Top Glove: Did Pankaj C Kumar Misunderstand?

Ben Tan

Publish date: Sat, 13 Mar 2021, 01:25 PM

This morning an article titled "Valuation is an art" [sic], written by Pankaj C Kumar, was published on The Star website. You can read the full article here.

Without focusing on the opinion-based parts of the exposé, here's what the author starts his analysis with:

"Despite the majestic results, Top Glove got the brickbats from the investment fraternity in the form of downgrades, both in target price as well as earnings, as the majority of them saw a peak in earnings and expectations are now running high that the average selling price (ASP) is on a downtrend."

[Emphasis mine]

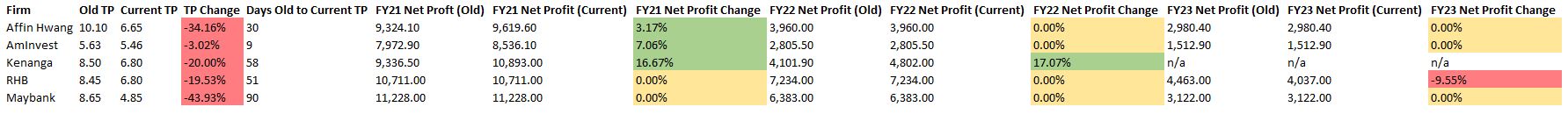

A few days ago I wrote a piece on some of the most curious valuations. You can read it here. One thing I didn't explicitly cover in my article at that time were the changes in earnings the corresponding analysts provided. Below is a summary of these changes in earnings, which according to Pankaj C Kumar were adjusted downwards (they were downgraded):

The author seems to be confusing ASPs being on a downtrend (something which the company said is not happening yet, and its earnings will in fact trend upwards in 2HFY21), with earnings projections being downgraded.

To summarize: no, analysts did not downgrade the company's earnings as a whole. The only one who downgraded his FY23 net profit forecast was the RHB analyst (by 9.55%), while leaving his forecasts for FY21 and FY22 unchanged, and slashing his price target by 19.5%. Three of the five analysts whose price targets we reviewed actually upgraded their earnings forecast, with one leaving his/her forecasted net profit unchanged.

And yes, valuation is an art, not an exact science. But when things make little sense we should certainly question them rather than attempt to explain them away simply as a "you don't understand" or "it's their opinion" matter. Assumptions and predictions may change, but when your assumptions on net profit change upwards or remain the same, it's truly complicated to justify your price target changing downwards (especially if the change is significant), isn't it?

Important disclaimer: Any views expressed are for informational and discussion purposes only. None of this information is intended as, and must not be understood as, a source of advice. It is imperative that you always do your own research and that you make any decisions based on your personal situation and your own personal understanding.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trying to Make Sense Bursa Investments

Created by Ben Tan | Jun 04, 2021

Created by Ben Tan | May 09, 2021

Created by Ben Tan | May 04, 2021

Created by Ben Tan | May 01, 2021

Discussions

DickyMe, that's not what the author is saying. On the contrary, he explains that there is always underlying logic behind the valuations, but different analysts may use different assumptions and may have different targets. So even based on the same set of evidence and facts, they may arrive at different valuations. With all of this - I completely agree with him.

But yet again, this is not what my post was about at all.

2021-03-13 15:30

Since year 2000 did any analyst projected the earnings of glove counters will shoot up in year 2020 to what it is today? As far as I know, NO. Elek. Ta'ada. So now in year 2021 can we trust these analysts projections for year 2022 and forward? Just take their opinions with a pinch of salt.

2021-03-13 16:55

i rather trust TSLWC more than these ...san kwans....anytime of d day ...period !!!

2021-03-13 18:02

These analysts are writing garbage projections. The results of their analyses is plain garbage. Whatever basis they used it doesn't matter but their analyses were written with a certain pre-conceived end result in mind. Thats the problem!!!

2021-03-13 18:20

Thanks Ben for the article. RHB and maybank are quite realistic based on my own assumption and calculation in terms of profitability. The performance may be better for Top Glove post 2022 if the HK listing materilise and they could increase capacity or growth thru M&A.

2021-03-13 19:57

Hi Ben, thanks for sharing the article by Pankaj C Kumar. This is a very good article.

