PublicInvest Research Headlines - 15 Apr 2024

PublicInvest

Publish date: Mon, 15 Apr 2024, 11:16 AM

HEADLINES

Economy

US: Import prices climb slightly more than expected in March. Import prices in the US increased by slightly more than expected in the month of March. Import prices climbed by 0.4% in March after rising by 0.3% in Feb. Economists had expected import prices to increase by another 0.3%. Import prices also rose by 0.4% compared to the same month a year ago, marking the first YoY increase since Jan 2023. Meanwhile, export prices rose by 0.3% in March after climbing by a revised 0.7% in Feb. (RTT)

US: Consumer sentiment index drops more than expected in April. Consumer sentiment in the US has deteriorated by more than expected in the month of April. The consumer sentiment fell to 77.9 in April from 79.4 in March. Economists had expected the index to edge down to 79.0. Year-ahead inflation expectations rose to 3.1% in April from 2.9% in March, climbing just above the 2.3- 3.0% range seen in the two years prior to the pandemic. (RTT)

EU: German inflation eases to lowest in almost three years. German inflation eased in March, adding to the signs that euro zone price pressures are abating and increasing the pressure on the ECB to start cutting interest rates. Inflation in Europe's largest economy slackened to 2.3% helped by lower food and energy prices. This is its lowest level since June 2021. German consumer prices, harmonised to compare with other EU countries, had risen by 2.7% YoY in Feb. (Reuters)

UK: Economy's growth points to exit from recession. Britain's tepid economy is on course to exit a shallow recession after output grew for a second month in a row in Feb, and Jan's reading was revised higher. GDP expanded by 0.1% in monthly terms in Feb. Jan's reading was revised to show growth of 0.3%, up from 0.2% earlier. The data confirm Britain's economy started 2024 on a stronger footing, with the three-month average growth rate rising to 0.2% in Feb from zero in Jan - the highest such reading since Aug. (Reuters)

China: Set to keep key rate, liquidity steady to cement recovery. China may hold a key interest rate and make liquidity abundant this week when a policy loan matures, maintaining accommodative conditions to aid a patchy economic recovery and increased debt sales. The PBOC will keep the rate on its mediumterm lending facility unchanged at 2.5%. The central bank will also roll over the CNY170bn (USD23.5bn) special loan. The PBOC may refrain from fresh stimulus, given recent economic green shoots including improved manufacturing and consumption, while it also faces constraints from a widening US-China yield gap. (Bloomberg)

China: March exports and imports shrink, miss forecasts by big margins. China's exports contracted sharply in March while imports unexpectedly shrank, undershooting forecasts by big margins, highlighting the stiff task facing policymakers as they try to bolster a shaky economic recovery. The dour data represented a setback for the world's second-largest economy after a generally better-than-expected start to the year. China has struggled to mount a sustainable post-COVID bounce, burdened by a protracted property crisis, mounting local government debts and weak private-sector spending. (Reuters)

Japan: Households' inflation expectations rise, open room for rate hike. Japanese households' inflation expectations rose in the three months to early March, leaving scope for another interest rate hike this year. Aside from consumption, wages and price moves, inflation expectations are among key factors the BOJ looks at in deciding when to scale back stimulus. Of the households surveyed by the BOJ, 83.3% said they expected prices to rise a year from now, up from 79.3% in the previous survey three months ago. (Reuters)

India: Inflation eases to 4.85%; industrial output growth hits 4- month high. India's consumer price inflation eased more-thanexpected in March to the lowest level in nine months, largely due to a slowdown in food costs and cheaper fuel and light costs. Industrial production expanded at the fastest pace in four months in Feb. The CPI posted an annual increase of 4.9% in March, slower than the 5.1% increase in Feb. In the same period last year, inflation stood at 5.7%. (RTT)

