Mplus Market Pulse - Volatility beckons

MalaccaSecurities

Publish date: Mon, 25 Jan 2021, 01:29 PM

Market Review

Malaysia: The FBM KLCI (+0.1%) managed to hold onto its intraday gains as the key index snapped a six-day pullback with the rebound was largely anchored by bargain hunting in gloves heavyweights. The lower liners also trended higher on the back of rotational play in healthcare and technology sector, while the broader market ended mixed.

Global markets: US stockmarkets finished lower as the Dow slipped 0.6% amid the rising Covid-19 cases, which is threatening the pace of the economic recovery, whilst the US$1.9tn stimulus bill may face a tough stance from the Congress. Meanwhile, European stockmarkets were downbeat, while Asia stockmarkets ended mostly lower.

The Day Ahead

Tracking a mixed performance on Wall Street last Friday, we think the mild rebound on the FBM KLCI last Friday could further fizzle off today and market sentiment is expected to be cautious ahead of the first US Federal Reserve meeting under the Biden’s administration as well as the holiday-shortened week. As we are heading into the reporting season, investors may turn to selected sectors with high earnings certainty while the Covid-19 cases continued to rise.

Sector focus: Based on the upcoming reporting season, we reckon the technology, plantation and furniture sectors to be the potential winner and will be on traders’ radar. Meanwhile, investors may switch from banking sector to glove makers after the rebound last week as well as anticipating a strong result from Harta today.

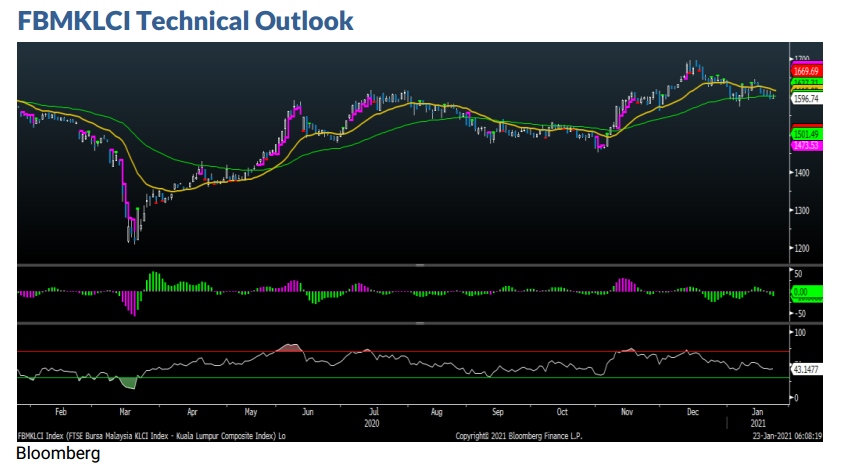

The FBM KLCI snapped a six-day losing streak and closed mildly higher last Friday, but still hovering below the EMA 60 level. The key index is expected to move sideways below 1,620 amid investors’ mixed sentiment. Meanwhile, Indicators turned mixed as the MACD Histogram has turned into a green bar, while the RSI remains below 50. Support is pegged at 1,590. Followed by 1,570. The resistance is envisaged around 1,620-1,640.

Company Brief

Dagang Nexchange Bhd (DNeX) will pay RM314.0m (US$78.0m) for an additional 60.0% stake in Ping Petroleum Ltd, raising its stake in the oil and gas company to 90.0%. Ping has proven to be a strategic fit with DNeX’s energy division and has contributed positively to the Group’s earnings over the past few years. (The Star)

Tenaga Nasional Bhd's (TNB) foreign shareholding fell to 12.9% as at 31st December 2020 from 13.8% as at end-November 2020. The December and November 2020 updates, which were published on TNB's website showed that its latest foreign shareholding figures had fallen from 17.6% as at end-February 2020. (The Edge)

Supermax Corp Bhd spent RM53.9m to buy back its own shares on 22nd January 2021, its first share buyback exercise this year. The glove manufacturer bought back 8.2m shares at between RM6.24 and RM6.70 apiece. It now holds 103.0m cumulative net outstanding treasury shares, which is equivalent to 3.8% of its total share capital of 2.72bn shares. (The Edge)

CIMB Group Holdings Bhd has appointed Paul Wong Chee Kin as president and CEO of CIMB Thai effective 1st February 2021, succeeding acting president and CEO Sutee Losoponkul after the departure of the previous CEO, Adisorn Sermchaiwong. Losoponkul will remain with CIMB Thai and assume the role of advisor to the president and CEO, until 31st December 2021. (The Edge)

SC Estate Builder Bhd has proposed to undertake a private placement of up to 20.0% of the total number of issued shares to third-party investors at an issue price to be determined later. Based on the indicative issue price of 5.5 sen per placement share, the proposed private placement is expected to raise gross proceeds of RM10.5m. (The Edge)

Serba Dinamik Holdings Bhd proposed private placement involving 336.8m new shares was oversubscribed by 1.9x. In conjunction with the completion of the private placement’s book-building exercise, the oil and gas service provider reported that the issue price of the private placement shares was fixed at RM1.51 per share, and that it is expected to raise gross proceeds of RM508.6m from the exercise. (The Edge)

HB Global Ltd has proposed to raise RM12.2m via a private placement to repay creditors, and for use in future investments and working capital. It would be issuing 93.6m placement shares or 20.0% of its total share capital, at an indicative issue price of 13 sen to third-party investors. (The Edge)

PLS Plantations Bhd has proposed to place out 19.0m new shares in the durian planter to CIMB Group Holdings Bhd's ex-chairman Datuk Seri Nazir Razak at 95 sen each under a private placement of up to 10.0% of the total number of issued shares in the company to improve its public shareholding spread and raise money to finance the expansion of its existing business. The placement will also enable the company to raise funds to partially repay the group’s bank borrowings, which stood at about RM121.5m as at 31st December 2020. (The Edge)

