An investing lesson from Globetronics

Ricky Yeo

Publish date: Sat, 20 Aug 2016, 03:08 PM

This is not a Globetronics bashing session. And Gtronics would easily qualified as one of the top 10% stock within KLSE in terms of return on equity, management and earning quality. But it is a reminder that more things can happen than we imagined, particularly to long-term investors.

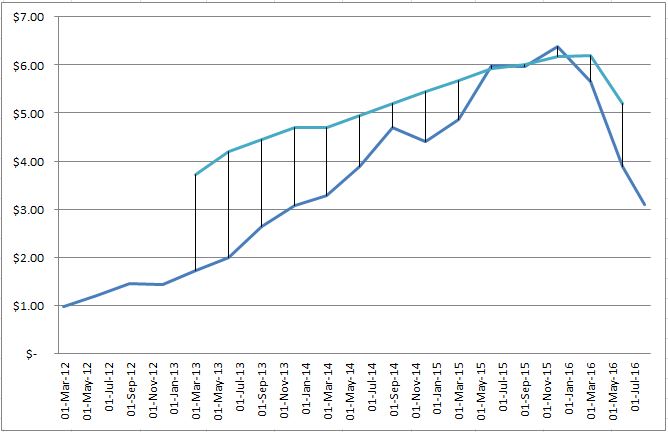

Gtronic's share price (Blue line) went from a dollar in early 2012 to $6 in a span of 4 years, registering 500% gain, tracing (outpacing) their revenue & earnings growth.

Throughout this period, many investors would come out with terms like 'Solid', 'Growth', 'Defensive' to describe the stock, backed by the business prospect and share price.

If one is not convinced, he can perform a DCF valuation. A DCF valuation (Teal line) done in any point over the past 3 years using 12 months trailing EPS will justify Gtronic as a BUY with huge margin of safety (shaded area) ranging from 20-50%, albeit shrinking towards the 2nd half of 2015.

This can be achieved by forecast 10% growth rate over 10 years, justified as a growth company by its historical growth rate. In fact, one can even have plausible reasons to BUY it right at the very peak, quoting Warren Buffett 'I am owning a quality company at a fair price', before the share price flies off the cliff.

What went wrong? Its not that DCF method is unreliable, it is a great tool. But how useful a tool is ultimately depends on how one use it, and more importantly, to understand its limit. This is not to say now you should throw away all analysis or valuation methods, as most would like to believe with a 'either or' mindset. Rather, one should be careful against their own assumptions, hypothesis and what they know and don't know. And knowing what you don't know is more important than what you know.

We suffer from hindsight bias. Everything looks so obvious in the rear mirror. The smartphone market has entered a saturation stage and slowing down, coupled with macro headwinds etc, we all see it coming. But if everything is so obvious now, why didn't we see it turn?

Hindsight bias is not limited to when things go wrong, but started when things are going really well, which got us into trouble in the first place. We look at past figures, create a hypothesis that fits the phenomenom we observed, and extrapolate into the future. In essence, we choose the most convenient reason to explain why things turn out this way rather than generating multiples hypothesis and select the most plausible ones.

In the case of Gtronic, the most convenient hypothesis is - Smartphone & gadgets are driving the needs for more sensors and test equipments. And China, where most of the growth is coming from, only has a smartphone penetration rate of 38% compare to 68% in US. A projection is done to derive a higher valuation followed by finding confirming information to justify the decision. And one of the most comfirming information that reinforce behavior is the increase of share price.

Second level thinking such as competitors' reaction or industry dynamics are rarely brought up due to the lack of information or in short, discomforting. But more often than not, contradicting information are ignored because they do not conform or fit with the situation. No matter how accurate your valuation method is, it cannot protect you against your own ignorance.

Recently, there's a surge of interest in the construction sector especially the likes of Gadang and so on. I made no effort to analyse the current valuation of Gadang but purely as a great example while it is fresh in everyone's memory.

The most convenient hypothesis for Gadang is its strong order book, earning visibility, and positive prospects from various divisions, namely construction, property and utility. While other hypothesis that explains its risk from potential normalization of profit margin, cyclical nature of the industry to adverse material cost situation and strong dependency on key customers, which are dependent on governments, are generally less studied. Mainly because they are hard to predict and some are plainly unknowable. But it doesn't mean they're not there, unimportant, or will never happen. Even less examined is the share price itself, on what's been priced in, and what's the expectation.

