Oil Price Dynamic

zhangzuode

Publish date: Sun, 07 Nov 2021, 02:45 PM

Oil Price – dynamic

Further to my post – Hibiscus buy Hibiscus IV Oil price, here are some dynamic on oil price movement that have been observed recently.

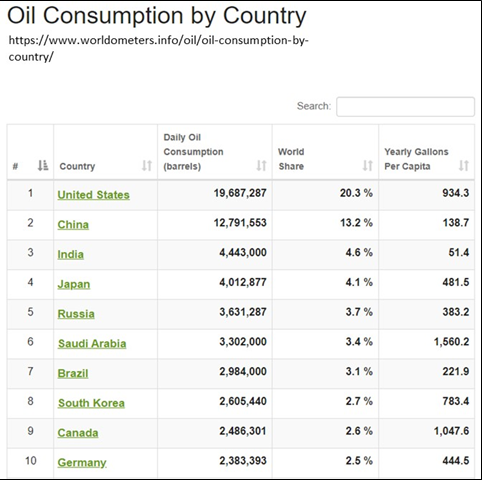

US set oil price

US is the largest oil consumer. Plus, financialization of commodities, US thus set price of oil.

As such it is to the US, where data is in abundance, for a drill down on pricing dynamic. Primarily, the main source of data is from EIA – U.S. Energy Information Administration.

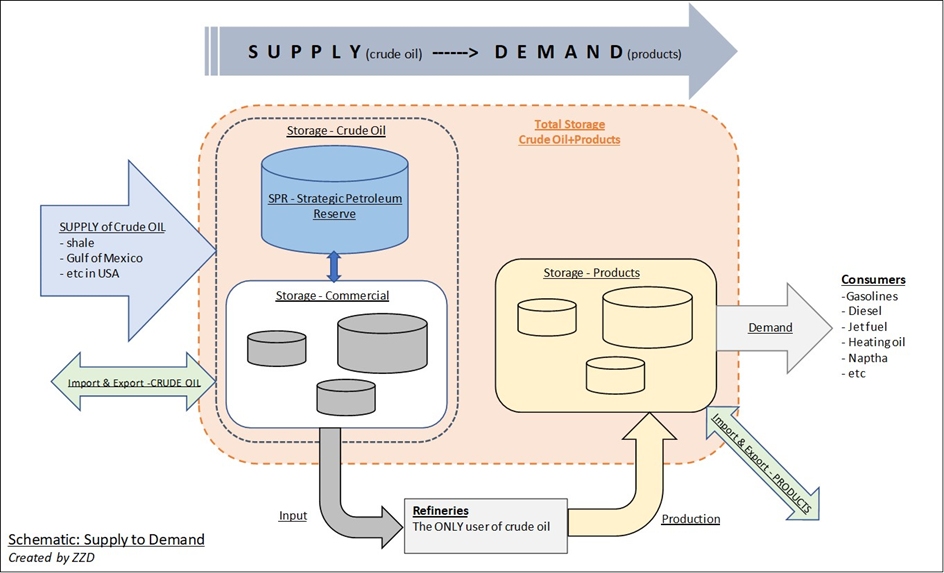

Here is a simplistic view of the dynamic of crude oil supplied to become products for consumers:

- Crude oil is produced via shale patches, Gulf of Mexico and around USA and they finally flow into STORAGE, mainly commercial (Cushing is just one of many) and or the Strategic Petroleum Reserve (SPR).

- There is also import and export of crude oil. Nonetheless, finally, balance of this export and import has to be either stored (BUILD) or deducted (DRAW) from STOCKS.

- The main (can be said ONLY) user of crude oil is the refineries. In the data world it is known as INPUT to and PRODUCTION from the refineries. And the products are also STORED before being send to end users / consumers. Storing is required to act as a balance between production capability, weather interruption, seasonal use and distribution issues.

- There is also import and export of products and this finally also show up in the STOCKS level of the products storage tanks.

- Finally, to the consumers, the products are supplied (DEMAND).

