LAY HONG (Part 3) - Opportunity to enter at a lower price than NH Foods Ltd

Chicken King

Publish date: Sun, 02 Sep 2018, 06:49 PM

In my previous two articles, I shared about the revenue and cost drivers that generally apply to all poultry companies. However, expected favorable swings in commodity and egg prices aren’t the things that make Lay Hong attractive as a long term investment. What we need is long-term and sustainable growth!

THE PROCESSED & FROZEN FOODS SEGMENT

Let’s look at the “processed and frozen products” segment which makes up 50% of Lay Hong’s annual revenue. Lay Hong first ventured into the local frozen processed food market in 2012 under the brand name NutriPlus, and has been able to consistently grow the segment’s revenue. Their main products are frozen sausages and nuggets. This segment has stable & high margins (23% gross, compared to less than 5% gross for table eggs). This is because when you venture downstream, good branding gives you better pricing power. Furthermore, all of Lay Hong’s broiler capacity is catered for internal food processing use only.

HOW TO GROW THIS SEGMENT?

Unfortunately, in Malaysia, the animal protein market is a matured market with low growth rates. No matter how much you grow your capacity, you will ultimately be constrained by local population/demand growth and competition, leaving you at the mercy of fluctuations in egg prices, broiler prices, feed prices, etc. Therefore, the only way to achieve high growth rates as a poultry player in Malaysia is to export downstream processed food.

To be able to export chicken as branded downstream products means a big deal to a local poultry player, as it opens up markets overseas with high growth potential. But how is Lay Hong going to compete in overseas markets? This is when Japan’s NH Foods Ltd comes in to the picture!

THE GAME CHANGER – NH FOODS JOINT VENTURE

Who is NH Foods?

Commonly known as Nippon Ham, they are the No. 1 largest fresh meat company in Japan and No. 4 largest in the world, with footprints in 18 countries, and USD11.4 billion sales last year!

What’s the story?

NH Foods was looking to venture into a huge and fast growing market – the Halal market. But there’s one thing that’s been stopping them from doing so: they don’t have a Halal certification to sell their products in Muslim markets.

Therefore, in 2016, NH Foods decided to make Malaysia as their export hub for Halal food, and chose Lay Hong as their partner. In January 2016, NH Foods bought a 23% stake in Lay Hong at a cost of RM0.58/share (after adjusting for bonus issue & share split), and have not sold a single share or warrant since!

This means: As an investment, your cost would be lower than NH Foods’ at RM0.535/share now!

Anyway, after forming a joint venture company and applying for certification with JAKIM, they need to build a new food processing plant which will be used by the JV company, with 70% capacity catered for exports. The plant will be ready by September 2018 and will double Lay Hong’s existing food processing capacity!

So what’s the agreement?

The joint venture ownership is a 49:51 split. Lay Hong will supply the chickens/broilers while NH Foods will be in charge of R&D, production, export, and sales overseas.

While waiting for construction to be completed, Lay Hong and NH Foods has already begun experimenting and coming out with new products since November 2016. But since they are still using their old processing plant, they can only sell in Malaysia. From 5 products initially, they have already launched 18 products to-date in the local market, in order to gauge demand.

And they did very well and managed to grow the segment by 37% last year just by testing the market and selling only in Malaysia.

Just imagine: Once the export market opens up for Lay Hong, earnings should enter a new phase of growth, unconstrained by the Malaysian market. Key markets highlighted include middle-east countries and Indonesia, which all has high meat consumption growth. Furthermore, Lay Hong might stand to benefit from the 2020 Tokyo Olympics.

WHAT’S THE POTENTIAL EARNINGS UPSIDE?

By referring to my sensitivity analysis in Part 1 and 2, working backwards, I’m able to roughly estimate that the “processed and frozen products” segment historically contributes around RM7-8 million to quarterly profit when there’s no drag from egg losses and feed costs, implying 70% of profit came from this segment.

As for the JV, we know Lay Hong plans to double their processing capacity and allocate 70% of the new capacity to the export market, but since Lay Hong hasn’t started exporting, we do not know how good will demand be in those countries, or how fast it could pick up.

