SCH - UNDERLOOKED BENEFICIARY OF GOVT INFRA SPENDING (ECRL, BDR MSIA, etc) !!!

BURSAMASTER

Publish date: Sun, 19 May 2019, 11:44 AM

SCH - UNDERLOOKED BENEFICIARY OF GOVT

INFRASTRUCTURE SPENDING (ECRL, BDR MSIA, etc) !!!!!

(PERSONAL TP 0.17 Short Term, 0.25 Mid to Long Term).

SCH WA - PERSONAL TP 0.095 Short Term, 0.18 Mid To Long Term

The sentiment of investors on BSKL had improved towards the end of the week with momentum led by CONSTRUCTION counters such as GAMUDA and GADANG as market movers/leaders, and KLCI index closed +6.17 points to end at 1,605.36. The Star paper had also published on Saturday 18 May 2019 that "Bursa Malaysia likely to rise further next week":

Recently I had spotted this small cap company; an investment grade, which have been underlooked and undercovered - SCH GROUP BERHAD or SCH (Stock Code 0161, listed on ACE MARKET, INDUSTRIAL PRODUCTS/SERVICES, market cap RM 72.22M)

In summary, SCH is in the business of distributing and supplying a wide range of quarry-based products. The group's products are categorized into four major segments, namely, supply of quarry industrial products, supply of quarry machinery, supply of spare parts for quarry machinery and manufacturing and distribution of quarry grill.

The group had also recently diversified into the manufacturing and trading of fertilizers, as well as rental and trading of event related equipments.

I noticed considerable interest starts to build in on Friday where the volume registered a sizeable increase to 3.4 million units, which is a 3 month high volume.

This positive momentum & enthusiasm, coupled with strong sentiment in CONSTRUCTION counters, I believe, should carry forward next week since it was able to close at the day's high on Friday conclusively at 0.13. I foresee it trending to the next resistance of 0.15 before heading to my personal TP of 0.17 (short term) to 0.25 on the intermediate to long term with its warrant trending in its stride.

WHY I THINK THIS STOCK IS UNDERLOOKED AND COULD HAVE GREAT POTENTIAL TO RISE FURTHER?

1. Beneficiary of Government Spending on MEGA Projects - ECRL, Bandar Malaysia, etc

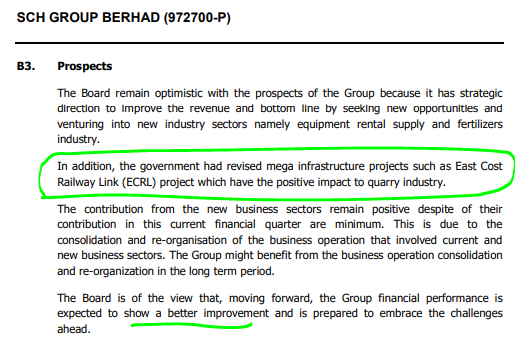

Refer below excerpt of the latest April 2019 Quarter Report on prospects commentary by the Board.

The one-year old PH government, in its stride and mission to accomplish a robust economy for Malaysia; has acknowledged the importance of reviving mega projects and introduced more projects which should further boost and jump-start the slowing economy.

These mega projects will have a direct/ indirect impact on other sectors of the economy; hardware (especially quarry); steel; aluminium, labour market, etc.

With these mega projects put in place; it will further boost the economy particularly the construction industry BUT the HARDWARE / QUARRY sector which has been silently lagging behind the construction industry in the recent run up should surely comes into play when market participants realised its importance / direct correlation with the construction industry.

With the confirmation by Malaysian government to proceed on mega projects such as ECRL and Bandar Malaysia, it is expected that quarry business shall be a direct beneficiary as there would be more demand for quarry products from market.

With a few more potential projects still in discussion and yet to be finalized such as MRT 3, and HSR, I foresee that quarry businesses shall be busier than ever once more projects are given the green light to proceed.

Hence therefore, SCH Board has commented that moving forward they expect financial performance to show a better improvement in view of above matter.

http://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=204642&name=EA_FR_ATTACHMENTS

2. Financial Analysis - No Risk of Quarter Report Uncertainty in MAY 19 & 2 Consecutive Quarter Profits

Refer below latest Financial Result summary of SCH.

