Ageson: How the huge losses occurred?

BLee

Publish date: Sat, 25 Feb 2023, 02:39 PM

Ageson has been reporting QR profit continuously for many many quarters, why the losses of RM166,044k in this Sixth Financial Quarter of year ended 31 December 2022?

One Forumer pointed out due to Reversal and impairment as stated below:

"Forumer79> Below are the biggest items causing huge losses to current quarter results: Reversal of bargain purchase 126,687,000 Impairment losses on other receivables and goodwill 84,709,000"

Good highlighting on 6QR2022; since I am a blur on accounting, I have done some reading on what is Reversal of bargain purchase and trying to piece together (therefore inaccurate) why the huge losses…

"How do you calculate goodwill or bargain purchase?

Goodwill is calculated by taking the purchase price of a company and subtracting the difference between the fair market value of the assets and liabilities. Companies are required to review the value of goodwill on their financial statements at least once a year and record any impairments."

It seems it is "not wrong to review this Reversal and Impairment" at the 6Q2022; only a big surprise of reporting profits for the last 5 quarters getting investors confidence the company is doing well financially??

Lesson learnt: Look at all the 4 or 6 quarters to decide is it a good counter to invest??

Details of my assumption on the Reversal of bargain purchase and Impairment from the 6QR2022 as below:-

Detail no.1: Negative income? For the period (all the 6 periods) still positive..

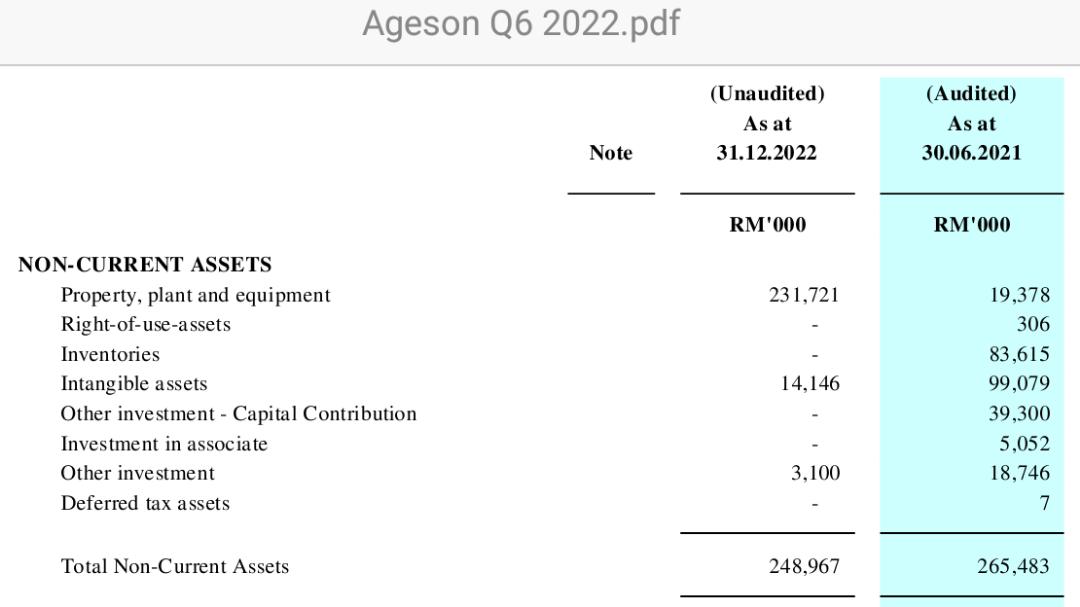

Detail no.2: Big changes in Property, Plant and Equipment. Is this part of the bargain purchase?

Detail no.3: Big changes in retained profit although still positive.

