Opensys - Largest CRM Technology Supplier to Banking Sector

BursaButterfly

Publish date: Wed, 03 May 2017, 12:08 AM

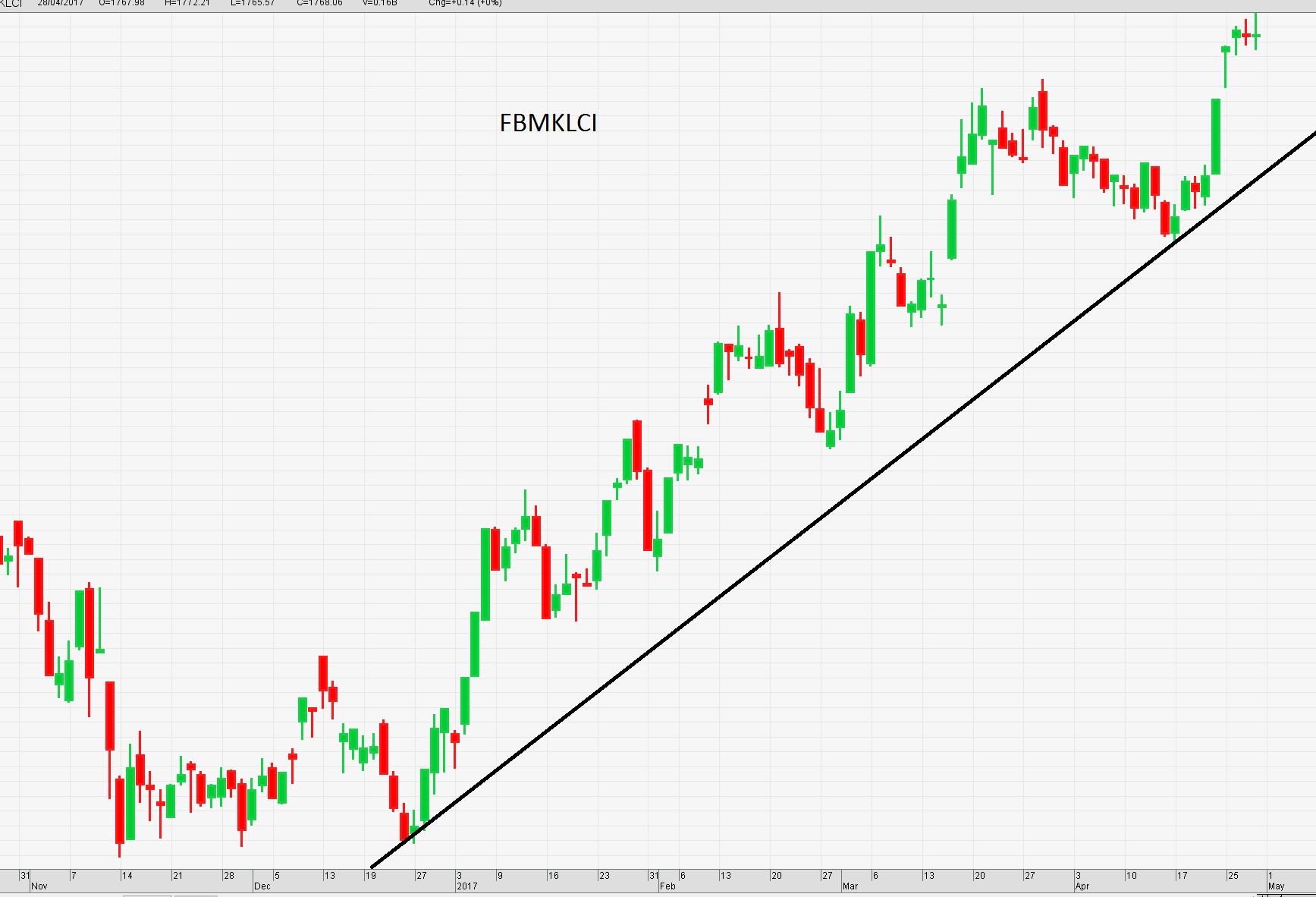

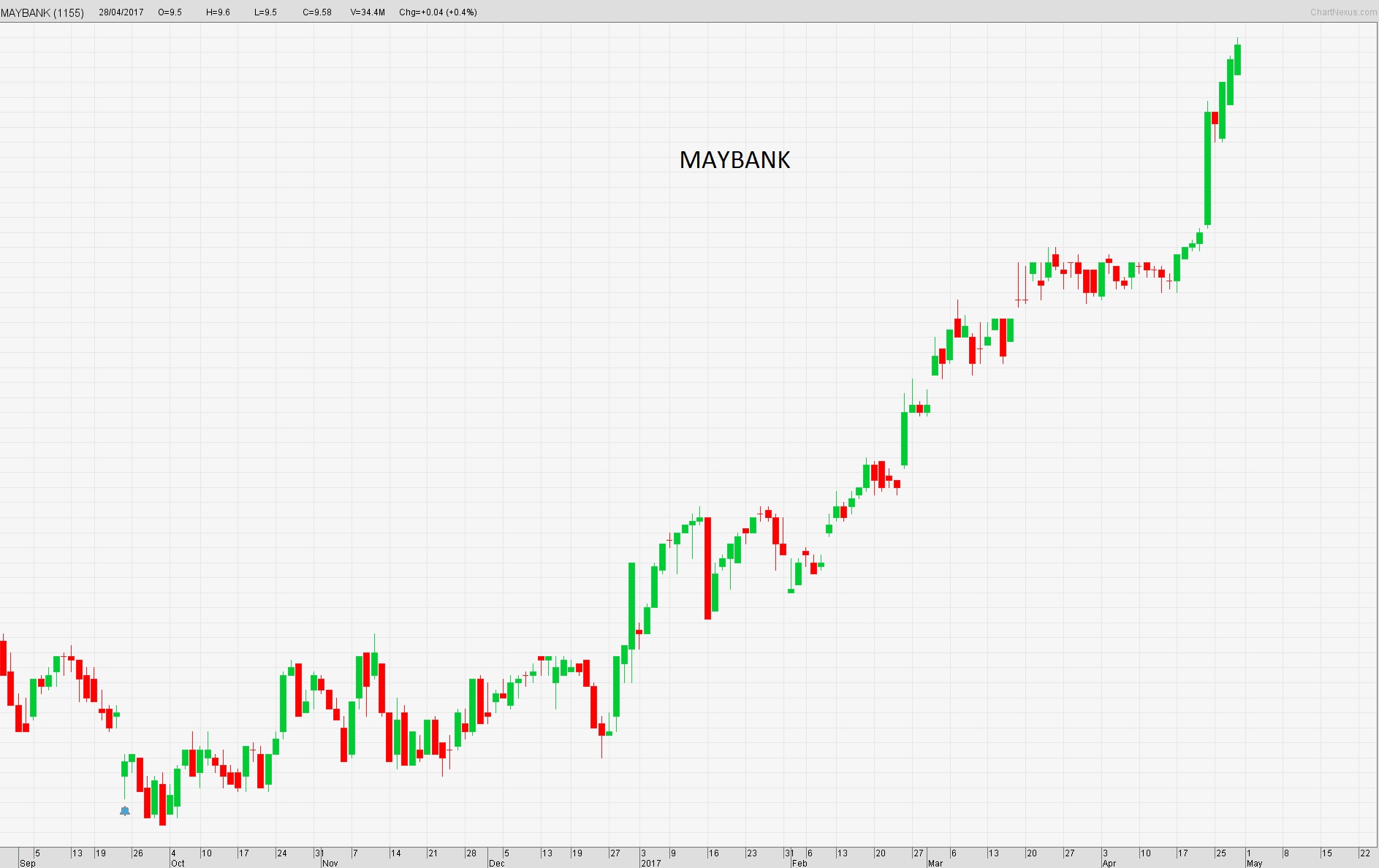

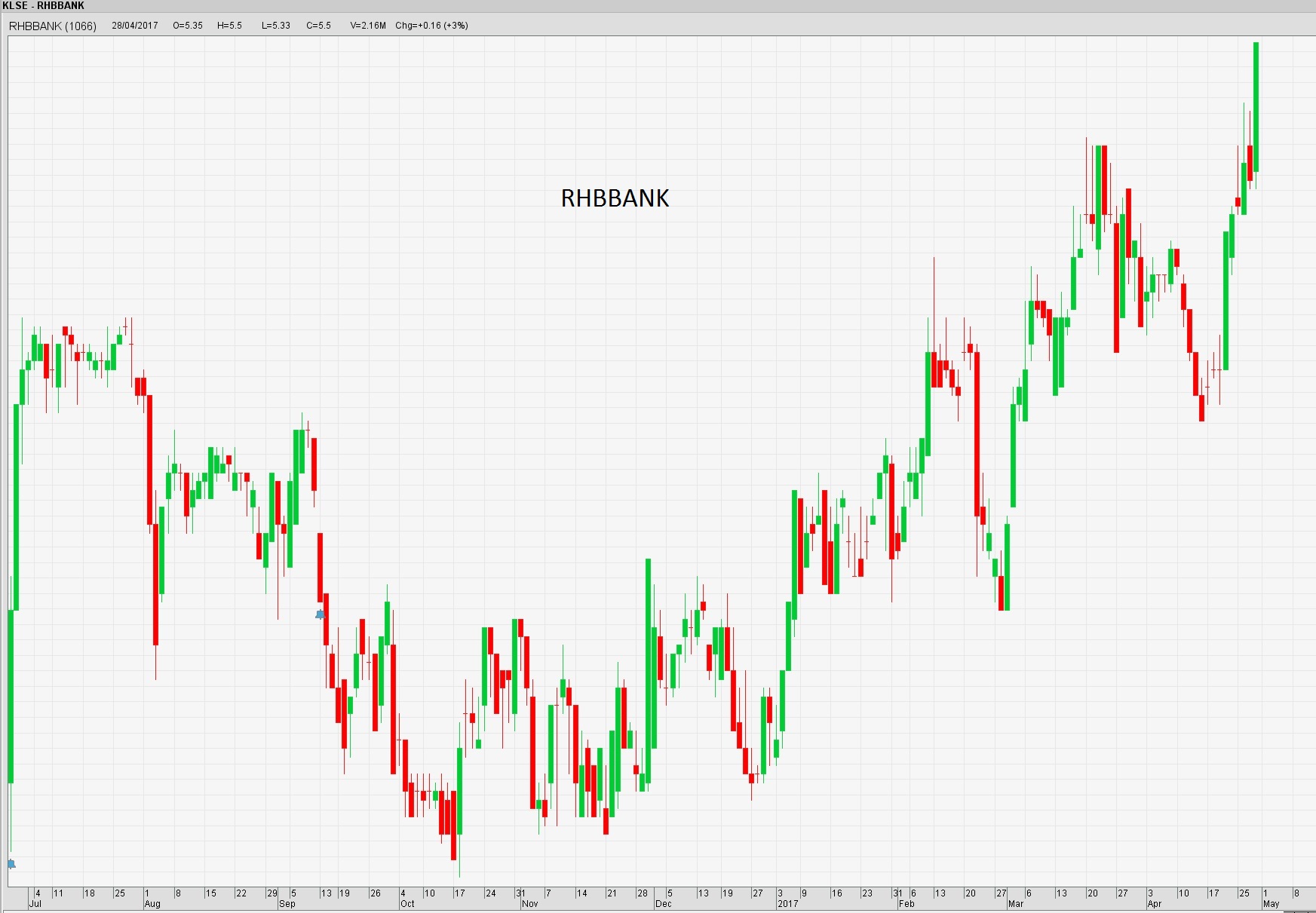

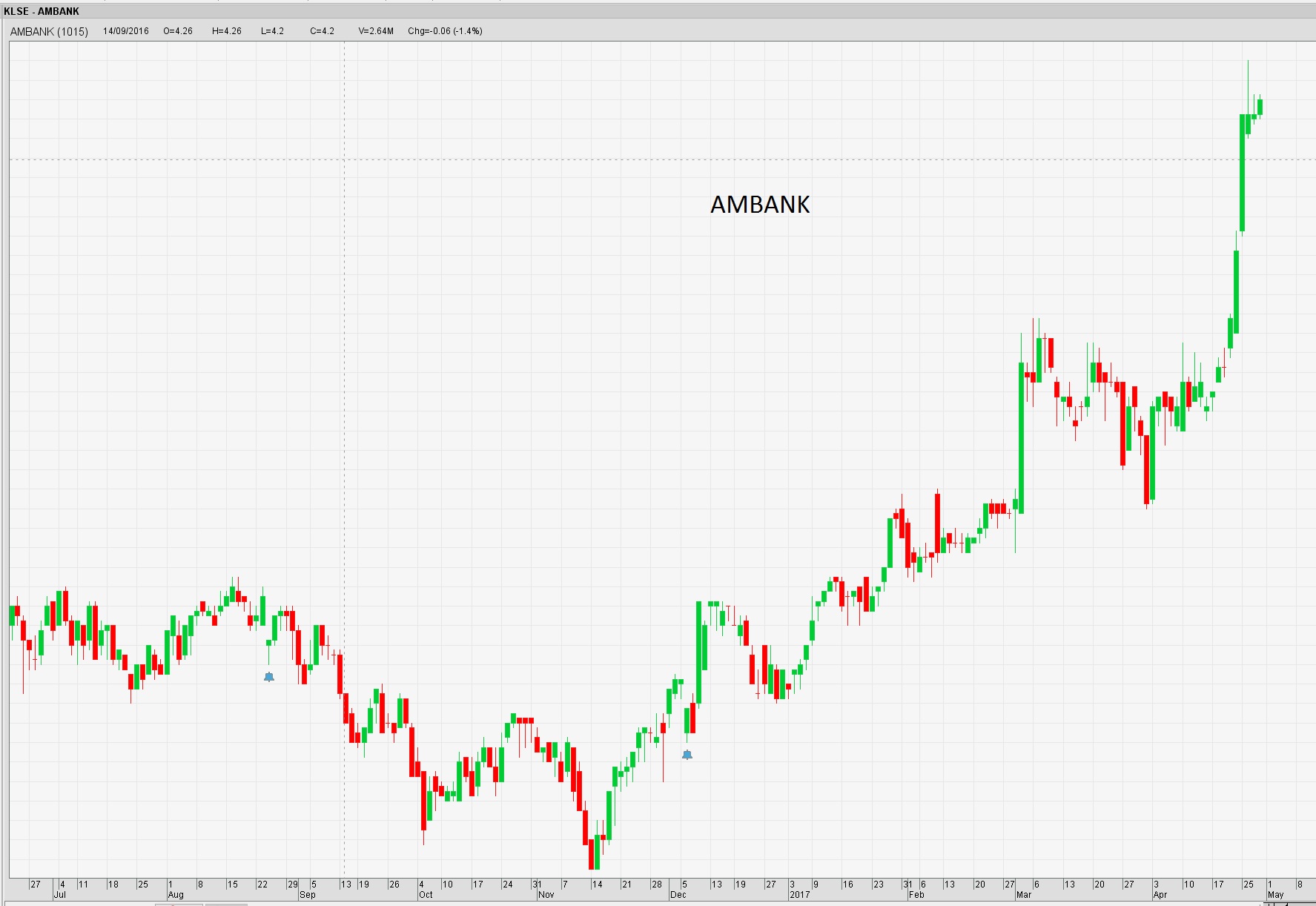

Since Jan 2017, FBMKLCI has begun its uptrend due to increasing net buying of foreign funds, spurred by persistent buying momentum in selected bluechips, as well as banking and consumer-related stocks, YTD FBMKLCI closed at 1778, expecting our MYR continue to appreciate against USD which would