J.Wolf Invest

EVERGRN (5101) - Never Green OR Ever Green?

JWOLFINVEST

Publish date: Sun, 08 Nov 2020, 04:31 PM

BUSINESS HIGHLIGHTS:

-

EVERGREEN main business is the production of medium density fiberboard (MDF-Medium Density Fibreboard) and particle board. (PB-ParticleBoard)

-

These are now hot-selling ready-made assembled indoor furniture (RTA -Ready To Assemble) and furniture parts wood products.

-

Other businesses include resins, adhesives and energy, and planted rubber.

-

The export markets are Southeast Asia, the Middle East, the United States, Europe and other countries, but the sales are mainly from Malaysia and Thailand, with sales accounting for 51% and 39% respectively.

-

In the two previous quarters, production and sales were affected by MCO, and the fire accident at Batu Pahat plant slightly affected production.

-

Recently due to the bottom rebound of timber prices and the increasing market demand, Q4 performance is expected to rise.

- The company will focus more on sales in the local market and the production of high-quality products in the downstream industry to increase the profit.

IS THE BUSINESS DOING GOOD??

Source:https://www.malaysiastock.biz/CorporateInfomation.aspx?securityCode=5101

-

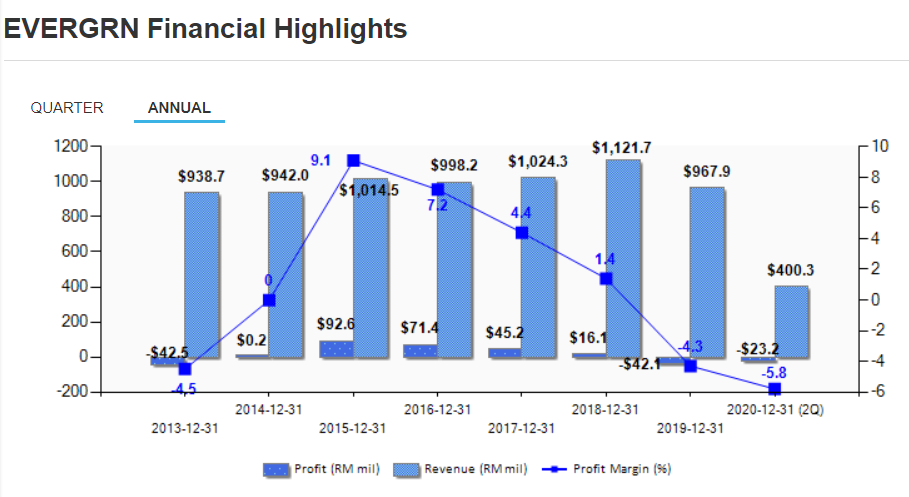

In the past three years, the price of Rubber wood/lumber has fallen due to oversupply in the market, EVERGREEN experienced two consecutive years of annual losses and 7 quarters of losses.

-

From a record net profit of RM92 millions in 2015, it fell all the way to a loss of RM42 millions in 2019. The recent loss shows signs of narrowing.

- EVERGREEN is making losses due to high depreciation & amortisation of capital expenditure, the company is generating positive cash flow from operation.

FUTURE GROWTH DRIVER & FUTURE PROSPECT:

- Wood based panel market will reach an estimated valuation of USD 250.43 Billion by 2027, while registering this growth at a rate of 7.0% for the forecast period of 2020 to 2027

-

Timber prices stabilized, which can improve the performance of timber stocks.

-

The home office model under the new normal has contributed to the demand for office furniture, especially RTA furniture.

-

EVERTGREEN is exploring new avenues to improve cost and operational competitiveness, therefore higher profit margin.

- The China-U.S. trade war boost the orders & demand shift to Malaysian timber industry.

RISKS:

-

When the epidemic slows down, demand will gradually decline as office workers resume their daily office.

-

The weakening of the US dollar against the ringgit affects the company’s export revenue.

-

In the face of competition from Vietnam, because labor costs are lower than those of Malaysia, many orders placed under the China-US trade war are "grabbed".

-

Face labor shortages due to the epidemic indirectly affecting production lines.

-

EVERGREEN failed to turn profitable during next quarter earnings.

TECHNICAL POINT OF VIEW

-

On Friday, EVERGREEN successfully breakout the resistance level 0.30 and closed at 0.30.

- High potential for EVERGREEN to continue its upward momentum.

SUMMARY:

- High demand of office furniture due to Covid-19 pandemic, new working norm established.

-

Timber prices was stabilized & going upward, it will improve the performance of timber stocks.

-

Recently due to the bottom rebound of timber prices and the increasing market demand, Q4 performance is expected to rise.

-

Wood based panel market to growth at a rate of 7.0% for the forecast period of 2020 to 2027.

#J.WOLF INVEST #EVERGRN #FURNITURE #COVID-19

JOIN US NOW: https://t.me/Jwolfinvest

Disclamer: Nothing contained in this article should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

More articles on J.Wolf Invest

Discussions

Be the first to like this. Showing 0 of 0 comments