AGESON: How is it related to Fintec Group?

BLee

Publish date: Sat, 04 Dec 2021, 05:39 PM

Below is my discussion with 3 forumers in i3 investor forum:

@Forumer1: ingat 2c 2c 2c ...any price abv it is overvalued

30/11/2021 2:44 PM

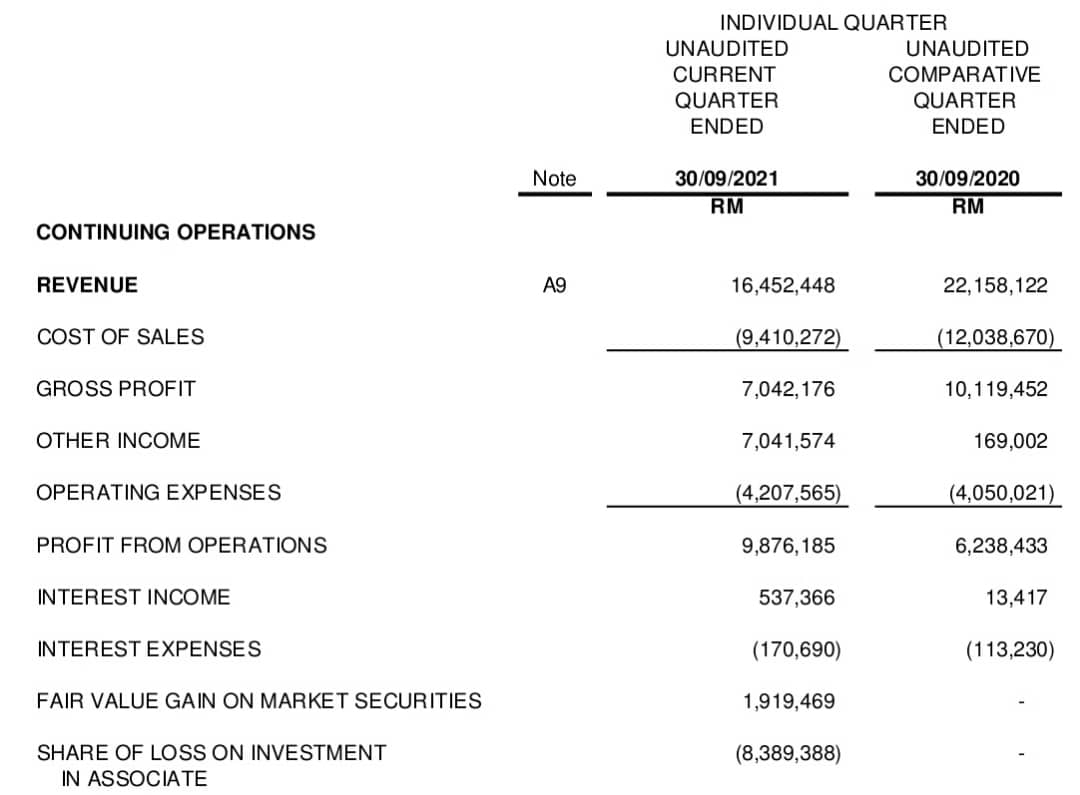

BLee: Hi @Forumer1, below are the latest financial details of QR Sept. 2021, indicating Focus D NOT really overvalued, and a growth stock. Figure DON'T lie..

PROFIT FROM OPERATIONS: RM9,876,185

SHARE OF LOSS ON INVESTMENT IN ASSOCIATE: RM(8,389,388)