But if we take a longer-term stance and assume they would eventually fully utilize this new plant and conservatively assume margins are similar to Malaysia:

70% export x RM8 million x 49% ownership in JV = RM2.8 million additional profit per quarter

This translates to potential 25% upside to Lay Hong’s long-term core profits (RM2.8 million / RM11 million per quarter).

IMPORTANT NOTE: This is still very conservative because I am not assuming any margin expansion here. Margins tend to expand when you export, especially if its premium products. Given Lay Hong’s current 4-5% net margin, I expect the bulk of the earnings growth to come from margin expansion (which is not factored in here).

Since the “real profit” (excluding the effect of egg price and feed cost) is expected to grow by 25%, does this mean there’s only 25% upside to the share price? I don’t think so, in my opinion. This is because:

BEING A FOOD EXPORTER MIGHT PROPEL LAY HONG INTO A DIFFERENT LEAGUE

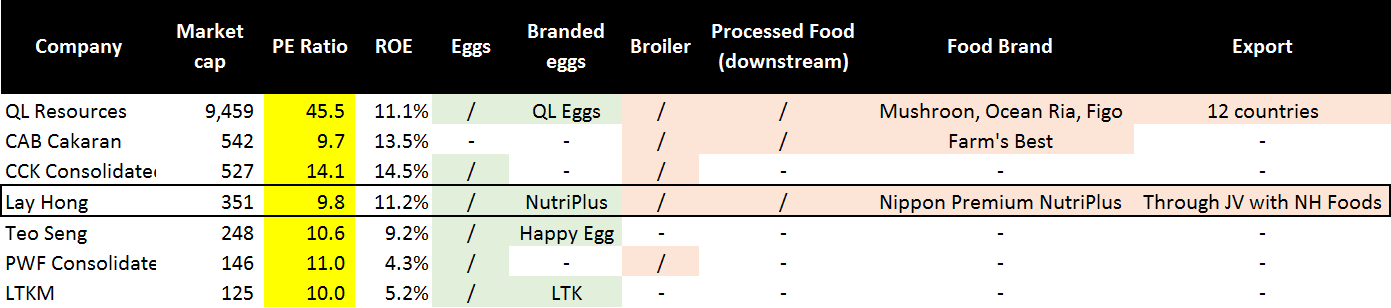

Let’s do a comparison and take a look at Lay Hong’s peers:

Note: I adjusted the PE ratios for some companies to reflect their normalized earnings.

We can see that Lay Hong is currently the cheapest poultry player in Malaysia in PE ratio terms, only slightly behind CAB Cakaran. But what is a fair PE ratio for Lay Hong? The closest comparable right now that has a similar business model as Lay Hong – strong egg brand, strong downstream processed food branding with exposure to export markets – is QL Resources.

Now calm down, I am not suggesting that 45x is a fair PE ratio for Lay Hong, but the point here is that Lay Hong is cheap, and downside is limited when you tie their business with their valuations and compare them to their peers.

So what is the fair value for Lay Hong? I will be able to discuss this sometime down the road once we dive further into the company's financials.

So, after 3 articles, what are the key takeaways so far?

- Earnings should be rebounding (Part 1)

- Costs should be coming down (Part 2)

- Double-digit organic growth should continue (commencement of JV processing plant)

- Valuations are cheap (lowest PE among peers)

To add to the above, we get even more comfort to know that at this price of RM0.535/share, we will be investing at a price 8% cheaper than NH Foods’ cost of RM0.58/share from 2.5 years ago!

Piecing all of the above together, I believe the market has overlooked Lay Hong's growth potential and this has given us an opportunity invest in a high growth stock at cheap valuations. What do you guys think? Let’s discuss.

In my next article, I will finally be drilling into their financials, especially the balance sheet, to address one of the biggest concerns a lot of us are having – high debt and gearing, and explain why I’m not too concerned. On a related note, I will also discuss about the major shareholder’s disposal of warrants and my views on the matter. Stay tuned!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on CKing Stock Ideas

Created by Chicken King | Sep 05, 2018

Created by Chicken King | Sep 01, 2018

Created by Chicken King | Aug 31, 2018

Discussions

The balance sheet looks bad. Everyone still hesitating to enter due to this issue. Hope you can enlighten us how the management can solve this issue. Thanks.