Based on the foregoing, one only need to monitor:

- INPUT to refineries, as this indicates the strength of demand

- Products supplied and storage or STOCKS levels. This provide insight to demand

- Total storage levels of both crude oil (SPR + commercial) and products. This show how supply is meeting demand.

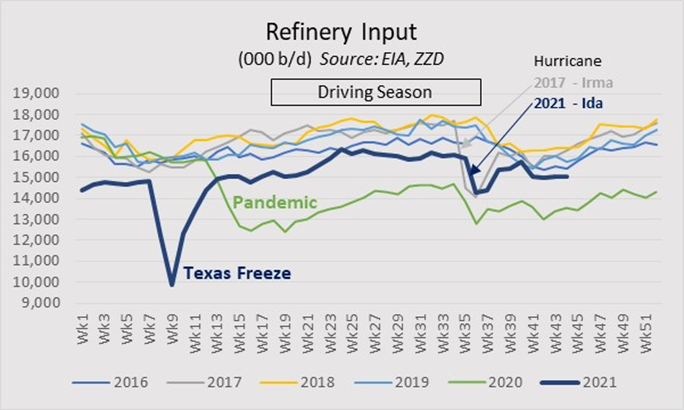

Let’s look at the refineries crude oil INPUT now:

The oil input is consistent and varies within a tight band over the years. In 2020 the input drop on lock-down. This year there was the Texas freeze and hurricane Ida. Similarly in 2017, hurricane Irma hit around same month causing similar drop in input as refineries where hurricanes “make” landfall had to be shut down and some incurred damage or flooding.

It is clear that oil input is seasonal. Between Week 18 to 36, refineries are working flat out to supply products to consumers that drives all over US – driving season. Around Week 36 to 44 (8 weeks/2 months), input drops. During this period, refineries carry out maintenance or refurbishment. And 2021 is no different. Do note that data reported lag by a week. In the coming weeks, input to refineries is going to increase.

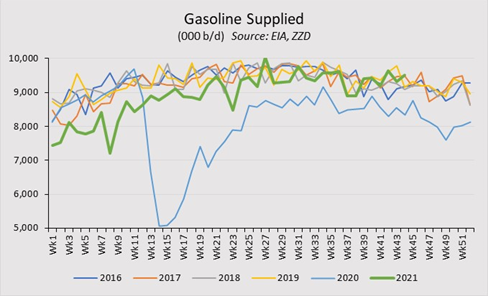

Figure above shows the tight band of gasoline supplied over the previous years. 2020 (blue line) started within the band but then become an outlier once lock-down was declared. 2021 gasoline supplied (demand) is firmly back and within upper limit of the band too.

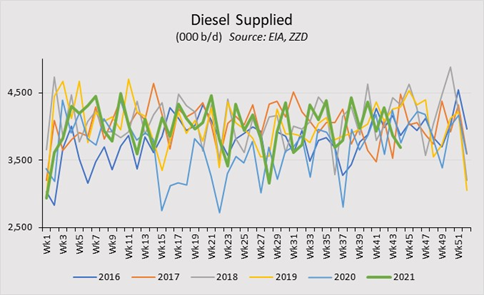

Diesel supplied did not suffer a drastic drop like that of gasoline in 2020, as it is mainly used for commercial transportation and certain manufacturing that are essential.

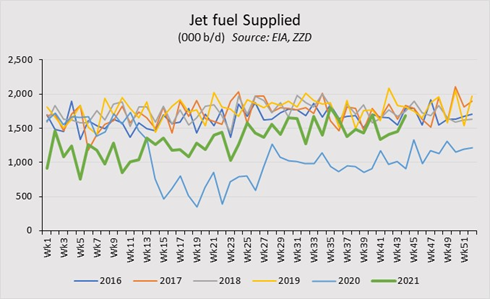

Jet fuel is no different to gasoline. Demand still lags but is edging towards the band. Only these three major products (gasoline, diesel & jet fuel) are considered. The other products share similar pattern.

