TAS : CAN IT RE-ENACT ITS RECENT RUN UP AND TREAD HIGHER THEREAFTER.

BURSAMASTER BULLSEYE

Publish date: Wed, 16 Dec 2015, 12:56 PM

|

TAS (5149) |

|

|

|

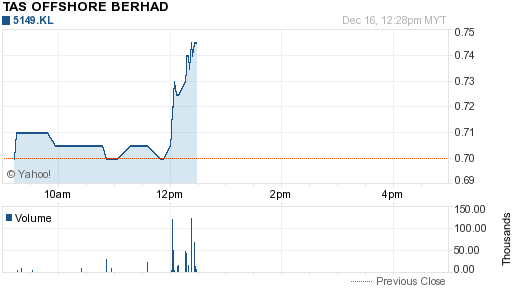

TAS has today re-enacted its last run up today with a forceful momentum. It closed the morning session at 0.745 for an impressive 4.5 cents gain. In the last run up on 9th Dec 2015; it made a high of 0.79. I believe it will try to break this 0.79 level in order for it to tread to my 1st TP 1.00 in the near term. The next major resistance of 0.83 which is also the 52-week high. TAS offshore is a fundamentally good counter.

Market Capital (RM) : 134.10m

EPS (cent) : 8.79 *

P/E Ratio : 8.48

Par Value (RM) : 0.500

Number of Share : 180.00m

NTA (RM): 1.170

Dividend (cent) : 2.000

Dividend Yield (%): 2.68

* Calculated based on the net profit of the trailing twelve months and latest number of shares issued.

What is the possible reasons for this sudden upsurge in price and volume? The feel good SARAWAK ELECTION THEME PLAY, which has witness most Sarawak counter to be in play which was hinted by the Sarawak Chief Minister on 7 Dec 2015; to be very soon. If this election play to be continuous; I foresee a higher TP of 1.20 to 1.50 before the election. |

Background

We were incorporated in Malaysia on 18 March 2008 under the Act as a public limited company under the name of TAS Offshore Berhad. We were incorporated as an investment holding company to facilitate the Listing and commenced operations through the acquisition of Tuong Aik Shipyard Sendirian Berhad (TAS) on 3 April 2009. Through our wholly-owned subsidiary, TAS, we are involved in shipbuilding and ship repairing. Our history can be traced back to 1977 with the incorporation of Tuong Aik (Sarawak) Sendirian Berhad (TASSB). TASSB was initially a supplier of marine coatings and a provider of shipping services before diversifying into shipbuilding and ship repairing in 1991. In 2002, TAS was incorporated to undertake shipbuilding and ship repairing activities. TAS initially started with ship repairing activities before the shipbuilding and ship repairing operations of TASSB were transferred to TAS in 2004. Datuk Lau Nai Hoh is the Managing Director and founder of our Group. Since the commencement of the shipbuilding operations of TASSB in the early 1990s, Datuk Lau Nai Hoh has been instrumental in the growth and development of our Group. With approximately 17 years of experience in the Shipbuilding Industry, Datuk Lau Nai Hoh has successfully led the Group to become a reputable player in the industry. In 2004, TAS acquired its current shipbuilding yard covering 12.3 acres in Sungai Bidut in Sibu, Sarawak. The yard provides us with the capacity to construct an average of 23 units of vessels per year (actual number will depend on the types of vessel constructed) based on an eight (8)-hour shift. We have the capabilities to construct a range of vessels including Tugboats, Anchor Handling Vessels, landing craft, barges, ferries, workboats, utility/ support vessels and offshore supply vessels. The vessels that are constructed by us are built in accordance with stringent international maritime standards. We currently construct vessels under the governance of Bureau Veritas, Nippon Kaiji Kyokai, and Germanisher Lloyd classification bodies. Our achievements have been recognised by external bodies whereby in 2006, TAS was awarded "2nd Position out of the Top 10 Golden Bull Award 2006? organised by Nanyang Siang Pau, Malaysian Chinese language daily newspaper. As part of our emphasis on quality, TAS received ISO 9001:2000 certification on 23 August 2007 issued by Bureau Veritas Certification Malaysia. (sourced by: http://www.tasoffshore.com/corporate-profile/history-and-business)

Website:

http://www.tasoffshore.com/

HAPPY TRADING & GOOD LUCK

BURSAMASTER

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.

More articles on BURSAMASTER BULLSEYE

Created by BURSAMASTER BULLSEYE | Jul 11, 2016

Edward94

Hi. I would like to ask how about GCB? Anymore uptrend today? Thank you

2015-12-16 13:10