Mplus Market Pulse - 6 Jul 2021

MalaccaSecurities

Publish date: Tue, 06 Jul 2021, 09:25 AM

Market Review

Malaysia:. The FBM KLCI (-0.1%) edged mildly lower, dragged down by weakness in selected plantation and Petronas-related heavyweights yesterday. The lower liners, however, marched higher, while the technology sector (+2.1%) outperformed the mostly negative broader market with several stocks closed at limit-up.

Global markets:. The US stockmarkets was closed for the Independence Day public holiday with futures market pointing to a mixed opening. European stockmarkets were boosted by the Eurozone’s Markit Composite PMI at 59.5 in June 2021; the strongest reading since June 2006, while Asia stockmarkets ended mostly higher.

The Day Ahead

The FBM KLCI started the week with mild losses as market sentiment remained tepid on the back of high number of Covid-19 infections despite improvement in vaccination rates. Nevertheless, the local bourse may see bargain hunting activities emerging especially in most of the oversold counters. Meanwhile, millions of Covid-19 vaccine doses are expected to arrive in Malaysia in July, which could see another breakthrough in vaccination rate. Commodities wise, both the CPO and oil prices extended their uptrend move.

Sector focus:. The plantation and oil & gas counters may be in focus in line with the rising commodities prices. Besides, the technology sector is likely to track the movements in Nasdaq last week, do note that technology sectors may perform well in the month of July (based on statistics over the past 20 years).

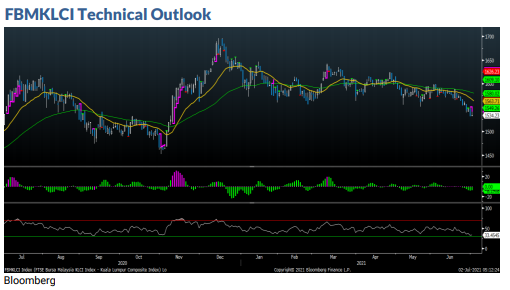

The FBM KLCI posted modest losses to settle at another fresh year-to-date low. Technical indicators remained mixed as the MACD Histogram has extended a green bar, while the RSI is hovering below the 30 level in the oversold region. With that, bargain hunting activities may emerge with resistance set at 1,560-1,580, while the support level is envisaged around 1,500-1,520.

Company Brief

Solarvest Holdings Bhd was awarded a contract by MK Land Holdings Bhd to build a large scale solar photovoltaic plant in Kerian, Perak. The engineering, procurement, construction and commissioning of the 11.0-MW solar farm was worth RM42.9m. The project was scheduled to start on 8th July 2021 and to be completed by 30th December 2022 (The Star)

Chin Hin Group Property Bhd is planning to acquire a 65.0% equity interest in construction firm Kayangan Kemas Sdn Bhd for RM38.0m. It has also proposed to diversify its business into construction, to complement its property development business. Chin Hin Group Property plans to pay for the acquisition via cash (RM29.2m) and the issuance of 11.0m new Chin Hin Group Property shares at an issue price of 80 sen apiece. The cash portion will be financed using internal funds, fundraising, and/or a combination of which the proportions will be determined later. (The Edge)

Straits Inter Logistics Bhd has partnered with Petronas Dagangan Bhd (PetDag) to provide marine fuel oil to vessels at all ports in Malaysia. The collaboration will be undertaken through its 70.0%-owned unit Tumpuan Megah Development Sdn Bhd, will be hugely synergistic and value-adding to both parties. (The Edge)

OM Holdings Ltd’s smelting complex in Sarawak has been given the green light to resume operations with four furnaces within a phased plan to ramp up production in stages, given the constrained manpower environment and its focus to prioritise employee safety. The plant was temporarily suspended from 28th May 2021 as part of the Movement Control Order 3.0 and the group declared force majeure on all its sales contracts and its power purchase agreement until the plant is able to resume and achieve steady-state operations. (The Edge)

Green Packet Bhd has proposed to dispose of its stake in G3 Global Bhd to its managing director and chief executive officer (CEO) Puan Chan Cheong (CC Puan) for between RM61.3m and RM91.9m in cash. Green Packet plans to sell up to 612.6m shares, or a 24.8% stake, in G3 Global (after exercising warrants into shares) between 10 sen and 15 sen per share. (The Edge)

Mi Technovation Bhd has proposed to undertake a private placement of up to 10.0% of its share capital to raise up to RM270.7m, to expand the group's business. The placement, to be issued to third party investors to be identified at an issue price to be determined, will involve the issuance of up to 82.0m placement shares. Mi Technovation expects to use RM187.0m to expand the group's business, RM15.0m to repay its bank borrowings, and RM64.2m for working capital. (The Edge)

Boustead Plantations Bhd has announced that Ibrahim Abdul Majid is relinquishing his role as CEO of the company effective immediately to accept a bigger role at parent Boustead Holdings Bhd (BHB). He assumed his current post in December 2019. (The Edge)

Ireka Corp Bhd's substantial shareholder Ideal Land Holdings Sdn Bhd sold 21.7m shares via an off-market transaction last Friday. Ideal Land; a vehicle controlled by Ireka executive chairman Datuk Lai Siew Wah and his son, who is Ireka's group managing director Datuk Lai Voon Hon, as well as his daughter and group deputy managing director Monica Lai Voon Huey has sold the shares. (The Edge)

JF Technology Bhd's wholly-owned subsidiary JF Microtechnology Sdn Bhd (JFM) was granted six new patents for the group's integrated circuit (IC) testing-related inventions during the financial year ended 30th June 2021. Out of the six new patents, two were related to high-frequency IC test contacting solutions, while four were related to IC test contacting solutions for automotive and high-power applications. JFM received three of the patents from Malaysia, two from the US and one from the Philippines. (The Edge)

Source: Mplus Research - 6 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

PETDAG2024-11-15

PETDAG2024-11-14

PETDAG2024-11-14

PETDAG2024-11-13

PETDAG2024-11-13

PETDAG2024-11-13

SLVEST2024-11-13

SLVEST2024-11-13

SLVEST2024-11-12

PETDAG2024-11-12

PETDAG2024-11-12

SLVEST2024-11-11

JFTECH2024-11-11

JFTECH2024-11-11

JFTECH2024-11-11

JFTECH2024-11-11

PETDAG2024-11-11

PETDAG2024-11-11

SLVEST2024-11-08

BPLANT2024-11-08

IREKA2024-11-08

PETDAG2024-11-07

BSTEAD2024-11-07

PETDAG2024-11-07

PETDAG2024-11-06

PETDAG2024-11-06

PETDAG2024-11-05

OMH2024-11-05

OMH2024-11-05

PETDAGMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024