Mplus Market Pulse - 14 Apr 2022

MalaccaSecurities

Publish date: Thu, 14 Apr 2022, 09:20 AM

Quick profit taking sapped gains

Market Review

Malaysia:. The FBM KLCI ended on a flat note as majority of its intraday gains were interrupted by quick profit taking activities in Petronas-related and gloves heavyweights yesterday. The lower liners advanced, while the healthcare (-0.9%) and property (-0.1%) sectors underperformed the positive broader market.

Global markets:. Wall Street rebounded as the Dow (+1.0%) recovered all its previous session losses ahead of the Good Friday public holiday, lifted by the rebound in technology stocks, while the 1Q22 earnings season kicked off. Both the European and Asia stock markets ended mostly higher.

The Day Ahead

The FBM KLCI ended flat on the back of mixed sentiment across regional markets. Sentiment however, turned positive in the US despite the accelerated inflation as investors focused on the upcoming earnings season. On the local bourse, we believe the elevated crude oil and CPO prices will continue to bode well for the energy and plantation counters, while the increasing demand for traveling following the reopening of travel borders will support the economic recovery going forward. Commodity wise, both the Brent crude oil and CPO prices trended higher, hovering around USD108 and RM6,100 respectively.

Sector focus:. We expect to see trading interest to return within the oil & gas stocks amid firmer Brent crude oil price. Meanwhile, investors may continue to favour planation stocks ahead of the earnings season. Given the Nasdaq performed a rebound, local technology stocks may follow suit under this environment.

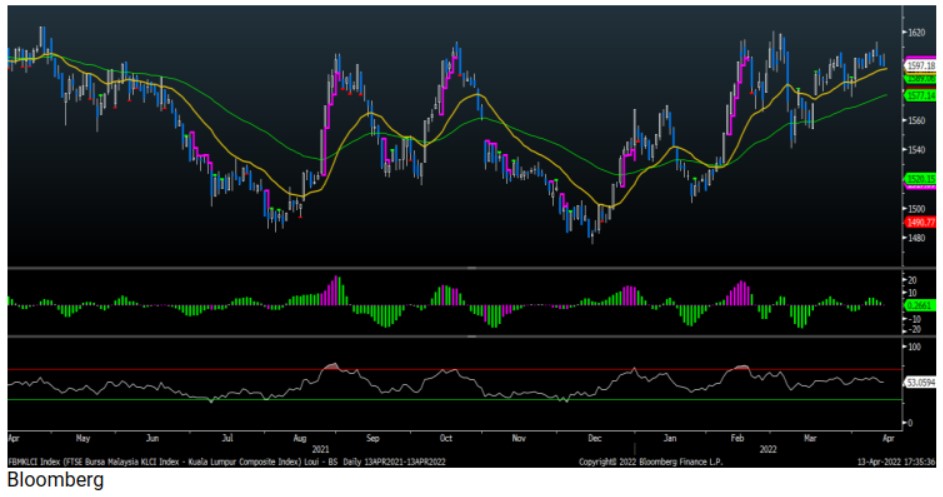

FBMKLCI Technical Outlook

The FBM KLCI closed flat and remained below the 1,600 and daily EMA9 level. Technical indicators are mixed with the Histogram mildly declining, while the RSI is hovering above 50. Resistance is envisaged around 1,600-1,620, while the support is located around 1,580.

Company Brief

The Securities Commission has compounded Serba Dinamik Holdings Bhd and four individuals, including its CEO and top executives, with the maximum permissible sum of RM3.0m each for charges of submitting a false statement to Bursa Malaysia Securities Bhd. The Public Prosecutor had accepted the representation made to the Attorney-General's Chambers by the oil and gas firm and the individuals involved regarding the charges pending in court. The individuals involved in the charges are Serba Dinamik CEO/group managing director Datuk Mohd Abdul Karim Abdullah, executive director Datuk Syed Nazim Syed Faizal, group chief financial officer Azhan Azmi and vice president of accounts and finance Muhammad Hafiz Othman. (The Star)

Bank Islam Malaysia Bhd (BIMB) reiterated that it has no affiliation with a scam share brokerage website and will not use such a method or investment platform to obtain the public's investment in BIMB shares. BIMB took note and was aware of the existence of a scam share brokerage website using a logo similar to its official logo to cheat the public into investing in BIMB shares. (The Star)

Sedania Innovator Bhd’s gaming arm Esports Players League (ESPL) aims to generate up to 300,000 gamers in partnership with Yield Guild Games Southeast Asia (YGG SEA). The Singapore-based ESPL recently announced a partnership with YGG SEA as part of its vision to amass gamers in the cryptocurrency, non-fungible token (NFT) gaming and Metaverse sphere. (The Star)

