Details of PADINI (7052) - AGM 2019

LouisYap

Publish date: Mon, 02 Dec 2019, 12:42 PM

[Details of PADINI (7052) - AGM]

Padini Holdings Berhad ("Padini") was established in 1975. Prior to that, the company provided production services to clothing retailers and wholesalers.

The company is engaged in the apparel industry and has more than 10 brands, such as Padini, Seed, Padini Authentics, PDI, P & Co, Vincci, Vincci Accessories, Vincci Mini, Miki kids and Brands outlet. Each brand represents a unique design concept to meet the needs of consumer of all level of ages and gender.

The company's main products are clothing, shoes and accessories. This business is conducted domestically and abroad, but the main turnover and profit coming from domestic. The company sells products through stores, consignment counters and as well as online platforms (www.padini.com).

Their business accounts for most of the company's turnover, and sales volume is impacted by events and festivals season, such as public holidays, school holidays and store promotions. And, the company's sales volume will be higher than usual. In addition, almost all the businesses transaction is dealing with cash sales, hence the company's having strong cash flow!

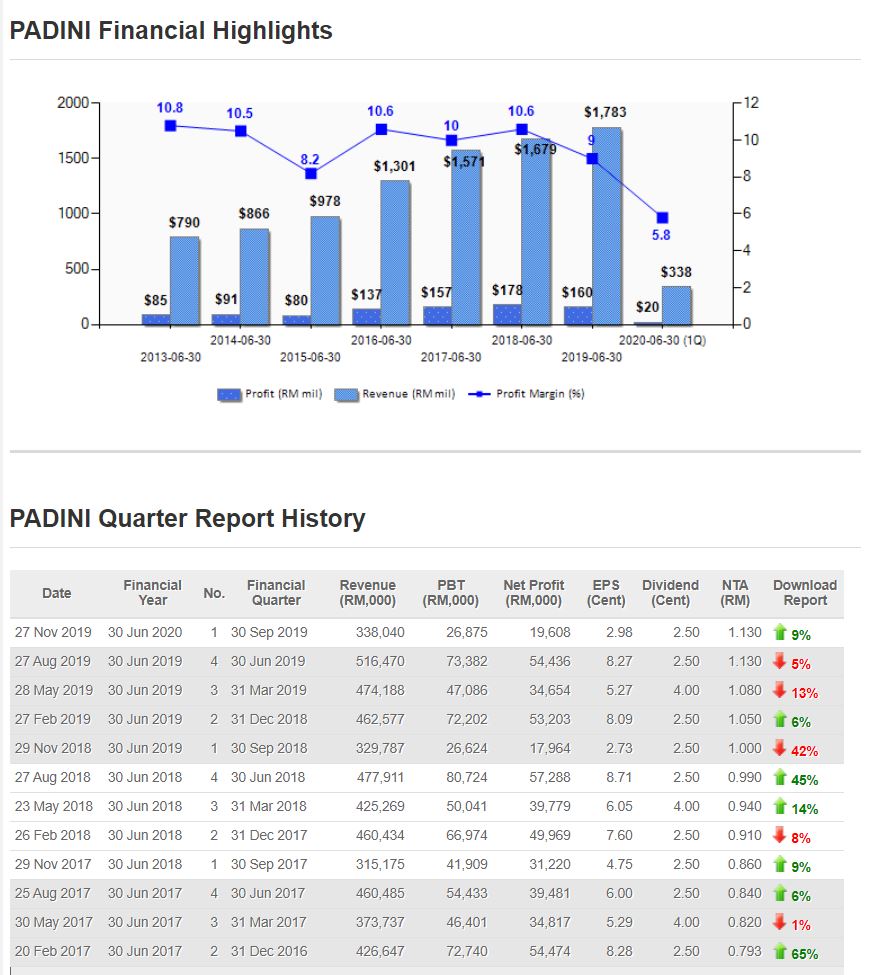

Over the past 5 years, Padini's turnover has continued to rise and grows averagely at 18% annually

Earnings before taxes also rose steadily with turnover, except for fiscal 2015, the gross profit has fell by 3%, partly because of GST started on Apr 2015, but the product price remained the same.

