Mplus Market Pulse - 6 Apr 2022

MalaccaSecurities

Publish date: Wed, 06 Apr 2022, 08:36 AM

Broader market still upbeat

Market Review

Malaysia:. The FBM KLCI (-0.1%) edged mildly lower on a lacklustre trading mode yesterday, dragged by weakness in selected banking and telco heavyweights. The lower liners, however, remained upbeat, while broader market closed mostly positive, led by the transportation & logistics sector (+2.1%).

Global markets:. Wall Street turned volatile as the Dow (-0.8%) retreated on the back of the hawkish tone from the US Federal Reserve on the interest rate direction and US and EU may impose more sanctions against Russia. The European stock markets ended mostly negative, but Asia stock markets closed mostly higher.

The Day Ahead

The FBM KLCI saw another session of pullback amid further profit taking in banking and telecommunication heavyweights. Meanwhile, global sentiment may stay fragile amid concerns over more hawkish stance of the US Federal Reserve’s action to tame inflation. Also, we expect the unresolved tension between Russia and Ukraine could limit the upside potential over the near term. Nevertheless, we expect the reopening of travel borders may continue to benefit the economy, while investors could position themselves ahead of the GE15 (albeit the timeline is still uncertain). On the commodities market, both the crude oil and CPO price remained elevated despite a mild pullback overnight.

Sector focus:. We believe traders will continue to focus on O&G and plantation sector amid the elevated Brent oil and CPO prices. Meanwhile, recovery-themed sectors such as consumer, banking, transportation & logistics and aviation may benefit following the reopening of borders. Besides, trading interest may build up on construction and building material sector ahead of the GE15.

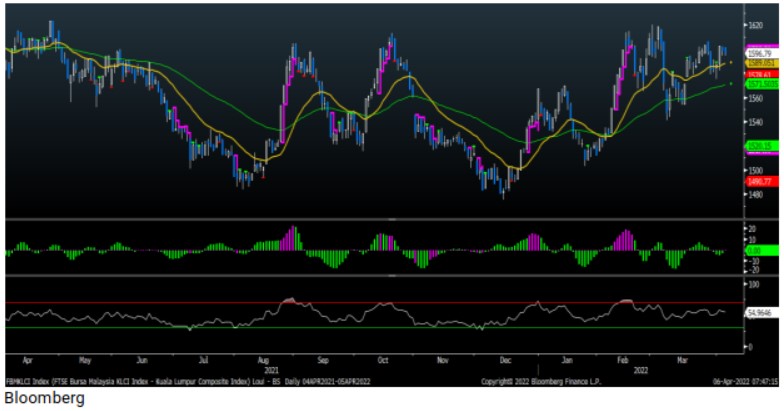

FBMKLCI Technical Outlook

The FBM KLCI managed to hold above the daily EMA9. Technical indicators remained mixed as the Histogram is below zero, but the RSI is hovering above the 50 level. Resistance is set around 1,600-1,620, while the support is located at 1,580.

Company Brief

Eco World Development Group Bhd confirms that Hasrat Budi Sdn Bhd (HBSB), a wholly-owned subsidiary of the company, has filed an originating summons seeking the removal of Tan Sri Shahril Shamsuddin and Anuar Rozhan as directors of MYSJ Sdn Bhd (MYSJ). HBSB has a 10.0% stake in MYSJ and is entitled to one board seat in MYSJ. However, as an investor, HBSB is not involved in the management or day-to-day operations of MYSJ. (The Star)

Samaiden Group Bhd has proposed a bonus issue of up to 224.0m shares, on the basis of 2 bonus shares for every 3 existing shares. The proposed bonus Issue is intended to reward the existing shareholders of the company for their loyalty and continuing support to Samaiden and its subsidiaries. The proposed bonus issue is expected to be completed by the 3Q22. (The Star)

Genting Malaysia Bhd (GENM) is seeking its shareholders' approval to buy back its own shares at its upcoming annual general meeting. The group intends to seek the approval of its shareholders for the proposed renewal of the authority for GENM to purchase its own shares of an amount which, when aggregated with the treasury shares, does not exceed 10.0% of its prevailing total number of issued shares at any time. (The Edge)

Reservoir Link Energy Bhd's unit Reservoir Link Sdn Bhd has received a letter of award from ExxonMobil Exploration and Production Malaysia Inc (EMEPMI) for the provision of annulus wash and cement placement equipment and services. The scope of work includes the provision of rental equipment or systems that meet EMEPMI's requirements and are capable of cleaning and washing the annulus behind single and multi-layer casings and provide assurance for cement placement behind the washed casings. (The Edge)

