M+ Online Technical Focus - 9 Nov 2018

MalaccaSecurities

Publish date: Fri, 09 Nov 2018, 10:20 AM

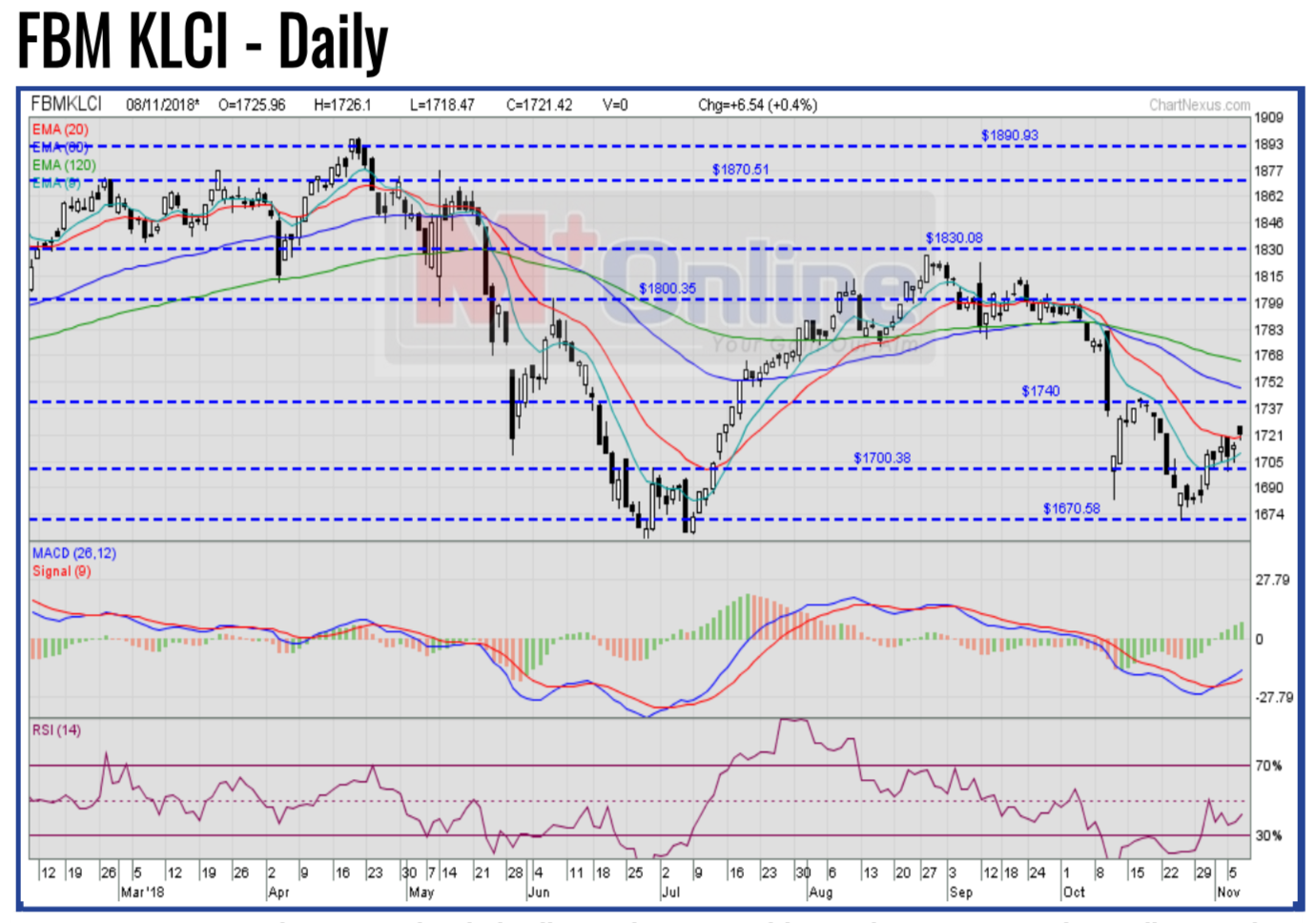

The FBM KLCI gapped-up as the key index lingered in the positive territory for the entire trading session, before closing higher to around the 1,721.42 level yesterday. The MACD Histogram has extended another green bar, but the RSI remains below 50. Resistance will be pegged around the 1,740-1,750 levels. Support will be set around the 1,700 level.

KGB has experienced a trendline breakout above the RM1.15 level with rising volumes. The MACD Histogram has extended another green bar, while the RSI has risen above 50. Price may advance, targeting the RM1.28 and RM1.35 levels. Support will be set around the RM1.06 level.

REACH has experienced a trendline breakout above the RM0.40 level with improved volumes. The MACD Histogram has extended another green bar, while the RSI is approaching 50. Price may trend higher, targeting the RM0.45-RM0.47 levels. Support will be anchored around the RM0.37 level.

WEGMANS has experienced a breakout above the RM0.35 level with improved volumes. The MACD Indicator has issued a BUY Signal, while the RSI is approaching 50. Price may extend its gains, targeting the RM0.375-RM0.405 levels. Support will be pegged around the RM0.33 level.

Source: Mplus Research - 9 Nov 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024