HOHUP - A COUNTER NOT TO BE FORGOTTEN - INTEREST RE-EMERGING !!

BURSAMASTER

Publish date: Sat, 30 Mar 2019, 08:31 AM

HOHUP - A GEM UNDERLOOKED !! (PERSONAL TP 73 - 80 cents)

This week, BSKL has seen rising interest in the CONSTRUCTION sector as talk of ECRL project revival is nearing to completion; which should continue into next week.

Recently I had spotted this small cap company; an investment grade, which have been underlooked and undercovered - HOHUP CONSTRUCTION COMPANY BHD or HOHUP (Code 5169).

I noticed considerable interest starts to trickle in on Friday where the volume registered a sizeable increase to 4.5 million.

A bullish bias may appear above the MYR0.445 level, with an exit set below the MYR0.405 threshold. Towards the upside, the near-term resistance is at MYR0.505. This is followed by the MYR0.55 level.

This positive momentum should carry forward next week ( forbearing instances of the adversity/ negativity of the regional markets sentiment affecting Bursa Malaysia) since it was able to close Friday conclusively above its major resistance of 0.445.I forsee it trending to the next resistances of 0.505 & 0.55 before heading to my personal TP between 0.73 to .80 on comfortable P.E. of 10 to 11 in the intermediate term.

I would like to express my opinion on this stock :

WHY I THINK THIS STOCK IS UNDERLOOKED AND COULD HAVE GREAT POTENTIAL TO RISE FURTHER?

1. Lack of Coverage by IB / Research Houses

I think this is the biggest factor causing this stock not to reflect its true value. For the past 1-2 years, there have been lack of analyst reports and media coverage on this stock. With this article being posted, I hope that some of the IB / Research Houses and media members can serve public the justice by analyzing and publishing coverage on HOHUP.

2. Financial Analysis Point of View

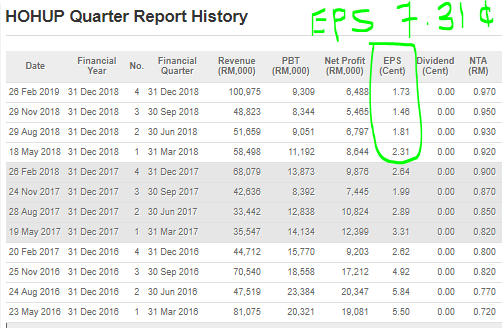

Let us refer to below image of the latest 3 years quarter reports of HOHUP.

Recently, HOHUP had posted its historic highest revenue or RM 101 million in Feb 2018 report. Also, earnings in latest quarter are better compared to previous quarter. Totalling up the EPS per quarter, we get a total full year EPS of 7.31 cents.

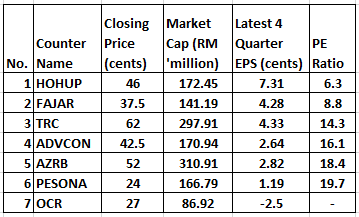

Comparison With Few Main Board Construction Stocks

Below table of comparison between HOHUP and few peers in the Main Board - Construction.

As you can see, HOHUP is currently trading at only a PE Ratio of 6.3, which is significantly lower compared to its few other peers out there. With a conversative PE Ratio of around 10-11, I would opine that this stock should be trading around 73-80 cents in near term.

2. Technical Analysis Point of View

Let us refer to the monthly chart belowof HOHUP; captured from January 2013 to March 2019. We can see that HOHUP was trading significantly higher in the past and the current price presents big upside opportunity (up to 80 cents for first major resistane), compared to downside.

Technically, the stock is seen in bullish momentum as the MACD has crossed upwards with positive buildup in volume.

As the financials get better for HOHUP, for example EPS gets to 15-20 cents, I do not see any reason why it cannot go to above RM 1 in the longer term.

Considering all the above, my personal TP for HOHUP is set between RM 0.73 - 0.80.

Based on Feb 2019 quarter report, company expects a sustainable performance from following initiatives:

1.on going JDA entitlement with Pioneer Haven Sdn Bhd, based on its sales activities

2.intensify sales for higher priced units in The Crown, Kota Kinabalu

3.marketing of Aurora Duo,a high end condominium situated next to Aurora Place in Bukit Jalil

4.initial launch of Laman Iskandaria township development in Kulai

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

I WILL PLACE HOHUP INTO MY INVESTMENT PORTFOLIO BEFORE FUNDS START BUYING INTO IT.

