https://dividendguy67.blogspot.com

HEKTAR - KYS Catalyst?

DividendGuy67

Publish date: Fri, 13 Sep 2024, 12:16 AM

Background

Recently, there was some interest on this REIT from a fundamental perspective, due to the significant price fall to 52 sen.

Fundamentals

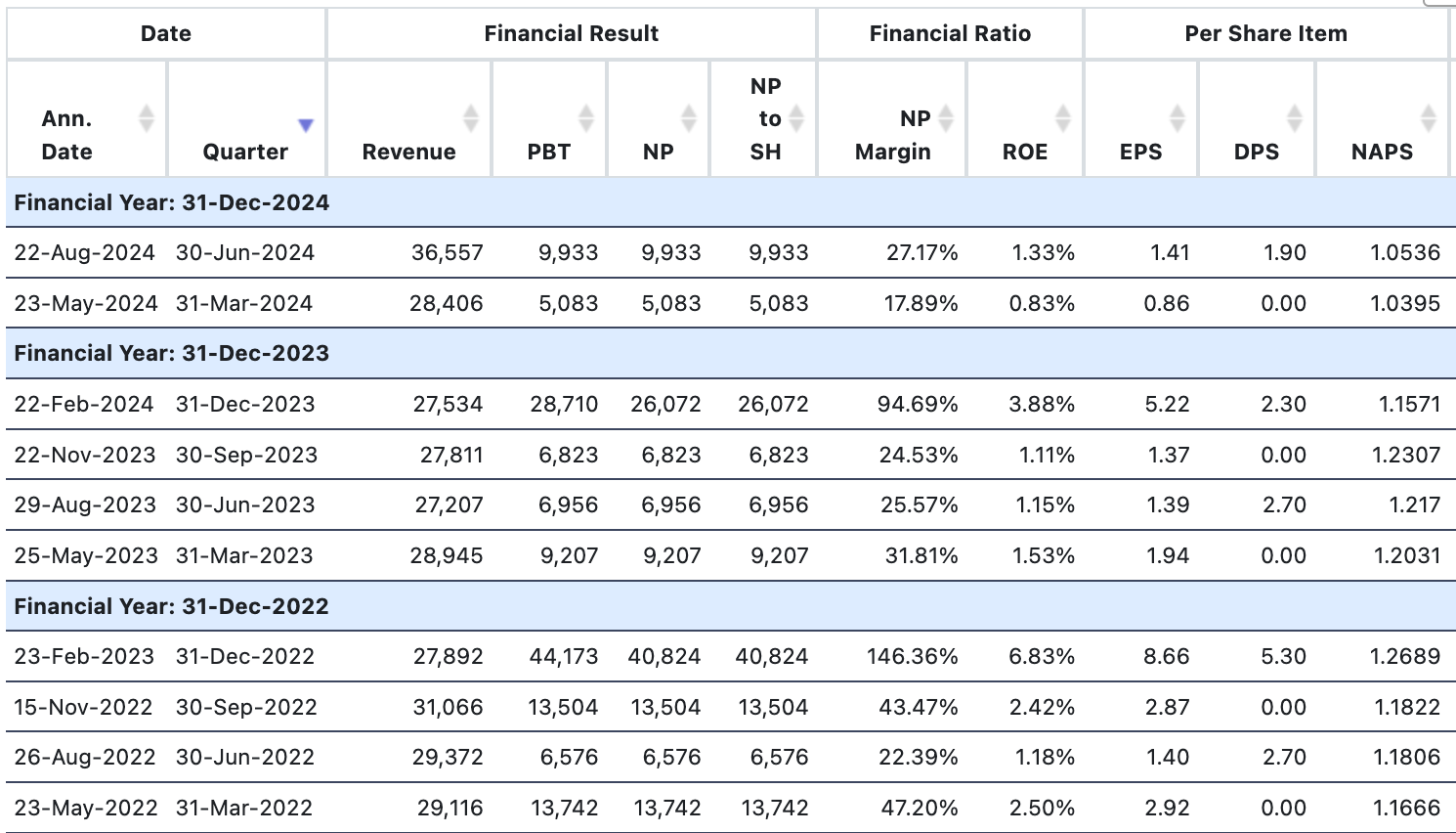

Key observations:

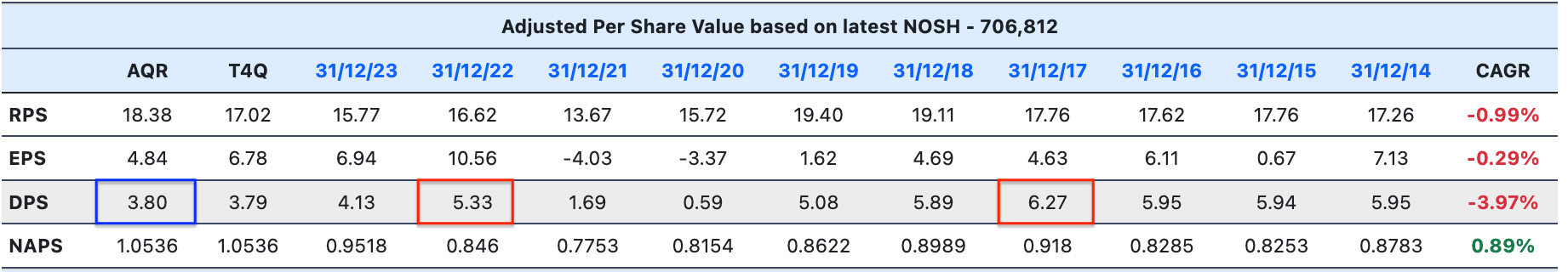

- HEKTAR pays dividends twice a year, Q2 and Q4. Its FYE is in December.

- Its DPS has fallen significantly since peaking at 5.3 sen for Q4/22.

- Latest Q2/24 dividend is 1.9 sen.

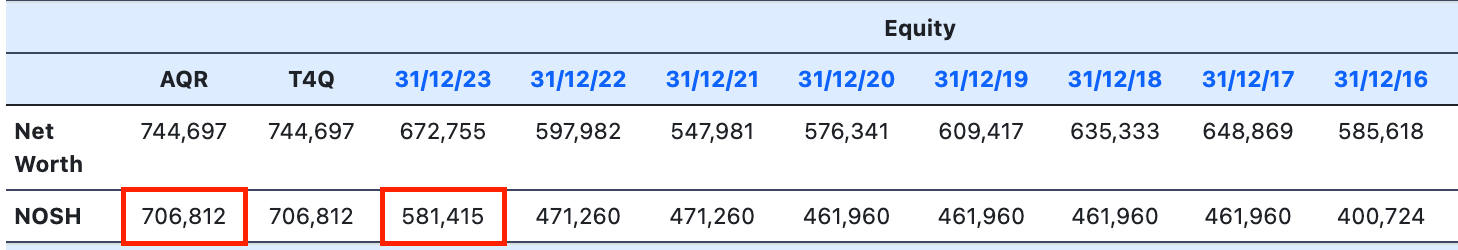

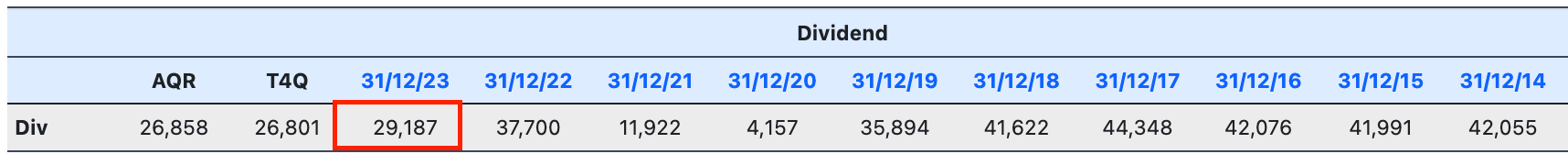

- At FYE23, HEKTAR total dividend cost is around RM29 million.

