Mplus Market Pulse - 22 Apr 2022

MalaccaSecurities

Publish date: Fri, 22 Apr 2022, 08:35 AM

Reaching out for 1,600 again

Market Review

Malaysia:. The FBM KLCI (+0.3%) extended its upward momentum, driven by gains across selected plantation and banking heavyweights yesterday. The lower liners, however, were mixed, while the broader market closed mostly higher, anchored by the energy sector (+1.6%) as oil prices recovered.

Global markets:. Wall Street endured another volatile session as the Dow (-1.1%) fell following the spike in treasury yields as traders are pricing in a potential 50 basis points rate hike in the following Federal Reserve meetings. The European stockmarkets ended mostly upbeat, while Asia stock markets closed mixed.

The Day Ahead

The FBM KLCI extended its rebound, mainly buoyed by gains in banking heavyweights as investors shrugged off the negative tone across the regional markets and focused on the economic recovery following the reopening of travel borders. While foreign funds continue to support the local bourse, the overnight selldown on Wall Street may impact negatively in the technology sector. Investor may also monitor Malaysia’s inflation data which will be releasing later today. Meanwhile, the Brent oil and FCPO are still hovering above USD105 per barrel and RM6,300 respectively.

Sector focus:. As the commodity prices remained well supported, investors may continue to position themselves in the energy and plantation stocks. Besides, we expect broad based recovery in various sectors on the back of recovery in economic activities following the reopening of travel borders.

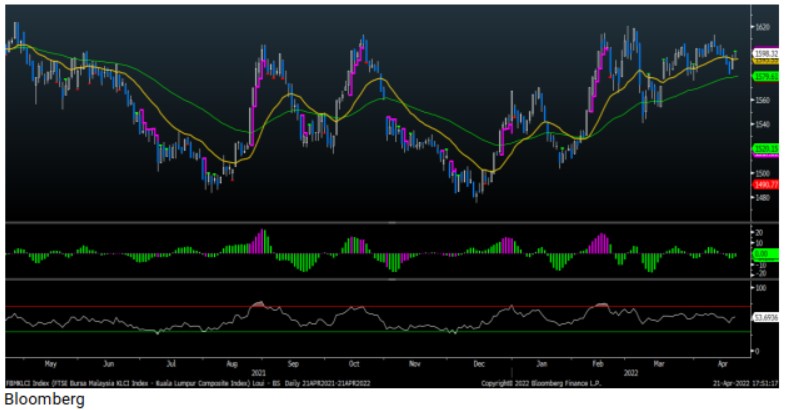

FBMKLCI Technical Outlook

The FBM KLCI rose for the second straight day and finished above the daily EMA9 level. Technical indicators were mixed as MACD Histogram remained below zero, while the RSI hovered above 50. Resistance is envisaged at 1,600, followed by 1,620, while the support is located at 1,580.

Company Brief

Kawan Food Bhd’s wholly-owned subsidiary, Kawan Food Manufacturing Sdn Bhd has proposed to acquire 5 parcels of leasehold industrial land in Shah Alam worth RM50.5m from RGP Warehouse Solutions Sdn Bhd. The acquisition was in line with its corporate strategy of expanding, growing its operations and diversifying. The land acquisition was proposed to build and construct for second manufacturing facility for its operations. (The Star)

Sasbadi Holdings Bhd’s 2QFY22 net profit fell 7.8% YoY to RM3.3m, on decrease in the contribution from the print publishing division due to the deferment of the school's new academic year to March 2022, coupled with the long festive season. Revenue for the quarter declined 2.7% YoY to RM23.5m. (The Star)

Malaysia Airports Holdings Bhd (MAHB) has reported that its nationwide airport network recorded a 52.0% MoM increase in international passenger movements to 420,000 in March 2022, driven by the implementation of various Vaccinated Travel Lane (VTL) programmes. VTL programmes were implemented between Kuala Lumpur and Singapore, Bangkok, Phuket and Phnom Penh, and between Penang and Singapore. (The Edge)

Serba Dinamik Holdings Bhd believes an internal irreconcilability of the charges levelled by the Securities Commission Malaysia against the company over the alleged false RM6.01bn revenue figure was what prompted the Attorney-General (AG) to compound the company and its top executives, instead of pressing ahead with the criminal charges against them. (The Edge)

Tomei Consolidated Bhd's wholly-owned precious metals arm YX Precious Metals Bhd (YXPM), en route to list on the ACE Market of Bursa Malaysia by the end of June 2022, has signed an underwriting agreement with Public Investment Bank Bhd in conjunction with its upcoming initial public offering (IPO). The IPO exercise entails a public issue of 111.7m new shares in YXPM. (The Edge)

Taliworks Corporation Bhd has completed the acquisition of majority economic interest in four solar projects from TerraForm Global Operating LP (TerraForm Global) and several of its subsidiaries on 21st April 2022. The solar projects, located within the vicinity of the Kuala Lumpur International Airport, have an aggregate capacity of 19.0-MWp. (The Edge)

Holders of tranche one of Eastern & Oriental Bhd's (E&O) subsidiary Tanjung Pinang Development Sdn Bhd's RM1.50bn Islamic bonds or sukuk have rejected a special resolution proposed by Tanjung Pinang Development in December 2021, according to the bond's facilitating agent RHB Investment Bank Bhd on 21st April 2022. (The Edge)

Tropicana Corp Bhd has announced that Lee Han Ming will step down as its chief executive officer (CEO), effective 1st May 2022, 14 months after he took over the post. old Lee will get a new assignment and position to focus on and expand group property development. (The Edge)

KPower Bhd has proposed to change its name to Reneuco Bhd. The move is in line with the Group’s rebranding, restructuring and recapitalisation efforts of KPower in undertaking transformation and growth. The proposed name change is also to heighten focus in the renewable, sustainable and green segment and its leadership shift and continuity from the former management. (The Edge)

Boustead Naval Shipyard Sdn Bhd, a subsidiary of Boustead Holdings Bhd has succeeded in getting the High Court to extend the restraining order until 2nd June 2022, pursuant to a scheme of arrangement and leave to hold the court-convened meeting. Judicial Commissioner Liza Chan Sow Keng granted the extension, after the court took into account the Cabinet's position to continue with the littoral combat ship project. (The Edge)

Source: Mplus Research - 22 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

AIRPORT2024-11-16

TOMEI2024-11-15

AIRPORT2024-11-15

RENEUCO2024-11-15

TROP2024-11-15

TROP2024-11-14

TROP2024-11-13

SASBADI2024-11-13

SASBADI2024-11-13

TROP2024-11-12

SASBADI2024-11-12

SASBADI2024-11-12

TROP2024-11-11

SASBADI2024-11-11

SASBADI2024-11-11

TROP2024-11-08

KAWAN2024-11-08

SASBADI2024-11-08

SASBADI2024-11-08

SASBADI2024-11-08

SASBADI2024-11-08

TROP2024-11-08

TROP2024-11-07

BSTEAD2024-11-07

TROP2024-11-06

SASBADI2024-11-06

SASBADI2024-11-06

TROP2024-11-05

AIRPORT2024-11-05

AIRPORTMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024