Mplus Market Pulse - 11 May 2022

MalaccaSecurities

Publish date: Wed, 11 May 2022, 09:46 AM

Signs of bargain hunting

Market Review

Malaysia:. The FBM KLCI (+0.4%) staged a mild recovery from a 3-day slump as bargain hunting activities in telco-related heavyweights yesterday. The lower liners, however, remained downbeat, while the broader market ended mixed with the telecommunications & media sector (+1.3%) leading the winners list.

Global markets:. Wall Street ended mixed as the Dow fell 0.3% but the S&P 500 (+0.3%) and Nasdaq (+1.0%) rose on bargain hunting from the selloff inn technology shares. The European stockmarkets advanced, but Asia stock markets ended mixed.

The Day Ahead

The FBM KLCI bucked the downtrend in the regional markets, following the three straight session of decline, mainly powered by bargain hunting in telecommunication and selected banking heavyweights. We foresee investors to continue to buy the dip ahead of the earnings season, but overall market sentiment may be tested by concerns over (i) impact of Cukai Makmur, (ii) mixed performances on Wall Street overnight, and (iii) the upcoming BNM’s interest rate decision. Commodities wise, the CPO and crude oil price hovered around RM6,300 and USD102.

Sector focus:. We expect buying support to emerge gradually in the healthcare sector following HARTA’s result, despite recording losses due to one-off Cukai Makmur. Besides, the proposal by the Malaysia’s commodities ministry to cut the export tax on palm oil by half may propel the plantation sector.

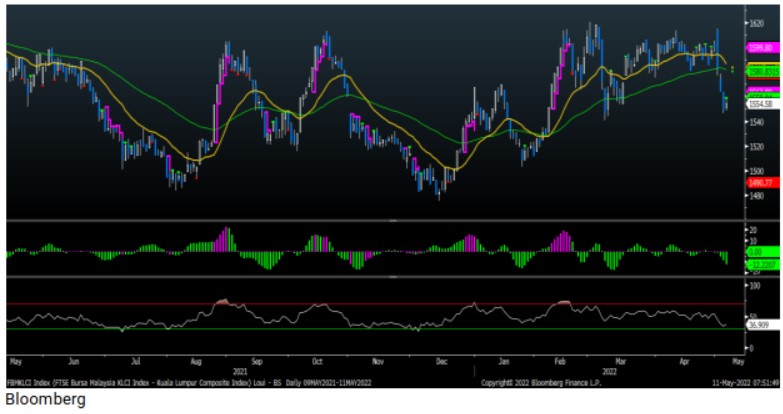

FBMKLCI Technical Outlook

The FBM KLCI improved above the SMA200 level, snapping its three-session decline in a volatile trade. Technical indicators remained negative as the MACD Histogram has extended a negative bar, while the RSI hovered below the 50 level. The support is pegged at 1,505, while the resistance is envisaged around 1,570- 1,580.

Company Brief

Serba Dinamik Holdings Bhd (SDHB) is taking steps to seek leave from the High Court to allow the company to convene one or more court-convened creditors meeting to present one or more scheme(s) of arrangement to seek a constructive resolution to the company and its subsidiaries’ payment obligation. The proposed scheme of arrangement would address 100.0% of the amounts to creditors of Serba Dinamik Group including the petitioners. The company and subsidiaries were served with the winding-up petitions on 28th April 2022 and the case management has been fixed on 1st July 2022 and the hearing on 6th July 2022. (The Star)

Xin Hwa Holdings Bhd has proposed to acquire a 79.0% stake in Micron Metal Engineering Sdn Bhd for RM19.8m. The purchase would be satisfied via a combination of cash amounting to RM16.8m and issuance of new Xin Hwa shares amounting to RM3.0m. It will issue 10.5m new shares in Xin Hwa at an issue price of RM0.2855 per consideration, based on the 5-day volume-weighted average market price. The proposed acquisition is subject to approvals from Bursa Malaysia Securities Bhd and shareholders of Xin Hwa at an extraordinary general meeting to be convened. (The Star)

KSL Capital Sdn Bhd, which emerged as a substantial shareholder of Advanced Packaging Technology (M) Bhd recently, is believed to have links to the Liew family who sold out of Jadi Imaging Holdings Bhd. (The Edge)

CSH Alliance Bhd’s electric vehicle (EV) unit has inked a sale and purchase agreement (SPA) on 10th May 2022 to acquire three adjoining plots of industrial land measuring 55.3-ac in Tanjung Malim, Perak for RM12.0m from Minetech Resources Bhd, to build an EV assembly plant. The land acquisition is expected to be completed in 4Q22. (The Edge)

Frontken Corp Bhd's 1QFY22 net profit rose 15.7% YoY to RM26.5m, resulting from bigger contributions by its subsidiaries in Taiwan and Malaysia and the continual efforts to improve efficiencies across the group. Revenue for the quarter grew 15.1% YoY to RM119.2m. (The Edge)

GIIB Holdings Bhd has further extended the employment suspension of its executive director Wong Weng Yew, who had been suspended since 28th March 2022 for a period of 14 days, pending the finalisation of a review report. The extended suspension took effect from 10th May 2022. (The Edge)

Hartalega Holdings Bhd’s 4QFY22 net loss amounted to RM189.7m vs. a net profit of RM1.12bn recorded in the previous corresponding quarter, mainly due to the provision of the Prosperity Tax (Cukai Makmur). Revenue for the quarter slumped 57.9% YoY o RM968.7m. A third interim dividend of 3.5 sen per share, payable on 9th June 2022 was declared. (The Edge)

Mesiniaga Bhd has bagged a contract worth RM59.6m from Telekom Malaysia Bhd (TM) to provide maintenance and support services for telecommunication cloud core data centre. The contract has no automatic renewal clause and will last between 1st April 2022 to 16th November 2024. (The Edge)

SLP Resources Bhd’s 1QFY22 net profit fell 25.1% YoY to RM4.5m, due to costs hike in almost every aspect of operations which include materials, labour and utility. Revenue for the quarter slipped 1.1% YoY to RM45.5m. An interim dividend of 1.0 sen per share, payable on 6th July 2022 was declared. (The Edge)

Source: Mplus Research - 11 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-16

HARTA2024-11-15

AIZO2024-11-15

FRONTKN2024-11-15

FRONTKN2024-11-15

FRONTKN2024-11-15

MSNIAGA2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-14

AIZO2024-11-14

AIZO2024-11-14

FRONTKN2024-11-14

FRONTKN2024-11-14

HARTA2024-11-14

TM2024-11-14

TM2024-11-14

TM2024-11-13

FRONTKN2024-11-13

GBAY2024-11-13

GBAY2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

MSNIAGA2024-11-13

TM2024-11-13

TM2024-11-13

TM2024-11-12

HARTA2024-11-12

HARTA2024-11-12

HARTA2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

XINHWA2024-11-12

XINHWA2024-11-12

XINHWA2024-11-11

FRONTKN2024-11-11

GBAY2024-11-11

GBAY2024-11-11

SLP2024-11-11

SLP2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

XINHWA2024-11-08

HARTA2024-11-08

MSNIAGA2024-11-08

SLP2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-07

FRONTKN2024-11-07

MSNIAGA2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

VELOCITY2024-11-06

HARTA2024-11-06

HARTA2024-11-06

HARTA2024-11-06

HARTA2024-11-06

HARTA2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-06

XINHWA2024-11-06

XINHWA2024-11-06

XINHWA2024-11-05

FRONTKN2024-11-05

MSNIAGA2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

XINHWAMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024