I actually read the article three times to make sure I fully understand his points. I’m not concerned about the (mis)statement on earning downgrade. What I found useful is Prakaj has pointed out common valuation mistakes committed by analysts. More importantly, he has also provided a valuation approach which I will work out here.

Pankaj’s valuation approach is simple and yet practical. Basically he assumes by FY23 earnings will revert to normal. He therefore applies the historical mean PE of 20 times to FY23 forecasted EPS. After that, by adding expected dividend for FY21 and FY22 to the earlier value, we get the current "fair value" for Top Glove.

I try to improve on his approach by adding two modification.

First, I assume the HK listing will be completed by May-Jun as expected by Top Glove, thereby adding additional shares of 1,495 million to existing 8,015 million, making a total of 9,510 million shares. For simplicity, I shall assume dividend and earning dilution to kick in only from FY22. (Note: the HK IPO is expected to raise RM7.77 billion based on RM5.2 IPO price used by Top Glove for illustration purpose. However, I expect the extra capital raised will have little contribution to FY23 revenue as existing cash flow is more than sufficient to support expansion until then.)

Second, I will convert FY22 dividend and FY23 PE to present value by using the 8.5% cost of equity assumed by Prakaj. I agree with him that it will be cheaper to use debt capital which only costs 3% plus. However by raising a lot of cash in HK, the resulting cash balance will be sufficient to cover at least the RM10 billion Capex planned until FY25. Hence the assumption of of 100% equity capital and the higher discount rate at 8.5%.

With the above modifications, the components of Top Glove value will be

(A) Dividend per share for remaining of FY21.

Expected FY21 net profit = RM10,695 million

Expected FY21 EPS = RM10,695 million/ 8,015 million shares = RM1.334

Expected FY21 DPS = 70% * RM1.334 = RM0.934

Remaining FY21 DPS to be paid = RM0.934 – RM0.165 = RM0.769

(B) Dividend per share for FY22

Expected FY22 net profit = RM4,145 million

Expected FY22 EPS = RM4,145 million/ 9,510 million shares = RM0.436

Expected FY22 DPS = 50% * RM0.436 = RM0.218

Present Value of FY21 DPS = RM0.218 / 1.085 = RM0.201

(C) Value based on 20 times of FY23 Earning

Expected FY23 net profit = RM2,496 million

Expected FY23 EPS = RM2,496 million/ 9,510 million shares = RM0.262

“Fair Value” based on 20 times historical mean PE = 20 * RM0.262 = RM5.249

Present value = RM5.249 / (1.085)^2 = RM4.459

Summing up the three components, the current value = A + B + C = RM0.769 + RM0.201 + RM4.459 = RM5.43. I'm a bit surprise to find the result is quite close to current share price at RM5.20

Of course, the above valuation changes as assumptions change. For example, if vaccine resistant virus is established and gain dominance in the coming months, a PE multiplier higher than the historical mean of 20 times will be warranted.

On the other hand, we also have to watch for sign of looming competition and its impact on margin, especially due to Chinese competition. Currently analysts assume FY23 net margin is about 20% (= RM2,496m net profit/ RM12,524m revenue). This is actually much higher than the 6% to 12% net margin achieved between FY11 to FY19. In a price war scenario, the net margin could easily revert to say 10%. Even if PE remains at 20 times, the PV for FY23 share value will be halved to RM2.237. Adding back the dividends, the present value is only RM3.21.

This might not be a valid outcome. However I like to consider all possible valuation approach and assumptions out there to make sure all considerations are covered.

2021-03-13 23:37

Ben , thks again for your article .

In my opinion ,Pakaj Kumar proposed method of assuming FY 2023 reverting to normal earning and add the dividends receive in.FY 21 and FY 22 is a layman and "rough" method of valuation which I had used many times in my comments in topglove forum. This method "conveniently forget " the balance 50 or 30 % extraordinary earnings in FY 2021 and FY2022 which is not paid out as dividend kept by the company to be used for capacity expansion or other purposes. These cash has enormous value but "forgotten" .To many retail investors, they dont value such money but as professional analyst, such cash should not be conveniently ignored. A professional analyst should not omit such cash if the company decide not to pay any dividend but keep all the earnings for capacity expansions. However ,as a layman, I like this method so that I can tell the retail investors not to ""forget "" the huge dividend which will be receive after the earnings go back to normal.

