The Era of USD/MYR = 5.0 In The Coming 2017?

Ming Jong Tey

Publish date: Sat, 31 Dec 2016, 05:33 PM

USD/MYR: Bullish

Pattern: Rounding Bottom

I believe a lot of us are concern about the direction of Ringgit against USD, especially those keen on investing/trading the exporting theme stocks, to bet on the strong USD against the weak RM.

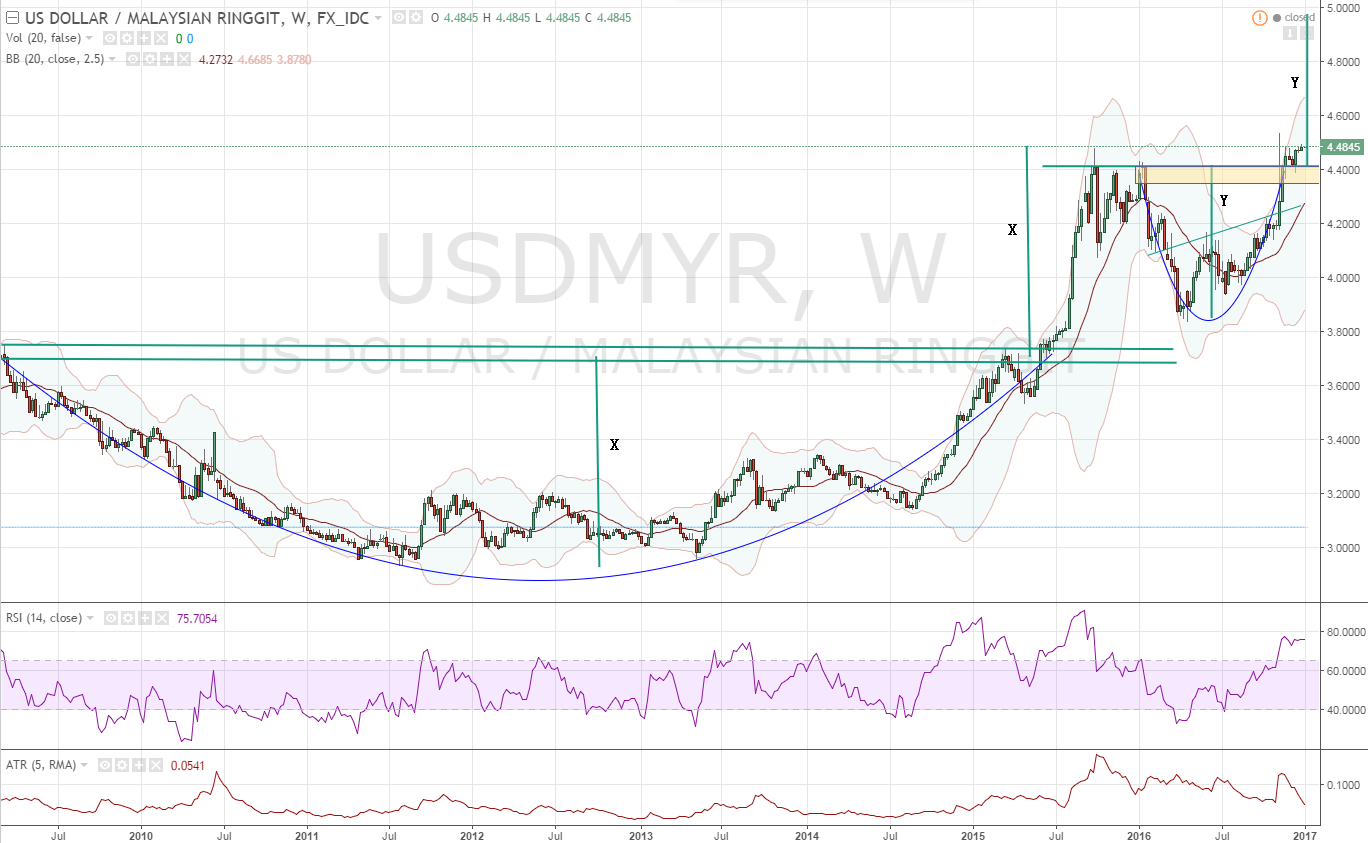

Let's take a look at the weekly chart of USD/MYR below:

The weekly chart above shows the trend from 2009 till today, around 7 years in total.

