Hibiscus - What now

zhangzuode

Publish date: Tue, 01 Mar 2022, 07:13 PM

Hibiscus – what now

Since the last post on 7/11/21, much has happened:

- Oil price zoomed up from usd 83 to today usd 101 (May 22 contract)

- Hibiscus price also zoomed up from 91 sen to RM 1.22 (today)

- Russia invaded Ukraine

In 17/10/21, it was estimated that Hibiscus value - RM 1.46 and FY2022 earning, EPS (fully diluted) might be RM 0.24.

Incorporating the following (from latest reports on Hibiscus web-site):

- latest Q2 FY22 result

- subsea component failure affecting Anasuria production until Q3 CY22

- Completion of the Repsol deal on 24/1/22 with expected production for FY22 at 2.5 million barrels oil equivalent

- Management guidance, Anasuria + North Sabah total production for FY22 would 2.7 million barrels of oil equivalent

- Total daily production is now around 23,000 bpd compared with 8,000 bpd before.

Few comments on above and assumptions made:

-

Anasuria + North Sabah production

- Up to Q2 FY22, 1st half, a total 1.6 mb have been produced. Following Management guidance of total 2.7 mb will mean 2nd half production is 1.1 mb, i.e., 6074 bpd. This is far below the 8,000bpd production and is thus deemed too conservative. Instead about 8,000bpd is used.

- The 90,000 barrels over-lift is discounted in the 2nd half production calculation

- Hence, total production is about 3 million barrels.

- 1st Jan to 23rd Jan production from Repsol asset is not included

- Negative goodwill of RM 35.79 million was included in q3 in Repsol’s estimate

- While oil price is now around usd 101, this is ignored and conservative price of usd 90 was used for Q3 and 88 for Q4.

This resulted in the total production of about 5.6 million barrels compared with 6.2 million barrels in the October 2021 estimate, a drop of about 15%.

Price of oil used now is about 17% more than that of Oct 2021.

Combined – lower production but slightly higher oil price led to lower earnings of RM 0.172 compared with RM 0.241, a 29% reduction.

Lower profitability was used for Repsol’s estimate to account for lower efficiency and not fully into Hibiscus work pace.

Potential cash from operation is about RM 870 million. Deducting, say, RM 370 million for purchases of equipment and intangibles, leaves RM 500 million, just about clear the RM 519.3 million balance for Repsol (usd 123.65 x 4.2 = 519.33). Potentially, whatever loan from Trafigura might be repaid by the end of this fiscal year.

This estimate is of course crude, but it provides some range of possibilities. One can muck around with the profitability, oil price, etc., to come up with earnings that meet one’s requirement.

What now

Current price (1.22) is about 84% of target price of 1.46.

What should I do: -

- take profit, if so, how much – 20%, 50% of Hibiscus holding?

- wait till it hit 1.46 then sell 50%

- when it hit 1.46, sell all?

It is a dilemma. Have been asking the following questions –

- will oil price appreciate further, 110 to 120 range?

- From 1.2 to 1.46, there is an appreciation of about 18%

- Are there other counters that might give similar returns (+18%) or better going forward (within a year)?

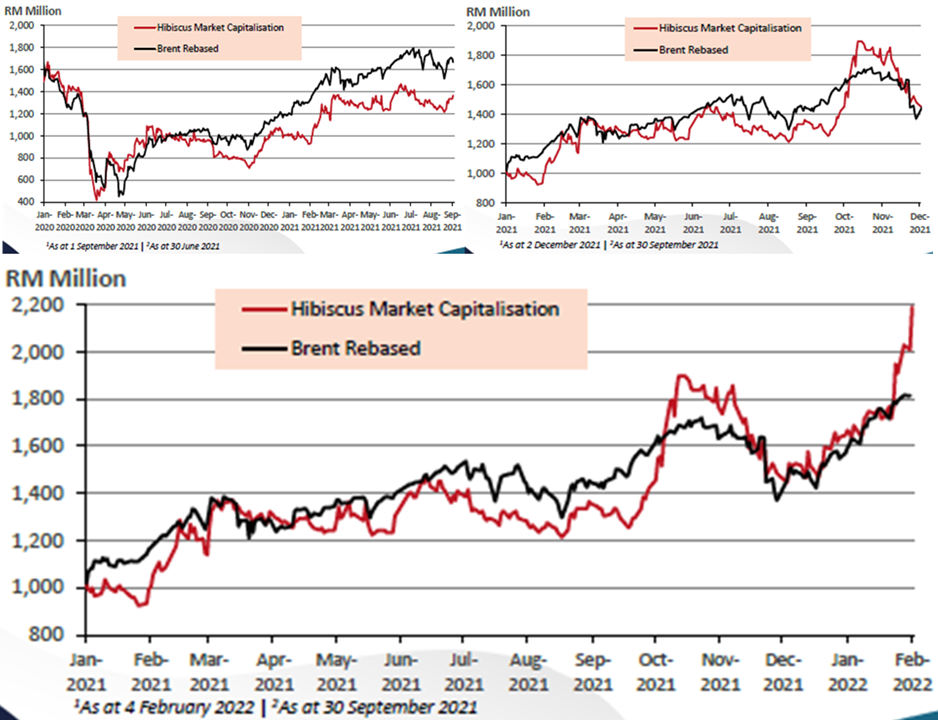

These charts from Hibiscus’s September 2021, December 2021 and February 2022 presentation slides swayed me to take some profit.

