Mplus Market Pulse - 24 May 2022

MalaccaSecurities

Publish date: Tue, 24 May 2022, 08:38 AM

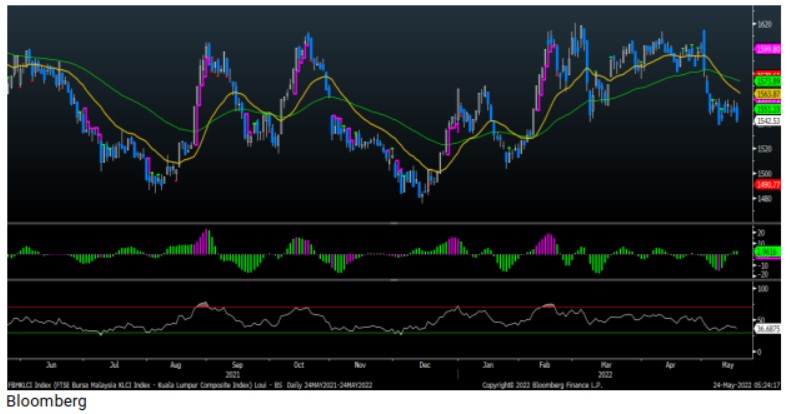

Back to near support 1,540 level

Market Review

Malaysia:. The FBM KLCI (-0.4%) charted lower as selling pressure return to the fore in selected plantation heavyweights yesterday. The lower liners declined, while the broader market ended mixed with the plantation sector (-2.6%) underperformed following the Indonesian government lifting the ban on palm oil exports.

Global markets:. Wall Street staged a sharp rally as Dow (+2.0%) re-acted to US President Joe Biden plans to review and lifts some of the China tariffs imposed by the Trump administration. The European stock markets extended their recovery, but the Asia stock markets ended mixed.

The Day Ahead

Steep selloff in plantation heavyweights sent the FBM KLCI into the negative territory amidst mixed regional performances. Investors are likely to trade cautiously at the start of the session, prior to the release of Malaysia’s inflation rate tomorrow. Nevertheless, we believe bargain hunting activities could kick in as the concerns over inflation may have priced in and traders may focus in the recovery themed sectors. Also, we believe buying interest may emerge in the technology stocks in line with the rebound in Wall Street. Commodities wise, the crude oil price hovered around USD113 per barrel mark, while the CPO is trading around RM6,200.

Sector focus:. Investors may see bargain hunting activities in technology stocks following the rebound in Wall Street overnight. Besides, consumer, gaming and banking stocks may gain traction amid reopening of business activities in Malaysia.

FBMKLCI Technical Outlook

The FBM KLCI extended losing streak below its daily EMA9 level for the third straight session. Technical indicators remained mixed as the MACD Histogram extended a positive bar, while the RSI hovered below the 50 level. Support is set at 1,500-1,530, while the resistance is pegged around 1,570-1,580.

Company Brief

GIIB Holdings Bhd has announced that the findings in the investigation report by its external independent auditor found that there is sufficient basis to hold its executive director (ED), Wong Weng Yew, accountable for misconduct per the charges made against him in the show cause letter dated 28th March 2022. Based on the report, Wong appeared to have not fulfilled his responsibility to spearhead the glove project, which was entrusted to him by the board of directors when he was first appointed as the ED of the company and its subsidiaries. (The Star)

Malaysian Genomics Resource Centre Bhd’s (MGRC) 3QFY22 net profit leapt 9.8x YoY to RM2.0m, led by a higher margin generated by the distribution of immunotherapy and cell therapies. Revenue for the quarter surged 211.7% YoY to RM5.1m. (The Star)

Boustead Plantations Bhd's 1QFY22 net profit soared 36.3x YoY to RM435.0m, on stronger palm product prices and improved fresh fruit bunch (FFB) production. Revenue for the quarter climbed 88.5% YoY to RM324.0m. A first interim dividend of 7.3 sen per share, payable on 24th June 2022 was declared. (The Edge)

Sarawak Oil Palms Bhd's 1QFY22 net profit jumped 146.6% YoY to RM195.0m, driven by better fresh fruit bunches production and higher palm product prices. Revenue for the quarter increased 82.0% YoY to RM1.43bn. (The Edge)

Ta Ann Bhd’s 1QFY22 net profit soared 155.4% YoY to RM104.6m, on higher average selling prices of crude palm oil (CPO), fresh fruit bunches (FFB) and better prices for plywood products. Revenue for the quarter climbed 43.2% YoY to RM487.8m. (The Edge)

Innoprise Plantations Bhd's 1QFY22 net profit soared 227.8% YoY to RM29.5m, thanks to higher average selling prices (ASPs) of crude palm oil (CPO) and palm kernel (PK). Revenue for the quarter rose 82.7% YoY to RM74.45m. (The Edge)

Sports Toto Bhd's 3QFY22 net profit leapt 329.5% YoY to RM79.6m, underpinned by higher contributions from HR Owen PLC and STM Lottery Sdn Bhd. Revenue for the quarter gained 54.0% YoY to RM1.73bn. A third interim dividend of 2.0 sen per share, payable on 22nd July 2022 was declared. (The Edge)

S P Setia Bhd’s 1QFY22 net profit fell 10.3% YoY to RM67.5m, due to lower contributions from its property development and construction segments. Revenue for the quarter dropped 17.6% YoY to RM867.1m. (The Edge)

