Pensonic Holdings Berhad (9997) Quarterly Result Review

bonesoythe

Publish date: Thu, 28 Jan 2016, 06:27 AM

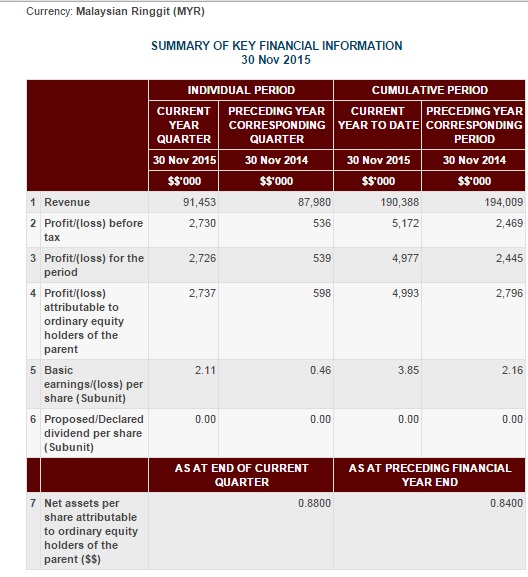

Pensonic (9997) achieved an awesome quarterly result ended November 2015. Net profit increase from RM 598k to RM 2.7million. In other words, the net profit had increased by 350% / 4.5 times. The increasing of net profit is mainly due by cost saving and appreciation of USD.

PE Ratio Valuation Approach

|

Ended |

EPS (cents) |

|

2015-11-30 |

2.11 |

|

2015-08-31 |

1.74 |

|

2015-05-31 |

9.71 (3.24) |

|

2015-02-28 |

1.69 |

2015-05-31, there is a RM 8.4million disposal gain. If we take off the one-off gain, the EPS would be 3.24 cents (in bracket of the above table)

If we exclude the one off gain, Pensonic EPS was 8.78 cents.

Pensonic is under consumer sector. Currently consumer sector average PE ratio is about 15x.

With 15x, Pensonic target price would be RM1.32

TP : RM1.32

Dividend Valuation Approach

For the past 1 year, Pensonic given two times dividend. First is 1.5 cents, second is 2 cents.

We know that in current banking Fix Deposit the highest interest is 4.5% (Maybank promotion rate). With this rate guidelines, we want to get same rate in pensonic so what is the reasonable price for pensonic stock?

3.5cents / 0.045 = 78cents

With 78cents, every year we get 3.5 cents dividend. We got 4.5%.

I expect pensonic dividend will be increase to 4 – 4.5cents this year as the company cash position getting stronger.

If the company giving 4.5cents dividend, what is the reasonable price to buy in?

4.5cents/0.045 = RM1.00

So, this year pensonic target price would be RM1.00 with dividend valuation approach.

TP : RM1.00

EXPANSION

Pensonic new factory had just opening in October. This factory had increase the company capacity and yet the result had not include in current quarterly yet. It may only reflect in the next quarter. It will help the company to increase 50% in revenue and profit.

Let’s do an assumption, if the expansion increase revenue and profit by 50%

Last year EPS 8.78 cents

8.78 cents + 50% = 13.17cents

13.17 cents x PE 15 = RM1.98

So, our Target Price after including the expansion is RM1.98

TP : RM1.98

CONCLUSION

WE ARE USING THREE METHOD TO CALCULATE THE INSTRINSIC VALUE FOR PENSONIC (9997). IT’S SHOW THAT THE SHARE PRICE WAS DEEPLY UNDERVALUE WITH TARGET PRICE OF RM 1.32, RM 1.00 & RM1.98. THE AVERAGE TARGET PRICE WAS RM1.43

IN CONCLUSION, I HAD GIVE PENSONIC HOLDINGS BERHAD A TARGET PRICE OF RM1.43.

“ANGPAU BEFORE CNY FOR CHINESE”

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

"The revenue reported for second quarter is slightly lower than preceding quarter by RM7.5 million

or 7.6%. The current adverse development economy situation has caused the slow demand in local

sales or decrease in local sales 17.4% however the export sales still perform favourably"

Pensoni results augers well for the reporting season.....especially for the exports business.

to note...Pensoni do about 1/3 export business, 2/3 domestic business.

local sales decline by 17.4%.....that is SHit. people not getting married anymore?

whether the results is good enough to propel the share higher in this environment is difficult to say....but it deserves a higher PE rating....for year 2016, people will have no choice but to buy Pensoni products and no more money for German products.

2016-01-28 07:44

EPF contributions by employees to be reduced by 3%. This is expected to increase private sector spending by RM8bil.

2016-01-28 13:20

hello bone,wanted to correct that appreciation of USD is actually negative to pensoni,atless for now,cos their bought raw material with USD,but only export 30% of products.

thats why pensoni suffer with RM3.9m forex losses in 1st half,cos extra cost haven fully past to customers yet,otherwise net profit for 1st half should much more higher.

2016-01-29 02:31

Agreed with Sherlock. This clear the doubt I have when read against the Qtr report which shows RM3.9mil losses in forex.

2016-04-05 22:46

Icon8888

Ha ha bonesoythe

2016-01-28 07:43