Investors buying into SCH this month would avoid the uncertainty of QR result being bad, as the next cycle of QR for SCH will be in July 2019. This to me is a BIG relief, as majority of companies will be posting QR this MAY 2019 and I would rather avoid companies which the QR has yet to be reported so as not to get caught by surprise if the results were not up to expectations.

As for the trend of result, SCH had posted 2 consecutive quarter profits, from RM 49k in Jan 2019 report to RM 737K in April 2019 report. As a result of being a beneficiary of government spending as indicated in above point 1, I opine that SCH might be showing improvement of revenue and net profit in the coming quarters.

https://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=0161

3. Technical Analysis - Possible Break-Out of 2 Year Downtrend

Refer below WEEKLY chart for SCH. As we can see, SCH has been on a downtrend since February 2017. In this period, the price had tested resistance area about 4 times and did not manage to stage a break-out.

With the price hitting all time low of 0.09 in December 2018, the price had rallied to 0.15 in Feb 2019 and retraced to a HIGHER LOW price of 0.11.

With a solid weekly candle close at 0.13, building volume and bullish MACD crossing, I foresee that it would try to break the resistance and turn into an uptrend counter soon. First immediate resistance is seen at 0.17, with a longer term resistance of 0.25.

4. Alternative Entry Into SCH via SCH Warrant A (SCH WA)

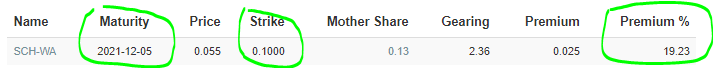

Refer below SCH WA profile captured from KLSE SCREENER website (link given) for those looking at alternate cheaper entry, to consider the warrant due to below:

https://www.klsescreener.com/v2/screener-warrants

a. Maturity in December 2021 (another 2.5 years to go), which allows reasonable time for price appreciation

b. Strike price of ONLY 0.10 is considerably low, and mother share is currently trading above this strike price

c. Reasonably low premium of 19.23% and gearing of 2.36 for a warrant with 2.5 years maturity date. Normally, a warrant with significantly long life will be trading at premiums of higher than 50%. This implies a relatively lower risk entry level for SCH WA compared to other warrants which are trading with significantly higher premium.

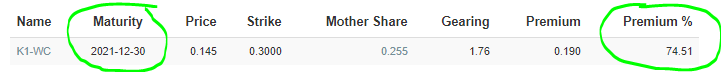

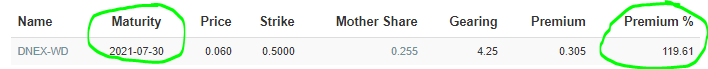

Just for illustration purposes, you may see below examples of warrants with similar maturity, K1 WC (maturity December 2021, trading at premium of 74.51%) and DNEX WD (maturity July 2021, trading at premium of 119.61%).

Therefore for those with lower capital, can opt for entry into SCH WA based on the abovementioned factors.

I foresee that if SCH is able to break 0.17 conclusively, SCH WA should be trading at 0.095 - 0.105 range (considering consistent premium of 13-17%) . Should the mother share hit 0.25, SCH WA should be trading at 0.18-0.20.

If the market decides that the premium of this warrant should be higher, then we would see prices trading higher than those of my personal targets.

CONCLUSION

Considering all the above, my personal TP for SCH is set at RM 0.17 (Short Term), and RM 0.25 (Mid to Long Term), and TP for SCH WA is set at RM 0.095 (Short Term) and RM 0.18 (Mid to Long Term).

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

Discussions

All the revived projects talk only. There are no signs of moving forward. Efficiency: 0. We will keep on talking about there projects till 2023. After that Najib will come to kick start it.

2019-05-21 14:49

1 year gone and we are not even one third of being Asian tiger. When all market was catching up, we stalled. Going down of regional and international markets, we are very fast to go down too. Foreigners are moving out, yet no action being made. You mean on the end of the third year, we are going to jump from semut to tiger or elephant?

2019-05-21 14:56

kyosan

already dispose today bursamaster?

2019-05-21 13:07