Markets

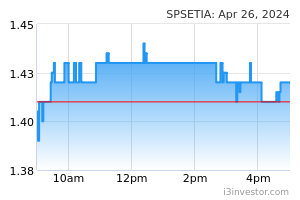

SP Setia (Outperform, TP: RM1.00): ASB trims 2.18% stake in S P Setia for RM141m. Amanahraya Trustees, the trustee of Amanah Saham Bumiputera (ASB), reduced its stake in property developer S P Setia by selling 100m shares on April 8, cutting its stake from 24.54% to 22.37%. The off-market trade was executed at RM1.41 per share, representing a 2.76% discount compared with the closing price on April 8. ASB remains the second-largest shareholder in S P Setia, behind Permodalan Nasional. (The Edge)

Bahvest: Gold mining ops in Sabah get approval from federal govt's mining regulator. Bahvest Resources’ subsidiary, Wullersdorf Resources SB, has obtained approval from the federal government's mining regulator, the Department of Mineral and Geoscience Malaysia (JMG), for its gold mining operations in Tawau, Sabah. This approval, granted under Section 10 of the Mineral Development Act 1994 (MDA), complements the previous approval from the Sabah state government under Section 18(d) of the Sabah Mining Ordinance 1960. (The Edge)

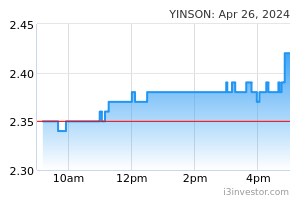

Yinson: Hires bankers for potential USD500m bond issue. Yinson Holdings is considering a potential bond issue of up to USD500m (RM2.37bn). The company has enlisted Nordic investment banks DNB Markets and Pareto Securities, along with ABG Sundal Collier ASA, to arrange meetings with fixed-income investors. The proceeds from the proposed bond issue will be utilized for refinancing existing debt and general corporate purposes. (The Edge)

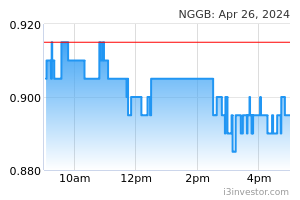

Netxgreen: IOI Pulp inks MoU with Xiamen C&D for pulp production facility. Nextgreen Global’s subsidiary, Nextgreen IOI Pulp SB (NIP), has inked a memorandum of understanding (MoU) with Xiamen C&D Paper & Pulp Group Co Ltd for the development and operation of a green and sustainable paper pulp production facility. Xiamen C&D is a wholly owned subsidiary of Xiamen C&D Inc under Xiamen C&D Corp Ltd, a Fortune Global 500 company. Under the MoU, NIP and Xiamen C&D will establish a JV company, with equity interests of 75% and 25% respectively. The paper pulp production facility is set to be developed across 43 acres of land within the 410-acre Green Technology Park (GTP) in Pekan, Pahang, which is part of the Eastern Corridor Economic Region. (SunBiz)

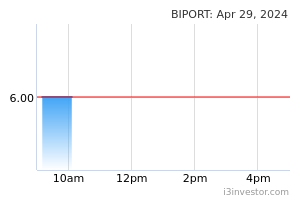

Bintulu Port: Upgrading of Bintulu Port project slated to be awarded in 3Q. Bintulu Port Holdings (BPHB) will invest in a fullyintegrated and state-of-the-art port operating system for Bintulu Port. The tender for the project has been called and the contract is expected to be awarded in 3Q24 according to group chief executive officer Ruslan Abdul Ghani. He said the project would be implemented in phases over the next two years and upon operational will revolutionise the overall management of the port, which is operated by wholly-owned subsidiary Bintulu Port SB. (StarBiz)

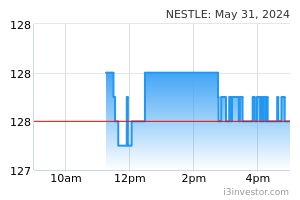

Nestle: Adds puff pastries to its plant-based offerings. With the growing trend of plant-based products, Nestle Malaysia has expanded its Harvest Gourmet brand product range with the launch of Puff Pastries. In a statement, the food and beverage giant said the “puffs are a delectable fusion of plant-protein goodness with gourmet pastry, perfect for those looking to indulge in a savoury snack without compromising on flavour.” (StarBiz)

