M+ Online Technical Focus - 17 Jan 2018

MalaccaSecurities

Publish date: Wed, 17 Jan 2018, 08:20 AM

The FBM KLCI advanced for the third straight session after recovering all its intraday losses as the key index formed a hammer candle, closing at the 1,826.03 pts yesterday. The MACD Histogram has extended another red bar, while the RSI remains overbought. Resistance will be pegged around the 1,830-1,850 levels. Support will be set around the 1,800 level.

GKENT has rebounded off the EMA20 level accompanied by rising volumes The MACD Histogram has turned green, but the RSI is overbought. Monitor for a breakout above the RM3.74, targeting the RM4.00 and the RM4.20 levels. Support will be set around the RM3.55 level.

N2N has formed a breakout-pullback-continuation pattern above the EMA60 level with improved volumes. The MACD Indicator has expanded positively above zero, while the RSI is treading below the overbought level. Price may trend higher, targeting the RM1.14-RM1.20 levels. Support will be anchored around the RM0.95 level.

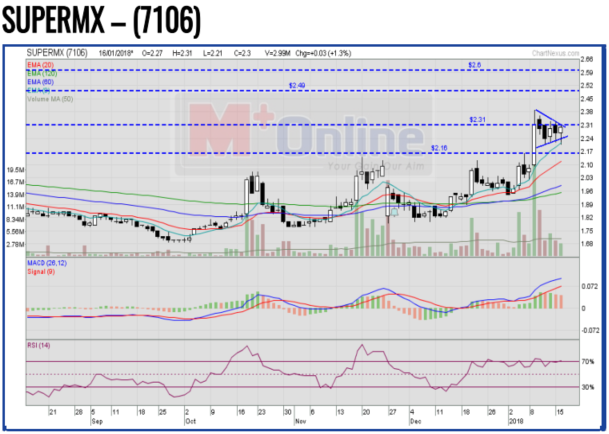

SUPERMX has formed a hammer candle above the EMA9 level. The MACD Indicator has expanded positively above zero, while the RSI is slightly overbought. Price may rally, targeting the RM2.49-RM2.60 levels. Support will be pegged around the RM2.16 level.

Source: Mplus Research - 17 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024