Hibiscus buy Hibiscus II

zhangzuode

Publish date: Thu, 17 Jun 2021, 08:43 PM

Hibiscus Buys Hibiscus

On 3 June 2021, Hibiscus announced the acquisition of Repsol’s assets in S.E. Asia.

Details of the assets being acquired, terms and conditions, etc., are clearly articulated in:

- the announcement (https://malaysiastock.biz/Company-Announcement.aspx?id=1324467) and,

- the Presentation pack (https://www.hibiscuspetroleum.com/wp-content/uploads/2021/06/HPB-Proposed-Acquisition-of-Repsol-Assets-Final.pdf)

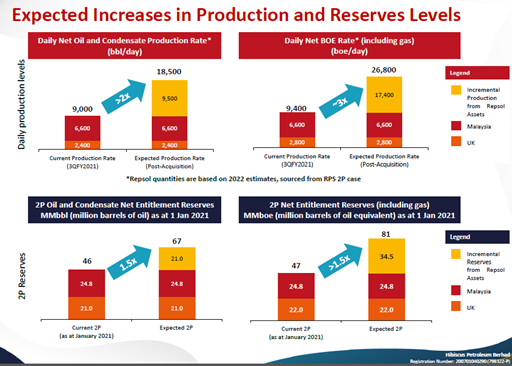

The effect of the acquisition is sum up in the Presentation pack as:

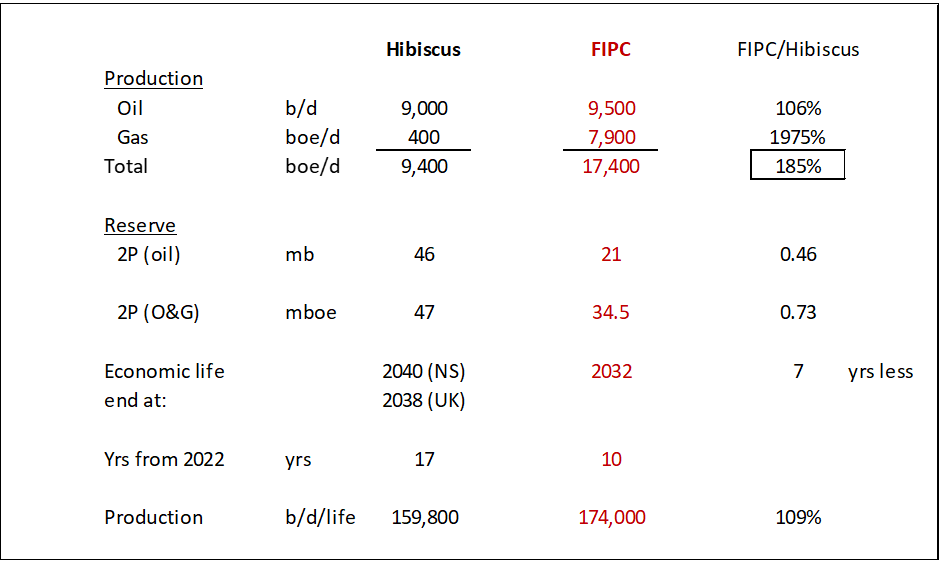

This information is presented in another way as shown in the table below.

It can be seen that, all things being equal, the calculated total production at the end of economic life of both Hibiscus and FIPC is almost the same, a difference of 9% ONLY.

While the 2P reserve of FPIC is smaller than Hibiscus, BUT it is neutralized by the higher production. In fact, get the money first rather than later is a positive way to look at it.

Thus, in the greater scheme of life, this is considered the SAME.

So, Hibiscus is buying another “Hibiscus”.

Please remember this – Hibiscus buys Hibiscus.

At the end of May 2021,

- 1,988,930,904 Hibiscus shares issued / outstanding.

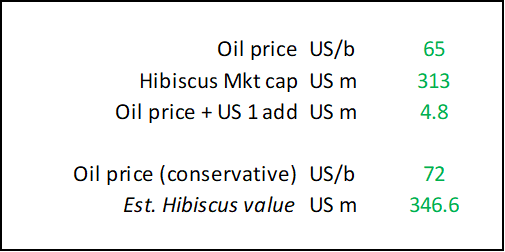

- @ 65 sen a share, to be conservative

- market capitalization of Hibiscus equal RM 1.293 billion.

