Mplus Market Pulse - 17 Feb 2021- Liquidity driven market

MalaccaSecurities

Publish date: Wed, 17 Feb 2021, 09:23 AM

Market Review

Malaysia: The FBM KLCI (-0.1%) snapped a four-day winning streak as the key index succumbs to selling pressure in selected index heavyweights in the second half of the trading session. The lower liners, however, managed to extend their upward strides, driven by stronger liquidity while the energy sector (+3.1%) outperformed the mixed broader market on the back of rising crude oil prices.

Global markets: US stockmarkets ended mixed as the Dow rose 0.2%, but the S&P 500 and Nasdaq shed 0.1% and 0.3% respectively on mild profit taking on healthcare, utilities and real estate sector. European stocksmarkets ended lower, but Asia stockmarkets were mostly upbeat.

The Day Ahead

Profit taking activities emerged on the FBM KLCI, snapping the four-day positive streak. We believe sentiment should stay positive, despite the mixed trading tone on Wall Street and the MCO extension in several states as we think the ongoing rally in the crude oil price and the clearer timeline for the Covid-19 vaccination programme should be the focus for the economic to recover moving forward. As we are heading into the reporting season, companies with high earnings certainty could be under the limelight.

Sector focus: Traders are likely to focus on the O&G sector amid firmer crude oil prices. Meanwhile, the restart of economic activities should bode well for construction and building material segments as well as recovery-theme sectors such as gaming, aviation, banking, consumer products. Market players may lookout for packaging and plantation stocks ahead of the reporting season.

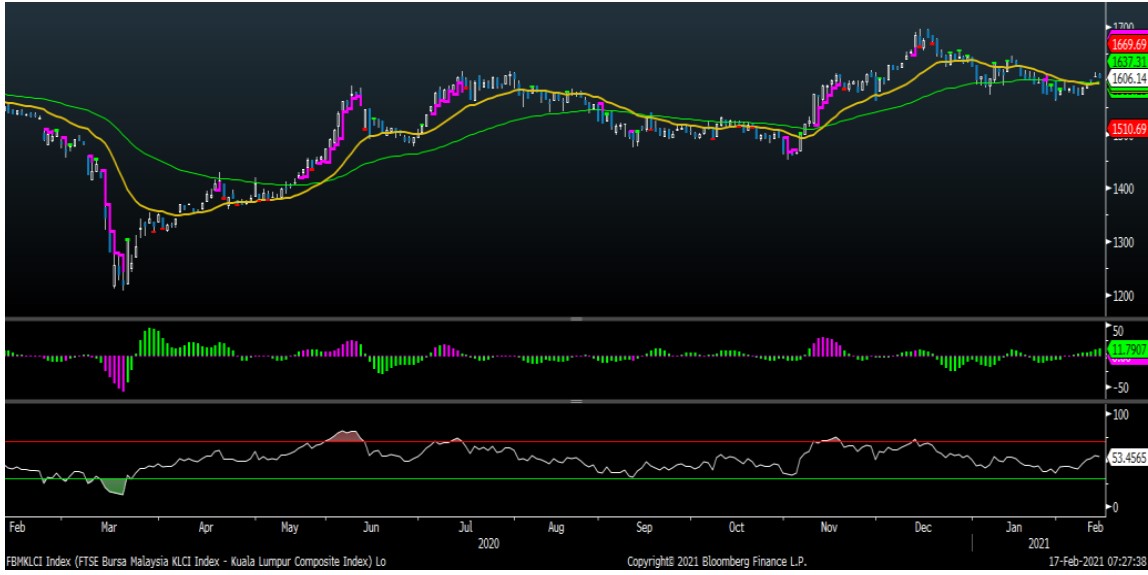

FBMKLCI Technical Outlook

The FBM KLCI slid into red in afternoon trading, but still hovering above 1,600. As the technical indicators remained positive with the MACD Histogram extending another green bar, while the RSI hovering above 50, we believe the key index will continue to climb higher, revisiting the resistance along 1,620-1,650. Meanwhile, the support level is located around 1,600, followed by 1,560

Company Brief

Pestech International Bhd (PSB) and its consortium partner Furukawa Electric Co Ltd have secured two contracts worth RM165.0m in Cambodia. The consortium was awarded the contract by Electricite du Cambodge (EDC) of Cambodia for Phnom Penh's transmission and distribution system expansion project phase 2 (I) – package 3, procurement of underground transmission and distribution line works. (The Star)

Genting Malaysia Bhd has announced that Resorts World Genting and Resorts World Awana resumed business at 6.00pm yesterday, after the group temporarily suspended operations at the resorts, following the implementation of the Movement Control Order from 22nd January 2021 to 4th February 2021. However, its Resorts World Kijal and Resorts World Langkawi will only resume operations on 19th February 2021. (The Edge)

Top Glove Corp Bhd has continued its share buyback by purchasing 8.1m more shares in the open market yesterday. The glove maker bought the shares at between RM6.05 and RM6.15, for a total of RM49.3m. (The Edge)

Kossan Rubber Industries Bhd’s 4QFY20 a net profit soared 758.2% YoY to RM523.5m, thanks to higher volume of gloves sold and better average selling prices. Rrevenue for the quarter jumped 126.5% YoY to RM1.31bn. A second interim dividend of 3.0 sen per share, together with a special dividend of 8.0 sen per share, payable on 17th March 2021 was declared. (The Edge)

Careplus Group Bhd has entered into a conditional share acquisition agreement with Shin Heung Precision Co Ltd to acquire the latter's subsidiary Shin Heung Electronics Malaysia Sdn Bhd, which owns a piece of land at Oakland Industrial Park in Seremban, Negeri Sembilan. The company said it intends to acquire the dormant company for a total cash consideration of RM9.3m, given it is the registered owner of a parcel of 2.0-ac. freehold industrial land. (The Edge)

Media Prima Group Bhd has assured it will not shut its television channel ntv7 to make way for DidikTV KPM, a new educational TV programme. The ntv7 channel will be used for Didik TV KPM from 17th February 2021 onwards. (The Edge)

Source: Mplus Research - 17 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-23

GENM2024-07-23

KOSSAN2024-07-23

TOPGLOV2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

PESTECH2024-07-22

TOPGLOV2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

MEDIA2024-07-19

TOPGLOV2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

TOPGLOV2024-07-16

GENM2024-07-16

GENM2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

TOPGLOV2024-07-16

TOPGLOV2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-15

PESTECH2024-07-15

PESTECH2024-07-15

PESTECH2024-07-15

PESTECH2024-07-12

GENM2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

PESTECH2024-07-12

PESTECH2024-07-12

TOPGLOV