LAY HONG (Part 4) - The debt is so high! Will there be rights issue? The answer is here

Chicken King

Publish date: Wed, 05 Sep 2018, 12:09 AM

Will there be rights issue?

The short answer is – NO.

The long answer is, well, I’ll explain using colorful graphs to keep it interesting and also try to keep it as simple as possible to make it easy for everyone to understand. Feel free to ask if you need further clarification.

REASON 1: CAPEX CYCLE IS ENDING – MEANING NO MORE INCREASE IN DEBT

First, let’s understand the debt structure of a poultry company.

As you can see, Lay Hong’s debt looks very high because most of it are short-term debt. These are called Bankers’ Acceptances (BAs). BAs are typically used when importing chicken feed from overseas and will be paid within 1-6 months. It’s part and parcel of a poultry operator’s daily business and this is the reason why most poultry company’s debt seems high. Short-term trade financing are low risk and personally, from a business standpoint, I think they function more like trade payables. But in accounting standards, these have to be classified as debt because they are financial instruments that have banks acting as a middlemen to guarantee the payments.

Anyway, short-term debt is not what we should be focused on or worried about. So let’s just ignore short-term debt and move on to: Long-term debt.

Long-term debt has been increasing! And interest costs were rising too as a result!

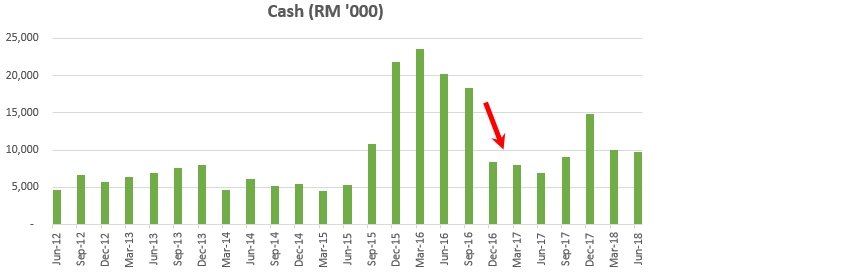

Furthermore, cash levels are not rising!

Why? Where is the money going? Don’t worry. Let’s take a look at the chart below:

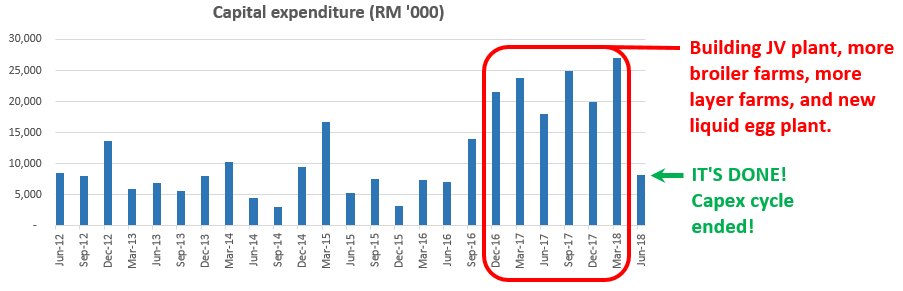

Lay Hong is actually using the money to expand the business! You can see during the highlighted period they needed a lot of money to build all the farms and factories which will bring them a lot of growth in the future!

At first, in 2016 they only used internally generated cash and cash they raised from private placements. After that, they started borrowing money from the bank. This is why the debt and interest costs were rising.

But right now, as we can see from the latest quarterly result, the capex has reduced significantly. This means they have nearly finished expanding and it’s almost time to reap the rewards. This also means once the new plants start running and generating cash, they can use it reduce their debt level and also their interest costs. In time, I believe they will start generating positive free cash flows too, which will attract more investors to look at this stock.

But that’s not all! If you need more comfort, I have good news for you. This is because:

REASON 2: NH FOODS AND THE YAP FAMILY WILL BE CONVERTING THEIR WARRANTS

UOB has explained in their report:

Source: https://research.uobkayhian.com/content_download.jsp?id=46500&h=f72f75a7a20745214ee32fff9bc0ef0f

If you need a summary of how a warrant conversion works: Basically you pay the company the strike price of the warrant to turn your warrant into new mother shares.

