I just received an email containing some great questions from a beginner's perspective, which I think some readers might find them useful.

Below is the email from JH

***********************************************************************

Hi Ming Jong,

I have been reading your blogs in i3investor and I would like to say each of your sharing is very clear and structured. I'm a very fresh beginner in stock trading/investing. Would you recommend or write about any stocks trading books/materials/ways of studying that you find useful for you and if possible categorize them as materials/approaches for beginner, intermediate or advanced level? Approaches to study everything about stock trading ranging from macro to micro level knowledge which includes how stock market operates, how orders are queued and matched, how to read the trading platform, relevant securities commissions rules/guidelines one needs to know, position sizing (which you have written and i remembered that you said you are going to write about how to trade according to one's personality, i'm very interested and i think these are something important to know), trading mindset, fundamental analysis and technical analysis in different level etc. I have been in the market for few months and I found that there are tricks or techniques (like cut queue, roadblock etc) which i just came to know. I understand that the most direct way to learn about all this is by googling but i would like to know is there any structured, systematic and organized way to study all this?

Also, I'd like to ask if it is effective or is it correct to study about stock trading like we study for exams? Like what I have mentioned above including all those tricks or technique, is that it is impossible to master all these knowledge by just studying? If we don't have any mentor in real life, is that we can only learn by trial and error? For a beginner, would you recommend me to get a charting tool now or later?

Thank you for your sharing and reply.

***************************************************************************

Hi JH,

Thanks for your email and lots of great questions.

For a beginner, the best way to learn to trade is to start studying (books, video or paid course) and demo trading for a few weeks or 1-2 months. The intent is to get yourself familiar with the broker platform, how to buy/sell, commissions, etc...Or at least you can start with the minimum lot size with real money, i.e. 100 shares to test the water if demo account is not provided.

These are prerequisites as you will need to know the basic first before you get into the detail. Fortunately, I believe your broker will be able to help you with the basic, i.e. their platform, when to pay after you buy, contra, offset, deposit/withdrawal etc...

During this period, apply what you have learned from books/videos/courses. You can also paper trade to make sure you understand what you have learned. When you are confident with the platform and approach, start by playing small pool of fund to avoid staying demo/paper trade for too long because real trading and paper trading is different. When money comes, some psychology factors will manifest.

Trading Journal

The most important thing is to keep a trading journal along the way to log every trade, with the date, entry price, stop loss, target price, reasons to enter a trade and a comment section after you close the trade.

Do you execute the trade according to your plan? Make a screenshot for your entry and exit. If possible, record the screenshot sometime after you exit (might be a week or a month).

Review your trading journal weekly. What did you do well? What mistakes did you make (move stop loss? did not cut loss?) Record what you have learned for each trade and make sure you never repeat the mistakes.

Trading Books

For books, you might need different books at different times.

Initially, you might be very keen for solid technical analysis, pattern/candlesticks, etc...Then probably self-help books (discipline, focus, to understand yourself better) when you did not follow your plan. After that, possible psychology for trading, lol..

Pick up whatever necessary for you at different times.

Start with these 3 first:

1. Technical Analysis Of The Financial Markets - John J Murphy (solid technical)

2. Diary of a Professional Commodity Trader - Peter Brandt (lessons from a pro trader, understand the reality of trading)

3. Trading in the Zone - Mark Douglas (psychology)

You might find yourself in a rabbit hole to look for tons of information. Watch out for information overload. Your trading journal is your best helper apart from a mentor.

To be successful in the stock market you don't need to learn and know everything from macro to micro. My definition of successful is to make money to your satisfaction, i.e. if you aim to have 20% return per year, as long as you hit your target, you are successful. So make sure you set a realistic goal.

You just need to know enough and master a few set of your skill to make a killing in the market.

There are tons of tricks like you mentioned. Ask yourself this question, is it necessary? Do you really need that to be successful?

Some of them could be good to enhance your winning rate, some might be just "good to know" rather than "useful". Having the ability to differentiate what you need and what you don't is essential too, which you will be able to pick up along your journey.

For example, value investors don't really need to look at the charts to invest, because they only invest based on the fundamental.

Similarly, traders don't need to look at the fundamental to trade well because they believe everything has been factored in and reflected in the price. Of course, they are people who look at both to trade/invest. You just need to find what suits you.

To be honest, learning and applying by joining all the puzzles together is not an easy task. You can study material in every single aspect of trading but the hard part is to apply them because you will need to master each technique to know its limitation and where and how to use them to get a higher winning probability.

Let me ask you a question:

What's your purpose to trade? To make some money or to get a title of a chartered market technician (CMT) so that it can facilitate you in your career? Is a professional CMT a profitable trader in real life? A doctor needs years of experience to practise before he/she becomes a knowledgeable doctor.

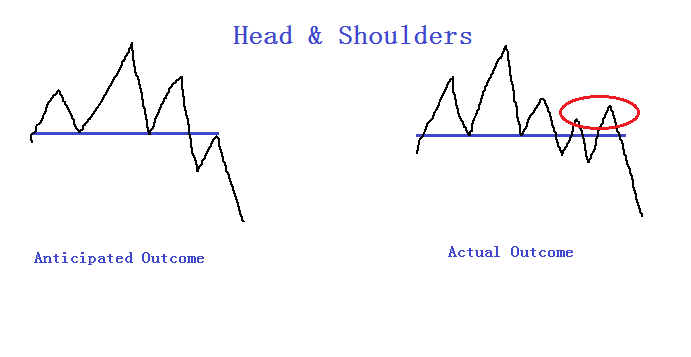

The market does not play by book. The pattern illustrated in a textbook often turns out to be very different in the real market, such as:

Hopefully, this question will answer your question related to "study stock trading like we study for exams".

Charting Software

Free tools like Chartnexus (handy software for offline usage), tradingview (for forex, commodities, oversea stocks) or investing note (provide about 15 years of data for SGX and Bursa) should be sufficient for charting purpose.

Topics That You Do Not Want To Miss

How to determine the "bullishness" of the patterns- https://www.facebook.com/BursaSGXcandlestick/videos/378260995905662/

The Trade Management Technique You Need To Know - http://klse.i3investor.com/blogs/candlestick/114496.jsp

Entry Illustration - http://klse.i3investor.com/blogs/candlestick/113605.jsp

Stop Loss & Safe Trading - http://klse.i3investor.com/blogs/candlestick/113510.jsp

Position Sizing - http://klse.i3investor.com/blogs/candlestick/113061.jsp

Create Trading Ideas & Turn Them Into Investing Ideas - http://klse.i3investor.com/blogs/candlestick/114110.jsp

Cheers,

Ming Jong

Get Update From ==> http://www.vipplatform.com/lp/ideas/

& FB page ==> https://www.facebook.com/BursaSGXcandlestick/

Telegram Channel ==> https://t.me/BursaSGXCandlestick

Contact Via Email ==>

![]()

watermelon

Thanks! Regardless of trading style, having a trading journal to constantly review and reflect is indeed important.

2017-01-16 21:14