PROFIT BEFORE TAX: RM3,772,942

PROFIT FOR THE PERIOD: RM1,650,508

Cash and bank balances: RM118,378,808

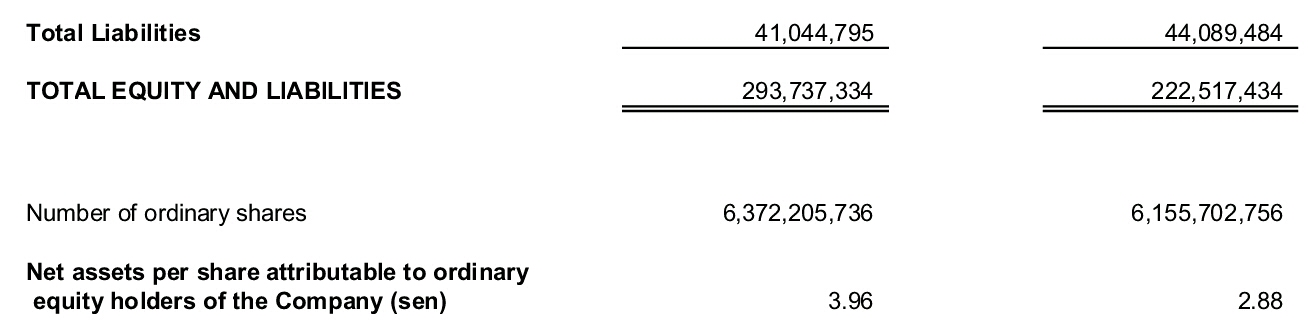

TOTAL ASSETS: RM293,737,334

Total Liabilities: RM41,044,795

Net assets per share attributable to ordinary equity holders of the Company (sen) as at Sept.2021 of 3.96 vs Sept.2020 of 2.88 (Growth indication)

If ignore share of loss on investment in associate (paper loss) of more than RM8mil, final profit shall be around RM12mil...also cash rich of RM118mil.

TQ, Happy Trading and TradeAtYourOwnRisk

30/11/2021 3:45 PM

@Forumer2: @BLee how did u get this?

30/11/2021 5:57 PM

BLee: Hi @Forumer2, it is an extract from Focus D QR of the attached link: https://www.klsescreener.com/v2/announcements/view/3465315

Happy Trading.

30/11/2021 6:37 PM

To further simplify the details, below are the snapshots of the QR for easy reference:

Snapshots No. 1: Focus D Trading/Profit statement.

Snapshots No. 2: Focus D Financial statement.

@Forumer3: Do not waste money, just avoid this counter owned by kon fintec group loh!

BLee: Hi Bro @Forumer3, when is Fintec group and Ageson related? Only relation for me is I have invested in both counters. For info, I have flipped 80% of Insas (remainder 20% become zero cost) and inclusive of huge profit during recent Insas RI of RPS into Fintec, Focus D, KGroup and recently into Ageson at 6sen. How can Ageson be con counter when continuously making profit for the last 23 quarters of profit?

Details of latest Ageson QR:

Gross profit: RM9.065mil

Other operating income: RM126.692mil (very exceptional)

Total comprehensive income for the financial period: RM11.833mil (surprisingly increase after tax as usual case will be lower than gross profit)

EPS (sen): 1.48 this QR vs 0.57 of last QR, sign of growth stock of almost 3 times.

NET ASSETS PER SHARE (RM) of 0.25 divide by share price of 0.05 equal 5 times vs Insas NTA of RM3.23 divide by share price of RM1 equal only 3.23 times. Which is more undervalued?

The next QR could be better due to recent PP exercise to settle outstanding loans from previous management; interest free PP pay up on interest bearing loans. NOT all PPs are bad...I am with you to fight against PP on dilution of shareholders interest. TQ

Details of latest Fintec QR:

Gross profit: RM1.786mil

Profit for the period: RM23.572mil

NET ASSETS PER SHARE (RM) of 0.0872 divide by share price of 0.015 equal 5.81 times vs Insas NTA of RM3.23 divide by share price of RM1 equal only 3.23 times. Which is more undervalued?

Both Fintec and Insas are investment based businesses, if Fintec is a con company, how about Insas which very much depends on Inari market price?

Happy Trading and TradeAtYourOwnRisk.

04/12/2021 1:26 PM

Snapshots No. 3: Ageson Trading/Profit statement.

Snapshots No. 4: Ageson Financial statement.

Snapshots No. 5: Fintec Trading/Profit statement. Noticed Typo error actual Not 'loss' as figure not in bracket and calculation as addition.

Snapshots No. 6: Fintec Financial statement.

During a 'bear' market, penny stocks could be a blessing in disguise for me as the downside could be very limited to a very few sens acting as a sanctuary for me vs others blue chip counters I hold such as Tenaga and RHB bank...

Sources: i3investor and other internet surfing.

Happy trading and TradeAtYourOwnRisk.

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance.

More articles on AGESON

Created by BLee | Feb 25, 2023

For sharing how Ageson reporting huge losses..

Discussions

@sangkancil: PE <2 ...frankly , risk reward ratio... worth a bet

04/12/2021 5:49 PM

BLee: Hi @sangkancil, thanks for comments. At least I won't feel I might be the odd one out believing the upside is more than the downside.

Happy trading.