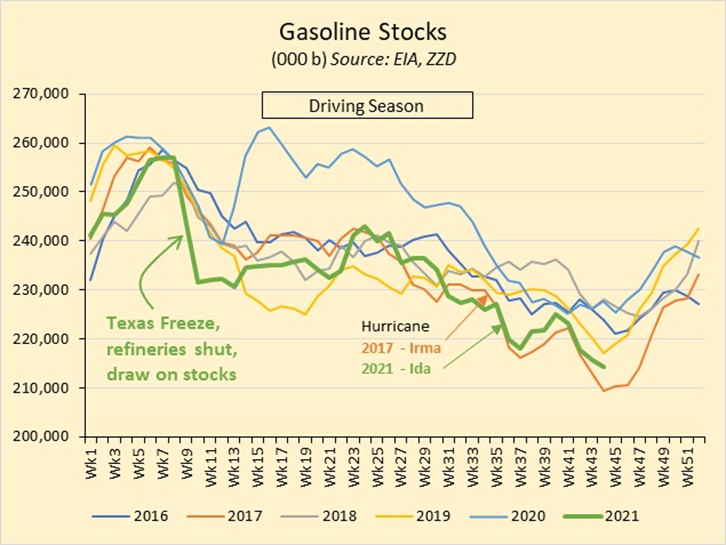

Gasoline stocks (inventory) level is as shown below. It is clear that stocks draw a lot during driving season, despite refineries running flat-out.

From the refinery input, 2021 Texas freeze occurred about week 7 to 11, thus gasoline stocks level dropped correspondingly (near vertical, green line). And similarly, when Hurricane Ida hit around week 35. From both the supply and stocks level, demand for gasoline is back to normal (upper end) and stocks is at the lower end. Thus, demand is strong and supply is just keeping up. Gasoline stocks is now expected to rise to prepare for 2022 driving season.

Similar figures can be made from EIA data for diesel and jet fuel. They tell the same story.

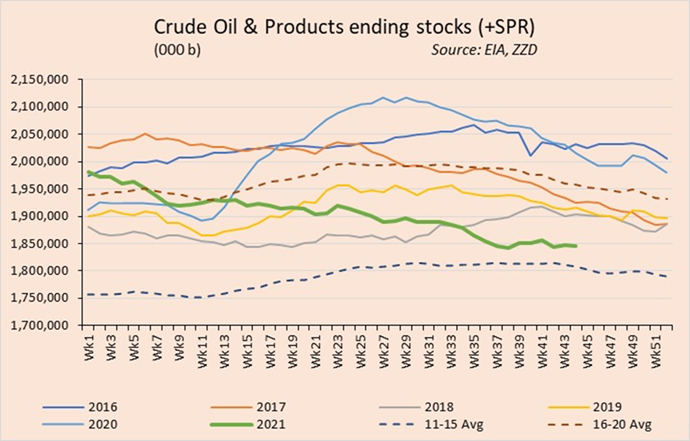

Finally, the Total stocks level of crude oil plus products is as shown:

Total stocks level (green line) has fallen from 1,980 mb to almost flat around 1,850 mb now. This is despite the build in crude oil. But products draw made the overall Total remaining flat for the past 8 weeks.

From the supplies and storage figures above, it can be said that DEMAND is strong and should remain within the band as per previous years. Average stocks for year 2011 to 2015 is provided, this was the stocks when oil price was last in the 100s. The Total stocks then, was 1,750 mb to 1,810 mb. Current level is ONLY 40 mb to 100 mb from the 11-15 average. Based on current refineries input, these 40mb to 100mb will be used up in no time.

Expectation is that Total stocks level should draw (reduce) towards the 11-15 average in the coming weeks. This could lead to higher oil price going forward, all things being equal.