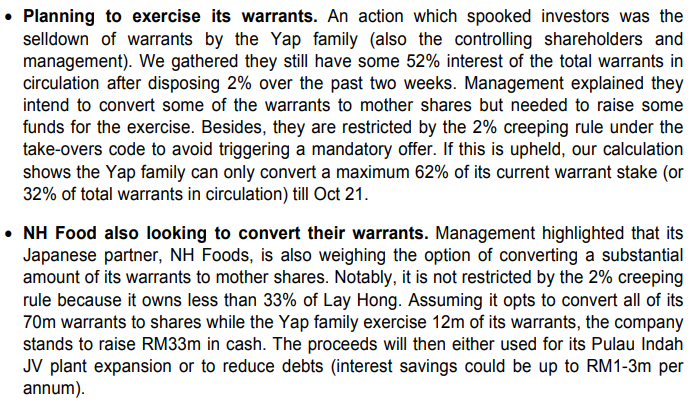

According to UOB, both NH Foods Ltd and the Yap family will be pumping in more cash into the company! And they will use the money to expand the new JV processing plant and REDUCE DEBT!

The total amount of cash that will be pumped in is RM33 million! For comparison: Lay Hong’s current cash level is RM9.7 million while long-term debt it RM96.5 million.

In short: Rather then asking for more money from shareholders, the management is putting their own money in for your benefit!

Therefore, it would make no sense for them to call for a rights issue.

BUT WHY IS MANAGEMENT SELLING WARRANTS THEN?

We can refer back to UOB’s report:

Simply put, what it says here is, according to regulations, once you own more than 33% of the company, you cannot increase your shareholding in the company by more than 2% per year. Otherwise, you will be forced to make an offer to buy all of the company’s remaining shares. Obviously, the Yap family doesn’t want to privatize Lay Hong.

So, since the Yap family already owns more than 33%, they cannot convert so many warrants, thus they have been selling the warrants they cannot convert to raise more cash, and will eventually put this extra cash back into the company when they convert their remaining warrants.

Therefore, I don't believe the warrants disposals are a sign of management lacking confidence. They didn't sell a single mother share did they?

This also means: The one that will be pumping in the most money into the company will be NH Foods because they still own less than 33% of the company, and will be converting all of their warrants. NOW THIS IS A SIGN OF CONFIDENCE!

After understanding this, I am not worried about Lay Hong’s debt level at all. I'm also not worried when the Yap family sells their warrants. Also, I am very confident that there won’t be any rights issue!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on CKing Stock Ideas

Created by Chicken King | Sep 02, 2018

Created by Chicken King | Sep 01, 2018

Created by Chicken King | Aug 31, 2018

Discussions

I am also in the mid of writing an article from the point of view of accounting analysis over the past 5 years' financial performance & positions.

The Management had instead done remarkable good jobs in the past 5 years:

1. Able to maintain GP margin while growing revenue

2. Able to raise funds internally or elsewhere without asking money from shareholders in supporting the capacity growth

3. Debts equity ratio stable despite increase in borrowings

4. Ratio of Selling/Distribution/Admin expenses to Revenue remained consistent

5. Kelantan Bird flu outbreak vs CAB share price & financial performance (Mar ~ Jun 2017) (in replying the concern over the Sabah avian flu)

Another key area that I agreed most with Chicken King is the ending of latest Capex Cycle, of which started in 2016 after the JV of NH Foods Japan.

2018-09-05 02:26

If the company didn't ask for the right issue during the peak of capex cycle, why they need right issue now or soon since it is already at the tail end?

During the peak and as indicated in the Cashflow Statements of the Company, the Purchase of property, plant and equipment were as follows:

2017 - RM50,816,823

2018 - RM70,536,308

While in the latest QR, the capital commitment was RM30mil.

https://cdn1.i3investor.com/my/files/st88k/9385_LAYHONG/qr/2018-06-30/9385_LAYHONG_QR_2018-06-30_LHB-QR%20Q1-FYE2019_-854503929.pdf

Anyway, anything can happen in stock market, may be you will be right someday.

-----------------------------------

qqq3 rights issue is more than likely

05/09/2018 02:18

2018-09-05 02:42

Malayan Flour Mills Bhd proposes rights issue due to expansion for its poultry business too, but they raise fund before they build more processing plants.