2021-12-04 18:50

Risk reward ratio is skewed towards our perception, hard earn money dude don’t play play con counter

2021-12-05 11:41

@stockraider: Avoid this kon stock loh!

05/12/2021 11:27 AM

BLee: Hi Bro @stockraider, did Fintec in great debt, great liabilities and bank borrowing to be considered as con counter?

Figures DON'T lie..I DON'T see any sign of financial difficulties.

- Receivables, deposits and prepayments of RM45.724mil vs Payables and accruals of RM6.831mil

- TOTAL ASSETS of RM349.370mil vs Total liabilities of RM7.212mil

- Cash and cash equivalents of RM19.673mil vs Borrowing RM0.0 (Zero bank loan)...continues

2021-12-05 20:36

I am against PP, nevertheless I have asked two questions in below discussion which I cannot find an answer myself...

Stock: [FINTEC]: FINTEC GLOBAL BERHAD

Oct 20, 2021 1:41 PM | Report Abuse

@AlexT12: just take care, lol, not worth it to lose money such counter. buy real tech companies. penny stocks is the easiest way to throw ur hard earned money to these operators. they are buying sport cars using your money now.

20/10/2021 8:49 AM

BLee: AlexT12, you take care too. My investment shown in my portfolio still remain same, only loss in commission and taxes..Agreed some penny stocks are very hard to recover from years of losses. My advise is to read QRs and ARs of counters before throw our hard earned money. Find out reasons why the decline in stock prices vs business environment (balance sheet, cash flow, feed stocks prices, etc).

Two questions: 1. How can operators earn money in PP investment if the PP tranches prices keep decline by almost 10% since from Fintec tranche 1 to tranche 4 without any rebound of price?

2. How can money flow out (siphon) as money collected from PP, ESOS, SIS, RI are locked in bank FD account as shown Fintec latest QR reporting?

Continues...

2021-12-05 20:42

Another discussion on 'cash raising' warrants and preference shares which might be considered con issue?

Stock: [FINTEC]: FINTEC GLOBAL BERHAD

Nov 17, 2021 11:38 AM | Report Abuse

@whistlebower99:

===========================

Total issued shares = 5,287,940,331

WA = 170,092,838

WB = 116,443,428

WC = 1,146,126,828

===========================

Very heavy with 3 children

===========================

TRADE WISELY, don't be caught with corporate exercise that is not beneficial to retail shareholders

17/11/2021 10:38 AM

BLee: Hi @whistlebower99, hope a very good trading day to you. Agreed that, PP and ESOS might NOT be beneficial NOT only to retail shareholders, it should be to ALL shareholders..

I am against PP and ESOS due to the 5 days VWAP price setting and usually at 10% discounted price...it might has other benefit such as interest free cash.

As I have post earlier, if WA, WB and WC exercises, the conversion will increase the cash coffer in Fintec.

16/11/2021 11:35 AM

Rome is not built in a day; therefore it take time for most investment to reach any result..TQ

Happy trading and TradeAtYourOwnRisk.

2021-12-05 23:53

BLee: Two questions: 1. How can operators earn money in PP investment if the PP tranches prices keep decline by almost 10% since from Fintec tranche 1 to tranche 4 without any rebound of price?

2. How can money flow out (siphon) as money collected from PP, ESOS, SIS, RI are locked in bank FD account as shown Fintec latest QR reporting?

Continues...

Very good questions BLee, at least these seems like critical questions that let us think outside the box rather than simply shoot common answers like PP, RI, Consolidation, etc cheats your money but then ignore the nonstop price fall. I've even got a friend who knew investment bankers (you would have thought that he knew more than most of us since he has such friends) that tell me to sell during consolidation because it's better to get back some capital (huge loss) rather than lose all.

But I persist and at the end not only got back full capital, I earned some profits too. Why I insist to keep? Well only a simple scenario in my mind: big shareholders/insiders are holding the share at high price as well, and latest annual report still shows they are there. These are after considering the selldown volume, RI price, etc... you somehow get the picture that they are still inside with higher cost.

1. How can operators earn money in PP investment if the PP tranches prices keep decline by almost 10% since from Fintec tranche 1 to tranche 4 without any rebound of price?

All speculation here: Everyone except retailers and non-insiders are together in the money. Means they have huge pool of money, can create fake volume/charts/price actions, work together with market makers/operators, and can wait years and years to flush out outsiders. If you try and study some history of those penny stocks, many times during pump and dump they almost coincides with corporate announcements/news/exercises, you cannot help but feel that the entire timeline is all planned out.

