M+ Online Research Articles

Malaysia Smelting Corporation Bhd - Recovery In Sight

MalaccaSecurities

Publish date: Tue, 09 Jul 2024, 09:35 AM

Summary

- 1Q24 results recap; broadly in-line. Malaysia Smelting Corporation Bhd’s (MSC)recorded 1QFY24 core net profit of RM18.3m (+66% QoQ, -48% YoY). Although thecore PATMI amounting to 19% and 17% of our previous and consensus estimates,we believe the earnings will be back loaded with the elevated tin prices throughoutthe 1H2024.

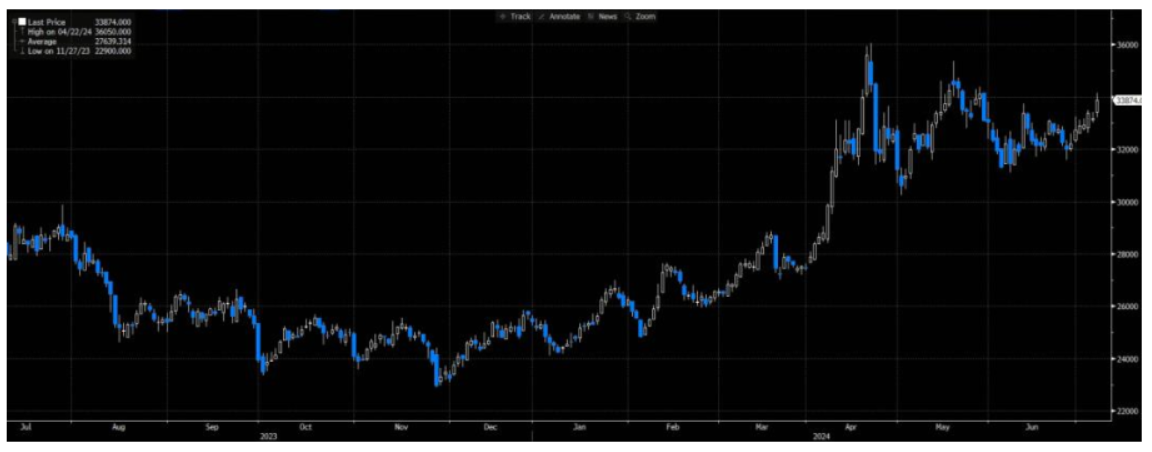

- Tin prices in 1H24… Tin price has rebounded significantly and stayed resilient in 1H24. The average tin price was traded at USD24,666 during 4Q23, and it has increased to average tin price of USD26,397 (+7.0% QoQ) and USD32,325 (+22.5% QoQ) in 1Q24 and 2Q24, respectively.

- …supply remains tight. Supply of the metal, which is used in electronics, has been hit by the disruptions in Indonesia and Myanmar, where there are still uncertainty when Myanmar will resume their production.

- Tin outlook. We opine that the demand will be coming from the global improved semiconductor sales, where the sales rose 19.3% YoY and 4.1% MoM, based on the stats from Semiconductor Industry Association, driven by the electronic goods demand. Currently, we expect the tin prices to have limited downside risk with the support from surging demand in EV and E&E industries as well as the rising adoption of solar energy on the path towards greener environment.

Valuation & Recommendation

- Forecast unchanged. We keep our forecast unchanged as we believe the earnings may recover into 2H24.

- Upgrade to Buy, with unchanged TP of RM3.40 as the share price has retraced from RM3.38 range towards the recent low point of RM2.48. Our TP is based on an assigned P/E of 15.0x pegged to its FY24f EPS of 22.7 sen. The 15x P/E is justified at a ~30% discount to its 5Y average P/E 21.4x as we are in a commodity upcycle phase with rising investments in the EV, solar and E&E and the recent China recovery. The ongoing supply constraints of tin ore in Indonesia and Myanmar and the highly correlated MSC price with tin price despite earnings volatility may drive the P/E elevated going forward.

- Risks to our recommendation include the (i) volatility in the tin prices - which affect ASP and margins and (ii) forex fluctuation risk - given that the tin prices are traded in USD and MSC purchased most of their raw material from other miners.

Source: Mplus Research - 9 Jul 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on M+ Online Research Articles

Well Chip Group Bhd - Raising Capital To Feed The Golden Goose

Created by MalaccaSecurities | Jul 10, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments