TECHBND - Another Trade with a different system

DividendGuy67

Publish date: Tue, 03 Sep 2024, 12:03 AM

Background

I am a complex investor and trader, I invest and trade multiple systems in Bursa.

To recap, my investing system consumes by far the largest amount of my capital by design. Once I have a full position, it looks after itself. This is because it tends to revolve around Buffett-like principles which is to look for above average quality stocks (business and fundamental perspective), run by honest, able, aligned and trustworthy management (e.g. pays me a nice regular, increasing dividends, good payout ratios, good management of results, etc.), that is selling at an attractive price (e.g. not chase). You are obviously familiar with my investing positions such as MAYBANK, PBBANK, RHBBANK, TENAGA, etc. So, these are "do nothings" and when the bull market enters a euphoric zone, one day, hopefully I'll be there to let that go near the peak of the cycle.

My trading systems on the other hand are complex, many variations, which afford me more activity - in a year, I typically have more ideas than I should execute. Here, you'll see some of the many different types - e.g. cyclicals (PCHEM), turnarounds (LCTITAN), deep fears (CEB), crashes/wave 4 (GENETEC) and today, I want to share a different system that has a higher win rate expectancy i.e. "buy the dip on uptrend channels for fundamentally sound stocks" (TECHBND). My risk is over-trading on the long side, and I just shared that in another chatgroup that I plan to scale down here due to systems correlation reasons.

Long Term Price Chart

- Trading System = Buy the Dip during Uptrend Channel.

- Note there's enough price volatility here in fact, it's quite possible to make 20% in a few months, if lucky, 40%-50% in a year or two, from the bottom of the channel to the top of the channel.

- The uptrend channel over the past 5 years is fairly clear.

Fundamentals

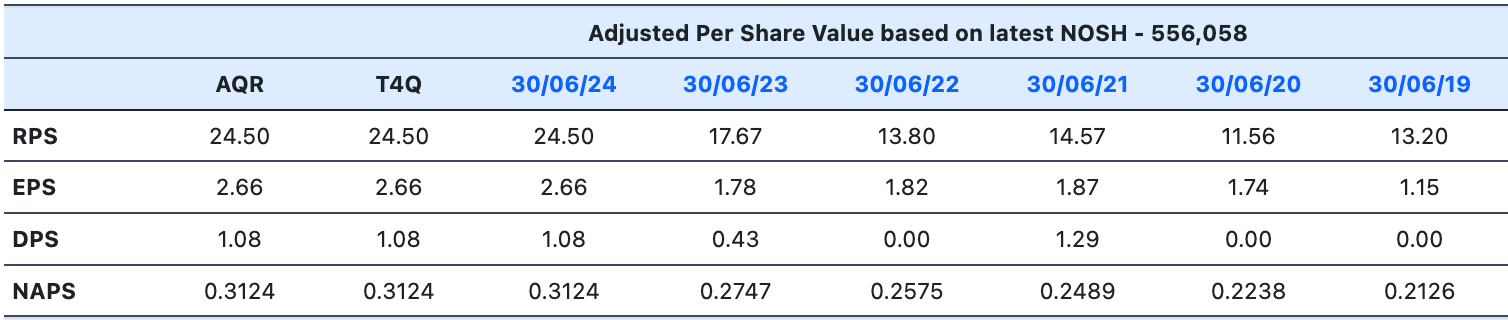

RPS, EPS, NAPS are growing. It doesn't meet my criteria for long term investing due to less predictable DPS (nil in 3 years), but overall fundamentals are decent. This stock is also own by Robert Kuok, our famous fundamental / business investor.

How I am trading this?

The notes in the chart and the above are quite self-explanatory.

- Position size small < 1% capital.

- Entry = 42.5 sen (filled).

- Target exits:

- First target = middle of channel (likely sell around 40% holdings)

- Second target = near top of channel (likely let go all or another 40% holdings depending).

- Current mindset after entry = queue in sell orders, don't watch the stock anymore. Pretend you don't own this stock anymore, as there's nothing more to do.

- Supplementary mindset = Mr Market decides if I win / lose.

- Mr Market decides how much I'll win.

- Mr Market decides when I'll win.

What if I'm wrong?

Do nothing until the dust settles. Just wait for the next setup to appear. Then, if Mr Market allows, execute that setup. Ignore the fact that you owned the stock. Usually, the next setup (if appear) is usually a better setup for fundamentally sound stocks.

I'm not a fan of blindly averaging down when wrong. Despite the drop in price, the P/E is not cheap, P/B still premium i.e. depending on the fear when wrong, lower and good attractive price can be had by stalking.

Disclaimer: As usual, you are solely responsible for your trading and investing decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://dividendguy67.blogspot.com

Discussions

Stop loss is rather personal. For me this is semi investing since the business is profitable, not a bad fundamentals and is owned by Kuok ie a lower price once stablilized or at logical zones is more likely to be an add than a stop. However if I see a better quality opportunity elsewhere then I may swap.

2024-09-04 20:06

fusing79

Thanks for sharing, may i know do you set stop loss point? where you

where is point i reliaze Mr Market decides if I lose

2024-09-04 10:48