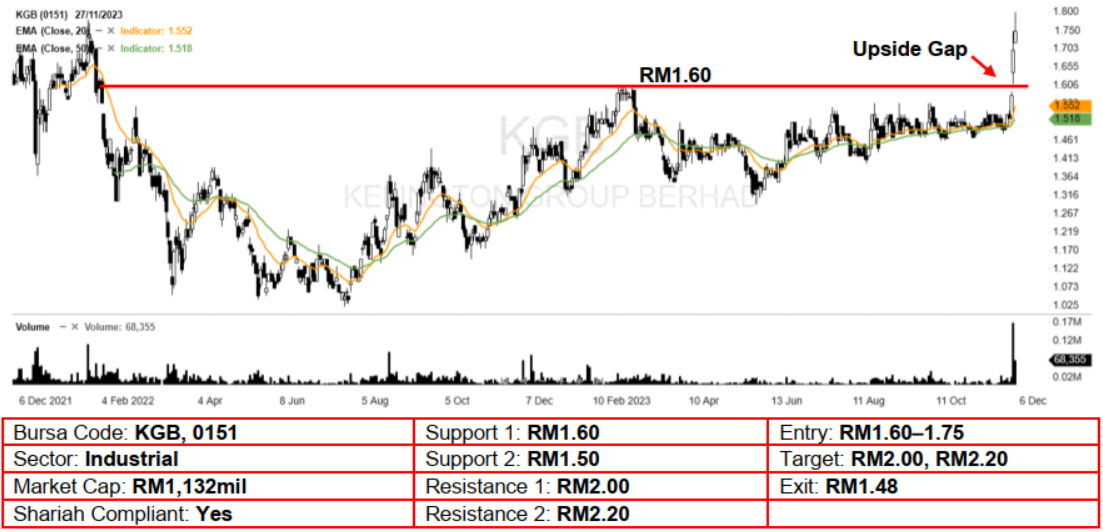

Technical Analysis. KGB may trend higher after it gapped up and hit a new 52-week high 2 sessions ago. The stock also posted 3 white candles in a row and its 20-day EMA is starting to turn upward, likely suggesting that upward momentum is picking up further. A bullish bias may emerge above the RM1.60 level, with stop-loss set at RM1.48, below the 50-day EMA. Towards the upside, nearterm resistance level is seen at RM2.00, followed by RM2.20.

Source: AmInvest Research - 28 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Dec 20, 2024