ANCOM or HEXTAR - Which to buy for 110% gain?

JustinLong

Publish date: Fri, 27 Aug 2021, 11:00 PM

Let's do a valuation exercise on 2 of the listed Agrochem players in Bursa:

ANCOM & HEXTAR.

1) HEXTAR

From Hextar's most recent briefing post the release of its Q2 results, Hextar illustrated how it may achieve PAT 64m post the 2 acquisition exercises.

Hextar guided Proforma PAT RM64m (future earnings post-acquisitions)

PE25 = RM1.6b market cap

Current market cap? already RM1.6b

But,

YTD PAT only 18.2m for 2 quarters.

To justify the current market cap at PE25, the coming 2 quarters would need to make up the remaining RM45.8m PAT shortfall.

Meaning to say, each quarter to hit at least RM23m.

Given that the acquisitions may not be completed that soon, the accretive earnings may not be recognized in time to make up the 64m number. The original core agrochem biz of Hextar is also slightly hampered by raw material cost increases as mentioned by its Chief Corporate Officer.

At RM1.6b, it is already fully-future-valued.

2) ANCOM

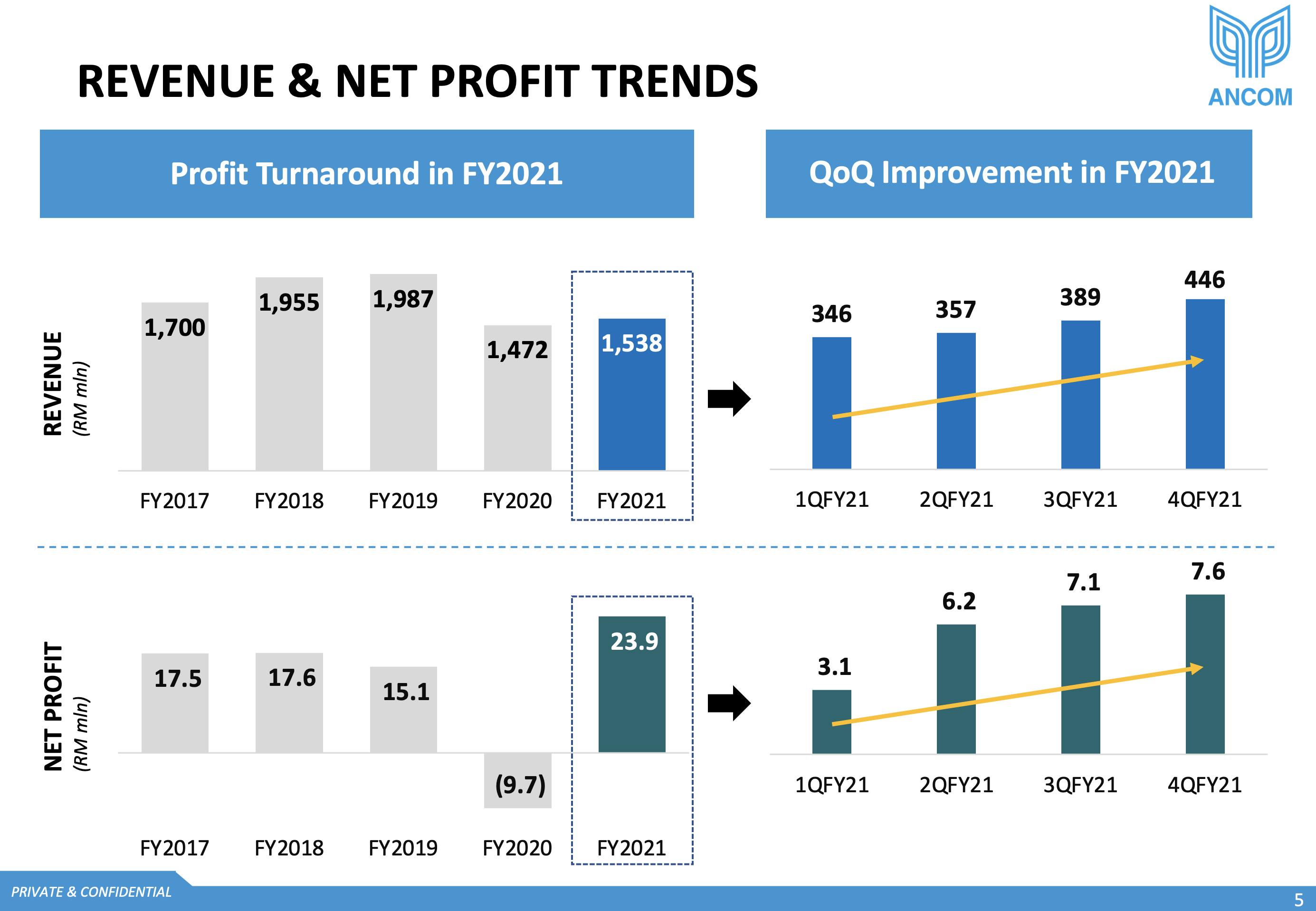

Ancom's FY21 PAT RM24m

PE25 = RM600m market cap

Current market cap? RM366m

Management has guided FY22 PAT to be 20-25% better conservatively, given the slight delay in obtaining permits for construction of its new active ingredients chemical plant during MCO. But the good news is, the development order has been obtained as of early August, so things are already moving ahead. Plus, the PAT guidance is without the full consolidation of Nylex, which is expected to be completed by end-2021.