MARKET UPDATE

The FBM KLCI might open weaker today as US stocks sold off last Friday after major US banks' results failed to impress, capping a week marked by market-moving inflation data, evolving expectations for US Federal Reserve policy, and looming geopolitical tensions. Results from a trio of big banks marked the unofficial launch of first-quarter earnings season. JPMorgan Chase & Co, the biggest US bank by assets, posted a 6% profit increase but its net interest income forecast fell short of expectations. Its shares slid 6.5%. The Dow Jones Industrial Average fell 475.84 points, or 1.24%, to 37,983.24. The S&P 500 lost 75.65 points, or 1.46%, at 5,123.41 and the Nasdaq Composite dropped 267.10 points, or 1.62%, to 16,175.09. European shares were flat on Friday after hitting a one-week high in early trade, as rising tensions in the Middle East eroded some of the continued optimism around the European Central Bank's hint of imminent rate cuts. The PanEuropean STOXX 600 ended the session 0.1% higher, after rising as much as 1.2% during the day, but logging its second straight weekly decline.

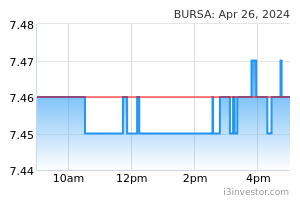

Back home, Bursa Malaysia closed mixed on Friday, trended within a tight range as investors exercised caution amid the volatile sentiment across the region. At the closing, the FBM KLCI declined 2.47 points or 0.16% to 1,551.04 from Tuesday's close of 1,553.51. The regional stocks were mostly lower on Friday after gains for Big Tech shares helped US stock indices claw back much of their slide from the day before. In Tokyo, the Nikkei 225 index was up 0.4% at 39,609.60, with the dollar standing at 153.23 Japanese yen, slightly lower than the 34-year high of 153.32 yen it reached on Wednesday. Hong Kong’s Hang Seng index declined 2.2% to 16,721.69 and the Shanghai Composite index edged 0.5% lower, to 3,019.47.

Source: PublicInvest Research - 15 Apr 2024

Related Stocks

Market Buzz

2024-12-24

BAHVEST2024-12-24

BURSA2024-12-23

BAHVEST2024-12-23

BAHVEST2024-12-23

BAHVEST2024-12-23

BAHVEST2024-12-23

NESTLE2024-12-23

SPSETIA2024-12-23

SPSETIA2024-12-23

SPSETIA2024-12-23

SPSETIA2024-12-23

SPSETIA2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-23

YINSON2024-12-20

NESTLE2024-12-20

SPSETIA2024-12-20

SPSETIA2024-12-20

SPSETIA2024-12-20

SPSETIA2024-12-20

YINSON2024-12-20

YINSON2024-12-20

YINSON2024-12-20

YINSON2024-12-19

BURSA2024-12-19

NESTLE2024-12-19

NESTLE2024-12-19

SPSETIA2024-12-19

SPSETIA2024-12-19

YINSON2024-12-19

YINSON2024-12-19

YINSON2024-12-18

BURSA2024-12-18

NESTLE2024-12-18

SPSETIA2024-12-18

YINSON2024-12-18

YINSON2024-12-18

YINSON2024-12-17

NESTLE2024-12-17

YINSON2024-12-17

YINSON2024-12-17

YINSON2024-12-16

NESTLE2024-12-16

SPSETIA2024-12-16

YINSON2024-12-16

YINSON2024-12-16

YINSON2024-12-16

YINSON2024-12-16

YINSON2024-12-16

YINSON2024-12-16

YINSON2024-12-16

YINSON2024-12-16

YINSON2024-12-16

YINSON2024-12-13

BURSA2024-12-13

BURSA2024-12-13

NESTLE2024-12-13

YINSON2024-12-13

YINSON2024-12-13

YINSON2024-12-13

YINSON2024-12-13

YINSON2024-12-13

YINSON2024-12-13

YINSON2024-12-13

YINSON