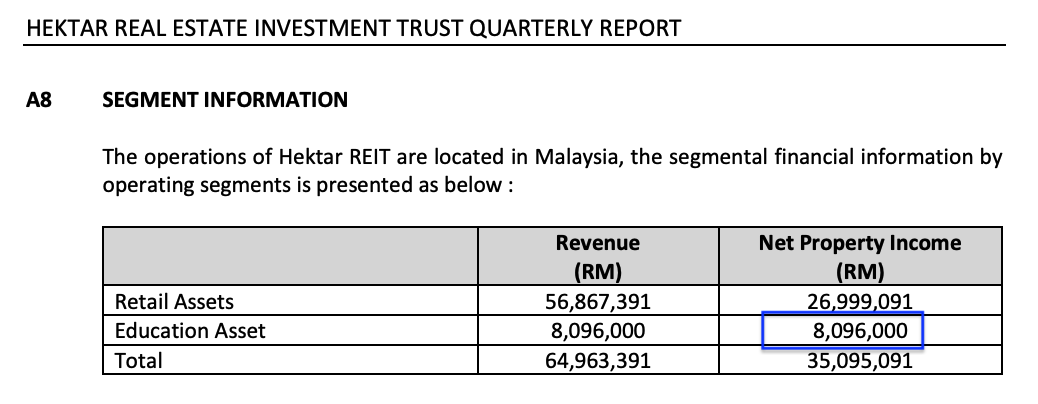

- The KYS catalyst is the education asset. HEKTAR first recognize the Net Property Income (NPI) amount of RM8 million in Q2/24 QR.

- Prior Q1/24 QR showed no recognition. This means there is another 3 quarter of KYS NPI to come. Total amount estimated at say: 8m x 3 quarter = 24 million.

- The size of RM24 million in the context of RM29 million dividend bill last year is not a small amount. Sure there are other costs (let's use 50%), but even half - RM12 million - suggests a potential boost in the order of +40%. In short, if all else is equal, KYS education asset looks very promising to significantly raise near term DPS.

- Next DPS due will be in Q4/24 for FYE 31/12/2024 probably reported around late Feb 2025 i.e. roughly another 5-6 months from now.

- If the DPS is a good one, HEKTAR share price might shoot up, if all else is equal.

- The risk is nobody knows if all else is equal.

- As share price is low at 52 sen, the Dividend Yield after 10% tax to retailers is around 1.9 x 2 x 90% / 52 sen ~ 6.6% per annum.

- If KYS boost Q4/24 DPS by say 50% then, this is an excellent gain to both DY and likely Price.

- HEKTAR is clearly under-valued - its NAPS is RM1.05 but trading at only 50% of its NAPS at 52 sen.

Other News

- Here, the Manager shares its ambition to double its portfolio size by 2027. This is double-edged for 2 reasons - first, it is ambitious and ambitious plans have its own way of finding new risks. Second, unclear extent of new share issuances, prices and dilution.

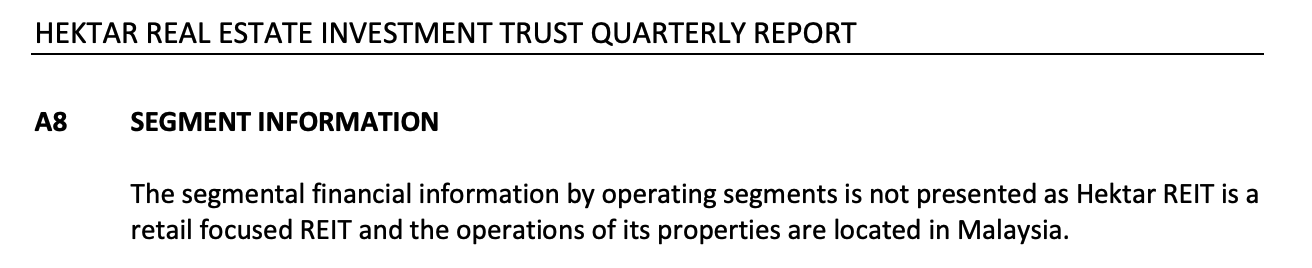

- Elsewhere there are past announcements that HEKTAR is looking to diversify its revenue away from the previous 100% retail assets source. This is a positive direction for me. Diversifying into KYS / Education assets is a good start but still quite concentrated in retail assets. Growth in overall portfolio size, if result in greater diversification is a plus in my book.

Price Chart

If you are bullish on HEKTAR's future prices up to 2027, then, maybe this chart "anticipation" could appeal to you. As for me, I note this is just one out of many infinite possibilities. The future remains unknown.

Key observations and speculations:

- HEKTAR price has been downtrending since 2017 peak above RM1.6x.

- Since Covid low in Mar 2020, price kept falling to form a potential inverse "left shoulder" and "head", before rallying to create a higher high.