- Exchange rate of 4.13 gives US 313 million

FPIC purchase price, US 212.5 million, a 32% discount to Hibiscus market cap of US 313 million.

At prevalent market condition (increasing oil price), a very good buy!

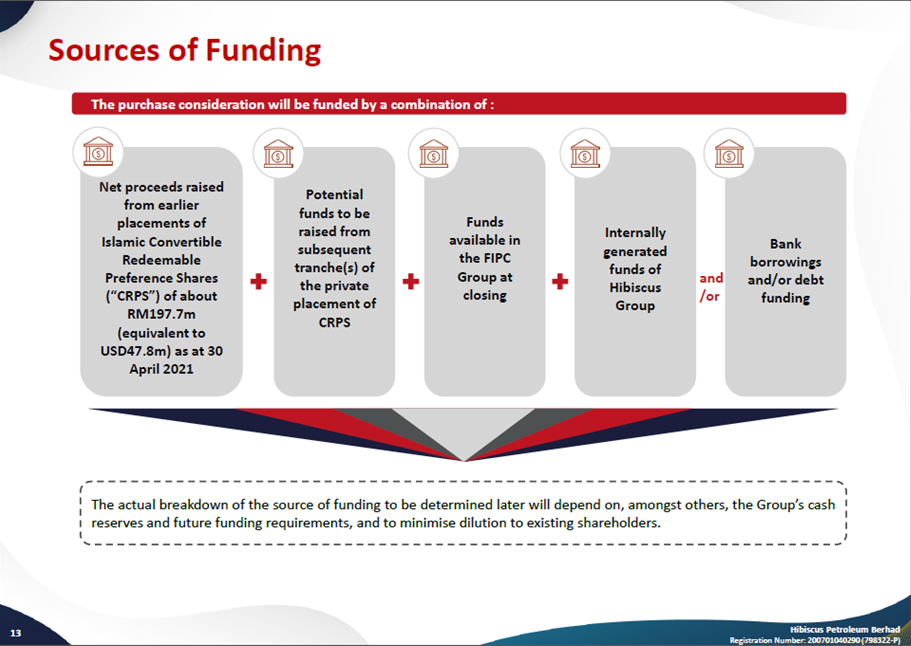

Funding

As per slide 13 of Hibiscus’ Presentation pack, the sources of fund would be from:

The most interesting source is from FPIC itself, BRILLIANT!!

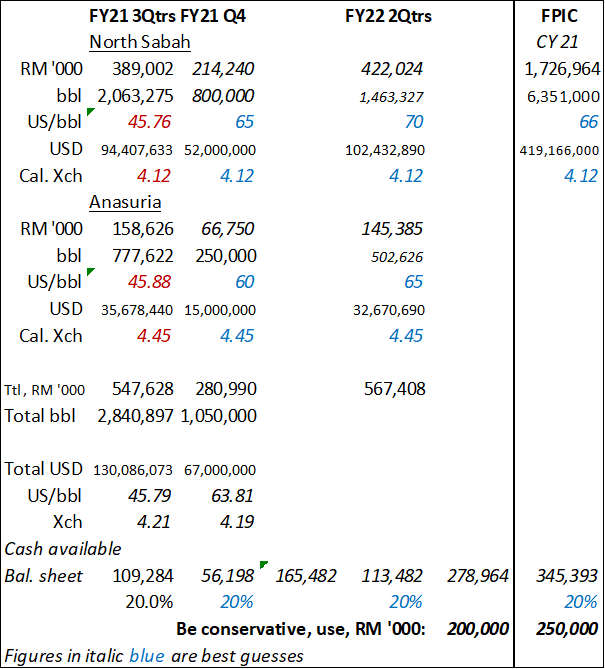

The anxiety now is the fund that could be internally generated by both Hibiscus and FIPC.

The internally generated fund is conservatively estimated to be RM 450 m at the end of 2021. There remain a balance of about RM 390 m.

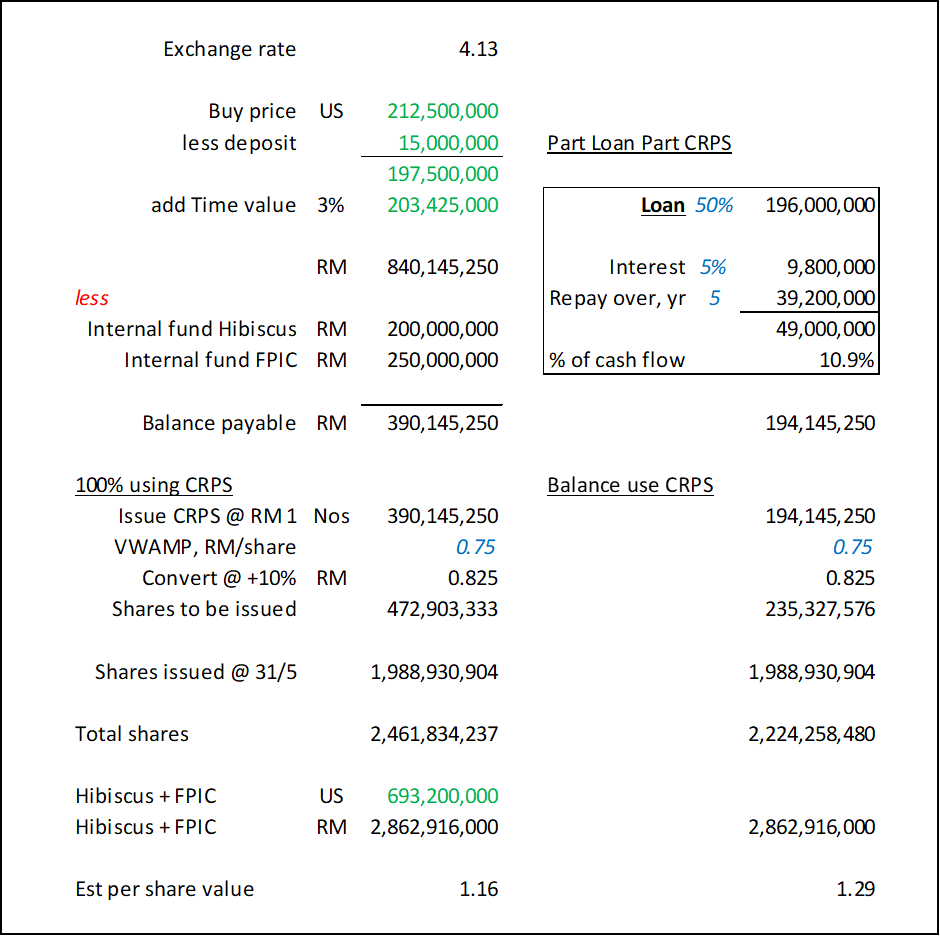

Two scenarios to pay the balance of the purchase price were considered – 100% using CRPS or part CRPS part loan. The results are:

Remember Hibiscus buys Hibiscus, the combined (Hibiscus + FPIC) value is arrived as 2 x Hibiscus. And Hibiscus value when oil price increases is:

The purchase is estimated to be completed at the end of 2021. So, the share price and oil price used to determine the conversion price of CRPS and value of Hibiscus are conservative.

It is assumed that CRPS would only be issued towards the fourth quarter when the amount of internally generated funds become clearer.

RISKS

There are many risks, and these are well explained in the announcement on 4 June 2021. Please refer to them for better handle of the risks involved.

SUMMARY

Hibiscus signed a Purchase agreement to buy Repsol’s South East Asia asset, FPIC (Fortuna International Petroleum Corporation). The Purchase price, US 212.5 m is 32% discount to Hibiscus market valued at US 313. A good buy.

FPIC estimated economic "life production" is only 9% more than Hibiscus’s life production. So, it is concluded that Hibiscus is buying another Hibiscus.

The purchase will be funded, as guided by management, by internally generated fund from both Hibiscus and FPIC, issuance of CRPS and maybe also bank loan.

Internally generated funds of both companies conservatively totalled RM 450m. The balance, RM 390m, may either be 100% funded by issuing CRPS or a combination of loan and CRPS. It is finally estimated the share value (post completion) maybe RM 1.16 or 1.29 for 100% CRPS or combine loan+CRPS respectively.

Peace Investors.

Disclaimer:

I wrote this myself without pay. I own Hibiscus shares. This is not as advice to buy / sell Hibiscus or any other equities / securities / assets. Always do you own due diligent before investing in anything.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

supersaiyan3

Well written.

2021-06-17 23:04