T7 Global Bhd has bagged a RM6.0m contract from Hess Exploration and Production Malaysia BV for the provision of technical and non-technical manpower. It’s manpower subsidiary T7 Intelligent Resources Sdn Bhd received the letter of award from Hess to provide the manpower for the latter's North Malay Basin integrated gas development project. The contract will span a 2-year period. (The Edge)

Dagang NeXchange Bhd (DNeX) has reported that the recent North Sea oilfield development's decarbonisation options may include wind power generation. This follows 90.0%-owned subsidiary Ping Petroleum Ltd's final investment decision on its proposed crude oil production within the Avalon oilfield in the North Sea was anticipated for later this year after the UK's North Sea Transition Authority indicated it had no objection to Ping's planned development concept for the oilfield. (The Edge)

Hibiscus Petroleum Bhd is considering listing a special purpose acquisition company (SPAC) in Singapore that could raise as much as S$200.0m (RM620.4m). The blank-cheque company will look for acquisition targets in the renewable energy sector. (The Edge)

Khazanah Nasional Bhd is trimming its stake in CIMB Group Holdings Bhd by placing out 83.0m shares representing a 0.8% stake in the banking group in an accelerated placement. The price range is set between RM5.10 and RM5.28 per share for the book-building that opened on 13th April 2022 and closed the same night. The price range represents a discount of up to 3.4% to the stock's closing price of RM5.28 on the day. (The Edge)

Zhulian Corp Bhd's 4QFY22 net profit jumped 116.0% YoY to RM26.2m, thanks to a RM14.0m net gain from the disposal of land in Indonesia. Revenue for the quarter, however, slipped 16.6% YoY to RM34.6m. (The Edge)

Parkson Holdings Bhd has announced that its external auditor has reported a material uncertainty that may cast significant doubt on the group's ability to continue as a going concern. This is in respect of the retailer's audited financial statements for the 18-month period ended 31st December 2021 (FY21). Separately, Parkson has reassessed its condition and concluded that it does not trigger any Practice Note 17 prescribed criteria based on the FY21 results. (The Edge)

Seacera Group Bhd has received a winding up statutory notice demanding a sum of RM34.6m in connection with a share sale agreement (SSA). The notice was issued by solicitors acting for Ismail Othman, who signed the SSA with the group's subsidiary, Seacera Properties Sdn Bhd, in 2016. (The Edge)

Source: Mplus Research - 14 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

PARKSON2024-11-17

T7GLOBAL2024-11-16

BIMB2024-11-16

HIBISCS2024-11-15

CIMB2024-11-15

CIMB2024-11-15

CIMB2024-11-15

CIMB2024-11-15

CIMB2024-11-15

DNEX2024-11-15

HIBISCS2024-11-15

ZHULIAN2024-11-15

ZHULIAN2024-11-14

BIMB2024-11-14

HIBISCS2024-11-13

BIMB2024-11-13

BIMB2024-11-13

CIMB2024-11-13

CIMB2024-11-13

CIMB2024-11-13

CIMB2024-11-13

CIMB2024-11-13

T7GLOBAL2024-11-13

T7GLOBAL2024-11-13

T7GLOBAL2024-11-12

BIMB2024-11-12

BIMB2024-11-12

CIMB2024-11-12

CIMB2024-11-12

CIMB2024-11-12

DNEX2024-11-12

DNEX2024-11-12

HIBISCS2024-11-12

T7GLOBAL2024-11-12

ZHULIAN2024-11-12

ZHULIAN2024-11-11

BIMB2024-11-11

CIMB2024-11-11

CIMB2024-11-11

CIMB2024-11-11

ZHULIAN2024-11-11

ZHULIAN2024-11-08

BIMB2024-11-08

CIMB2024-11-08

CIMB2024-11-08

CIMB2024-11-08

T7GLOBAL2024-11-08

ZHULIAN2024-11-08

ZHULIAN2024-11-07

CIMB2024-11-07

CIMB2024-11-07

CIMB2024-11-07

CIMB2024-11-07

PARKSON2024-11-07

PARKSON2024-11-07

ZHULIAN2024-11-07

ZHULIAN2024-11-06

CIMB2024-11-06

CIMB2024-11-06

CIMB2024-11-06

CIMB2024-11-06

CIMB2024-11-06

CIMB2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

T7GLOBAL2024-11-06

ZHULIAN2024-11-06

ZHULIAN2024-11-05

BIMB2024-11-05

BIMB2024-11-05

BIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

CIMB2024-11-05

T7GLOBAL2024-11-05

ZHULIANMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024