Most investors would proclaim that the most important thing is never lose money, yet would spend majority of the time finding conforming views than musing on opposing ones.

In 2014, when Magni-tech was selling at $2, I made the decision not to buy its shares after studying it for some time due to a lack of information on both annual report and primary sources. And there goes my 100% return. But by looking at the outcome itself one would have misses the point. It is the process, the risk of what I don't know that counts, not what's countable in the balance sheet or income statement.

Does that mean one is wrong if they own Magni? Absolutely not. Position sizing and portfolio diversification plays a huge role too.

The lesson here is focus on your investment thought process. Examine how you reach a conclusion is as important as the conclusion itself. When you solidify thought processes, and address what you don't know, any valuation tools you utilise will be much more potent.

You are only as strong as your weakest link. That applies to both investing and life. So don't let it breaks.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Intelligent Investing

Discussions

Very educating article.

A Buy decission is never my option in Premium rated investment.Hold on till the peak & fundamenal taking a reverse.

2016-08-20 16:55

Great article written, ricky yeo. Absolutely agree with you that knowing what we don't know is more important. One should not take DCF as a whole comparison with different industry, since each industry has their own business nature. Always prepare a better margin of safety with unexpected risks we don't know.

2016-08-20 23:31

When Globetronics announced its fantastic result for year ending 31st December 2015 on 23rd February 2016, I did take a good look at Globetronics with the intention to invest in it.

Earnings per share improved (again) by about 15% to 25.3 sen per share. ROE and ROIC were again great at more than 20%, more than twice its costs of capitals. Cash flows were great too. This is what I would classify as a great company.

However, bear in mind a great company is not necessary a good investment, provided that it is selling at a reasonable price. So was Globetronics selling at a reasonable price at RM5.95 at that time?

PE ratio was at 22.3, not really expensive as the company has excellent operating numbers. However, Enterprise value was 17 times earnings before interest and tax. This is definitely on the high side for me as it is two and half times more than I would pay for an ordinary company.

I did a discount cash flow analysis from the fundamental aspect assuming growth is internally generated through return on capitals, assuming a bold 15% growth for the next 5 years and 5% subsequently. I was only able to get an intrinsic value of RM4.15, way below its price of RM5.95 at that time.

With that market price, investors were expecting Globetronics would continue to growth at very high rate of more than 20% as before, and with margin expansion and higher return on capitals, and hence willing to pay a high price.

I gave it a pass and gave up the idea of investing in it.

Shortly after that, the growth expectation did not materialize, and with the high price paid, it was a double whammy, and the rest is history.

Great company becomes bad investment when people overpay for it.

Growth is good. But bear in mind it is just an expectation. Don't overpay for some "expectations".

2016-08-20 23:42

RAIDER SAYS CHASING GROWTH STOCK IS AN AGGRESSIVE INVESTMENT STRATEGY LOH....!!

JUST LIKE PLAYING BADMINTON...U KEEP ATTACKING U R EMPLOYING AGGRESSIVE BADMINTON STRATEGY MAH..!!

WHEN U ATTACK U ACTUALLY AT RISK LOH....IT EXPOSE OR WEAKEN YOUR DEFENSIVE POSITION....JUST LIKE U VERY HARD SMASH..IF UR OPPONENT MANAGE RETRIEVE WITH A TRICK SHOT...U WILL HARD TIME...CHASING AND HITTING BACK LOH...!!

EXPERIENCE PLAYER ....LIKE CHONG WEI.....CHEN LONG....LIN DAN DON SIMPLY ATTACK ALL THE WAY AND WON'T DEFENSE ALL THE WAY LOH....!!

HE MIX IT WITH DEFENSE AND ATTACK WITH A VARIETY SHOTS LOH....!!

SO COMING BACK TO GROWTH STOCK....SHOULD U CHASE ?? THE ANSWER IS YES....JUST LIKE BADMINTON SHOULD SMASH ?? BUT ALWAYS MIX IT WITH A VARIETY OF BALANCE STROKE LOH....!!

2016-08-21 10:46

Thanks for the excellent article! Moral of the story is, it's not just about pursuing profit, but it is also about minimising risk.

2016-08-21 12:26

Liked this article by Ricky.... so contented yet can see how constructive comments being harmonized into diplomatic notes...

高招!