definitely benefit to financing sectors, our heavyweight listed financial company, among banking stocks, Maybank and CIMB closed at RM9.60 and RM5.88 respectively, RHB Bank gain four sen to RM5.54 and AMBANK perked fourteen sen to RM5.62

We believe that Opensys would be benefit from financing sector too, it is a business that supply and maintain cash recycler machines (CRM) and cheque deposit machines (called ESM or Efficient Service Machines) to major banks in Malaysia. It also provide Business Processing Outsourcing (BPO) for bill payment kiosk to select utility, telecommunications & insurance businesses in Malaysia. Opensys was incorporated as a private limited company in 1995 and is a public listed company in the ACE Market since year 2004.

OpenSys is service provider to most heavyweight company as shown in picture above

cash processing solutions

Traditionally, banks deploy dedicated self-service machines for either cash dispensing called Automated Teller Machines (ATM) or cash deposits called Cash Deposit Machines (CDM). Today, the worldwide trend is moving towards cash recycling machines (CRM) with combined functions of cash dispensing and cash deposit. The “recycling” of cash results in significant cost savings.

OpenSys cash recycling machines and solutions with proven reliability and efficiency have helped major banks to realize savings of between 25 to 30 per cent in capital expenditure and operating cost.

Cheque processing solutions

Our image based cheque processing solutions are made up of cheque deposit machines, front-end scanner devices and software applications which seamlessly capture cheque images and data and sending them to the central bank for straight-through cheque clearing and settlement.