A beautiful rounding bottom was formed from 2009 to 2015 July. As soon as it broke up, USD/MYR hit the target price of 4.48 based on the projection of X within 3 months. Subsequently, it retraced and formed a small rounding.

Let's zoom in with the daily chart below:

From the daily chart above, the target price from the break up of the rounding bottom is expected to hit around 4.95, based on the projection of Y.

However, the recent price action appears to be losing momentum and I expect a pull back to 4.2 - 4.4 region (if the market is mercy) before resuming the bull run to hit 4.95, as shown in the possible path above.

Should this happen, we will likely be witnessing a parity of EUR/USD.

Exciting time ahead. Trade safe!

Happy New Year and have a fruitful 2017.

Topics That You Do Not Want To Miss

How to determine the "bullishness" of the patterns- https://www.facebook.com/BursaSGXcandlestick/videos/378260995905662/

The Trade Management Technique You Need To Know - http://klse.i3investor.com/blogs/candlestick/114496.jsp

Best Way To Learn To Trade Without A Mentor - http://klse.i3investor.com/blogs/candlestick/113821.jsp

Entry Illustration - http://klse.i3investor.com/blogs/candlestick/113605.jsp

Stop Loss & Safe Trading - http://klse.i3investor.com/blogs/candlestick/113510.jsp

Position Sizing - http://klse.i3investor.com/blogs/candlestick/113061.jsp

Come Up With Trading Ideas & Turn Them Into Investing Ideas - http://klse.i3investor.com/blogs/candlestick/114110.jsp

Cheers,

Ming Jong

Get Update From ==> http://www.vipplatform.com/lp/ideas/

& FB page ==> https://www.facebook.com/BursaSGXcandlestick/

Telegram Channel ==> https://t.me/BursaSGXCandlestick

Contact Via Email ==> ![]()

More articles on Candlestick & Breakout Patterns

Created by Ming Jong Tey | Jun 29, 2017

Created by Ming Jong Tey | May 25, 2017

Created by Ming Jong Tey | May 21, 2017

Discussions

The pass Pm has failed us, will our existing Pm will worsening the situation ?

2016-12-31 17:48

The chart done to perform cup just waiting to complete handle... Then we will suffering with weakening rm

2016-12-31 18:29

USD is expected to appreciate 10 % if they implement 5 % tariff on imports. On the bright side, our exports will still be 5 % cheaper after the tax.

2016-12-31 18:58

Furniture Exporters

1) Liihen - Net Cash RM82.9M

2) Hevea - Net Cash RM94.6M

3) Pohuat - Net Cash RM42.6M

4) Latitude - Net Cash RM139.8M ( Includes Investment Securities Of RM46.4M )

2016-12-31 19:11

Paperplane being one of the top 20 Stock Pick winner has 1 week advantage bcoz his closing date for 2017 contest is 6/1/2017 whereas others was 30/12/2016. Salute to Icon8888 & Luvluv for picking their stocks on 30/12/16 eventhough they are also top 20 winners.

2016-12-31 20:33

Rikki, I have make my picks. Think won't change.....I try avoid AirAsia, Bjcorp next year due to high debts. Initially thinking to add EG, but also drop due to high debts.

Yet I still have some high debts pick like MMCCorp.

2016-12-31 20:36

Paperplane, salute you if you have submitted your picks to Mr Tan KW. You are at the same level playing field with the rest. Taday alone there are more than 15 picks by IBs/Newspapers & many more will be called by analyst the next few days.

