Mplus Market Pulse - 13 Mar 2023

MalaccaSecurities

Publish date: Mon, 13 Mar 2023, 08:35 AM

Spooked by renewed volatility

Market Review

Malaysia:. The FBM KLCI (-1.1%) took a beating with more than two-thirds of the key index components ended in red as the key index closed at its lowest level in 4 months. The lower liners also extended their decline, while all 13 major sectors faltered with the energy sector (-2.9%) taking the worst hit.

Global markets:. Wall Street stayed downbeat as the Dow (-1.1%) extended its slide after SVB Financial Group turmoil sparked concern over further distress in the banking industry, while investors are keeping close tab on the CPI report releasing this week. Both the European and Asia stockmarkets were splashed in red.

The Day Ahead

The FBM KLCI succumbed to broad-based selling pressure amidst intensified selldown across regional markets due to persisted worries over interest rate hikes and concerns over the Silvergate and SVB events last week. We believe the risk will remain tilted to the downside given the potential contagion effect within the banking sector in the near term as New York Signature Bank is being shut down, but there is a glimpse of hope on the potential bailout situation at this juncture; the US futures are rising. Meanwhile, the US inflation rate will be in focus this week. Commodities wise, the crude oil is above USD82, while CPO is above RM4,000.

Sector focus:. The negative sentiment abroad may cause the banking and technology sectors to observe a slight selldown at the start of the session, however we expect swift recovery towards the end of the session. Besides, the plantation sector may also fall amidst lower CPO prices. We reckon investors may get exposure into defensive sectors such as the telco, utilities, and REITs.

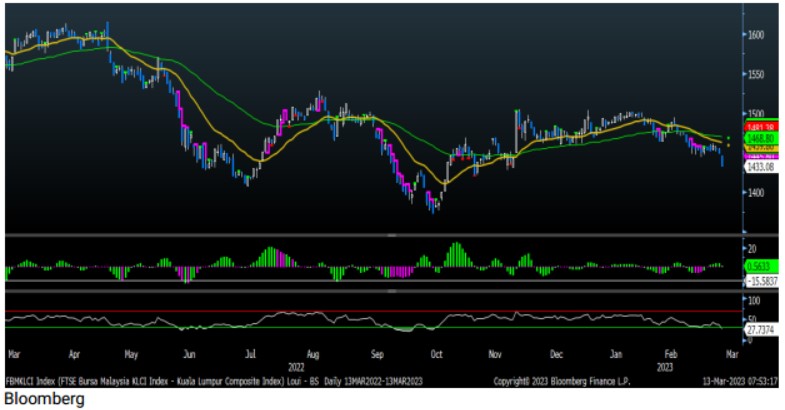

FBMKLCI Technical Outlook

The FBM KLCI slumped for a third straight session after hovering in the negative territory for the entire session. Technical indicators remained negative as the MACD Histogram turned negative, while the RSI is oversold. Support is located at 1,430-1,445, while the resistance is envisaged along 1,460-1,490.

Company Brief

Pecca Group Bhd has proposed to acquire 80.0% equity interest in PT Gemilang Maju Kencana (GMK) for a total purchase consideration of 6.40bn Rupiah (RM1.9m). Upon completion of the acquisition, Pecca Leather Sdn Bhd (PLSB) will inject 2.40bn Rupiah (RM703,200). This acquisition represents a significant opportunity to penetrate and establish in the Indonesian market. (The Star)

Betamek Bhd’s wholly owned subsidiary Betamek Electronics (M) Sdn Bhd (BESB) has entered into a memorandum of understanding (MoU) with Krakatoa Technologies Pte Ltd to explore potential collaboration to develop a battery management system-on-a-chip for electric vehicles (EV). The MoU will be effective for a period of 12 months upon the execution and may be mutually extended by both parties. (The Star)

TWL Holdings Bhd’s shareholders approved the proposed renounceable rights issue of up to RM111.3m nominal value of 5.60bn 5-year redeemable convertible unsecured loan stocks (RCULS) with up to 1.10bn free detachable Warrants E. It would be on the basis of 10 RCULS together with 2 free Warrants E for every 10 existing shares held by entitled shareholders on the entitlement date. Fund raised from this issuance, which would range from RM25.0-111.3m, would be mainly used to undertake three affordable housing development projects under the Rumah Selangorku scheme, comprising a total of 2,600 housing units, with a total gross development value of RM624.0m. (The Star)

Insas Bhd announced its share sale and purchase agreement (SSPA) with furniture maker SYF Resources Bhd has become unconditional. The agreement was signed to facilitate Insas' proposal to list its stockbroking arm M&A Securities Sdn Bhd through a reverse takeover (RTO) of SYF Resources. (The Edge)

Kumpulan Perangsang Selangor Bhd (KPS) has entered into a Memorandum of Understanding (MOU) to explore the possibility of procuring solar energy from a consortium comprising Worldwide Holdings Bhd and two other firms. The parties will look into signing a long-term corporate green power agreement between KPS and its participating subsidiaries as the off-taker and the consortium via a special purpose vehicle as the provider. The consortium which also includes Dynac Sdn Bhd and Majulia Sdn Bhd will submit a solar power application to the Energy Commission of Malaysia by 20th March 2023. (The Edge)

Classita Holdings Bhd’s incumbent board of directors is distancing itself from the alleged RM30.7m misappropriation of funds that is currently under police investigation. The alleged abuse of funds involving its subsidiary Caely (M) Sdn Bhd were done via transactions between 2013 and 2021, before the appointment of the current board of directors. (The Edge)

Cape EMS Bhd has made an impressive debut on Bursa Malaysia's Main Market on 10th March 2023, opening at a premium of 52.0 sen or 57.8% over the initial public offering (IPO) price of 90.0 sen. The counter went on to close at the day's high of RM1.50 for a gain of 60 sen or 66.7% over the IPO price. (The Edge)

Source: Mplus Research - 13 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

CEB2024-11-16

INSAS2024-11-16

KPS2024-11-16

TWL2024-11-15

BETA2024-11-15

PECCA2024-11-14

M&A2024-11-14

PECCA2024-11-14

TWL2024-11-13

M&A2024-11-12

M&A2024-11-12

M&A2024-11-11

PECCA2024-11-08

PECCA2024-11-08

PECCA2024-11-08

TWL2024-11-07

PECCA2024-11-06

PECCA2024-11-05

M&AMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024