2. How can money flow out (siphon) as money collected from PP, ESOS, SIS, RI are locked in bank FD account as shown Fintec latest QR reporting?

Also speculation: Didn't know that money collected from these exercises are locked in bank FD, as I thought they can be used for those purposes stated in the shareholder circular eg, for company day to day operations, repay bank borrowings, to fund projects etc. Then with these purposes announced, it's easy to setup shell companies to act as vendors/customers to siphon out these collected funds from the bank.

2021-12-06 00:52

Confirm kon mah!

If just buying bargains company with negative goodwill can make millions without doing anything ...our Sifu Sslee will have make more than Rm 6 millions, just investing in Insas mah!

Kon counter avoid lah!

Sure kena cheat one...later cry also no tears mah!

Lu tau boh ?

2021-12-06 08:26

@stockraider: Confirm kon mah!

If just buying bargains company with negative goodwill can make millions without doing anything ...our Sifu Sslee will have make more than Rm 6 millions, just investing in Insas mah!

Kon counter avoid lah!

Sure kena cheat one...later cry also no tears mah!

Lu tau boh ?

06/12/2021 8:26 AM

BLee: Lu tau boh ? I could be boh as my investment in Ageson at 6sen, KGroup at 3sen, Fintec at 2sen and Focus D-PA at 1sen; all from profit selling Insas RPS-OR close to double LU price and flipped a few times with the windfall cash.

Our Sifu Sslee is a long term investor, in a different league from me. I won't keep my millions in the stock market as it is so cyclical. I am very much in properties, collecting rental for my old age.

I could be boh as I always buy low, stuck for years until I see my profit. Pump and dump NOT for me as I am too dumb…

Happy trading and TradeAtYourOwnRisk

2021-12-06 09:39

@sting79: BLee: Two questions: 1. How can operators earn money in PP investment if the PP tranches prices keep declining by almost 10% since from Fintec tranche 1 to tranche 4 without any rebound of price?

BLee: At least PP is regulated, with proper tracking by regulator and regular update of %usage of $ used. I am dumbfounded by the numbers of Fintec ESOS; really pushing the price down and diluting NTA…

I am speechless; link https://klse.i3investor.com/blogs/BLee_Fintec/2021-10-28-story-h1592921506-Fintec_I_am_speechless.jsp

Happy Trading

2021-12-06 10:37

They can just sapu the cash in ageson by injecting or buying some rubbish mah!

This is one a way how fintec kon money mah!

Lu tau boh ?

Posted by BLee > Dec 6, 2021 10:37 AM | Report Abuse

@sting79: BLee: Two questions: 1. How can operators earn money in PP investment if the PP tranches prices keep declining by almost 10% since from Fintec tranche 1 to tranche 4 without any rebound of price?

BLee: At least PP is regulated, with proper tracking by regulator and regular update of %usage of $ used. I am dumbfounded by the numbers of Fintec ESOS; really pushing the price down and diluting NTA…

I am speechless; link https://klse.i3investor.com/blogs/BLee_Fintec/2021-10-28-story-h159292...

Happy Trading

2021-12-06 10:43

@sting79: Also speculation: Didn't know that money collected from these exercises are locked in bank FD, as I thought they can be used for those purposes stated in the shareholder circular eg, for company day to day operations, repay bank borrowings, to fund projects etc. Then with these purposes announced, it's easy to setup shell companies to act as vendors/customers to siphon out these collected funds from the bank.

06/12/2021 12:52 AM

BLee: Hi @sting79, you are right. It is in bank FD prior to the intended usage timeline. All this is regulated, reported and audited. If you follow Fintec's regular monthly announcement, as an investment based counter, how much spent on investment in other counters are reported.

All Public listed counters like Fintec, perform crowdfunding. Can we say ALL Public listed counters also conning investors money? Only Fintec did PP and ESOS more than the others due to the recent leeway of easy PP until the end of the year. Who is the predator and who is the victim? All boils down to $ and holding power..

Happy Trading and TradeAtYourOwnRisk

2021-12-06 11:08

There are also other sign of konning beside this lah!

That means kon company loh!

Holding power no use...if it is kon company loh!

For kon company...u either cut or pray for better luck mah!