2018-09-02 19:08

Its yen, he didn't convert. Somebody going to get scolding by boss d. Hahahahaha.

====

Flintstones 11 trillion sales? Are you sure?

02/09/2018 19:08

2018-09-02 19:10

It's billion and I've made the correction. Thanks for pointing out!

Posted by Flintstones > Sep 2, 2018 07:08 PM | Report Abuse

11 trillion sales? Are you sure?

2018-09-02 19:11

Otb sir and koon wont considere now, given the ugly look from its TA chart.

Arent good we bought before them meh ?

2018-09-02 19:29

OTB 7 Koon with most of us here are different league ma.

Dont forget in LayHong we dare to buy and patient is our price.

I'm sure OTB sir will joint us here, when it is time .

2018-09-02 19:37

After reading so much article from Chicken King,

I planing to buy straight 50% Big 50% Small using my allocated money.

Need not to wait till the Big drop till 0.480 lah.

2018-09-02 19:41

Layhojg may not be i3 members cup of tea. Most members here trade quarter to quarter. I will be surprised layhong does not drop more from here

2018-09-02 19:46

I can average down once only, using 20% of my capital. And the other 80%, is using to average up. Or hunt for other stock, if there's any.

Anyway, a pack of 300g nippon premium nutriplus fried chicken chop is selling at RM11.80, really high margin there.

2018-09-02 19:57

That depend lah ...

Counter with good Growth Prospect

U buy and hold can earn good annual ang pow

LayHong with it strengthening for a premium league

Will earn you a Growth machine lo.

2018-09-02 20:31

aiyo, u see the debt....u see the cash flow....aiyo double face palm..

later rights issue incoming~

2018-09-02 20:39

Robot888, how to sell the chicken to get the eggs? Trade with who the chicken ?

2018-09-02 21:19

r18 , looks like we have common way of seeing thing now.

capex for growth plus alliance with strong leaqeue with Nippon Ham ...

i wont pay concern to the debt.

This take gut and second level of thinking as well .

2018-09-02 21:42

It's not as bad as you think to raise fund via rights issue. Another poultry player, Malayan Flour also proposed rights issue of rculs and the share price has plunged 10%. Not too bad.

2018-09-02 22:03

We all are panic to see Sapura Energy plunged recently due to rights issue. Its rights issue not 1:4 or 1:5 but as high as 5:3, so nobody wants to subscribe.

2018-09-02 22:04

q-o-q might see improvement. but y-o-y is weaker.

unfortunately, market is short-term-ish.

2018-09-02 22:53

Better let the results tell naturally lah ...

whoever follow closely , will have time to tap the rise ma.

2018-09-02 23:01

How do you derive the RM7-8mil for the frozen processed foods segment based on 'sensitivity analysis' in part 1 and 2

2018-09-02 23:56

It is actually based on a few assumptions and from whatever information on segmental margins I could dig up from analyst reports.

This initiation report here from UOB has plenty of info:

https://research.uobkayhian.com/content_download.jsp?id=44935&h=5de467a7575b9538de41b90d8df790b7

The concept is simple - Lay Hong has 3 main segments: Eggs (24% revenue), Processed food (50% revenue), and Others (26% revenue). The "Others" segment generally contributes minimally to earnings, while processed food has stable margins from their pricing power. Therefore, the main swing factors are only "Egg" segment profits and feed cost movements.

Using the above information plus egg & feed price trends, I observe q-o-q fluctuations and estimate what were their impact to earnings after considering capacity expansions as well. There's a lot of calculation.

But after stripping out the volatile portion, the remaining "stable" portion is always roughly RM7-8 million per quarter.

I admit it might not be 100% accurate, in fact it might be far from actual contribution. So it's still an estimation. But the idea makes sense: There are only 2 segments contributing to profit. The segment with higher margins should contribute more to bottomline.

Thanks for asking. I wasn't sure I should include this explanation in the article because it might become too long-winded.

Posted by valuelurker > Sep 2, 2018 11:56 PM | Report Abuse

How do you derive the RM7-8mil for the frozen processed foods segment based on 'sensitivity analysis' in part 1 and 2

2018-09-03 05:51

Thank you for such good sharing, Chicken King.

