高息股转型投资法

Siew Jian Bin

Publish date: Sat, 07 Dec 2019, 12:16 PM

买股票你必须要认识它,好像认识你的女朋友一般。每个股票都有它自己的特性,都有它自己的脾气,。当你掌握好后, 你就有比较高的把握从它身上赚钱。

在上期当中我提到了关于高股息投资法。在这一期当中我将会用一些的转型方法,让你的高股息投资法得到更高的回酬。

通常每间公司都有特定的时间来派发股息,有的是一年一次,有的是一年两次,有的是一年四次。通常当公司宣布股息时,公司的股价也会随着股息而增长一些,除非是公司业绩很差。因此如果我们能够在适当的价位,并且在业绩公布之前购买这些公司,很大可能我们将在股息公布后得到回报。

怎么说呢?比方说我们在1令吉50仙,买了A公司。不久后,A公司宣布了10仙的股息。当股息宣布后,通常股价也会随之而增长,可能是起几分到10分,或者是超过10分。当A公司股票的价钱起后,你就可以开始把股票卖了,然后你就可以用你的资金来买即将宣布股息的B公司。我相信通过此方法,可能我们可以一年赚4次因股息而得到的资本收益(Capital Gain)。如果我们能够在每一次的交易中得到大概5%的回酬,那么在四个交易中当中我们将很有可能得到20%的回酬。扣除了交易费后应该还有15%吧。

希望你必须记住适当在高息股转型投资法中,适当的价位购买是最大的最大的挑战。所以如果价位太高的话,我宁可守住我之前的股票,而不随便购买高价位的股票,因为如果你高价位购买一些股票,往往你会得不偿失!

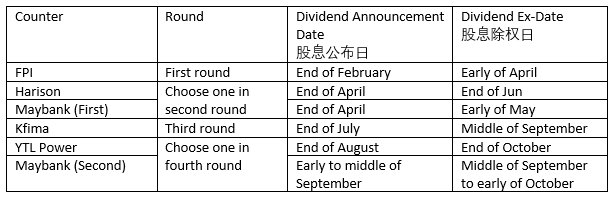

图表中显示了一些公司的以及他们的股息公布日和除权日作为你的参考。

希望这篇分享能帮到你们。如果这篇分享对你有帮助的话,希望能按一个LIKE 来作为我的鼓励,谢谢!

Transformation of High-interest Share investment Rule

You must know it when you buy stocks, as if you know your girlfriend. Each stock has its own characteristics and has its own temper. When you master it, you have a higher grasp of making money from it.

In the last issue I mentioned the high dividend investment law. In this issue I will use some transformation methods to get a higher return on your high dividend investment method.

Usually each company has a specific time to pay dividends, some once a year, some twice a year, and some four times a year. Usually when a company declares a dividend, the company's share price will increase with dividends, unless the company's performance is poor. So if we can buy these companies at the right price and before the results announcement, it is likely that we will be rewarded after the dividends are announced.

Why I said so? Let's say we bought A company at RM1 50. Soon after, Company A announced a dividend of 10 cents. When the dividend is announced, the stock price will usually increase, which may be from a few cents to 10 cents, or more than 10 cents. When the price of company A's stock starts, you can start selling the stock, and then you can use your funds to buy company B that will announce the dividend. I believe that through this method, we may earn 4 capital gains (Capital Gain) due to dividends. If we are able to get a return of about 5% in each trade, then we will likely get a 20% return in the four trades. There should be 15% after deducting the transaction fee.

I hope you must remember that in the high-yield portfolio investment law, the right price purchase is the biggest challenge. So if the price is too high, I would rather hold my previous stocks instead of buying high-priced stocks, because if you buy some stocks at a high price, you will often lose more!

The chart shows some companies and their dividend announcement dates and ex-rights days as your reference.

I hope this sharing can help you. If you found that this article is helpful to you, hope that you will press LIKE as my encouragement, thank you!

By

SHARE PANDA

More articles on Our Investment Journey

Created by Siew Jian Bin | Nov 29, 2020

Created by Siew Jian Bin | May 10, 2020

bursatrader2018

in the examples given,do you have net gain this year, after add in the capital gain/loss ? thks

2019-12-07 19:43