Given that their FY calendar is June-May, we can expect additional RM8m PAT recognition from Nylex in second half of the FY. This is assuming Nylex hits 16m PAT, the avg PAT level for Nylex for the past 10 years (their last Q4 alone is 11m PAT!).

So, doing the same Proforma exercise as Hextar:

Ancom Proforma PAT = 24m

+ 20% growth = RM28.8m

+ recognition from Nylex consol 8m = RM36.8m

PE25 = RM920m market cap

RM920m over enlarged share base post-consol 300m

= RM3.06 per share (114% upside)

Conclusion

Both Ancom and Hextar are the leading agrochem companies in Bursa, and thanks to them, I have made very handsome returns on my investments in both counters over the past few years.

In terms of retail participation and liquidity, Hextar is no doubt the winner over Ancom at this stage. But in terms of valuation and the upside potential, I am placing my bets on Ancom for now.

The price trend of Ancom may look stagnant for now but I have been informed that some institution funds have started taking positions in Ancom. We would be able to verify this once Ancom releases its annual report sometime end-Sep or early-Oct before the AGM.

If it is indeed true that some funds are in the TOP30 shareholders, this would intrigue other funds to "take a look" at Ancom to see what they have been missing out.

Then once the price is hot, retailers will then start to "take a look" at Ancom to see why did they miss out this gem of a counter.

By then, perhaps liquidity would not be an issue anymore when the price is RM3+ because everyone would be chasing after it, just like how they chase Hextar now!

Stay safe and have a great weekend :)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-22

ANCOMNY2024-07-19

ANCOMNY2024-07-19

ANCOMNY2024-07-19

ANCOMNY2024-07-19

ANCOMNY2024-07-19

ANCOMNY2024-07-19

ANCOMNY2024-07-19

ANCOMNY2024-07-18

ANCOMNY2024-07-18

ANCOMNY2024-07-18

ANCOMNY2024-07-18

ANCOMNY2024-07-17

ANCOMNY2024-07-16

ANCOMNY2024-07-16

ANCOMNY2024-07-16

ANCOMNY2024-07-16

ANCOMNY2024-07-15

ANCOMNY2024-07-12

ANCOMNY2024-07-12

ANCOMNY2024-07-12

ANCOMNY2024-07-12

ANCOMNY2024-07-09

ANCOMNY2024-07-09

ANCOMNY

.png)

calvintaneng

JustinLong

My reading of the current price trend of Nylex is that those who bought on rumours sold on news, maybe due to the Minority Interests (MI) not getting the full RM1 in cash.

This is very absurd and it seems to be a great value buy right now.

Nylex MI will get the RM1 in the form of:

1) 39sen/share cash distribution

2) 9sen/share cash remaining in the listed co

3) 52sen/share of Ancom share

**Ancom issued at RM1.50 so approximately 3 Nylex shares get 1 Ancom share

Cash alone (distributed + retained) is already 48sens.

The closing price today of 86 sens means you are only paying 38sen for one third of Ancom

= (38sen x 3) = RM1.14 per Ancom share. You do the math here.

Of course there may be a discount at this moment as the deal is still not voted by Nylex MI yet but the price should eventually converge to RM1 in the coming months.

No reason for MI not voting for it as without the deal Nylex would most likely be "stuck" without this value unlocking exercise.

Will continue to accumulate this stock as well as Ancom for the coming few months to vote for the deal.

03/05/2021 9:36 PM

jwinter3 JustinLong... Great clarity indeed. Time for accumulation.

12/05/2021 9:21 AM

JustinLong Market giving Nylex shares a discount to the RM1 value now due to the board yet to announce acceptance of the offer. Once it is announced sometime estimated in June, then discount should narrow and share price should gradually rise to RM1 nearing the EGM.

Ancom just dipped below RM1.50 now which is a no-brainer buy as their Q4 should be better than Q3 + the ongoing inflation theme on commodities. MCO3.0 really caused panic selling across the board.

Perfect time to add position.

19/05/2021 10:34 PM

THE MATHS SHOW THAT THE BEST PROXY BUY TO ANCOM IS NYLEX

BY BUYING NYLEX AT 82 SEN THERE IS A LOCK IN DISCOUNT TO ANCOM BY 10% TO 15% LOWER ENTRY PRICE

If Ancom could rise above Rm2.00 to Rm3.00 as forecasted then buying Nylex at such discounted price is a no brainer

2021-08-28 07:36