Serba Dinamik Holdings Bhd group managing director (MD) Datuk Dr Mohd Abdul Karim Abdullah's stake in the oil and gas service provider has slipped to 20.8% or 772.6m. Mohd Abdul Karim was forced to sell 5.2m shares, representing 0.1% equity interest at 15.0 sen a share on 20th May 2022. (The Edge)

Hextar Global Bhd’s 1QFY22 net profit rose 45.6% YoY to RM15.7m, driven by higher revenue, margins and growth from its specialty chemicals businesses. Revenue for the quarter added 33.8% YoY to RM153.6m. (The Edge)

KPower Bhd’s 3QFY22 net profit dropped 52.8% YoY to RM6.7m, mainly due to lower contribution from its healthcare and construction related activities. Revenue for the quarter tumbled 63.5% YoY to RM50.3m. (The Edge)

Destini Bhd's unit M Rail Technics Sdn Bhd (MRail) has secured a four-and-a-half year Level 4 maintenance, repair and overhaul (MRO) contract for 35 train sets operated by Keretapi Tanah Melayu Bhd (KTMB) worth RM531.4m from the Ministry of Transport. MRail is a 70-30 joint venture company between Destini and KTMB Technics Sdn Bhd, a wholly-owned subsidiary of KTMB. (The Edge)

Sarawak Consolidated Industries Bhd (SCIB)’s unit SCIB Properties Sdn Bhd has accepted a letter of award and acceptance for a RM38.0m engineering, procurement, construction and commissioning contract from Masama Sdn Bhd to undertake a road infrastructure project connecting Baleh Bridge, RH Belaja, Ng Benin, SK Ng Pelagus and Pelagus Resort in Kapit, Sarawak. (The Edge)

EUPE Corp Bhd’s indirect wholly-owned subsidiary EUPE Belfield Sdn Bhd has entered into a conditional sale and purchase agreement with Cahaya Tinggi Sdn Bhd to buy a 4.8-ac parcel of land located along Jalan Damansara and Jalan Belfield within the residential development of Kampung Attap, off Jalan Istana for RM125.0m cash. The acquisition and development will be funded through a combination of bank borrowings and internal funds as part of plans to turn it into a high-rise residential development. (The Edge)

Hock Seng Lee Bhd will be officially removed from Bursa Malaysia effective 26th May 2022, due to Hong Seng Lee Enterprise Sdn Bhd's (HSLE) plan to take the group private at RM1.35 per share. The takeover offer was first announced on 17th February 2022 involving HSLE, where the joint ultimate offerors comprised Datuk Yu Chee Hoe, Tang Sing Ngiik, Vincent Yu Yuong Yih and Tony Yu Yuong Wee. (The Edge)

Petron M Refining & Marketing Bhd has received a notice of arbitration from MTC Engineering Sdn Bhd, seeking RM50.5m for alleged outstanding additional costs from a project. The claims by MTC Engineering arose from the execution of Pipeline End Manifold (PLEM) Fabrication and Marine Equipment Installation for Marine Import Facilities 2 (MIF2) Project at Petron Port Dickson Refinery, Negeri Sembilan. (The Edge)

Nestle (Malaysia) Bhd (Nestle Malaysia) has appointed Syed Saiful Islam as the food giant's executive director, effective 1st August 2022. Syed Saiful, 49, joined Nestle Bangladesh in 1999 as a financial accounting manager before taking on various financial roles within Nestle India from 2000 to 2005. (The Edge)

Lien Hoe Corporation Bhd has announced the demise of its managing director Datuk Yap Sing Hock on 21st May 2022. Yap, who passed away at 73, had helmed the group since 2002. The management and operations of the group is to be led by its executive director and chief executive officer Christine Yap Tse Yeeng, assisted by its board and management team. (The Edge)

Source: Mplus Research - 24 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

SPSETIA2024-11-16

HEXTAR2024-11-15

HEXTAR2024-11-15

HEXTAR2024-11-15

HEXTAR2024-11-15

NESTLE2024-11-15

PETRONM2024-11-15

RENEUCO2024-11-15

SPSETIA2024-11-14

HEXTAR2024-11-14

HEXTAR2024-11-14

HEXTAR2024-11-14

NESTLE2024-11-14

NESTLE2024-11-13

NESTLE2024-11-13

SPSETIA2024-11-12

DESTINI2024-11-12

DESTINI2024-11-12

DESTINI2024-11-12

DESTINI2024-11-12

NESTLE2024-11-12

NESTLE2024-11-12

SOP2024-11-12

SPSETIA2024-11-12

SPSETIA2024-11-12

SPSETIA2024-11-12

TAANN2024-11-12

TAANN2024-11-11

DESTINI2024-11-11

SPSETIA2024-11-11

SPSETIA2024-11-11

SPSETIA2024-11-08

BPLANT2024-11-08

NESTLE2024-11-07

SCIB2024-11-07

SCIB2024-11-07

SPSETIA2024-11-07

SPSETIA2024-11-06

NESTLE2024-11-06

SPSETIA2024-11-05

DESTINI2024-11-05

HEXTAR2024-11-05

HEXTAR2024-11-05

HEXTAR2024-11-05

NESTLE2024-11-05

NESTLEMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024