THEAVY - POSSIBLE PRIVATIZATION TO TURNAROUND COMPANY ???

BURSAMASTER

Publish date: Sat, 01 Jun 2019, 11:07 AM

THHEAVY - POSSIBLE PRIVATIZATION TO TURNAROUND

COMPANY ???

(PERSONAL TP 0.10 Short Term, 0.20 Mid to Long Term)

Recently I had spotted this small cap company; which I believe is on its path towards upliftment of PN17 -TH HEAVY ENGINEERING BHD or THHEAVY (Stock Code 7206, listed on MAIN BOARD, ENERGY, market cap RM 72.88M as at writing)

In summary, THHEAVY is a company whose core business is in the fabrication of offshore oil and gas facilities. Recently, THHEAVY had diversified into Ship Building & Ship Repair (SBSR) business.

I noticed considerable interest starts to build in on Friday where the volume registered a sizeable increase to 7.5 million units.

With this positive momentum & enthusiasm arising from the quarter report, I believe, should carry forward next week. I foresee it trending to the next resistance of 0.08 before heading to my personal TP of 0.10 (short term) to 0.20 on the intermediate to long term.

WHY I THINK THIS STOCK COULD HAVE GREAT POTENTIAL TO RISE FURTHER?

1. Asset Takeover by SPV - Possible PRIVATIZATION to Turnaround Company ???

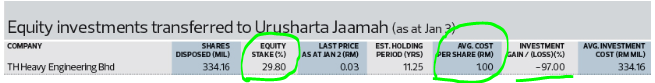

Refer below article on the takeover of Tabung Haji equities by SPV Urusharta Jamaah Sdn Bhd.

https://www.theedgemarkets.com/article/three-options-spv-taking-over-tabung-hajis-equities

Take note that the SPV had taken over THHEAVY shares from Tabung Haji at book value (RM 1.00) which equates to a total of RM 334.16 million, and not the market value.

Many companies which the SPV had taken over from Tabung Haji, had appreciated since early January 2019. These include FGV, UEMS, MMCCORP, MHB, IJM & DAYANG and many more. This means that the SPV is now in a big paper gain compared to its earlier position in January 2019.

Recently, Tabung Haji had been under public scrutiny and close watch due to declaring a very low dividend in 2018. At the same time, public is also keeping a close watch on the SPV to see how it will perform in recovering back the value of equities which it had taken over from Tabung Haji.

That being said, we can say for almost certain that neither Tabung Haji nor the SPV would want THHEAVY to fail, and be delisted from BURSA. It would be a bad outcome for their reputation moving forward.

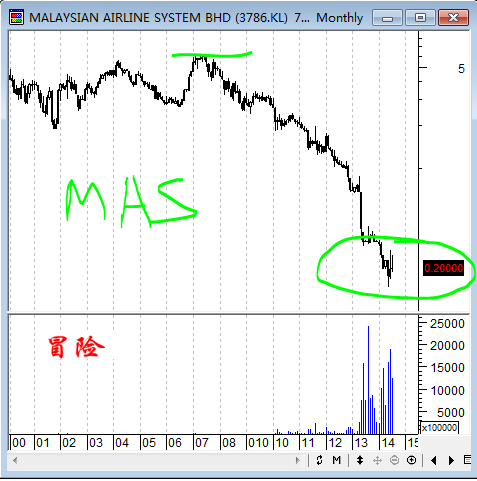

One prominent example of such a similar situation was the privatization of Malaysian Airlines (refer link below). Khazanah had spent nearly USD 500 million (which equates to about RM 2.4 billion as of today exchange rate) to takeover MAS private at 27 cents a share, and this was about 5% of the peak price around RM 5.20 in 2007.

https://airwaysmag.com/uncategorized/malaysia-airlines-to-be-privatized-restructured/

Therefore, one possible move to be taken by the SPV, to ensure a faster decision making in turning around the company, avoiding hassle of needing to convince shareholders in every corporate move, is to takeover the remaining shares that it doesn't own.