- However, after a potential double top, price has fallen the past 5 months to support around 50 sen.

- Question mark if 50 sen will hold.

- If it holds and if price rises (2 big "ifs"), then, it could form the "right shoulder". And if it then keep testing around 69 sen "neckline" resistance, then, if it breaks above that, then, it could soar to RM1 as it achieves its ambition to double its portfolio size by 2027.

Note there is a lot of "ifs".

As a result, the odds of achieving all that is normally considered to be a "minority" odds.

How I am trading this?

- Mindset / Psychology / Strategy

- My investment objective remains a modest 9% per annum target. I don't aim high but should I double or triple my objective, I will not object.

- I have already "fully positioned" in HEKTAR. I am highly diversified and it is slightly above average holding for me.

- If price goes lower, I am unlikely to add more unless it is appealing.

- My holdings comprise of a "core position" and a "trading position".

- The "core position" is long term (several years).

- The "trading position" is to take advantage of extreme short term price movements (if any).

- Position Sizing

- As dividend investor, REIT is a significant portion of my capital, over 20%+ capital. I am spread over 8 different REITS. You could say a neutral REIT position for me is 2.5% capital.

- HEKTAR is above average holding (> 3% capital) for me today, due to a combination of attractive Dividend Yield (> 6%-7%) and potential for price gains from now till 2027+.

- Managing Risks

- A lot of things can still go wrong.

- In theory, a REIT that overly aggressively expand runs high risks in many areas - e.g. if expansion is for the sake of expansion, it could come at the expense of asset quality. We hope they won't do that, but anything is possible when we are not the Manager but someone else is.

- Another theoretical risk is share dilution - HEKTAR has a history to increase the No of Shares Outstanding (NOSH) as shown in table above.

- At the end of the day, the impact is either a reduction in future DPS and/or fall in price and/or dilution.

- If fall in price, likely to do nothing, as we are already nearly fully positioned.

- If fall in DPS, likely to do nothing as well, unless a better opportunity comes along and then, likely to do a partial swap.

- If dilution, likely to do nothing as well.

- We will only sell if: (a) a better opportunity comes along. (b) Short term extreme price optimism (to take profits on the trading portion). (c) when core position has reached its full and fair value. Otherwise, it looks like mostly "nothing to do".

- We will only buy if: (a) there is a big enough price fall and we have lots of cash and we cannot find opportunities to deploy that extra cash. In such a minority situation, we may adopt a "rebalance approach" to revert back to original 3% capital again at the lower price. This is data dependent, so, is not a blind rule. E.g. if we are short of cash, found better opportunities elsewhere, then, we will continue to ignore HEKTAR and leave that position alone until the sell conditions arose).

- We abhor blindly averaging down because this is not exactly a proven REIT that will recover its price during crisis like PBBANK.

Summary and Conclusion

- As HEKTAR price has fallen towards 50 sen key support level, price is attractive.

- HEKTAR's KYS addition looks under-valued. Additionally, the diversification to include Education Assets is positive for me, instead of relying previously 100% on Retail Assets.

- HEKTAR is clearly under-valued, both in terms of high dividend yield (6.6% net of tax), and low P/NAPS (only 50%).

- However, there are no sure things in trading and investing - many things can still go wrong - e.g. uncertain about HEKTAR's ambitious expansion plan to double its portfolio by 2027 - will it execute well or will this turns out to be a mistake? Is it too desperate given how much price has fallen? Will HEKTAR dilutes shares/increase leverage? etc. We will never know.

- Hence, because we never know the future for any stock, my approach is to diversify. I am positioned close to/slightly larger than neutral.

- The slightly larger than neutral position is to reflect that some portion of that has been allocated for "trading". The remainder (slightly lower than neutral) is allocated for "core holding" till 2027 (a part of me leans towards optimism especially if the bullish inverse H&S formation turns out to be true - then, there's congruence between chart and fundamentals). The split between core vs trading is dynamic and depends on charts.

Disclaimer: As usual, you are fully responsible for your own trading and investing decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://dividendguy67.blogspot.com

Discussions

Be the first to like this. Showing 2 of 2 comments

Travestor

I think #6 under key observation is incorrect. The 8m is revenue for the year and not every quarter. You can check the circular.

2024-09-28 17:08