LIONIND - LION IN THE DEN SLEEPING, WAITING TO POUNCE !!!

BURSAMASTER

Publish date: Sun, 25 Oct 2020, 07:31 PM

LIONIND - LION IN THE DEN SLEEPING, WAITING TO POUNCE !!!

Hello to all readers out there. Recently, I noticed that some steel counters had been picking up momentum as most of them had dried up the sellers at the support line. Also, commodity prices are picking up as China has resumed industrial and construction works.

Having said the above, the stock which I'd like to talk about today is LION INDUSTRIES CORPORATION BERHAD (LIONIND - Stock Code 4235, Main Market, Industrial Products & Svcs - Metals)

BASIC INFORMATION ABOUT LIONIND

LIOND was listed on BSKL in 1973, with core business in:

i) Manufacturing of long steel products

ii) Property Management and Residential Development

Market Capitalization : RM 190.25 million

Shares Float : 717.91 million

Website : http://www.lion.com.my/WebCorp/licb.nsf/corp_profile

1. STEEL PRICES RISING WORLDWIDE ON INDUSTRIAL REBOUND !!!

Refer below article by Reuters. Many mills had been closed down or affected due to the COVID19 pandemic in Q2 and Q3.

However, recently, a lot of steel mills have been back online as industrial activity picked up.

China, the world's biggest steel market, had seen strong demand picking up, as they recover from the pandemic. The rest of the world is also picking up.

Thus, I opine that Malaysia steel players would also see a better future ahead in the near to mid term, as ths COVID19 pandemic would be over soon once the vaccine has been approved for public use.

https://www.reuters.com/article/us-steel-outlook-graphic/steel-prices-to-keep-rising-on-industrial-rebound-margins-soft-idUSKBN2662ID

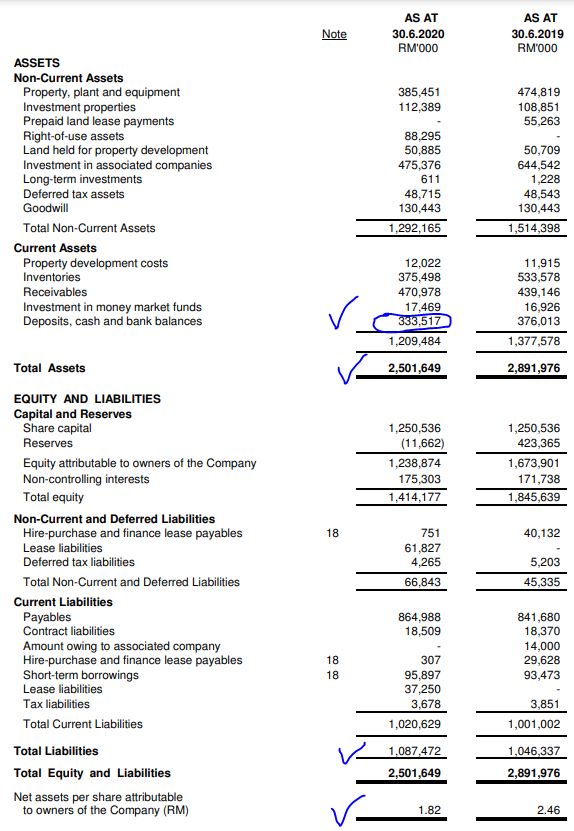

2. HIGH NTA RM 1.82, AND CASH IN HAND RM 333.5 MIL (46c) IS

MUCH HIGHER COMPARED TO MARKET CAP OF RM 190.3 MIL !!!

Below is the Asset Versus Liability sheet as of latest QR. A few key points to note:

- Total Asset stood at RM 2.5 billion (NTA RM 1.82)

- Total Liability stood at RM 1.09 billion

- Assets Exceed Liabilities by RM 1.41 billion (Asset surplus company)

- Total Cash position is RM 333.5 mil (cash per share of 46.4c, which is 175% of market cap)

This means that the latest closing price of 26.5 cents is a 85.5% discount to its NTA.

Also, the cash pile itself is already 1.75 times higher than its total market cap.

Best to say, that the company would be well prepared to weather the COVID19 pandemic.

3. TECHNICAL ANALYSIS - BUY AND ACCUMULATE AT SUPPORT,

PATIENCE PAYS!!!

Refer below the basic price and volume chart with key EMAs for LIONIND daily chart :

A few observations on the daily chart:

i. Refer Circle 1, the stock saw surge in volume entering in May 2020, after the Movement Control Order (MCO) was eased and Construction Sector was allowed to open.

ii. Refer Circle 2, the stock spiked to a recent high of 37c in June 2020, on the back of strong volume, and nearly touched the R1 resistance area before reversing direction

iii. Refer Circles 3 & 4, where we see that the sellers have been dried up, at the support area S1, which is between 25-26c. This area seems to have a large support of buyers, waiting to enter the stock.

iv. Should buyers be interested in this stock, we might see an upmove back to test the R1 resistance around 38-40c, then R2 resistance at 54-56c

CONCLUSION

Considering all the above, I opine that current price for LIONIND is attractive due to below:

i) Global steel prices are recovering, as industrial activities are picking up as the world works in a new normal facing COVID19 pandemic

ii) Latest closing price offers a 85.5% discount to its NTA, and the company has a huge cash pile of 46.4c per share, which is 1.75 times is latest market cap

iii) Chart showing a good level to accumulate this stock at the S1 support price between 25-26c

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

Discussions

Stupid write up. LionInd is selling off its steel mill. Rubbish write up. LionInd will shot up but nothing to do with steel price. Stop your nonsense.

2020-11-22 21:42

sensonic

WILL MARKET RALLY TOMORROW DUE TO NO STATE OF EMERGENCY ??

2020-10-25 20:10