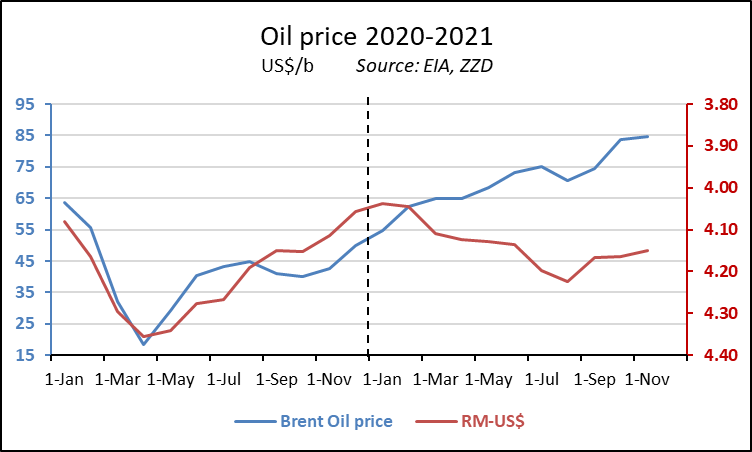

Below is the average monthly oil price since 2020.

It is a shame that Hibiscus also benefits from the poor RM->US$ exchange (-9%). It makes sense to get US$ bond now. When the RM->US$ exchange normalize, less RM will be required to redeem the bond, that is, if it normalized.

General

News about Cushing low stocks level is just a red-herring, as ultimately, it is the Total stocks level that count.

Recent talk of US, Japan, India and others in a coordinated release of their SPRs crude oil to bring down the price of oil is also another delusion. Refer to the schematic above, and like Cushing, it is just moving crude from one tank to another. There is no net gain in the VOLUME of crude oil at all. FUNDAMENTALLY THERE IS NO CHANGE. If one just looks at commercial crude oil stocks, yes, there will be a build. So, any price dip is an opportunity to add.

It is November now, new rigs added will ONLY materially bring new supply sometime in March 2022. Please do not forget DEPLETION, so net gain in supply could be small.

Support for current to higher oil price

Oil majors 3rd quarter results were impressive. However, despite the large free cash-flow, none of the majors indicated higher CAPEX, rather all said, shares buy-back and or higher dividend.

Here is a brief on shale oil firms result: https://oilprice.com/Energy/Energy-General/US-Shale-Patch-Reports-Blowout-Earnings.html. Again, they are ONLY interested in reducing debts, share buy-back and pay dividends. One, Continental Resources (CLR) planned to buy a Permian field for US$ 3.25B. You would think investors will be happy as it will increase production by 50,000 barrels a day, but instead, its share price dropped 9%. Maybe price paid is too high or shareholders thought that further investment in oil (or gas) production should be stopped due to climate issues? CLR is not the first, there were others also.

Supply (fundamental / structural) going forward would remain constrained.

High gas prices, especially in Europe and Asia would force some consumers to switch from gas to oil. However, this is only temporary until gas prices normalize.

Risk to current high oil price

Cases of Covid 19 in Europe is spiking. Should governments in Europe adopt lock-down again, demand will be cringed.

SEEK TRUTH FROM FACTS

Conclusion

US, being the largest oil consumer at 19.7 mb/d, set oil prices through it more developed financial system.

Data is abundance in US and is primarily sourced from EIA.

The main (or ONLY) user of crude oil is the refineries. Oil input to refineries follows a seasonal pattern. The refineries are now coming out of their maintenance season and will increase input to build up products for next year driving season.

Products supplied to consumers and stocks level gives an insight to current demand. Demand for gasoline and diesel is back to pre-Covid level while jet fuel still lag.

Looking at Total stocks (level) of crude oil (SPR & commercial tanks) plus products stocks provide the best information on how supply is meeting demand. Today Total stocks is near 2011-2015 average stocks, the stocks level when oil price was last around 100s.

Given the above, oil price should trend higher towards end of the year and into first quarter of 2022.

The current spike in Covid 19 cases could temper demand, but switch from gas to oil might mitigate it.

Disclaimer:

I wrote this myself without pay. I and my families own Hibiscus shares. This is not an advice to buy / sell Hibiscus or any other equities / securities / assets.

twynstar

Very detailed analysis. Thanks a lot !!

2021-11-07 22:11