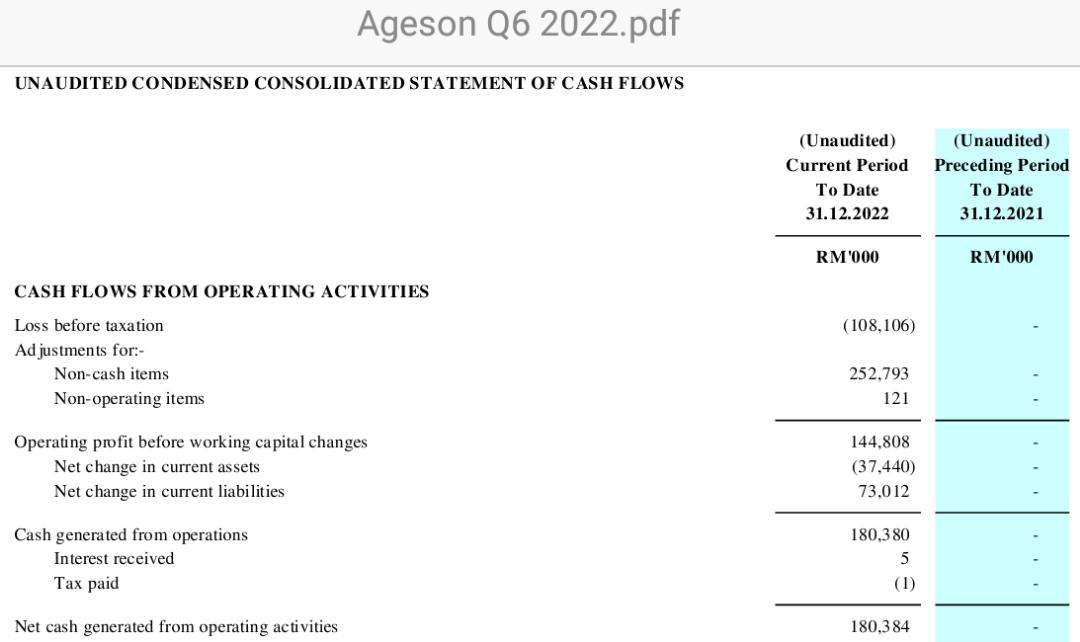

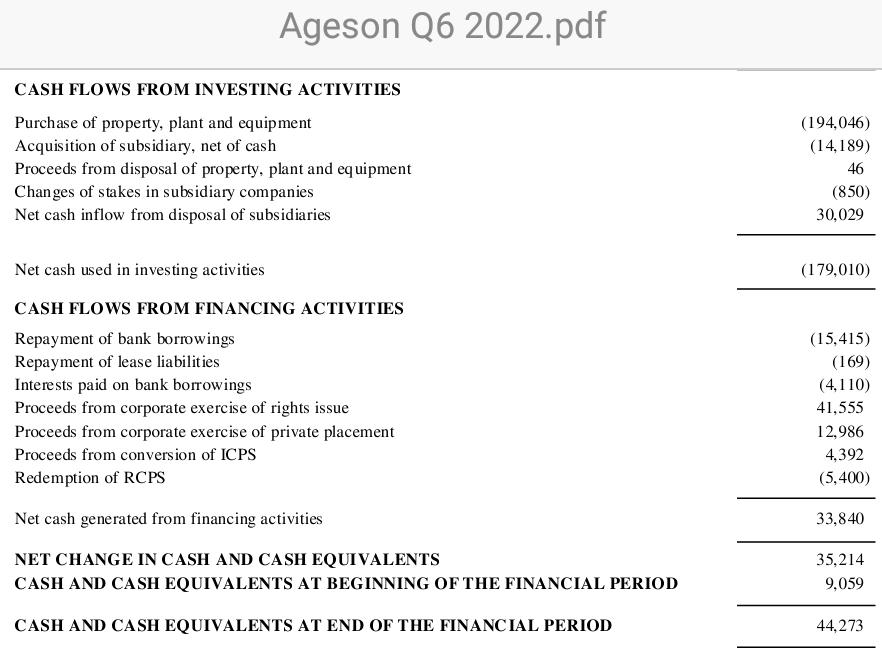

Detail no.4: Very positive Cash Flow

Detail no.5: Increase in Cash Equivalents

Detail no.6: Are these 2 purchases referred to as Bargain Purchases??

Detail no. 7: Answers to most of the questions are in these statements??

If anyone could answer some of the questions I have raised, please do so as it will contribute/share info for a better investing knowledge. Thanks in advance..

Disclaimer: The above article does not represent a recommendation for Holding, Buying or Selling Ageson; just a personal opinion and for sharing purposes only. Any offenses and errors are unintentional; my apology in advance.

More articles on AGESON

Discussions

"DickyMe> Goodwill value is just a number plucked from thin air."

Agreed, Goodwill is hardly measurable, most likely used to clean up the account "skeleton"..both negative or positive. As mentioned, "no material impact to the cash position". I am more worried about the Reversal of Bargain Purchase; what does it really mean? Is it paper loss which can be recovered when the Bargain Purchase improves?? Happy Trading and TradeAtYourOwnRisk

2023-02-25 17:32

DickyMe

Goodwill value is just a number plucked from thin air.

2023-02-25 15:05