Cutting Your Losses

Siew Jian Bin

Publish date: Sat, 07 Dec 2019, 12:24 PM

Cutting Your Losses

Imagine this, you had a cut and is currently bleeding, what would your reaction be. Would you wait and see if the bleeding would stop by itself? Perhaps if the wound is small and the bleeding seems likely to stop. But what if after a short while, the bleeding seems particularly bad and did not stop - what would you do then? Most likely you would take action to stop the bleeding right? Also the worse the wound, the more drastic an action you’d take right? You would certainly not let yourself bleed until you fall unconscious or worse surely.

I think this is the same with cutting financial losses with stocks that you own. Why is it important to cut your losses? If you think that the company that you bought is a good company why should you sell at a loss just because the stock price of the company drops ‘temporarily’? Afterall, the company is not likely to go bankrupt soon. Sure the price of it’s stock will rise again soon. Do you notice all the above are what ifs statements?

It’s certainly very emotional to cut losses because once you own the stock you create an emotional hope to it. But when your stock drop below the price that you bought it at, at some point you will need to cut it loose and stop bleeding. And like bleeding, the longer you wait (if it did not stop on its own) the worse it might get.

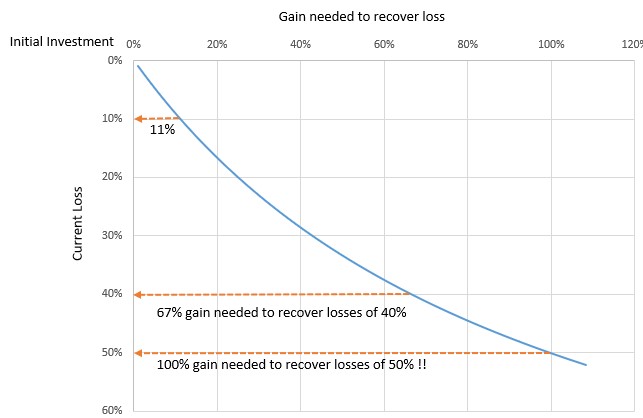

To drive the point in on the importance of having a strategy of cutting losses (vs the buy and hold strategy), have a look at the curve below. If your initial investment had a loss of 10%, by cutting loss at this level (10%), you will only need to reinvest the capital that you have remaining with something that have gain of 11% to recover your losses. However, if you only decided to cut losses after your investment drops to 40% it’s value your recovery investment will need to have a profit of 67% - something quite challenging but perhaps possible.

However if you waited till you lost half of your investment value to cut losses – you will now needed something that gain you 100% just to recover back to your original level of capital, very tough even with good circumstances.

In my last post, I mentioned a portfolio of investment that had a loss of over 25% over 2 years. If I set my cut loss level appropriately for the stocks, perhaps this loss can be reduced. Certainly I don’t want to wait for the losses to accumulate to 40% before cutting my losses.

So what is the level I should set for cutting losses? Obviously different people would have a different appetite for risk. But I think the first question would be what is the upside of the stock – ie. How much are you expecting (not hoping) to gain from your purchase. If you keep your cut loss limit low ie 20% and below as not to fall into the exponential recovery requirements from the ‘loss’ curve below then you could go with rules like half of expected gain.

For example if your expected gain is 16% you could set your cut loss to be at 8%. With this strategy your risks of upside and downside about breaks even and with even a 50-50 chance in your portfolio of gains you would make money or at least break even.

One last thing, unless you are a day trader, it’s important to filter out the noise in your cut loss levels, so usually using the closing price as your reference would work better than tracking the price throughout the day which may make you cut your losses prematurely. On the other hand you should not wait out too long as a rapid drop in prices would quickly take out much more losses that you had anticipated to cut.

Let’s apply this strategy of 8% cut losses and 16% profit strategy on the same portfolio of stocks that I use in the last post where I posted a loss of over 25% with hold-a-long-time method after the same period of 2 years. In addition I also use a strategy of buying back the stock: if after 2 consecutive month that the stock stays in the uptrend I will buy back in the 3rd month if the uptrend remains. Stocks are sold or bought only at the beginning of the month (means you only track the stock once a month!).

I think this represents a very conservative way of managing your stocks and most will not probably use this strategy, especially on taking profit. Just to note that no profit managed to be taken using this strategy for the duration of the 2 years.

With this simple strategy the 25% losses earlier have been reduced to under 17%. Quite an amazing feat seeing how simple and primitive the strategy used – where little thinking and analyzing is involved. Also need to note that all of the stocks chosen at the end of 2 years are on a downtrend.

The table below compares this simple strategy compared to buy and hold, for the same set of stocks that is not performing that I mentioned in my last post.

I think with a little bit more thought into the profit taking process and some better chart analyses we should be able to cut these losses even more or even start to make some profits despite an overall downtrend.

For me I feel like a strategy of cutting losses at some point is much more preferable to the hold strategy, even for long term investors especially for those of us who have limited resources to invest and cannot let our money ‘rest’ on a stock for an extended time waiting for the price to ‘surface’

By

CH Cheah

More articles on Our Investment Journey

Created by Siew Jian Bin | Nov 29, 2020

Created by Siew Jian Bin | May 10, 2020

bursatrader2018

identify the right sector to buy stk in, is a key first step, to minimise need for cut-loss later.

Choose a sector with good technicals , uptrending, good fundamentals, but not rally too high yet, may give better chance to make money.

The best bet maybe a sector that had been downtrending for some time, and has just bottom, like the plantation sector now.

2019-12-07 16:54