Chinwell (5007) - 螺丝考验经得起,未来需加倍努力? - bluefun

bluefun

Publish date: Tue, 28 Jun 2016, 10:40 PM

今天2016年6月28号,经过了上周五的 Brexit,看来股市已经开始稳定,投资者也不再陷入大恐慌,纷纷 support,以致股市一片青青向上扬,一切好的开始就在你我的心态, steady!!Chinwell 晉緯控股的股价最近也开始向南飞,也许是受到市场情绪的影响,也许是美元汇率转弱的影响。bluefun觉得此刻 Chinwell 的股价蛮吸引人的,至少已经从52week最高的RM2.34 discount了 38.89%至今天的 RM1.43。52 week low = RM1.30

52 week high = RM2.34

4 week low = RM1.39

4 week high = RM1.67

28.06.2016 share price = RM1.43

虽然说Brexit多多少少对 European Union有影响,而 EU又占了Chinwell 55%的revenue (FY16Q3),这难免让投资者担心吧?Malaysia的revenue剧增是因为2015年4月1号的消费税实行之前,客户们大量的订单使 Chinwell收了红包大礼,从FY15Q3的70m上升至100m,或相等于+ 42.5%。

从 2015的 Annual Report的Trade receivables里的currency exposure,bluefun推算出大约19%的 revenue是以欧元 (EUR)结账, 而剩下的 81%是与美元 (USD)交易的。虽然说最近马币因为油价维持在 USD45-USD51之间而转强,不过 EUR: MYR还是维持在 EUR1.00 : MYR4.49, 而USD: MYR也维持在 USD1.00 = MYR4.06.

虽然大部分投资者认为以出口 为主的公司已经没戏唱,因为股价早已在半年之前反映在股价之中,利好也已经退散,不过 bluefun就持以不同的看法。 看一看 Chinwell今天的股价RM1.43, 52week low是 MYR1.30,那时候马币对 USD的汇率还在 3.50以下呢。况且 Chinwell是 net cash company, cash yield, dividend yield也不错,而且是成长中的公司,FY16的 financial result一定创下新高,只等待2016年8月份 FY16Q4的成绩单,相信 net profit 11m并不难,到时就创下 58m的 net profit了, EPS要达到19cents应该绰绰有余。

EUR TO MYR exchange rate (52 week range)

USD TO MYR exchange rate (52 week range)

以下是bluefun对于Chinwell今天 share price RM1.43的calculation与analysis。

1. ROIC (RM1.00 invested capital earn RM0.14)

2. EBIT multiple (Current 6.20 < Average 8.02)

3. Cash Yield (Current 20.70% > Average 11.38% > +5%)

4. Dividend policy (Current: 39% > Average 32%)

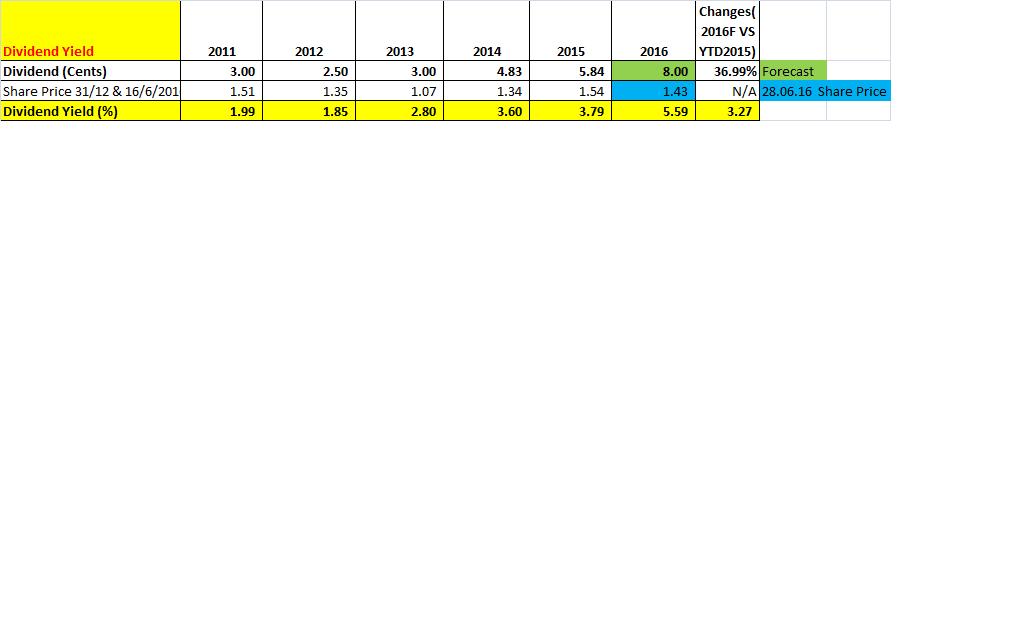

5. Dividend Yield (5.59% > 4.3%)

小总结:

1. Chinwell是一家net cash position的公司 。(cash 100m > borrowing 21m)

2. Chinwell比较依赖欧盟国家的订单。欧盟国家经济的放缓与进口政策对于公司有极大的影响力。 (Revenue 55% from EU Countries)

3. 美元兑换马币的汇率影响公司的 net profit。 (Revenue=75% export)

4. 公司维持 40%的 dividend policy。假设FY16Q4能收获4cents的EPS,YTD16 EPS=20cents。 Dividend = 20cents x 40% = 8cents。 (以现在 RM1.43的 share price, dividend yield = 5.59%。)

5. FY16的 net profit若无意外,将会创下历史新高。 YTD16Q3的net profit = 47.6m, YTD15= 49.5m。

后语:

机会永远是留给有准备的人, 做好功课了解公司才是根本。

bluefun

28.06.2016

P/S: This article is just for sharing, this is not a buy call, sell call, miss call or phone call, any trade please on your own risks.

Original article link: http://bluefun168.blogspot.my/2016/06/chinwell-5007.html

Please follow and support my FB page:

https://www.facebook.com/bluefun668

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on bluefun的投资分享心得

Discussions

The prospect is really challenging given that the anti dumping duty on China's product has expired and uncertainty caused by Brexit.

2016-06-28 23:21

Yeah now that EU has lifted tariff against Chinese imports, competition will be stiff. Past performance may not be a reliable guide to future earnings

2016-06-29 06:47

The lifting of Anti Dumping against China have huge impact to Chinwell. Outlook not good.

2016-06-29 13:58

Please refer to my past comments on the company's business models. With the exposure on the European market, we are unconvinced with the outlook for this company.

2016-06-29 14:03

Chinwel is an old company, share price is trading at reasonable level, the company holding more cash than debts (like debts free). If you worry the company will go holland, you worry about yourself first.

2016-08-01 10:26

probability

sounds like a not a bad investment..

2016-06-28 22:47