APM Automotive Holdings: On $1.5 bil sukuk, what it means for valuation, and potential M&A

Ricky Yeo

Publish date: Sat, 29 Oct 2016, 08:25 PM

Update on APM Automotive Holdings

I wrote about APM back in August (https://www.facebook.com/notes/contrarian-investing/apm-automotive-holdings-the-rule-of-minimum-valuation/1745265392395019) by posing a hypothetical question on how much debt can the company borrow based on their cash flow and deduce that APM as a whole shouldn't sell below the total debt plus net cash value.

RAM rating assigned an AA/A2 & P1 rating today to the proposed $1.5 bil sukuk. Means APM can borrow up to $1.5 bil of debt if they wanted to. RAM head of consumer & industrial rating Kevin Lim said "...group's debt load is expected to increase over the next 3 years...we also expect its funds from operations (FFO) debt coverage to range between 0.3 to 0.5 times."

We can do some deduction here. APM's FFO for 2015 is $95 mil or 10 years average of $125 mil. If we take FFO as $100 mil, a 0.5x debt coverage means APM will have an interest expense of $50 mil.

Debt coverage = Interest expense/FFO = 0.5x

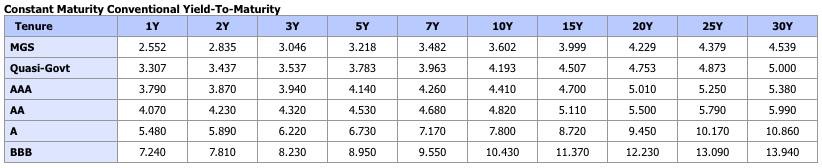

The next question is how much debt will have an expense of $50 mil. Based on RAM AA/A2 rating, and the 20 years term APM is planning to take, the yield to maturity is around 5.5%.

Debt = Interest expense/yield = $50 mil/5.5% = $909 mil.

What this means is RAM is confident of the underlying cash flow generating capability of APM that they do not see APM has any issue borrowing over $900 mil of debt.

A company with substantial earning power to take on $900 mil of debt, and with net cash of $240 mil, would make an investor ask, why is it selling for an enterprise value of $400 mil?

It is also interesting to see that despite sitting on $240 mil net cash, the proposal for $1.5 bil sukuk does ring a strong alarm bell for upcoming M&A. M&A at one of the worse automotive downturn in many years, contrarian indeed.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Intelligent Investing

Discussions

I am from the auto industy and APM is the backbone of the Malaysia vehicle manufacturing industry and also one of the key OEM in Asean. For me this is the company if you are looking to invest long term in the industry not DRB nor Pecca or UMW. How far will APM go further down, I don't know but contrarian that want to invest in car industry. This is it.

2016-10-29 23:28

Read about Schaeffler Group turnaround of the Continental AG. I feel and really think that APM could be a success with the right steps and management.

2016-10-29 23:35

very risky indeed on increasing its debt so much.........only a good management can handle it

2016-10-29 23:56

Yes wkitwing, you are right. Study and understand the company. There are a lot of great company and good value and PB but without a good

management, there is no point investing in it.

2016-10-30 00:14

Shaun you could be right and my interpretation wrong. I thought about that too but I'm thinking most analyst use the inverted version of the formula. Kevin lim did state gearing and net gearing ratio of not more than 0.3 or 0.1 times which I didn't included in here. And also the fact that APM ability to only serve half of the interest expense seems a bit out of common logic for me given the rating RAM assigned

2016-10-30 07:44

The long term trend of this stock is down both chart and earnings wise. APM maybe cheap but not to impose any hindsight bias here, the difference between buying at RM3 and RM 2 is 50%

2016-10-30 07:48

The management have a proven track record. It's a good move for them in the long run. Of course, their profit might be affected by need to sevice the interest n also start up cost for new business for next 1 to 3 years. in business it is either you expand or wither away.

2016-10-30 10:43

well ooihk899, it all depends how deeply the investor understand the business :D Perhaps you know APM well? Are you in the auto industry as well? In the region APM is like Continental in the German Auto Industry or Delphi in US.

2016-10-30 11:02

I'm not in this line but this stock is in my watch list. When to buy it, I don't yet cause the stock is in down trend, as investor, everyone like to buy cheap including myself. I always like a company when they expand their business cause there will be growth. Furthermore, they expand in the industry they r familiar with. Not like some other counter, from furniture expand into property, that's too risky.

Thanks a lot for your info. abangadik.

2016-10-30 13:09

hahah no problem. As value investor we are always lonely most of the time, and it is hard to get a chance to buy a company in a industry you know best. I would say once or twice in a person's lifetime. Only worry I have in Bursa is plenty of time, good undervalue company get taken private quickly. I hope this is not the case with APM.

2016-10-30 13:19

Blind leading the blind lol. Both this yeo and loong also same, continue posting and using the wrong ratios for the world to laugh at you la, good for you

Fact check and get your FFODC definitions right first before writing crap. Its a ratio, so the difference is in order of magnitudes

2016-10-30 14:23

Ricky, Shaun,

The RAM report states that gearing level of APM is expected to rise to 0.3x.

Per their Q2, 2016 quarterly report, the equity of APM stands at RM1.2bn. At 0.3x gearing, their expected drawdown will be circa RM360 mil, out of total CP/MTM facility of RM1.5 bn. It is worth noting that most companies do not plan to fully draw down their MTN facility.

The RAM report then goes on to say that the FFO debt coverage is expected to range between 0.3 to 0.5 times. As the report mentions 'debt coverage' instead of 'interest coverage', I suspect RAM is referring to FFO as compared to the total debt (instead of interest payment).

Assuming total debt is RM360 mil, FFO is expected to range from RM108 mil (at 0.3x) to RM180 mil (at 0.5x).The range seems reasonable as compared to its 2015 FFO of RM95 mil or 10 years average of RM125 mil.

This is what I understand from reading the RAM report, not sure if the others agree with me.

2016-10-31 10:50

For information on APM business background, visit http://www.donkeystock.biz/apm-automotive

2016-10-31 18:17

Thanks TabulaRasa, that makes perfect sense, my calculation was incorrect.

2016-11-03 11:11

Very good technical, analytical & writing skills, one of the best in i3 so far I have seen, BUT, always lack of business sense.

2016-11-05 14:26

Why? Too small market for car accessory producer. No government policy in helping the industry (protecting proton does not mean helping industry), car business is about volume, APM? too small.

2016-11-05 14:32

Mr Market may over react in short term, but won't go wrong in long term, APM has been going down since 2014.

So, Is Mr Market stupid? Or the people that recommended APM stupid?

2016-11-05 14:34

Perfect choice for Ricky Yeo, we will see how good is his pick, either he is empty tong or tong with full water.

2017-03-23 11:24

cheoky

Is it due to market current sentiment that vehicle sales will remain in doldrum for years to come, in effect wipe out the rm100m net cash from operation annually parameter. While issuer think otherwise. So, buy n hold?

2016-10-29 21:34