Mplus Market Pulse - 21 Apr 2022

MalaccaSecurities

Publish date: Thu, 21 Apr 2022, 08:32 AM

Light at the end of the tunnel

Market Review

Malaysia:. Following the public holiday, the FBM KLCI (+0.8%) resumed trading and snapped a 3-day losing streak, boosted by gains in more than two-thirds of the key index components. The lower liners also rebounded, while the broader market ended mostly higher, led by the plantation sector (+2.9%).

Global markets:. Wall Street ended mixed as the Dow (+0.7%) rose, but the S&P 500 (-0.1%) and Nasdaq (-1.2%) were dragged by weakness in Netflix (-35.1%) following the weaker-than-expected number of paid subscribers. The European stockmarkets advanced, while Asia stock markets ended mostly higher.

The Day Ahead

Renewed buying interest in most of the index heavyweights led by the banking stocks pushed the FBM KLCI higher following the positive overnight performance on Wall Street. However, we believe selected rebound on our local front, specifically the technology stocks are likely to give back the recent gains on the back of the weaker Nasdaq performance. Nevertheless, traders could monitor few other catalysts like (i) reopening travel borders theme, (ii) elevated commodity prices and (iii) recovering construction activities for trading purposes. On the commodity markets, the crude oil price hovered above USD105 per barrel mark, while the FCPO price remained supported above RM6,300.

Sector focus:. We expect investors to trade on a more cautious stance, while focusing on recovery-theme sectors such as consumer, banking, construction and building material. Also, we expect the plantation sector to continue charting higher territories amid the elevated FCPO price. Traders may avoid the technology sector.

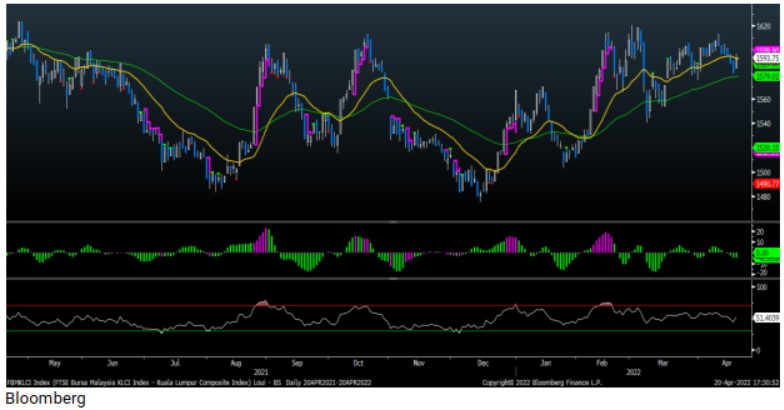

FBMKLCI Technical Outlook

The FBM KLCI snapped the three-day losing streak and bounced back above the SMA50 level as the key index remained supported above 1,580. Technical indicators were mixed as MACD Histogram remained below zero, while the RSI crossed above the 50 level. Resistance is pegged around 1,600-1,620, while the support is set at 1,580

Company Brief

OCR Group Bhd will be developing its first integrated eCommerce logistics hub on a 20.0-acre site in Section 15 in Shah Alam, Selangor via a proposed joint venture with Magna Ecocity Sdn Bhd, a 70.0%-owned subsidiary of Magna Prima Bhd. OCR Avenue will be responsible for the construction and completion of the proposed project on the leasehold land belonging to Magna Ecocity. With a planned gross development value of RM1.50bn, the proposed integrated eCommerce logistics hub is set to be OCR’s biggest venture into the commercial real estate (CRE) segment to date. (The Star)

Vizione Holdings Bhd’s joint venture (JV) company with Permata Rebana Sdn Bhd, Permata Rebana & Vizione Holdings JV Sdn Bhd (PRVH) has secured a RM654.0m contract from Social Security Organisation (Socso). The contract is for the planning, design, construction, equipping, testing, commissioning and maintenance of Sosco’s National Robotics and Cybernetics Rehabilitation Centre (Phase 1) in Bandar Meru Raya, Perak. (The Star)