Posted by BLee > Dec 6, 2021 11:08 AM | Report Abuse

@sting79: Also speculation: Didn't know that money collected from these exercises are locked in bank FD, as I thought they can be used for those purposes stated in the shareholder circular eg, for company day to day operations, repay bank borrowings, to fund projects etc. Then with these purposes announced, it's easy to setup shell companies to act as vendors/customers to siphon out these collected funds from the bank.

06/12/2021 12:52 AM

BLee: Hi @sting79, you are right. It is in bank FD prior to the intended usage timeline. All this is regulated, reported and audited. If you follow Fintec's regular monthly announcement, as an investment based counter, how much spent on investment in other counters are reported.

All Public listed counters like Fintec, perform crowdfunding. Can we say ALL Public listed counters also conning investors money? Only Fintec did PP and ESOS more than the others due to the recent leeway of easy PP until the end of the year. Who is the predator and who is the victim? All boils down to $ and holding power..

Happy Trading and TradeAtYourOwnRisk

2021-12-06 11:16

@stockraider: They can just sapu the cash in ageson by injecting or buying some rubbish mah!

This is one a way how fintec kon money mah!

Lu tau boh ?

BLee: Hi Bro @stockraider, Ageson needs cash to run their project, NOT cash rich. Please study their QR/AR to comments or discussion. Ageson has good connection in Kedah and Perak for projects and managed to sign SPA(D)evelopment order with China Company for project kick-off financing. Lu tau panlai?

Happy trading

2021-12-06 12:15

@stockraider: There are also other sign of konning beside this lah!

That means kon company loh!

Holding power no use...if it is kon company loh!

For kon company...u either cut or pray for better luck mah!

BLee: Hi Bro @stockraider, talk is ez..what is the other sign NOT reported in Ageson QR/AR? It will raise query from the authority if NOT properly reported..

Already invested way below NTA, around one fifth, why cut? Of course pray for better luck, that is investment strategy...

Happy trading

2021-12-06 12:27

Blee,

Ageson is a construction co & not tech co mah!

Its has big project is in china loh!

But think lah!

How can it be efficient & fight the chinese leh ?

Some more got lockdown cannot enter china mah!

Likely be kon CO....very fishy company mah!

Avoid lah,,,!

High risk loh!

2021-12-06 12:40

BLee: At least PP is regulated, with proper tracking by regulator and regular update of %usage of $ used. I am dumbfounded by the numbers of Fintec ESOS; really pushing the price down and diluting NTA…

I am speechless; link https://klse.i3investor.com/blogs/BLee_Fintec/2021-10-28-story-h159292...

@BLee: when I first knew and start taking notice about Fintec many months ago, I realized one thing Fintec has - unbelievable profits that goes straight up and up. And that time many people (especially Chinese media/groups) promoting like it's the most undervalued counter. Hence I stayed away and never look back.

Sorry about your current paper loss in Fintec, I hope your persistence will one day let you recover capital and even profit from it. That is what I'll do (never sell at loss and just wait) since I don't rely on stocks for a living, and most of us with real functioning full job/business have only certain amount of time in the day to chit chat in forum hahah... that's also one way to avoid the toxic/negativity/hopeless situation currently in local market.

2021-12-06 19:58

@stockraider: Blee,

Ageson is a construction co & not tech co mah!

Its has big project is in china loh!

But think lah!

How can it be efficient & fight the chinese leh ?

Some more got lockdown cannot enter china mah!

Likely be kon CO....very fishy company mah!

Avoid lah,,,!

High risk loh!

06/12/2021 12:40 PM

BLee: Hi Bro @stockraider, you got it ALL wrong, the project is in Perak. Please check your facts before posting. So much courage, garbage in garbage out.

Details:

The Land: 168 acres (“Industrial Land”) which is part of a land measuring approximately 475 acres located at Wilayah Sungai Kelian Baru, Mukim Batang Padang, Daerah Batang Padang, Perak

The cost: RM278.78 million

Purchaser: ZHEJIANG GUORONG DIGITAL ECONOMY GROUP LTD., ("ZGDEG") of China

Sold by: AHSB, an indirect 75%-owned subsidiary of the Company

Link to Agreement for work scope:

https://www.klsescreener.com/v2/announcements/view/3443269

Answered to Bursa Query:

https://www.klsescreener.com/v2/announcements/view/3446173

Ageson is more than a construction company as businesses include trading of construction materials and project development.

Happy Trading

2021-12-06 20:37

sangkancil

PE <2 ...frankly , risk reward ratio... worth a bet

2021-12-04 17:49