2021-03-14 07:56

Valuation is neither art or science. But base on the past and projected future.

What is the past NP %. So the simple question should you use pre-covid NP % to project post covid NP %?

2021-03-14 08:08

The mistake is in capacity expansion and forget about diversification.

If only the billion is used for diversification then the valuation will be different.

2021-03-14 08:18

@pjseow, FY21 and FY22 profits not distributed as dividends will be retained, primarily to fund future investments. If analysts have done their earnings projection properly, this retained earnings would have been responsible for their projected FY23 earning, which in turn is used to calculate the share price by applying a PE multiple.

Therefore adding the undistributed FY21 and FY22 profits will be like double counting. It’s for the same reason that in the typical PE valuation, the retained earning from last year is not added to the PE valuation.

2021-03-14 12:03

Also, quite a substantial part of profit earned last year not distributed had been reinvested back via SBB, & incurred a investment loss of about 30% to 40%.

2021-03-14 13:56

Thanks SS Lee and Observatory. Yes, the undistributed cash will be accounted in.the cash in bank in.Asset column which is balanced in.the balanced sheet as retained earning. The NTA will be increased but this will not be accounted for directly in the future P and L .However,if the cash is used to buy assets which help to increase earnings ,then indirectly this cash helps to generate future earnings through capacity expansions. In.my opinion, markets should give a higher PE to companies which use its cash earnings for capacity expansion than those which need to borrow heavily .

2021-03-14 18:28

It is very obvious that the analysts referred has seriously erred on their price targets for topglov..and predictions were made not very long ago. They are supposed to advise investors so that they make a good choise when buying stocks. But those who followed them blindly would have made serious losses. No excuses for that. When they are wrong, they are wrong. No point making a defence which obviously does not hold water..

2021-03-14 21:28

Hi pjseow, thanks for clarifying that the retained earning is just a balancing item for the difference between asset increase (from undistributed profits) and liabilities. Yes, I also agree that heavily indebted companies with weak balance sheet will suffer a valuation discount due to increased risk.

After HK listing Top Glove will probably have a war chest in the order of ~RM10 billion cash. It will be in a much stronger position to weather any potential storm. May be that warrant a slightly higher PE valuation as compared to the past? However, if the cash is not deployed in the next 1 to 2 years there will be a drag on its ROE, which may also correlate with a lower Price to Book ratio.

Nevertheless, I have no doubt the “safety factor” of Top Glove would have increased substantially after a successful HK listing. If a vicious price war breaks out the company is likely to be the last one standing, although shareholders will still suffer at least during the interim period. The best case scenario is for all players including the Chinese rivals to have an implicit understanding for measured expansion and not trying to undercut one another.

2021-03-14 21:32

@Starship2, as I've commented earlier, the main objective of free reports from sell side analysts are to encourage brokerage customers to trade. This is also the reason why the number of buy calls always out number sell calls given there are more potential buyers than potential sellers for stocks (as retail investors don't short sell based on sell recommendation)

Users who trade based only on analysts' TPs are engaging in gambling.

2021-03-14 21:39

U are wrong.The fun of TA and its pattern; investors gain more fatter profits compare with just news(slimmer profit).On the other hands TA also help one spot losses in advance(especially downturn) compare when news come out(losses ranging from 30-50 percents most of the time.

2021-03-15 00:12

Some retail investors may not be happy for being “misled” by those sell side analysts.

In this hour-long interview with Pankaj Kumar by Chuang Khoo Hsu, Pankaj explained the process and the dilemma faced by analysts, including by himself at one time (he has already retired from his professional investment career). He recounted the story where he was still remembered by the then CFO of Tanjung for being the only analyst making a sell call.

https://www.youtube.com/watch?v=HK5Y1khMdD8

2021-03-15 10:22

DickyMe

When valuation is an art, any attempt to explain in terms of scientific data is best, curve fitting. Art itself is non sensical to some. An artful person may see SHREK as the most handsome person.

2021-03-13 14:27