For illustration purpose, let us do the example calculation.

The shares that SPV do not own are 786.84 milllion (1.121 billion minus 334.16 million)

Let's say a takeover price of RM 0.10, then the total consideration amount is RM 78.684 million (which is 23.5% of the total initial investment of RM 334.16 million which the SV put in)

Let's say a takeover price of RM 0.20, then the total consideration amoount is RM 157.368 million (which is 47% of the total initial investment of RM 334.16 million which the SPV put in)

Considering the above, if any takeover move should be considered, then the action better be taken sooner or later to avoid paying higher costs.

2. Quarter Results - Genuine Revenue and Profit (Not One Off), Forecasted Positive Contribution From OPV Contract & Diversification into Ship Building Ship Repair (SBSR)

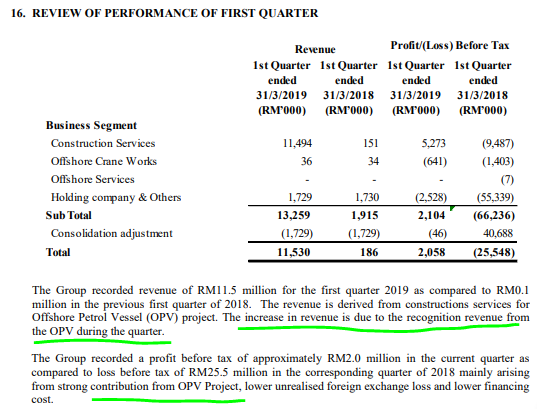

Refer below snapshot taken from latest QR 31/5/2019. We see that the main contributor to the revenue and profit is coming from the Offshore Patrol Vessel (OPV) Project, which THHEAVY has a JV with DESTINI via THHE Destini Snd Bhd (THHEAVY owns 49% stake in the JV).

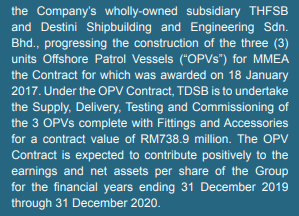

Refer earlier article (link below) on this contract when THHEAVY had secured it. The total contract value is RM 738.9 million. THHEAVY having a 49% stake in the project means that their portion amounts to RM 362.06 million. From the above report we see that only RM 11.5 million has been realized. Therefore, the balance of contract (est RM 350 million) shall be recognized in the upcoming quarters, which might help THHEAVY to be uplifted from PN17 soon.

https://www.theedgemarkets.com/article/th-heavy-destini-jv-bags-rm7389m-govt-job-supply-vessels

Also, take note of Management's comment in Annual Report as per snapshot below. Don't take it from me, but rather the management themselves have mentioned that this OPV Contract is expected to contribute positively to the earnings and net assets per share of the Group for FY ending 31 December 2019 through 31 December 2020.

Diversification into Ship Building and Ship Repair (SBSR)

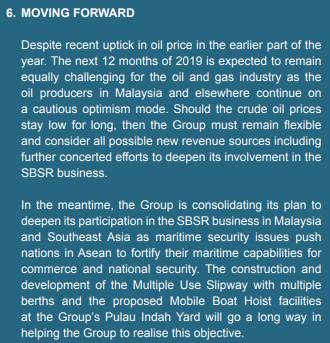

Refer below snapshot taken from latest Annual Report. Company has mentioned to remain flexible and not to depend on oil & gas business due t o the nature of volatile crude oil prices.

Therefore, the Group is consolidating its plan to deepend participation in the SBSR business in Malaysia and Southeast Asia as mostly are maritime based countries. The Group is developing its SBSR facilities at it's Pulau Indah Yard for the long run in realizing this objective.

