Mplus Market Pulse - 16 Dec 2024

MalaccaSecurities

Publish date: Mon, 16 Dec 2024, 05:26 PM

Bursa Exchange To Trade On A Robust Tone

Market Review

Malaysia: The FBMKLCI (+0.42%) bucked the trend and closed higher at 1,608 pts, led by heavyweights in the Utilities and Industrial Products sectors. The Healthcare sector (+2.87%) was the best-performing sector, as glove-related counters resumed their rallies amid news of a mystery disease in Congo and a flu outbreak in China.

Global markets: Treasury yields climbed, while Wall Street ended on a mixed note as investors stay cautious prior to FOMC meeting. Meanwhile, both European and Asian markets ended on a weak note, with China's stocks leading the losses as Beijing's stimulus packages fell short of investors' expectations.

The Day Ahead

The FBMKLCI closed higher after a 5-day losing streak, with the Healthcare sector rebounding amid recent news on disease outbreaks in China and Congo. We believe the US markets will continue to trade sideways ahead of the FOMC meeting, where the current market consensus anticipates a 25bps rate cut. Besides that, traders will closely monitor economic data like (i) Flash Manufacturing & Services PMI, (ii) Retail & Core Retail Sales, (iii) US GDP, (iv) Unemployment Claims, (v) Core PCE Price Index, and (vi) the BoJ monetary policy conference. In the commodities market, Brent crude oil rose near USD74 per barrel, despite rising production and larger inventories in 2025. Gold prices retreated below the USD2,700 mark, while CPO prices continued to trade below the RM5,000 level.

Sector Focus: Despite the mixed sentiment in the US, we expect Bursa exchange to trade on a more robust tone, with traders focusing on stocks linked to the data center supply chain, Technology, and Banking sectors to be the primary beneficiaries of the stronger USD environment. Also, we like Healthcare, specifically gloves as we think the earnings to grow moving forward. Meanwhile, we are also optimistic about East Malaysia-related, supported by recovering share prices and anticipated fund inflows into the region.

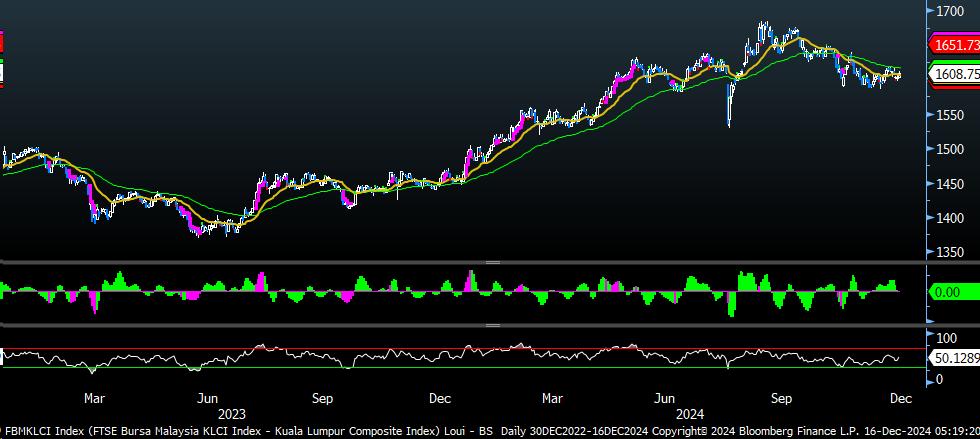

FBMKLCI Technical Outlook

The FBMKLCI rebounded and closed higher, approaching the 1,608 level. Meanwhile, the MACD Histogram has performed a rounding top formation and the RSI hooked above 50, suggesting that the momentum is stronger at this juncture. Resistance is envisaged around 1,623-1,628, and support is set at 1,588-1,593.

Company Briefs

Lotte Chemical Titan Holdings Bhd (LCTITAN) has announced the temporary shutdown of one of its plants in the Pasir Gudang Complex in Johor, effective Dec 15, to mitigate losses stemming from a prolonged downturn in the petrochemical industry. LC Titan will consider resuming the operation of the plant, named Naphtha Cracker Number 1 plant, when market conditions become more favourable. The plant has a nameplate capacity of 430,000 tonnes per annum. (The Edge)

Yinson Holdings Bhd's (YINSON) net profit fell 19.4% to RM200m in the third quarter ended Oct 31, 2024 (3QFY2025) from RM248m a year ago, as it recorded lower revenue and higher administrative expenses, as well as finance costs. Earnings per share slipped to 6.2 sen in 3QFY2025 from 7.3 sen in 3QFY2024. Quarterly revenue fell 34.1% to RM1.85bn from RM2.81bn. Finance costs jumped RM199m or 81.6% to RM444m. The group declared a third interim dividend of one sen per share, bringing its total dividend payout to 3 sen per share for FY2025. (The Edge)

Yinson has also appointed its chief strategy officer Chai Jia Jun to take on the role of group chief financial officer, while maintaining his current position. Chai, 44, will serve as the group chief financial and strategy officer with effect from Feb 1 next year. This follows the resignation of existing chief financial officer Guillaume François Jest, 60, effective Jan 31, after serving in the position for about four years. (The Edge)

Telekom Malaysia (TM) has unveiled its GPU-as-a-Service (GPUaaS) - a cloud computing service model that provides access to high-performance graphics processing units (GPUs) over the internet where users can rent GPU resources on a pay-as-you-use basis - and announced it has secured an international client with its latest offering. The GPUaaS is the first-of-its-kind solution in Malaysia, and hosted entirely within the country. It eliminates the need for capital-intensive investments by providing scalable and on-demand access to cutting-edge resources. (The Edge)