In September 2021, Hibiscus price value (market cap) was below Brent oil price. By December 2021, it has more or less caught up that included the surge in October 2021. There was another price surge in February 2022. Missed taking profit in October 2021 and because of FOMO, is taking profit now.

Uncertainties in oil price was another factor that pushed towards profit taking. These are the uncertainties:

- The nuclear deal with Iran (expected Q1 CY2022)

- Steady increasing rigs in USA despite the ESG issues, increased production (expected towards Q2 CY2022)

These uncertainties if and when it becomes facts could push oil price down to between 80 and 85.

So, basically, one bird in hand is better than two in the bushes.

Of course, Russian incursion into Ukraine complicated matters more. Thinking at the beginning is that it will be short – like a week. Now, maybe not - a month?

Winston Churchill said "In wartime, truth is so precious that she should always be attended by a bodyguard of lies."

As usual day to day, things changed and the behaviour of Hibiscus price is also erratic.

Without the Ukraine war, fundamental supply and demand currently is forecasted to build inventories (i.e., supply exceed demand). Coming EIA’s weekly reports and OPEC monthly reports will give clues to this supply demand dynamic.

Now with war, supply could be less than demand. That is, any disruption to supply from Russia (being one of the three largest oil producers in the world) would be a disaster – causing oil price to spike.

Should oil price is maintained above 100, Hibiscus price might be RM 2??

Another question is what do one do with the profit taken out. Never ending, this ……

Peace

Disclaimer:

I wrote this myself without pay. I and my families own Hibiscus shares. This is not an advice to buy / sell Hibiscus or any other equities / securities / assets.

More articles on Zhang Zuode

Discussions

rattynz, thank you for reading.

Between EBIT and Profit before tax, there is finance cost. There is no information on exact amount used from Trafigura's line, 70 million was allowed. This, thus, complicated the calculation. Apology for not showing this. Hope this clarify.

There is another issue that bugged me:

As a non-finance person, my thinking that the NAV in all reports (including the proforma) remains around 70+ sen is most unusual. From my limited business days, whenever I want to increase my revenue, I need to increase my assets to make it happen, that is, my NAV increases (OFC less any liabilities used to increase the assets).

So for Hibiscus, NAV to remains at 70+ sen but with production tripling, it is a miracle. So this coming May quarterly report will be most interesting.

2022-03-02 09:11

Yes - the current NAV is based on life before Repsol and before the recent increases in oil price. with next quarters results I expect this to be recalculated and even if you were very conservative it would double. The 70 Million for Trafigura does seem very high. The financing costs for the credit line are low - around 6% PA I believe. So perhaps you might want to consider the interest costs on the credit line only (which may be around RM5 Million). They also have additional cash reserves of RM550 million at Dec 2021 so the credit line is more than covered and I imagine would be a long term liability in their balance sheet.

2022-03-02 10:29

Indeed, 70 million is a bit excessive now come to think about it.

That was my premise when I said Hibiscus buying Hibiscus when the Repsol deal was announced. Should the NAV goes near 1.40, then paying two times book value will mean Hibiscus price could be 2.80

This would mean 17 (earning) / 280 = 6.1% return.

2022-03-02 11:19

Export from Russia grinding to a halt:

https://www.zerohedge.com/crypto/70-russian-crude-trade-frozen-surgut-again-fails-sell-any-urals-big-tenders

2022-03-03 07:52

Coming catastrophe? https://www.zerohedge.com/markets/two-oil-price-scenarios-one-bad-and-one-catastrophic

2022-03-04 09:05

rattynz

Very interesting observations.. If lower production of 15% is coupled with higher oil prices of 17% the the nett affect would be canceled and the eps should be similar to your previous estimate I beleive. So a 29% drop doesn't seem to make sense there.. Repsol was also funded from the crps allocation (around RM197 million).. I would have expected, with retained earnings and Q1 and Q2 2022 profits would more than cover the trafigura credit line.. Perhaps you can check the workings as it doesn't quite make sense.. Would love to know the upside if oil remains at 100 for the rest of the year.. It was interesting in May as TP assessment that from every dollar increase (above break even I assume) hibiscus profit ranges from 36 to 54 % (after tax).. So a prolonged hike in oil prices will have a significant impact/upside to their Profitability..

2022-03-01 23:26