Kinergy Advancement Q4FY2023 Financial Results Review

ProfitPilot

Publish date: Sat, 02 Mar 2024, 03:31 AM

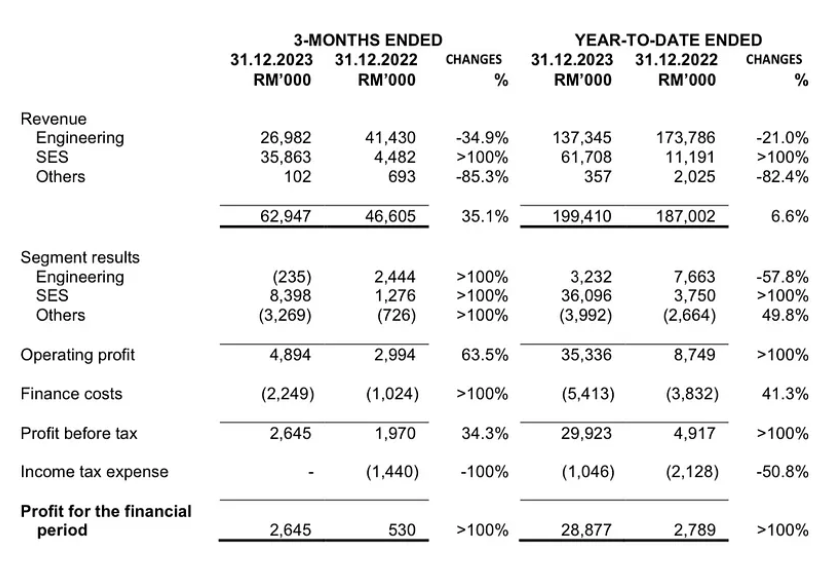

KAB achieved revenue of RM62.95 million in Q4FY2023, a 35.1% increase from Q4FY2022.

In Q4FY2023, KAB achieved an operating profit of RM4.89 million, compared to RM2.99 million to a year before.

For FY2023, KAB closed with historical high of RM199.41 million, with SES contributing RM61.71 million.

For Q4FY2023, KAB’s engineering revenue has seen a decrease of 34.9%, as guided by the management for the company’s transition into Sustainable Energy (SES) business, which increased from RM4.48 million to the current quarter’s RM35.87 million.

Profit wise, KAB had achieved RM4.89 million in operating profit, of which SES, the relatively new business segment of KAB that could bring in recurring revenue, contributed RM8.40 million, however dragged by Engineering segment which register a RM0.24 million operating loss and RM3.27 million in corporate expenses.

According to the company’s announcement, the SES segment’s top and bottom line growth was contributed by the success of better tariff rate and new impactful asset acquisitions.

One notable acquisition was the hydropower asset in Indonesia, with a capacity of 11MW; speaking of which, KAB also announced an acquisition of another hydropower asset in Pedu Dam, Kedah, which could deliver 9MW in capacity, with an expected commencement date in March 2027.

On the engineering end, the company had costs control measures but was partially dragged increased raw material costs.

For FY2023, KAB’s revenue rose to RM199.41 million, with Engineering segment contributing RM137.35 million, while the rest was contributed by the fast growing SES segment.

Despite the involvement of a one-off adjustment on the operating profit, still, KAB delivered RM36.10 million in operating profit for SES segment alone, which resulted in a Profit Before Tax (PBT) of RM29.92 million.

Notably, KAB currently have an orderbook of RM155.0 million and RM784.0 million for SES and Engineering segment respectively by the time the quarter closed. The SES segment carries more excitement, as evident in the current quarter, this segment delivers a significantly higher profit margin.

On the tenderbook’s front, KAB had RM210.0 million and RM2,978.0 million for the two segment respectively.

At the time of writing, KAB is currently trading at RM0.375 or equivalent to RM745.0 million in market capitalisation.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)