2016-12-31 20:50

Is it. I hope next year will not be bad....next year real challenging.

2016-12-31 21:33

our share market really overvalued.

in 1997 when US$1 = RM4, maybank was only rm3+

today US$1 = RM4.50, maybank still rm8.20!!!

2016-12-31 23:08

in 1997 when US$1 = RM4, maybank was only rm3+

today US$1 = RM4.50, maybank still rm8.20!!!

maybank should be trading at rm2.50 now (but unfortunately EPF, Khazanah, PNB, LTH are all supporting the price from falling in our smart retailer's hands)

2016-12-31 23:16

Posted by speakup > Dec 31, 2016 11:08 PM | Report Abuse

our share market really overvalued.

in 1997 when US$1 = RM4, maybank was only rm3+

today US$1 = RM4.50, maybank still rm8.20!!!

Mr Speakup, when i am doing my financial study in the University, the professor told us they is the issue of compounding of interest and business retaining earnings, which are the 2 major point driving up the earnings of companies.

That he say, in long run, you will see the share price of good company will always go up.

I still remember the lecture the respected professor deliver to us, a few years back.

2016-12-31 23:18

What killed the market in 98 was not the weak Ringgit, it was the high interest rate, which was a wrong policy by the Anwar led Ministry of Finance (mahathir accused him of purposely doing that to destabilize economy)

The government has learned the lesson, so this round they just let the RM falls without increasing interest rate

And it turns out everything is fine.

2016-12-31 23:21

Nope. Icon. What kill us is some stupid idiots go and use our money to defend MYR and play fired thinking they are smart. Those stupid idiots never learn, just like tht old man....they are living in own world.

2017-01-01 00:33

Planeplane, Latitude seems to be a better choice, since a major part of their exports are sourced in Vietnam is produces much better rubber wood than Malaysia besides cheaper production environment and possibly more cordial look by Trumpet...

2017-01-01 11:40

So far, the extreme measure like to force exporters to convert 75% of their proceeds into Ringgit, did not act as a catalyst to strengthen RM. The strong oil price (above 50) also does not help much.

Should Bank Negara raise the interest rate to catch up with the FED, this will at least flatten the up-trending curve if not having a solid pull back.

One thing to look for is whether Yellen will change her hawkish tone during the FOMC from targeted 3 times rate hike in 2017 to "Due to unforeseen global risk, we are not in a hurry to raise the rate, etc..." Then we might see a meaningful retracement of the USD.

2017-01-01 11:51

If bank negara hike rate the domestic market will doom and if cut another rate food price will up ( inflation ) and ringgit will weaken..

2017-01-01 12:01

Compare USD/MYR chart with Malaysia Exports figure/chart from the link below, and you will see how co-related it has becomes. Meaning, to achieve higher Exports, MYR needs to be weaken. http://www.tradingeconomics.com/malaysia/exports

2017-01-01 13:39

@twobits, the target price of 5 is based solely on USD/MYR. DXY is on its uptrend to test 106 and 112.

2017-01-01 14:06

speakup is right,bursa now really overvalue,maybank should be below RM 3,yet at RM 8.20 now is after a few times of bonus issues and the price should be more than RM 20 including dividends since 1998.the present govt scared to raise interest rate because many big govt bodies are tied to stocks. only interest rates can cause the downfall of bursa

2017-01-01 22:34

in 1998 interest rate shot up till 13% and the govt bigshots mostly hit hard not like nowdays only retails are hit hard.

2017-01-01 22:36

VenFx

Didn't our Pm promise us to have defence kuat kuat during election speak few year back at Rm vs Usd $0.360 meh ?

I took it with a huge scope of salt during he said so.

COORUPTERS YANG HARUS DIHAPUSKAN DULU bukan slogan slogan cantik umpama menipu sendiri dan seluruh rakyat Malaysia.

2016-12-31 17:47