Source: Mplus Research - 25 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-09

CIMB2025-01-09

CIMB2025-01-09

CIMB2025-01-09

CIMB2025-01-09

CIMB2025-01-09

CIMB2025-01-09

DNEX2025-01-09

SUPERMX2025-01-09

SUPERMX2025-01-09

SUPERMX2025-01-09

SUPERMX2025-01-09

TENAGA2025-01-09

TENAGA2025-01-09

TENAGA2025-01-09

TENAGA2025-01-09

TENAGA2025-01-08

CIMB2025-01-08

CIMB2025-01-08

TENAGA2025-01-08

TENAGA2025-01-08

TENAGA2025-01-08

TENAGA2025-01-08

TENAGA2025-01-08

TENAGA2025-01-08

TENAGA2025-01-08

TENAGA2025-01-07

CIMB2025-01-07

CIMB2025-01-07

CIMB2025-01-07

TENAGA2025-01-07

TENAGA2025-01-07

TENAGA2025-01-07

TENAGA2025-01-07

TENAGA2025-01-06

CIMB2025-01-06

CIMB2025-01-06

SCBUILD2025-01-06

SCBUILD2025-01-06

SCBUILD2025-01-06

SUPERMX2025-01-06

TENAGA2025-01-06

TENAGA2025-01-06

TENAGA2025-01-06

TENAGA2025-01-03

CIMB2025-01-03

CIMB2025-01-03

CIMB2025-01-03

CIMB2025-01-03

CIMB2025-01-03

CIMB2025-01-03

SUPERMX2025-01-03

TENAGA2025-01-03

TENAGA2025-01-03

TENAGA2025-01-03

TENAGA2025-01-03

TENAGA2025-01-02

CIMB2025-01-02

CIMB2025-01-02

TENAGA2025-01-02

TENAGA2025-01-02

TENAGA2025-01-02

TENAGA2025-01-01

TENAGA2024-12-31

CIMB2024-12-31

CIMB2024-12-31

CIMB2024-12-31

CIMB2024-12-31

CIMB2024-12-31

DNEX2024-12-31

TENAGA2024-12-31

TENAGA2024-12-31

TENAGA2024-12-31

TENAGA2024-12-31

TENAGA2024-12-31

TENAGA2024-12-31

TENAGA2024-12-31

TENAGA2024-12-31

TENAGA2024-12-30

SUPERMX2024-12-30

TENAGA2024-12-30

TENAGA2024-12-30

TENAGA2024-12-30

TENAGA2024-12-30

TENAGAMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Jan 08, 2025

Created by MalaccaSecurities | Jan 01, 2025

foo

一线市场焦点(法新社)(26日讯)抢5G和电动车商机 OSAT企业看高。 5G上路和汽车电动化,点燃半导体市场需求,联昌研究相信射频与电动车黄金时代的到来,大马外包半导体设备组装和测试(Outsourced Semiconductor Assembly And Test,OSAT)企业将受益匪浅,预估2021年领域销售有望增长13%,写下7年高位,净利更可能按年强增39%。

全球半导体销售今年料增8.4%世界半导体贸易统计协会(WSTS)预测在记忆体、逻辑等集成电路环节需求强劲,加上亚太、美国、欧洲和日本等主要市场殷切需求支撑下,2021年全球半导体销售料增长8.4%至4690亿美元。

国际半导体业协会(SEMI)预期2021和2022年组装、封装和测试设备需求将增长6至7%,归功于5G智能手机、基站设施和高效能电脑开始采用先进封装应用。

联昌研究表示,全球半导体需求改善,对大马OSAT企业绝对是好事一桩,看好在5G智能手机销售量攀升下,国内半导体领域将从强劲的射频晶片需求中受惠。

全球5G智能手机产量今年料倍增至5亿支市场研究机构TrendForce预测,今年全球5G智能手机产量将达到5亿支,较2020年的2亿4000万支增长逾倍,而5G智能手机的渗透率更将从去年的19%攀升至今年的37%。

思佳讯通讯技术发展公司(SkyworksSolutions)指出,5G智能手机射频成本平均为25美元,较4G智能手机的18美元高出40%,联昌研究相信深耕射频晶片组装、封装和测试业务将是潜在受惠者。

电动车加速普及与此同时,联昌研究指出,国际能源署(IEA)预测2025和2030年全球电动车销售将达到1400万和2500万辆,预期在电动车加速普及下,大马OSAT业者也将从汽车业日趋增加的半导体需求中受惠。

市场研究机构IHS Markit预测,2019至2026年全球汽车半导体市场销售复合年均增长率(CAGR)将达到7%,其中2021年全球汽车半导体营业额更将大增18%,主要是汽车零件库存低,以及全球政府振兴经济配套奖掖鼓励民众转向电动车。

半导体大厂──英飞凌(Infineon)预测电动车的半导体内容价值较内燃机汽车高出82%. 碳化硅普遍应用在电动车电源管理中受惠。大马OSAT今年销售将扬13%整体来看,联昌研究预估大马OSAT领域今年销售将强劲增长13%创下2014年以来最高。

同时在5G网络和智能手机射频晶片需求增加、汽车晶片需求复苏,以及云端基础建设服务需求殷切3大因素扶持下,我们预期OSAT领域净利也将年增39%,而2021和2022年领域净利赚益将介于15至16%,几乎较10年均值8%翻倍。该行认为半导体领看好领域长期增长前景,未来3年每股盈利复合年均增长率可能达到29%。

2021-01-26 22:19