This “paperless” cheque clearing process minimizes the physical movements of cheques whilst converting cheques into electronic fund transfer instruments. This unique “capture at source” model saves the banking industry millions of ringgit per year.

bill payment solutions

Many organizations have turned to self-service bill payment kiosks to automate and migrate bill payment services from the counter. Very often these self-service bill payment kiosks are available 24 by 7 and provide bill payment services by cash, cheque and cards with online updates.

We are the leading provider of self-service bill payment solutions and services in major utility, insurance and telecommunications companies.

Our clients have enjoyed tremendous benefits. Counter staff can now be redeployed for more productive and revenue generating services. At the same time, a new level of convenience, security and comfort for bill payment services can be conducted at the premise of the organization at significantly lower cost.

Management Discussion & Analysis

Opensys have installed over 2,000 CRMs in Malaysia hitherto – making them the industry leader with a market share of approximately 80 percent. Their critical success factors can be attributed to having a superior cash recycling technology, better software applications and more reliable after-sale support vis-à-vis their competitors

Besides our CRM success, OpenSys provides business process outsourcing (BPO) for bill payment kiosks to utility, insurance and telecommunication companies in Malaysia. The bill payment kiosks allow customers of the service providers to pay bills, reload prepaid cards and renew insurance premiums using cash, cheques, credit and debit cards. In the BPO process, the service providers leave the daily operation of their self-service kiosk infrastructure to OpenSys while they concentrate on their core competencies. OpenSys manages their whole infrastructure by providing hardware and software, modifying business applications, distributing software updates and advertising screens, monitoring the health of the kiosks centrally and providing maintenance support and services. In return for managing the infrastructure for these organizations, OpenSys charges a fee for each payment transaction performed by their customers. OpenSys is also the leading supplier of cheque-deposit machines and image-based cheque processing systems in Malaysia. Opensys image-based cheque processing systems are made up of front-end scanner devices and software applications to seamlessly capture cheque images and data and sending them to the central bank for straight-through cheque clearing and settlement. This paperless cheque clearing process that minimizes the physical movement of cheques by converting cheques into electronic fund transfer instruments saves the banking industry hundreds of millions of ringgit per year. OpenSys has four business revenue models, namely (i) outright sales, (ii) software services, (iii) outsourcing services and (iv) maintenance services. In outright sales, our CRMs and cheque deposit machines are sold directly to the financial institutions with a gross margin of 10-15 percent. In software services, we provide software development services to our customers when they need modification to their application software due to changes in their business or regulatory requirements. In outsourcing services, we provide bill payment kiosks to utility, insurance and telecommunication companies over a contract period of 3-5 years. The customers pay a rental for the machines plus a click charge for each transaction. In maintenance services, the banks pay us an annual maintenance fee of 10-12 percent based on the selling price of the machines that we sold to them. In return, we service and repair the machines to ensure high availability and optimum uptime. The gross margin for software, outsourcing and maintenance services is 45-50 percent. It is pertinent to note that all our customers are blue chip companies. Due to their size, they do not pose a risk to the collection of our trade receivables.

Future Prospect

In the near future, OpenSys will be introducing new products and services in two of the fastest growing areas in the technology sector, namely, FinTech and Internet of Things (IOT). FinTech are deployed by businesses that leverage new technology to deliver financial services that are cheaper, faster and more convenient to customers by reducing the use of intermediaries between producers and consumers. IOT is a system of inter-related computing devices, mechanical and digital machines, objects, animals or people that are provided with unique identifiers and the ability to transfer data over a network without requiring human-to-human or human-to computer interaction. The target market of our FinTech and IOT products, which has been under development for the past two years, is the financial services industry.

We give short term TP RM0.415, if third attempt(as in chart above) succeed, mid term TP2 RM0.5

Conclusion

We are optimistic to upcoming quarterly result and near future of OpenSys with the reasons below:

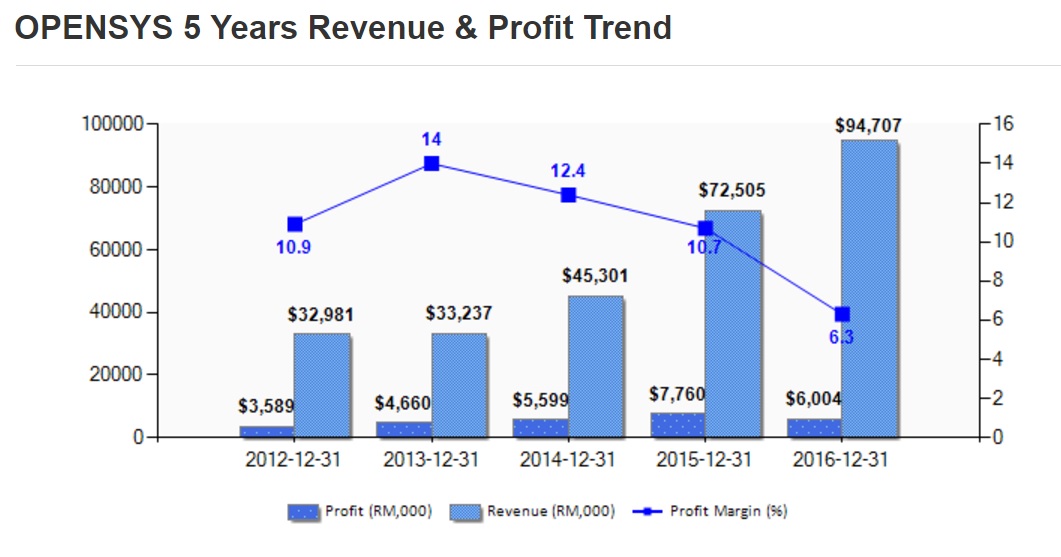

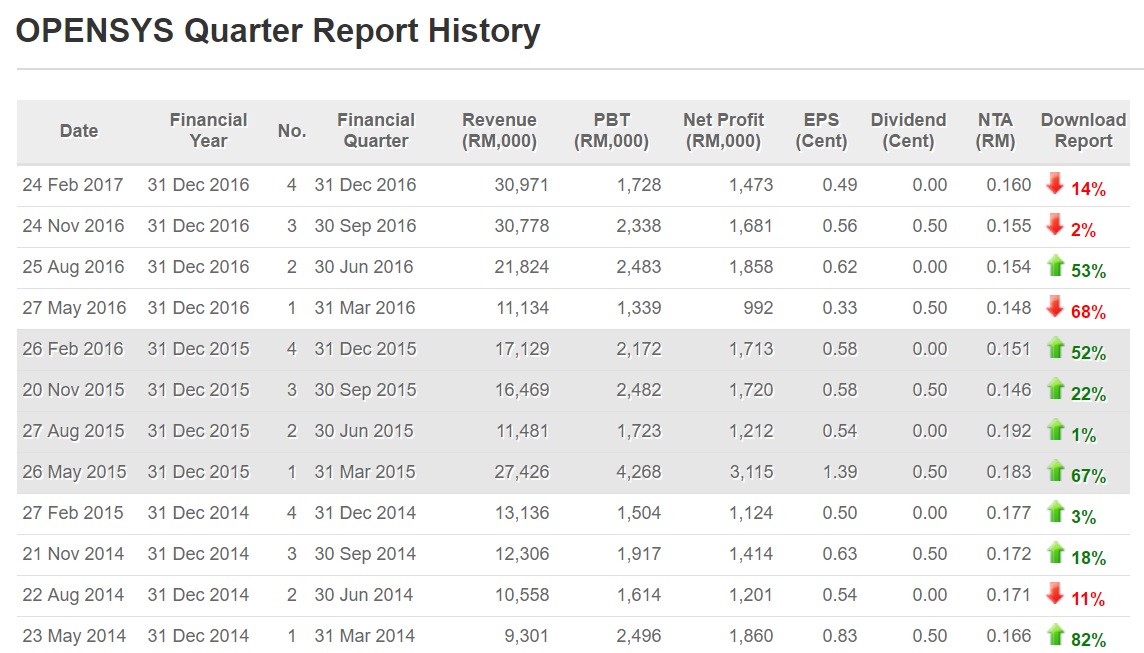

Strong upcoming FY17 results

Market Leader for CRM

Introducing FinTech and Internet of Things

Largest bank favourable user

Healthy balance sheet and cashflow

Sustainable income as the low CRM revenue in future will be able to compensated by revenue from Cash Recycling Solution

Reference

OpenSys annual report 2016

malaysiastock.biz

http://klse.i3investor.com/blogs/noobnnew/108645.jsp

===================================================================================================

For fastest update, Join our free channel at

DISCLAIMER

All information from author is for education purpose only, NOT RECOMMENDATIONS. kinldy speak to your remisier or dealer representative before making any orders, trade at your own risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

stockmanmy

I see better analysis nowadays then those Balance Sheet ratios and formulas and margin of safety stuffs from last year.....................

2017-05-03 00:37