I ANTICIPATE A GOOD RETURN ON THIS INVESTMENT.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

Discussions

Bro... cash flow also got problem .. but something may be cooking... if not good will hangus oo

2019-03-30 10:58

It it's gone, it's gone. Don't promote it. Don't let innocent people get trapped.

2019-03-30 15:56

If you want construction, wa kasi you all one very good tip: Econpile!

2019-03-30 16:44

@ nckcm - based on latest quarter report, company has rm 21.6 million cash in bank and rm 9.6 million in fixed deposit..dont accuse company of having bad cash flow without proper backing..its net assets stood at 97c as of feb 2019

2019-03-30 17:37

Hohup.... Lol. When its still in pn17 can buy..... Now ah... I dunno, never follow after tht

2019-03-30 20:37

https://klse.i3investor.com/blogs/koonyewyinblog/200268.jsp

Koon just like speakup now we both dont like Pakatan. speakup also donated a lot of money to Pakatan, only to feel cheated after they won GE14. FARK!

2019-03-30 22:04

Based on Feb 2019 quarter report, company expects a sustainable performance from following initiatives:

1.on going JDA entitlement with Pioneer Haven Sdn Bhd, based on its sales activities

2.intensify sales for higher priced units in The Crown, Kota Kinabalu

3.marketing of Aurora Duo,a high end condominium situated next to Aurora Place in Bukit Jalil

4.initial launch of Laman Iskandaria township development in Kulai

2019-03-30 22:10

Dear...pls becareful. Some time report is tipu...all must becareful I dont u all lost money..kena Fukk up...u know? Ha ha..

2019-03-31 06:17

U must know how to buy stop..all stok is control by big Boss...Fukk this Boss. Dont play play...

2019-03-31 06:21

I think alot people dont know how to buy stok...???U know...?All stok big Boss control ...tipu stiok holder. Fukk himm...u know...? Tks u..Good luck to u all...

2019-03-31 06:23

All big Boss is a human Being same like us..try to tipu stok holder get rich fast.. dont how to do business..u know?

2019-03-31 06:29

But..??? Becareful...u know..??? When after u buy...the company is kosong..??? Fukk the big Boss ...only take care himself... Tipu us stok holder..????

2019-03-31 06:41

for mandarin readers, please refer below link

https://klse.i3investor.com/blogs/InvesthorsHammer/200296.jsp

2019-03-31 08:11

Bank Overdraft RM32.032M

Cash restricted from use RM13.489M

Fixed deposit rm9.6M

Cash RM21M

Net (14 Million)

:(

No money to carry out development...

Major shareholders can't afford RI

IT WAS ABORTED AFTER PROPOSED

2019-03-31 12:30

Goreng Goreng only..

Even Major shareholders, Omesti sold @49.5 - 50cents last Aug...

2019-03-31 12:42

There are better counter to punt: Check it out here! https://klse.i3investor.com/blogs/Day3/200300.jsp

2019-03-31 13:17

@uptrending - rights issue cancellation was in Sept 2017 (spinning old story..out of date)..i believe company had taken alternative funding forms to execute its projects hence reflected in the improving quarter results..

Omesti had bought back some shares in Dec 2018 and this reflects the increasing confidence in company’s performance..i believe more share buy ins from major shareholders are coming in near time

2019-03-31 15:52

Total borrowings as of 31st Dec 2018 is

RM 366,343,000

The company kept increase bank borrowing since FY 2015, details are as follows :

Increase in borrowings

FY 2015 RM79, 249,000

FY 2016. RM61, 703,000

FY 2017. RM64, 721,000

FY 2018. RM57, 823,000

----------------------------------------------

TOTAL : RM263, 496,000

As of 31st Dec 2018, the company has negative cash in the form of overdraft....

:(

2019-03-31 16:46

All assets including the 18% entitlements to the JDA in BJC are charged to banks/financial institutions as collateral for borrowings. The company had gone desperate, even borrowed at very high rates @12% per annum for rm69 millions from a company of a major shareholders who has substantial influence on the company.

Source :Hohup AR2017

2019-03-31 16:50

I say ah I will choose the company that is best at doing foundation. After all foundation is the key to success. If you want to look at the best piling company in Malaysia, you should know who that is!

2019-03-31 16:55

abc123

Undercooked?!!!

2019-03-30 10:29