After the GST started, the stock price fell to around RM1.26. But the impact of GST is only for temporarily, and consumers still need to buy clothing under any circumstances. Therefore, the company gradually recovered shortly after the GST, and even higher turnover directly boosted the company's after-tax profit.

In fiscal year 2019, only 145.9m of pre-tax earnings were registered in total 3 quarters. This is because of the "Eid Mubarak" and "National 4-Day Special Promotion" falling in 4Q 2018 and making the turnover down in 1Q 2019. And on top of that, the higher staff costs, rented, and the cost of running stores also led Padini to experience lower pre-tax earnings.

In order to learn more about Padini, we also deliberately attended the annual shareholders meeting. The following is a question and answer session during the shareholders meeting.

Q1: In FY2019's annual report, each subsidiary recorded lower pre-tax profit margins. What is the company's profit outlook for FY2020?

A1: We believe FY2020 will be another profitable year. The 2020 Budget is favorable to consumers. The government intends to increase employment opportunities and benefits for low-income people.

Q2: The RMB against the ringgit has been depreciating from April to September this year, from 1 RMB to RM 0.618 to 1 RMB to RM 0.586, and most of the supply of PADINI comes from China, which will be good for PADINI's profit

A2: The depreciation of the RMB was initially benefit to lower down our costs, but because of the SST was introduced in September 2018, it has been offset the overall cost saving, and the cost now actually has increased slightly.

Q3: The company has 10 overseas branches across in Cambodia and Thailand. How are all these overseas branches performing?

A3: The company's own overseas branches accounted for 2.4% of the consolidated turnover. Cambodia started operations in FY2018. There are total 3 stores in Cambodia, and all of these stores are making profit, but low in profit margin than Malaysia. The seven small stores in Thailand have just started operations at the end of 2018 and at the early stages.

Q4: Since FY2017, although PADINI's turnover is still growing, the number of stores has declined. Will the company continue to expand the number of stores?

A4: The fashion industry is dynamic, fast-changing and competitive. We believe that we need to focus on brand building. We will be focusing more on launching diversified and affordable fashion products to market. For example, we will cooperate with Disney to do cross over branding, create functional textiles and clothing, such as: fitness wear, inner wear, etc. to add value and novelty to the brand.

We will not set a goal to open several stores, we will be vigilant and agile about the market, we will open new stores when there is a suitable location

Q5: The company's Gross Profit Margin has fallen from 41.0% in FY2018 to 39.1% in FY2019. What will the company do?

A5: As long as the company's Gross Profit Margin stays between 39% and 42%, it is still consider at healthy level. It will fluctuate, but if it is within this range, it is not an issue.

Q6: I noticed that PADINI has started to enter the second-tier cities. How is the performance?

A6: Branches in second-tier cities are profitable and perform well. Gross profit margins are in the range of 39% -41%. Revenue accounts for 20% of total revenue.

Q7: What does “fit out contributions” mean in the Chair ’s Statement of the annual report?

A7: This is a one-time off income. When we enter to a new mall, the mall management will provide some subsidies.

Q8: PADINI is a fashion industry. How do you define fashion?

A8: We have our own designer team, they will do a lot of research and data collection. But we will not just following the "fashion" trend, but ignore on the taste needs of Malaysians.

Team Opinion:

The entire shareholders' meeting went very smooth, and the shareholders did not have any dissatisfaction. The only incident that asked more was Dividend Pay-out. According to management, even if the company makes profit, they have no intention to increase dividend payout. This is because to reserve more cash on hand, and this will become a strong asset for the company on supplier partnering, as supplier will consider company asset and liabilities for future business partnership.

Cambodian stores are in profitable and plans to open up a 4th branch. The Thailand branch has only been operate for half a year and it used to be operate partnering with a local company, but now it is completely running by itself. Indonesia is now partnering with a local company, and considering to run the store by them self. GP Margin is usually standing at 39-41%.

.

Although online shopping is in the trend right now, Padini has started to prepare on his own website. And currently is working together with Zalora, Lazada, but the profit is still low.

.

Guan Yingjie emphasized that "doing business must meet market demand, create value for customers, and then be profitable." Long-term holding is not a problem, but MFRS 16, changing in new accountant term will impact them in profit at the short term.

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|