Now the new plants in Pulau Indah & Pasir Gudang for Layhong almost done. That's make sense to say that they won't raise fund via rights issue.

2018-09-05 06:20

If converting warrant is in the money, there is no need for rights. Make sense...those frightening others insist on rights may hv interior motive

2018-09-05 06:43

Out of this 30mil capital commitment only 18mil is contracted for. Furthermore, idle land has been disposed recently for 29mil for reducing of loan and working capital.

2018-09-05 06:55

My layman understanding is this entire thesis rest on the growth of LH's frozen food segment, which according to part 3, the underlying factor is margin expansion, which lies in the heart of pricing power in the name of brand. The end of the capex cycle assume the brand has been established, groundwork has been laid and there is no more outlay required to build to brand. So the future value comes from the moat of brand to protect Nutriplus from being outcompete by competitors.That is a big assumption. The assumption that brand has been build; the assumption that there is pricing power; the assumption that there is a product differentiation/brand loyalty needs to be investigated further.

2018-09-05 07:24

That is true. It's all about the market's expectation and how much has already been priced-in into the share price. My view is: risk-reward is favorable.

Posted by Ricky Yeo > Sep 5, 2018 07:24 AM | Report Abuse

My layman understanding is this entire thesis rest on the growth of LH's frozen food segment, which according to part 3, the underlying factor is margin expansion, which lies in the heart of pricing power in the name of brand. The end of the capex cycle assume the brand has been established, groundwork has been laid and there is no more outlay required to build to brand. So the future value comes from the moat of brand to protect Nutriplus from being outcompete by competitors.That is a big assumption. The assumption that brand has been build; the assumption that there is pricing power; the assumption that there is a product differentiation/brand loyalty needs to be investigated further.

2018-09-05 07:26

I think a lot ppl still not understand why trade receivables are increasing “terribly”. If you have time, u can write one more article to talk about this. I don’t concern on this and I knew that LH is a good paymaster.

2018-09-05 08:46

tough business...must be a very competitive business...eggs controlled pricing...no pricing power, thin margin, high short term borrowings to revenue and to current assets suggest living dangerously, struggling every day, lives days to day.

looking at the charts, trade la....but invest? not suitable.

aiyoh, some more chicken business...can die any time, needs high risk premium for investors.

2018-09-05 10:32

Very well observed & written, Chicken King, thank you for sharing.Truly appreciate.

2018-09-05 13:34

Hey chicken chikketty king...i don't agree with you. No one knows. Thanks for your explanation. Well,thats your opinion. There will be a rights issue for sure..I am sure..

2018-09-06 04:34

Agree with you ccc1..chicken.business is no easy to manage. I stay away this counter. Hard tough business..

2018-09-06 04:36

Chicken Coventry king. Thanks for your opinion. I will not invest in this company due to the difficulties of the chicken business. It's not easy. Margins low. I stay out buy will trade if price actions warrants a trading opportunity.

2018-09-06 04:42

I heard my father said , boss daughter is driving Merz sports . This fxxking company build chicken farms everywhere near villager's houses. The fxxking chicken manure's odor is so disgusting and causing pollution. Their family member enjoy luxury life, and villagers suffering from the pollution.

2018-09-07 08:06

No disrespect to your father, strongly advise you to read Lay Hong annual reports to find out how many are closed house farms & how many are open concept farms. Then you will realise you are spreading fake news & untruthful rumour.

By the way, what's wrong for people live at good standard living?

一卖 就涨 I heard my father said , boss daughter is driving Merz sports . This fxxking company build chicken farms everywhere near villager's houses. The fxxking chicken manure's odor is so disgusting and causing pollution. Their family member enjoy luxury life, and villagers suffering from the pollution.

07/09/2018 08:06

2018-09-07 11:10

LAY HONG - Why The Directors Do Not Want Right Issue? (moneySIFU - Part 1)

https://klse.i3investor.com/blogs/moneymoney/173015.jsp

2018-09-07 11:32

Jon Choivo

Pretty similar to my thesis, just written out better than i can haha.

Which fund are you with?

2018-09-05 01:17