To me, the insight analysis over the 3 articles from Chicken King made reasonable sense.

I have been monitoring Lay Hong for quite sometimes, even way back before QL gave up on their pursuit in taking over Lay Hong. But the valuation in terms of share price had stopped me from making any move.

Until late when I saw the rapid decrease in share price over just a month plus time, I asked myself, how can such a good company with such strong branded products suffered such huge drop in share price?

It seemed like a perfect storm, all bad news came at the same & short time. Anyway, perfect storm good for those not in yet.

Then I decided to go in with 2 questions:

What is upside potential?

What is downside risk?

Bearing any external factors, the answers were:

Upside = huge

Downside = limited

I started to buy at 60 cents all the way to 53 cents.

Since Chicken King has written the business & possible potential growth, I will share my findings on the financial cash flows & needs with hope to help ease on certain guesses about the company may go for right issues.

2018-09-03 17:18

hi paperplane, good to see you again, hope you are fine & doing well in stock market.

2018-09-03 17:49

LayHong has good potential but I think one must ready to hold till next year 2019 to see its fruits.

The new JV food processing plant will commence in Sept 2018 and it will take some times to setup and fine tune the machinery and processes. I suppose it will take months before the production can run smoothly and production output can contribute significantly to earnings.

2018-09-03 21:42

Well, well written!

But, whether LH has enough financial strength to accomplish is questionable. (Years ago i was wrong about QL, maybe i am wrong again.)

See the director sold more warrant, (i already told you the last shock) maybe another shock has just happened.

Yes, the feed price is getting lower and the egg prices etc is getting higher.

2018-09-03 23:23

It is always privileged to be linked to those good people, thank you, r18.

2018-09-04 12:11

@Chicken King, your works are brilliant & adorable, can we communicate through emails? Thank you.

Email: wealthwizard.invest@gmail.com

2018-09-04 16:44

Hi WealthWizard. Love your work too! I've dropped you an email :)

Posted by WealthWizard > Sep 4, 2018 04:44 PM | Report Abuse

@Chicken King, your works are brilliant & adorable, can we communicate through emails? Thank you.

Email: wealthwizard.invest@gmail.com

2018-09-05 07:22

Thank you for your comment, r18, wish you doing good.

r18 aiyo, moneySIFU, I really admire of you. Which kind of person dare to buy in while others still in panic selling mode. Only the person who has far-sightedness and full of confidence can do this impossible job. Kudos! Kudos!

04/09/2018 18:29

2018-09-05 07:48

The original question simply requires you to post up spreadsheet + chart of the 'egg prices and feed costs, considering capacity expansions as well' and exchange rates - saying 'there's a lot of calculation' wont quite do

After all, youve written four long posts, and the main selling proposition for LH is their NH/frozen food segment (which can be seen as a consumer-play)

UOBKH research report has no such information. Tracking only publicly available information (qtrly and AR), I dont see how you could 'backward calculate' the 7-8mil per quarter profit contributions (and I assume you mean PBT)

Chicken King It is actually based on a few assumptions and from whatever information on segmental margins I could dig up from analyst reports.

This initiation report here from UOB has plenty of info:

https://research.uobkayhian.com/content_download.jsp?id=44935&h=5d...

The concept is simple - Lay Hong has 3 main segments: Eggs (24% revenue), Processed food (50% revenue), and Others (26% revenue). The "Others" segment generally contributes minimally to earnings, while processed food has stable margins from their pricing power. Therefore, the main swing factors are only "Egg" segment profits and feed cost movements.

Using the above information plus egg & feed price trends, I observe q-o-q fluctuations and estimate what were their impact to earnings after considering capacity expansions as well. There's a lot of calculation.

But after stripping out the volatile portion, the remaining "stable" portion is always roughly RM7-8 million per quarter.

I admit it might not be 100% accurate, in fact it might be far from actual contribution. So it's still an estimation. But the idea makes sense: There are only 2 segments contributing to profit. The segment with higher margins should contribute more to bottomline.

Thanks for asking. I wasn't sure I should include this explanation in the article because it might become too long-winded.

2018-09-27 11:46

.png)

Jon Choivo

This was pretty decent.

2018-09-02 19:05