T7 Global Bhd (T7GLOBAL) has received a Letter of Award (LOA) from Petronas Carigali Sdn Bhd for the provision of pan-Malaysia offshore maintenance, construction, modification (MCM) and hook-up commissioning (HUC) services. The contract awarded to its wholly-owned Tanjung Offshore Services Sdn Bhd, was for Package C1 - Peninsular Malaysia Asset (PMA). The contract, which commenced on Sept 27, is for a period of five years, with an optional three-year plus two-year extension. (The Edge)

Shareholders of Datasonic Group Bhd (DSONIC) have rejected the company's proposal to relax the requirement to adopt directors' written resolutions at its extraordinary general meeting (EGM). This was one of two resolutions that were not passed at the EGM, which saw a total of five resolutions brought up for voting by its shareholders. Also rejected was a resolution to provide ESOS options to its recently- appointed independent non-executive director Tunku Datuk Nooruddin Tunku Shahabuddin. ESOS options to two other directors were approved: for executive director Erna Ismail and executive deputy chairman and CEO Datuk Abu Hanifah Noordin. (The Edge)

Exsim Hospitality Bhd (EXSIMHB), formerly known as Pan Malaysia Holdings Bhd, has secured a sub-contract worth RM20.98m for renovation works on 62 office units located on Old Klang Road. The sub-contract was awarded to its wholly-owned subsidiary, Exsim Concepto Sdn Bhd, by interior renovator firm Ntim Reno Sdn Bhd. The sub-contract, which is expected to be completed in three months, will contribute positively to the net assets, earnings and gearing of the company during the period. (The Edge)

Diversified group Sime Darby Bhd (SIME) has successfully issued the fifth tranche of its sukuk murabahah programme under its unrated Islamic commercial papers and medium-term notes to raise RM200m. The sukuk was issued by its indirect wholly-owned Sime Darby Enterprise Sdn Bhd and the sukuk murabahah will mature on Dec 11, 2030. Sime Darby has so far raised RM4.5bn under the programme via four issuances, with three tranches, with a nominal value of RM1.3bn, issued just earlier this week. (The Edge)

Loss-making group Carzo Holdings Bhd's (CARZO) wholly-owned subsidiary, Carzo Sdn Bhd (CZSB), has been served with a writ of summons and statement of claims from its fruit supplier. The writ of summons and statement of claims dated Dec 4, 2024, were served to CZSB at the Kuala Lumpur Magistrate Court on Dec 5, 2024. The disputes were between Everfresh Fruits Import Sdn Bhd (EFIT) and CZSB, among others, pertaining to the terms of payment for the fruits supplied by EFIT to CZSB which had resulted in the writ of summons and statement of claims being filed against CZSB. (The Edge)

GIIB Holdings Bhd (GIIB) former chief executive officer, Tai Boon Wee, who faced a forgery charge involving the misrepresentation of the company's financial report, was discharged by the Sessions Court on Friday after the prosecution withdrew the charge. The company considers the matter now closed and wishes to reassure all stakeholders that the company will continue to uphold its values of integrity, trust and respect. (The Edge)

Source: PublicInvest Research - 16 Dec 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-16

YINSON2025-01-15

CARZO2025-01-15

CARZO2025-01-15

DSONIC2025-01-15

EXSIMHB2025-01-15

TM2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-15

YINSON2025-01-14

TM2025-01-14

YINSON2025-01-14

YINSON2025-01-14

YINSON2025-01-14

YINSON2025-01-14

YINSON2025-01-13

TM2025-01-13

TM2025-01-13

TM2025-01-13

TM2025-01-13

TM2025-01-13

TM2025-01-13

YINSON2025-01-13

YINSON2025-01-13

YINSON2025-01-13

YINSON2025-01-10

DSONIC2025-01-10

DSONIC2025-01-10

SIME2025-01-10

T7GLOBAL2025-01-10

T7GLOBAL2025-01-10

T7GLOBAL2025-01-10

T7GLOBAL2025-01-10

T7GLOBAL2025-01-10

T7GLOBAL2025-01-10

T7GLOBAL2025-01-10

TM2025-01-10

TM2025-01-10

TM2025-01-10

TM2025-01-10

TM2025-01-10

TM2025-01-10

YINSON2025-01-10

YINSON2025-01-10

YINSON2025-01-10

YINSON2025-01-10

YINSON2025-01-10

YINSON2025-01-10

YINSON2025-01-10

YINSON2025-01-10

YINSON2025-01-10

YINSON2025-01-10

YINSON2025-01-09

SIME2025-01-09

SIME2025-01-09

T7GLOBAL2025-01-09

TM2025-01-09

TM2025-01-09

TM2025-01-09

TM2025-01-09

TM2025-01-09

YINSON2025-01-09

YINSON2025-01-09

YINSON2025-01-09

YINSON2025-01-09

YINSON2025-01-09

YINSON2025-01-08

SIME2025-01-08

TM2025-01-08

TM2025-01-08

TM2025-01-08

YINSON2025-01-08

YINSON2025-01-08

YINSON2025-01-08

YINSON2025-01-08

YINSON2025-01-07

T7GLOBAL2025-01-07

T7GLOBAL2025-01-07

T7GLOBAL2025-01-07

T7GLOBAL2025-01-07

TM2025-01-07

TM2025-01-07

TM2025-01-07

TM2025-01-07

YINSON2025-01-07

YINSON2025-01-07

YINSON2025-01-06

DSONIC2025-01-06

T7GLOBAL2025-01-06

TM2025-01-06

YINSON2025-01-06

YINSON2025-01-06

YINSONMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Jan 08, 2025

Created by MalaccaSecurities | Jan 08, 2025