Westports Holdings Bhd has reported that a fire broke out within the company’s extensive container yard facilities at 4.45pm on 4th April 2022, which was brought under control at 3.00am on 5th April 2022. Westports, authorities and external parties are still ascertaining the extent of the damage, and how many containers have been affected. (The Edge)

Tenaga Nasional Bhd’s (TNB) wholly-owned subsidiary TNB Power Generation Sdn Bhd (TPGSB) had lodged a Sukuk Wakalah Programme of up to RM10.0bn with the Securities Commission Malaysia. The Sukuk Wakalah Programme would provide TPGSB with the flexibility to time its fund-raising exercises with varying nominal value and tenures for optimal asset-liability matching. (The Edge)

AEON Credit Service (M) Bhd's 4QFY22 net profit dropped 79.4% YoY to RM23.4m, underpinned by higher impairment losses on financing receivables and lower bad debt recoveries. Revenue for the quarter fell 10.7% YoY to RM363.0m A final dividend of 15.0 sen and a special dividend of 5.0 sen per share, payable on 21st July 2022 was declared. (The Edge)

Khee San Bhd's wholly-owned subsidiary Khee San Marketing Sdn Bhd has entered into two distribution agreements which include a deal with pharmaceutical product manufacturer Jardin Pharma Bhd, from which Khee San Marketing secured the exclusive right to distribute Jardin Pharma's products for two years. Khee San Marketing will be the sole distributor of Jardin Pharma's products for two years from 15th March 2022. (The Edge)

Syarikat Takaful Malaysia Keluarga Bhd’s foreign shareholding stood at 9.3% as at 31st March 2022. The updates showed that the bank’s foreign shareholding had declined from 9.8% on 31st December 2021. (The Edge)

Ancom Bhd will change its name to Ancom Nylex Bhd with effect from 5th April 2022. The change in the corporate identity came after Ancom took over all the assets and liabilities of Nylex (Malaysia) Bhd for RM179.3m (RM1.00 per Nylex share) in October 2021. (The Edge)

Source: Mplus Research - 6 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

GENM2024-11-16

ECOWLD2024-11-16

TAKAFUL2024-11-16

TENAGA2024-11-15

ANCOMNY2024-11-15

SAMAIDEN2024-11-15

SAMAIDEN2024-11-15

TAKAFUL2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

WPRTS2024-11-15

WPRTS2024-11-15

WPRTS2024-11-15

WPRTS2024-11-15

WPRTS2024-11-14

ANCOMNY2024-11-14

TAKAFUL2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

WPRTS2024-11-14

WPRTS2024-11-14

WPRTS2024-11-14

WPRTS2024-11-13

ANCOMNY2024-11-13

GENM2024-11-13

TAKAFUL2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

WPRTS2024-11-13

WPRTS2024-11-13

WPRTS2024-11-13

WPRTS2024-11-12

ANCOMNY2024-11-12

ECOWLD2024-11-12

GENM2024-11-12

TAKAFUL2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

WPRTS2024-11-12

WPRTS2024-11-12

WPRTS2024-11-12

WPRTS2024-11-11

ANCOMNY2024-11-11

TAKAFUL2024-11-11

TENAGA2024-11-11

TENAGA2024-11-11

TENAGA2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-08

ANCOMNY2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

ECOWLD2024-11-08

SAMAIDEN2024-11-08

TAKAFUL2024-11-08

TENAGA2024-11-08

TENAGA2024-11-08

WPRTS2024-11-08

WPRTS2024-11-08

WPRTS2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ECOWLD2024-11-07

KHEESAN2024-11-07

TAKAFUL2024-11-07

TENAGA2024-11-07

TENAGA2024-11-07

WPRTS2024-11-07

WPRTS2024-11-06

ANCOMNY2024-11-06

ANCOMNY2024-11-06

GENM2024-11-06

GENM2024-11-06

TAKAFUL2024-11-06

TENAGA2024-11-06

TENAGA2024-11-06

TENAGA2024-11-05

ANCOMNY2024-11-05

KHEESAN2024-11-05

KHEESAN2024-11-05

TAKAFUL2024-11-05

TENAGA2024-11-05

TENAGA2024-11-05

TENAGA2024-11-05

WPRTSMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024