2016-08-21 12:32

1. Understand the business. 2. The business must have DURABLE COMPETITIVE ADVANTAGE. 3. Managers with integrity. 4. Buy at a reasonable price. Many "investors" got excited and bought into a company that showed a temporary improving revenue and profit growth trend. Often, the earnings of these companies had improved over a few quarters. As more and more "investors" piled into the stock, the PE expanded (they were willing to pay high prices to own it). The growth in revenues and profits was obvious for a year or two or three. More "promoters" got enchanted and there were a lot of hype on the good fortunes that would accrue for those who own this stock. Alas, in GLOBETRONICS case, the last two quarters showed a dramatic drop in revenues and profits. The lofty P/E quickly shrunk. The lower EPS (fundamental) and the shrinking P/E (sentiment) were double whammy for those who held the stocks and over a few months, the share price corrected by 50%. ONCE AGAIN, AS HAD BEEN OBSERVED MANY TIMES OVER, A LOT OF "INVESTORS" LOST A LOT OF MONEY BECAUSE THEY INVOLVED THEMSELVES WITH A STOCK THAT HAD RECENTLY SHOWED TEMPORARILY GOOD FORTUNES.

2016-08-21 16:13

3iii, do agree with ur expressed general concepts above. Good after all hv been said so what is your personal bottom line opinion based on the share price now at 2.90? Do you agree Gtronics is a good company? As per KC's valuation now MOS 30%, is it a good long term investment?

2016-08-21 17:12

Hi Citychew, the market can do anything to any stock. If your entry price is low, that should protect your downside.

2016-08-22 10:42

Hi Ricky understand to keep the entry price low concept. H/ever, it is still relative due to fundamental change. In case of Sifu KC's DCFA done in 2015 IV was 4.15 on Gtronic. Price dropped to 2.90 last Fri it presented a good opportunity to enter if not for any possible changes in fundamentals.

2016-08-22 11:29

Remarkable! Ricky, you're not only an investor but also a philosophist, thanks for the selfless sharing.

2016-08-22 20:54

Hi Bizfuneng, you're right, if no changes to the underlying fundamentals, and that's a hard thing to find out unless you've a good knowledge of the industry Gtronic operates in. There are many ways to invest but mainly you have 2 big categories - Balance sheet & income statement. For B/S, it is 'one bird in the hand', things on B/S has high certainty i.e. assets & liabilities, you are not trying to predict but rather finding MOS in B/S. This is good if you don't have a great knowledge of the business. But normally stocks only reaches B/S 'cheapness' in very depress condition.

On the other hand, you can study income statement, or the earning power. Means if you have a good knowledge of the industry ie industry profit margin, competitors, industry forces, entry barrier, how they compete, how buyers select suppliers etc, then you'll have a good idea about the earning power of a business, and you can use DCF to do estimates.

But many times, most analysis consist a mixture of B/S and I/S. So when you do DCF, you'll need to be able to pick apart the components inside DCF, namely revenue, profit margin, ROIC, reinvestment rates etc and explain how you come up with those numbers.

2016-08-22 21:13

In investing, it is just as important to know which companies to avoid.

In investing, it is just as important to know what are the companies you do not wish to invest in.

This is very important and if you are able to identify these companies that are not going to do well or that are going to do badly in their businesses, you can prevent yourself from a lot of future heart-aches and losses.

Being able to identify these companies that are going to do poorly over the long term, means you have the ability to also:

1. identify those companies with good long term prospects, which you may choose to dwell in deeper into to prospect for your long term portfolio of stocks.

2. identify those companies that are fundamentally poor which are presently exhibiting temporarily a period of exceptionally good results, so that you may avoid them.

These assessments are based mainly on the businesses of the companies. Do not look at the stock prices for guidance, especially in the initial stages of your analysis of the companies prospects.

It is better to assess the quality of the business and the quality and integrity of the management first.

When you like what you analyse, then do a valuation of its intrinsic value.

Then determine at what price you will be willing to buy at with a margin of safety and a promise of satisfactory return.

Then look at the market price. Looking at the market price to get guidance may bias you in your intrinsic value calculation.

2016-08-27 13:31

WHEN OVERVALUE COUNTER LIKE DLADY AND PET DAG SHOULD BE AVOIDED...HE KEEP PROMOTING LOH...!!

2016-08-27 22:45

citychew_1886

Hi jt,

Thanks for your good article,so do you think that magni will do the same with gtronic? Yes,there are lack infor for magni but i think it is worth to invest it since everthing look good right now. Unless the price is overvalue.

2016-08-20 15:57