Malaysia Stock Analysis Report – RCECAP (9296)

LouisYap

Publish date: Mon, 18 Nov 2019, 10:25 AM

Malaysia Stock Analysis Report – RCECAP (9296)

RCE Capital Berhad (Rcecap) was founded in 1953. It was listed on the second board of the Bursa Securities in 1994 and went to the main board in 2006.

It is one of the subsidiaries of AMCORP GROUP BERHAD. RCECAP provides consumer loan financing services to its clients through its subsidiaries, but its main customers are government civil servants.

It is also engaged in real estate investment, providing financial administration and debt management services, and securities trading. In addition, the company also provides IT support services, but the main target is small and medium-sized enterprises engaged in trade, construction and manufacturing.

In short, RCECAP is a company in the financial sector. The main counterparts are AEONCR and MBSB.

1) The cost of the company's borrowing this year will be reduced because reducing in interest rates with latest government bank policy.

2) The company's staff costs, and Director fees have been reduced, as well as the Employee Share Scheme costs are reducing too.

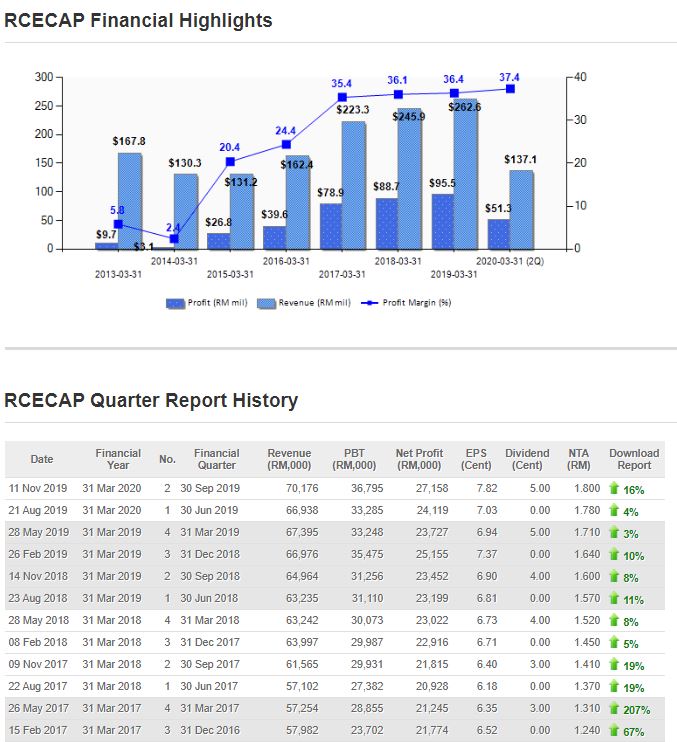

3) The loan volume has increased steadily since 2016, until a slight decline in 2019, mainly because unexpected results in the 2018 election affected the demand and sentiment of the loan.

5) The company's financing from the Sukuk Programme is lower.

And the company has a high chance of scrambling for CCRIS to obtain civil servants.

RCECAP's share price is very stable. Although the stock market has fluctuated greatly and the market sentiment has been low, and this indicating that investors investing in RCECAP are not short-term investors. It is a relatively low-risk investment.

AGM Q&A Session

Question:

The growth rate of FY2019's loan is 5.2%, compared with 8% of FY2018. What is the company's explanation for the decline in growth rate, and what is the goal of FY2020?

Answer:

According to the National Bank report, the ratio of Household Debt to GDP fell from 83.8% in 2017 to 83% in 2018. The banking industry expects their loan growth rate to be around 5.0% in 2019, and our company has successfully achieve over the average growth rate of the industry. The demand for loans is always there and we are focusing more on the quality of the loan as well as becoming a responsible loan provider.

Question:

The non-primary income of the company's FY2019 increased from RM 11.7 mil to RM 15.5 mil, an increase of 32.2%. Company will adopt

what kind of measurement in order to maintain non-primary income in FY2020?

Answer:

The increase in non-primary income was mainly due to the increase in sinking funds received from Sukuk Programmes, making the company put more deposits in licensed financial institutions and earn more interest income. We understand the importance of cash flow management, and we will manage and ensure that the cash liquidity will be enough. Our interest income, after all, is one of our sources of income.

Question:

From the annual report, the company's Cost To Income Ratio increased from 21.7% to 22.2%, Gross Impaired Loan (GIL) deteriorated from 7.1% to 7.4% and Loan Loss Coverage (LLC) decreased from 178% to 172.1%.

What kind of measurement will the company take in FY2020 to improve this?

Answer:

The increase in Cost To Income (CTI) is mainly due to the fact that we upgraded some facilities to increase efficiency. However, our CTI is still below the industry average. The increase in GIL is mainly due to the different algorithms used by FY2018 and FY2019 because of the new MFRS. If you use the same back algorithm, GIL is almost flat. Although LLC has decreased, it is still in an acceptable range, at least higher than the banking industry, they are only 97.9%. This proof our Asset Quality and Credit Risk Management are very good.

Question:

Have you ever thought about providing loan services to the public, not only for government civil servants?

Answer:

The reason we are focusing on civil service loans is because of the Salary Deduction Scheme. It is to minimizes the risk of recovering the loan, and this id only applies to civil servants. According to our experience, the risk to provide personal loans to the public is very high, which is why we only focusing on civil servants and improving the quality of loans.

Question:

Company's average Gross Impairment Loan (a loan that can't be recovered) is about 7%, which is higher than other regular banks, which bank is only registered at only 3%?

Answer:

The bank’s Loan is very diversified, including car loans and mortgages, and the risk of issuing these loans is far more than personal loans.

Anad the bank calculates the Gross Impairment Loan, it includes car loans and mortgages, Gross Impairment Loan will be lower, and we have solely on personal loans to compare with the bank is not too fair.

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|