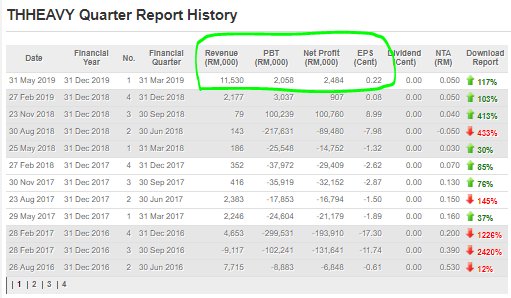

Long Term Target from EPS

Refer below the summary of QR as of latest. Latest report shows that earnings is 0.22 cents per share. However, another estimated RM 350 million from the OPV Project is pending to be captured as revenue. Considering a conservative growth of 10% EPS per quarter to be captured from this project, we would see total EPS full year at 1.02 cents. Taking a 10 X PE Ratio, we would arrive at a target price of RM 0.10.

However, let's say in a best case scenario, half of the contract gets realized this year 2019. This would come to about RM 175 million revenue. Taking a 10% margin net profit, we get RM 17.5 million (EPS 1.56 cents). Adding the current EPS, we get full year EPS of 1.78 cents. With a 10X PE Ratio, we arrive at a target price of about RM 0.18.

All the above are considering that THHEAVY delivers the ongoing project, and does not take into consideration other new potential projects which might be in the pipeline of the company.

3. Technical Analysis - Breakout of Downtrend (Monthly) & Ichimoku Breakout (Daily)

Refer below monthly and daily chart for THHEAVY.

From monthly chart, we see that since 2016 downtrend, THHEAVY price has tested the downtrend resistance for 3 times but failed to break through. However, recently, after hitting its all time low price in December 2018, the price had started to see support. Recently in April 2019, we see that THHEAVY had successfully broken the downtrend and price had been supported well. This signals that a long term uptrend is forming and major resistances are seen at 0.10 and 0.20.

As for daily chart, we see a few bullish indicators in this counter:

a. Price has achieved ICHIMOKU Cloud Breakout above 0.06 and managed to close at 0.065 conclusively

b. MACD is crossing the signal upwards

c. RSI and Stochastics are moving from oversold position, to upwards indicating uptrend momentum

d. Significant volume appeared on the solid daily chart

CONCLUSION

Considering all the above, my personal TP for THHEAVY is set at RM 0.10 (Short Term), and RM 0.20 (Mid to Long Term).

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

Discussions

Please dont write to rec.people to invest in such a rotten company for years...If you think it is good, keep it to yourself !!!

2019-06-01 17:55

@ Kingfisher - to you, this company might seem rotten (however i would not simply label other counters as 'rotten' without proper basis/justification)

But I feel that the writer is merely expressing that at the existing market price of 6.5 cents, this company looks appetizing/appealing as the company had recently posted 3 consecutive quarterly profits, despite being in PN17 category..based on the writeup & commentary, the future looks brighter for this company as it is taking the necessary actions to turnaround..

At 6.5 cents price, do not expect to get a company with blue chip quality like NESTLE or MAYBANK..I believe that the best investments come from companies that are starting to turnaround, as they provide a lower entry capital which means higher potential upside and lower potential downside

2019-06-01 23:23

(US/CHN trade war doesn't matter) Philip

Ok very much confirmed, bursamaster and investhor is the same guy trying to buy, pump and dump microstocks with bad fundamentals so that he can enjoy a few cents improvement and run off.

At least don't use the same color scheme and basic windows 98 paint editing to promote your stocks. It is too easily find out, the fonts the prose the tactics are so similar.

And most of all, stop liking your own posts.

If you want people to support your stock picks, at least choose good stocks with good fundamentals to begin with.

2019-06-02 00:07

@ Phillip - Sorry, as i said before i know Bursamaster and we are not the same persons..

I think you didn’t properly follow Bursamaster’s posts since you simply said that he is promoting microstocks..many of the articles were written on counters with good fundamentals that price went up much higher than after the post was made..examples are HOHUP, MASTER..

Plus the articles were written only to create ‘awareness’ of the facts and figures and no ‘promotion’ or ‘recommendation’ were made as mentioned in all his articles’ disclaimers

As for those microstocks..like i commented above, the price of the stock is commensurate to the current quality of the company..if you want to buy blue chips then go ahead and ignore the article..but you don’t need to condemn others for sharing their thoughts..