Scanwolf Corporation Bhd’s wholly-owned subsidiary, Scanwolf Marketing Sdn Bhd, has signed an exclusive distributorship agreement with Signature Cabinet Sdn Bhd, a wholly-owned subsidiary of Signature International Bhd, to strengthen the strategic partnership within the business-to-people (B2P) segment, focusing specifically on project sales. Scanwolf Marketing had also entered into a distributorship agreement with Signature Distribution Sdn Bhd, another wholly owned unit of Signature International, and Beyond Bath Sdn Bhd to collaborate on cross-selling brand and utilise the existing business platform and sales network to create values for its client. (The Star)

Caely Holdings Bhd has confirmed that the Malaysian Anti-Corruption Commission (MACC) has issued a freeze order on all the operational bank accounts of the company and its subsidiaries. This came after Caely received the notice from one of its banks, CIMB Bank, on 13th April 2022 that the company’s accounts had been frozen. (The Edge)

Bintai Kinden Corp Bhd's subsidiary Bintai Energy Sdn Bhd has been appointed the exclusive distributor for pipes and valves supplied by Gerab Group in Malaysia and Brunei. (The Edge)

Kejuruteraan Asastera Bhd (KAB) has teamed up with privately held MRH Empire Sdn Bhd to venture into the telecommunication infrastructure sector to grow its recurring income. Under the JV, KAB Telco Sdn Bhd (KABTEL) will hold a 60.0% stake in the JV company and MRH the remaining 40.0%.(The Edge)

GFM Services Bhd has scrapped plans to collaborate with Amzass (M) Sdn Bhd to complete the upgrade of the northbound and southbound Bemban lay-bys in Melaka that is located along the North-South Expressway into rest and service areas, as it is dissatisfied with the results of a due diligence review. GFM has notified Amzass of the unsatisfactory due diligence and further demanded a refund of RM500,000. (The Edge)

Sinmah Capital Bhd is selling its poultry business to F.C.H. Holdings Sdn Bhd for RM2.9m. The move is in line with the group's objective of streamlining its businesses to focus on property development as its growth prospect, moving forward. The proceeds earmarked for the development expenditure on the group's existing Taman Gambir Perdana mixed project in Johor. (The Edge)

Axis Real Estate Investment Trust’s (AXREIT) 1QFY22 net property income (NPI) gained 17.2% YoY to RM58.4m, mainly due to positive rental reversion from tenancy renewals, and contracted step-ups and contributions from newly acquired properties. Revenue for the quarter increased 16.0% YoY to RM66.7m. A first interim income distribution of 2.42 sen per unit, payable on 15th June 2022 was declared. (The Edge)

Vertice Bhd is planning to exit the fashion retail business by disposing of its 40.0% equity stake in Kumpulan Voir Sdn Bhd for RM9.0m in cash to cut its losses in the company that has been in the red since 2017 and now continues to face challenges presented by the Covid-19 pandemic. Vertice has inked a share sale agreement with Distinct Seasons Sdn Bhd to sell the remaining stake. (The Edge)

KIP Real Estate Investment Trust’s (REIT) 3QFY22 net property income (NPI) rose 5.9% YoY to RM14.5m, underpinned by higher revenue from contracts with customers. Revenue for the quarter increased 4.7% YoY to RM18.8m. (The Edge)

Ancom Nylex Bhd’s 3QFY22 net profit jumped 113.8% YoY to RM15.1m, on improved sales. Revenue for the quarter rose 31.0% YoY to RM510.0m. (The Edge)

Source: Mplus Research - 21 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

GFM2024-11-16

BINTAI2024-11-15

ANCOMNY2024-11-15

KIPREIT2024-11-15

KIPREIT2024-11-14

ANCOMNY2024-11-13

ANCOMNY2024-11-13

AXREIT2024-11-12

ANCOMNY2024-11-12

AXREIT2024-11-11

ANCOMNY2024-11-08

ANCOMNY2024-11-08

AXREIT2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-06

ANCOMNY2024-11-06

ANCOMNY2024-11-05

ANCOMNY2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

VIZIONEMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024