I see that all you are doing is going around condemning other people’s posts..better find something more beneficial to do..don’t make a fool of yourself to the community

2019-06-02 00:26

Shortinvestor77, i do realised u keep comment on different stock that right issue is coming. U spamming? Haha

2019-06-02 00:43

Yup, "they" are same person. but this guy has multiple personality disorder, MPD. So he denied what you said.

Posted by (US/CHN trade war doesn't matter) Philip > Jun 2, 2019

Ok very much confirmed, bursamaster and investhor is the same guy trying to buy, pump and dump...

2019-06-02 07:19

Only newbies are easily cheated. But virtual world here, don't be too serious.

2019-06-02 07:22

@ramada - sorry, only egoists like you who don’t do anything other than attack others’ posts are pathetic..

I already said that I know Bursamaster and he is already in the market longer than you know (please refer previous post which he had replied himself)..he does not have time to read your baseless and empty comments so why I am here helping to reply for him because I respect him..the fact that you don’t know who he is shows how ill-connected you are (even in a small market such as Malaysia)..

Instead of commenting the content, you keep persistently attacking the person/character..from here the community here knows that you are a sore loser who justs makes himself happy by putting others down..

As you said, its only a virtual world here, don’t be too serious..so if you want to go buy blue chips, then take my advice and please delete your account..just refer to your broker for the IB analyst reports...i think you will be a happier person then

2019-06-02 09:35

I think I have made some profit from hohup ahb and pccs from them. Thanks for recommending!

2019-06-02 10:41

no point to argue as there mentioned clearly this is not a buy call but personal opinion. or perhaps u wan buy at lower price so u keep attack other ppl post? haha

2019-06-02 12:32

Thanks bursa master so far I've made good money on HOHUp, Master and AHB..to those who always think bursa master in pump and dump maybe you guys have a problem because from what I see bursa master didn't force anyone to buy as everyone is entitled with their own opinion and bursa master is just sharing his views.. stop the crap if you don't like it.

2019-06-02 12:50

i know Dato BursaMaster and Investhor personally. They are separate persons but of course know each others, like OTB and KYY. Nevertheless, instead of figure out whether both are same person, we should take note on the article content.

THHeavy, no doubt is penny stock and yet under PN17. As u all noted, a lot oil and gas related companies were in the deep shit for few years and only try to recover recently. You can note from the QR, it has been show positive sign for 4 quarters. Also note that the company had appointed Public Investment Bank for it regularisation plan submission. Well, it is potentially to be uplifted from PN17 status. The company would not simply appoint Investment Bank without any reason. Regardless whether it will be privatised or not, for sure there is some plan going on.

Furthermore, from the prospect of the recent QR, it commented very positively on it future. Investhor also commented correctly on the new management after it took over by the SPV from Tabung Haji. Hopefully the worst had over for Thheavy and recovering.

If u ever follow Dato BursaMaster article, you may note that his article always cover all aspects, i.e. fundamental, technical, prospects... Of course, the companies need to has such good FA , TA in order to write such article, if not, nobody able to bull shit without such good data. So, just take a read and probably and keep it in your watchlist. Probably, is a good counter to keep. Cheer.

2019-06-02 13:11

Wei mr writer, you cranky aeh..arh! Lousy stock you want to promote. Please we all nit stupid..Are you? Well, you go ahead and punt lar. Definitely not me. You nothing to do arh. You go play play this stock yourself lar..hehe. Kikiki

2019-06-03 09:52

Forget this lousy THHEAVY. Look at this recession proof stock and why you should put money into this stock https://klse.i3investor.com/blogs/winners/209410.jsp

2019-06-03 23:25

i have faith in this comp, esp with its recent development which looks healthy.. no more BN crook. High probability, you wont be able to get at this price anymore.

2019-06-11 16:12

shortinvestor77

Prepare for right issues if you don't mind.

2019-06-01 14:13